$19T Liquidation Answers Gold vs. Bitcoin Reserves!

The Siren's song of Bitcoin reserves calls the faithful to the rocks.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

Deutsche Bank asks if Bitcoin can join gold as a credible reserve asset, and within a week, we have our answer, $19 trillion in crypto liquidations.

Bitcoin’s flash crash on Friday gave us a necessary reminder that its price does not “always go up.”

Bitcoin’s rapid collapse from just under its all-time high of $126,000 to under $105,000 in a matter of minutes sent shockwaves through the wider crypto market.

Sparked by President Trump’s announcement of 100% tariffs on China, it shows how volatility isn’t a bug but a feature.

While things seem extraordinarily calm today, make no mistake, this was the worst single-day liquidation event ever recorded—surpassing even the Terra (LUNA) collapse and the FTX.

That crash was fuelled by a leverage boom that culminated in billions in long positions getting liquidated.

The event also caused Ethena’s yield-bearing stablecoin USDe to lose its dollar peg briefly during the market rout, falling to 65 cents against the dollar on Binance.

Ethena is the third-largest stablecoin, highlighting stablecoins’ potential fragility.

Ethena’s yield, as does the yield in Binance given to Circle USDC holders, among others, comes from loans that create crypto leverage, not loans that finance cars or houses.

As much as crypto fans would like to deny it, a loan for leveraging Bitcoin is not the same as one from your local bank used to finance real economic activity.

Does this sound like a house of cards to you?

Still, the siren song of Bitcoin reserves is strong.

Last week, Senator Cynthia Lummis stated that funding for a US Strategic Bitcoin Reserve “can start anytime.”

Never mind the reality that if the US starts a BTC reserve, it is a global admission that the dollar is so weak that even the US doesn’t want to hold it.

What should be of concern to the US isn’t the lack of BTC reserves, but other nations dumping dollars for gold.

These nations already know the answer to the BTC vs Gold question.

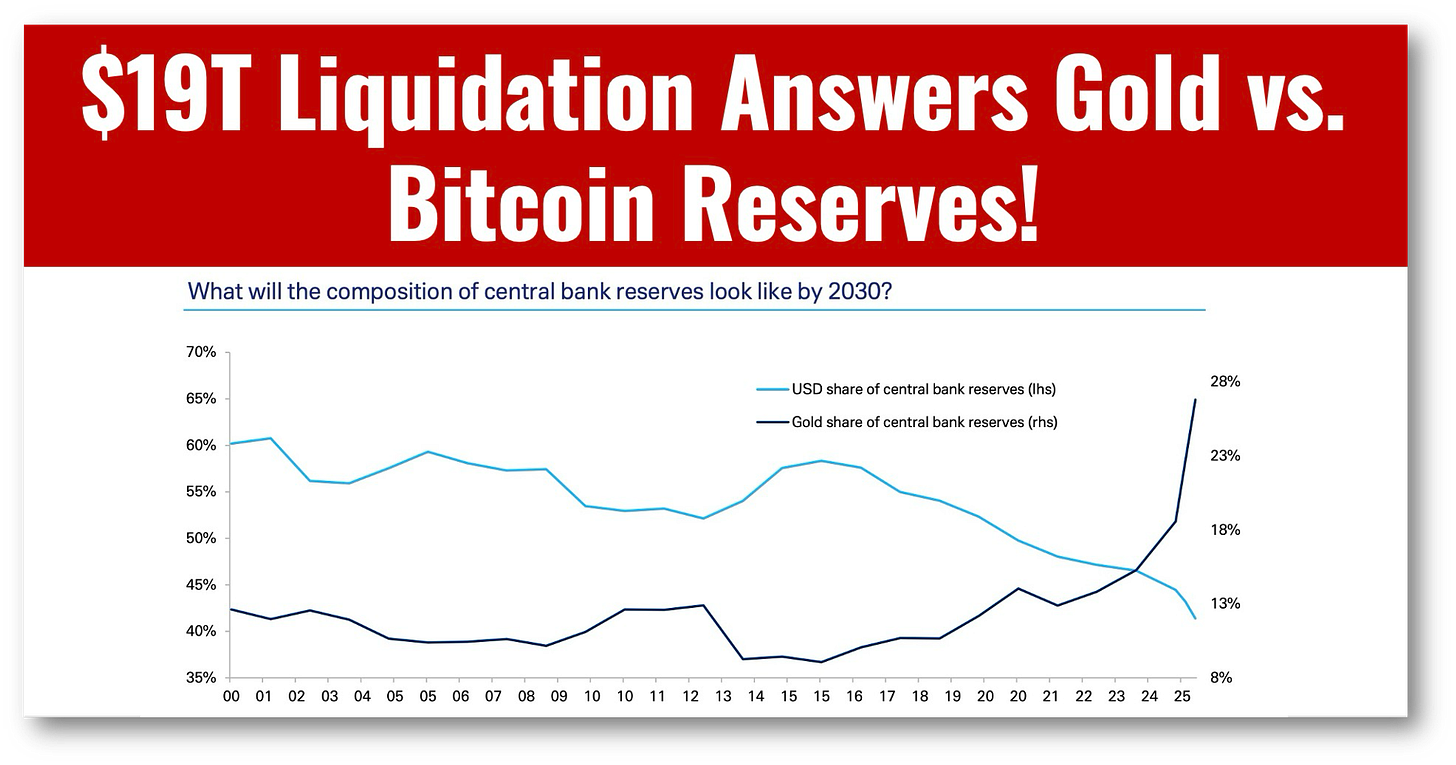

Central banks recently crossed a symbolic line as their combined gold reserves now exceed their U.S. Treasury holdings for the first time in nearly three decades. (chart above)

The last thing central banks need is the US buying BTC and pushing other nations to diversify away from the dollar.

Will the flash crash make any fans of Bitcoin as a reserve reconsider?

Not a chance.

They are fixated on the Siren’s song of Bitcoin with nearly religious fervor, regardless of how close to the crypto rocks they sail.

So, which would you pick for your government’s reserves, Gold or Bitcoin?

👉Arguments Against Bitcoin as a Reserve Asset

🔹 Lack of intrinsic value.

🔹 High volatility: Still seen as too unstable for sustained long-term value growth.

🔹 Limited usage: Only ~30% of activity is transactional.

🔹 Perceived risk: 44% of US respondents view cryptocurrencies as too risky for wider adoption.

🔹 Speculative nature: Treated more as a “riskon” asset than a “safe haven”.

🔹 Cyber vulnerability: Exposed to hacking and security risks.

🔹 Liquidity concerns: Less liquid than traditional assets.

🔹 US BITCOIN ACT proposes 1mn unit Bitcoin purchase program to acquire total stake of ~5% of Bitcoin supply. Trump has reportedly endorsed the act.

HAND CURATED FOR YOU

🚀 Every week I scan thousands of articles to find only the best and most valuable for you. Subscribe to get my expertly curated news straight to your inbox each week. Free is good but paid is better.