2025 Is the Year of Stablecoins—Start Building Today

Prepare now, as the GENIUS Act will turn US dollar stablecoins into a reality.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Deloitte has a straightforward and informative report tells companies to ask themselves how they want to engage with payment stablecoins (PSC) and get building NOW!

This is sound advice, given the likely passage of the US GENIUS Act this summer, and Deloitte provides a useful framework for integrating PSCs into business.

It’s time to stop waiting and get building.

Stablecoins, when used with the appropriate KYC and AML, are fabulous payment tools and deserve a shot at transforming our existing sclerotic payment systems to a 24/7, blockchain-fueled marvel.

Clearly, many are already building as 2025 saw the announcement of stablecoins from “X,” Fidelity, Bank of America, Ripple, The State of Wyoming, and, unsurprisingly, Trump-backed “World Liberty Financial.”

These early movers are trying to capitalize on what will undoubtedly be a hype-filled feeding frenzy after the immediate passage of the GENIUS Act.

The question that companies need to ask themselves is what role they want to play in this new ecosystem. There are more options than many know.

The new GENIUS Act allows non-financials the opportunity to issue stablecoins. Will we see Google and Apple entries like we have seen with “X?” Why not Amazon or Walmart?

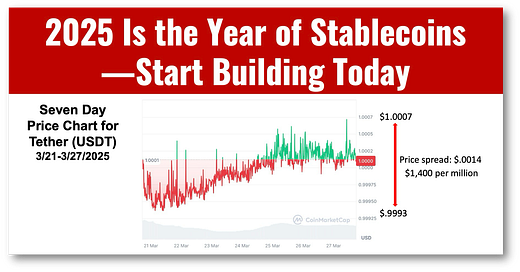

Still, I have one lingering reservation and that is despite the name, stablecoins are still less stable than they need to be.

The price of Tether varied by $0.0014 for the past week. On a $1 million transfer, that’s a $1,400 loss if you were unlucky and transacted on those days. Circle’s USDC did better but still had a difference of $0.0007.

Can the new batch of stablecoins under the Genius Act put more “stable in stablecoins?”

👉Stablecoin Risks:

🔹 Cybersecurity and data protection:

Issuers should safeguard their digital infrastructure against cyber-attacks, which could lead to the theft of PSCs and loss of private keys. Furthermore, the risk of technological failures, such as malfunctions in the blockchain network or issues with the underlying protocol, can disrupt PSC operations and lead to transaction delays or failures.

🔹 Anti-money laundering:

Issuers should comply with stringent regulations related to AML, KYC, and applicable state laws. Failure to comply can result in enforcement actions.

🔹 Blockchain and smart contract risk:

The reliance on blockchain technology and smart contracts introduces unique risks. Smart contracts can contain vulnerabilities or bugs that malicious actors may exploit. The underlying blockchain network may also experience forks, congestion, or other technical problems.

🔹 Depegging of stablecoin:

The primary risk associated with PSCs is the potential for depegging, where the units of the PSC in circulation diverge from its intended peg (e.g., 1:1 dollar value to its underlying fiat reserves).

🔹 Tax considerations:

While stablecoins may be used as a means of payment and carry a value similar to fiat currency, they may not be considered money or currency for US income tax purposes.

🔹 Accounting considerations:

From an accounting perspective, holders of stablecoins will need to assess the terms to identify whether those stablecoins represent financial assets or intangible assets, which will impact accounting for subsequent transfers.

🔹 Operational and market risks:

Issuers also face operational risks, such as the potential for human error, fraud, or internal misconduct, and market risks, including fluctuations in the value of reserve assets, which can affect the stability and value of PSCs.

🔹 Regulatory non-compliance:

The regulatory landscape for PSCs is complex and continuously evolving. Non-compliance with relevant laws and regulations can lead to severe penalties and legal actions.