40 CBDCs within 6 years, digital euro privacy, Beijing's dollar dilemma, Alipay+, and the end of dollar hegemony

9 of 10 central banks are working on CBDCs and digital euro privacy defined!

This week:

1. The CBDC Revolution Arrives, 40 in the next six years?

2. ECB sets digital euro privacy standards: equal or better than credit cards

3. Beijing’s dollar dilemma, it has too many! Decoupling nowhere in sight.

4. APAC Fintech Policy Toolkit

5. Alipay+ Launches

6. Dollar hegemony at risk? 3 of 4 big time economists agree

1. The CBDC Revolution Arrives, 40 CBDCs in the next six years?

According to recent statistics from the BIS, we’ll have around 40 CBDCs in circulation in six years. So if that isn’t a revolution, what is?

Nine out of 10 central banks worldwide are exploring central bank digital currencies, with two-thirds likely to launch within six years! (Graphs 1 & 6) (Graphs 1)

From the BIS report: “Gaining momentum – Results of the 2021 BIS survey on central bank digital currencies”

Download my highlighted version: here

These figures are from the BIS survey of 81 central banks just published. Once again, the BIS is making it clear that the future is arriving faster than you think.

Two-thirds of the 81 central bank respondents claim that they are “likely or might possibly” launch a CBDC within six years. (Graph 6) In rough numbers, this means around 50 CBDCs if all goes well and 40 if some fail.

We are at the threshold of a new digital currency world and staring over the precipice!

This BIS report is so important it got its own article here on Substack!

To read my full report on this CRITICAL CBDC document click below:

2. ECB sets digital euro privacy standard equal to credit cards or better.

STOP THE HYSTERIA: ECB declares that “digital euro privacy equal to that of private digital solutions [think credit cards]”, small transactions likely private exceeding cards!

As I have proclaimed for many months on these pages the privacy levels that you will get with a well-built CBDC will be similar to those that you currently have with credit cards and that CBDC is not the end of freedom as we know it!

The ECB is proposing three critical usage scenarios each with differing digital euro privacy:

🔹 High value payments: Data transparent to intermediary for AML/KYC compliance, just like cards are today with normal KYC “customer checks” for onboarding.

🔹 Low value payments (online): Will have a “higher degree” of privacy, not clear yet if fully private. Reduced KYC for onboarding for these users.

🔹 Offline payments (low value): Will be private and no data available to the intermediary.

The ECB is clear that at the minimum or “baseline”: “a digital euro would provide people with a level of privacy equal to that of private digital solutions.” This means that you will have at least the privacy of credit cards and banks but likely much better due to privacy on low-value transactions

Now, if this sounds like China’s scheme, it is. The ECB, like the PBoC, recognizes the difference between high-value payments that must have AML/KYC associated with them and lower-value payments that will be private.

What is important to recognize is that this is a HIGHER DEGREE OF PRIVACY THAN YOU HAVE NOW. With the digital euro, your low-value payments will be private, which you don’t have with credit cards!

It is absolutely critical that all citizens understand the design choice that the ECB is making.

To NOT have access to user data, the ECB is putting all AML and KYC in the hands of banks and likely other institutions like mobile operators. This way, no one can accuse the ECB of spying on users. Without this data, the ECB will not know who is using CBDC!

This is good for privacy but a setback for “disintermediation” meaning that your bank will get your payment data as they do now. In China, the banks don't get payment data! So each design decision has trade-offs.

Fair-minded readers who have read this far would rightly conclude that the hysteria surrounding CBDC privacy is unwarranted. You're right it isn't!

Download ECB PowerPoint on digital euro privacy: Here

3. Beijing’s dollar dilemma, it has too many! Decoupling is nowhere in sight.

Beijing's dollar dilemma is that it has too many, as China convenes a meeting to protect itself from the risk posed by US sanctions.

Reports are that Chinese regulators met with banks to discuss how to manage the risk of sanctions imposed on China like those imposed on Russia. Frankly, there’s not a lot that China can do.

With over US$ 1.5 trillion in US assets (Chart 1) China is essentially stuck if the US were to impose a freeze on deposits and bank cut-off as with Russia. In reality, China has such large dollar holdings that there is no practical solution for what to do with them. They can’t be converted into another currency because there is simply no other currency with markets deep enough to absorb cash flows of this size.

My take on this situation is that China and the US are like Ying and Yang forever linked to one another due to dependencies on currency and imports. ☯

I don't see this changing any time soon, do you?

4. APAC Fintech Policy Toolkit

The Asian Development Bank is trying to lay out the rules for regulating Fintech in Asia and the Pacific, it's not going to be easy but I give them credit for trying!

APAC is all over the place with regard to fintech capability. From industry leaders like Singapore and Hong Kong to tiny island nations there is a diverse community to tend to. Hopefully, documents like this can help some of the hard-fought gains in the more advanced countries filter down.

The document excels at showing real examples of fintech at work within the region including notable failures like China’s P2P loan failure! For all China’s success in fintech, its P2P loan platforms are considered a model of what can happen when fintech goes wrong!

What should hit you immediately is how each of the nations has varying degrees of sophistication, with some wholly unprepared.

Download the Asian Development Bank Report: “FINTECH POLICY TOOL KIT FOR REGULATORSAND POLICY MAKERS IN ASIA AND THE PACIFIC”

5. Alipay+ Launches (infographic)

Alipay+ shows us the future with "one payment solution to connect them all," a new way of interconnecting mobile payment platforms from across the globe.

Anyone thinking that Alipay isn’t innovating hasn’t been keeping up with Alipay+ a service that is pushing the cross-border use of mobile payment to new levels.

While Alipay+ has been around for more than a year it’s starting to get some serious traction that makes it newsworthy.

Alipay+ binds together mobile wallets, bank apps and merchant acquirers. It makes it so that when you go to the store and see the Alipay+ logo you can pay with your mobile wallet at millions of stores throughout Asia and Europe.

All eight Asian mobile operators will now be able to share each other’s network! Mobile payment will be easier to use away from home than ever before.

6. Dollar hegemony at risk? 3 of 4 leading economists agree

Is US Dollar hegemony at risk? Ask four leading economists, and you’d expect different answers, but the score is a shocking 3 to 1 in favor of decline.

I follow articles on dollar decline every day, and this was one of the best. It has something for everyone as the four leading economists, all have a different take on dollar hegemony.

One problem they agree on, however, is that there is no suitable replacement for the dollar at the moment. For the dollar to decline it has to be replaced with something, and so far none of the major currencies seems a likely successor.

So like it or not the dollar’s role is secure from any dramatic change but 3 out of 4 doesn’t rule out gradual decline. As an IMF report recently reported a reduction in dollar use is real but gradual, 12% over 20 years. That was pre-sanctions.

IMF report showing a 12% decline in dollar use in the past 20 years. Slow, but the real question is how much will this accelerate due to sanction

Comments from the economists, green checks signify decline, red X signifies no decline:

✅BARRY EICHENGREEN

“Countries cannot migrate to the euro or the yen, because Europe and Japan have cooperated with the US in applying sanctions. Renminbi markets are still limited in terms of liquidity and accessibility….. Given this, I expect any erosion of the dollar’s global hegemony to be gradual, not abrupt.”

✅ŞEBNEM KALEMLI-ÖZCAN

“Yet, having watched Russia’s central bank being cut off from its dollar reserves, many countries now have a strong desire to diminish the dollar’s outsize role.”

❌PAOLA SUBACCHI

“As the world economy has become more fragmented, the risk of holding a global public good that is also the US currency is more tangible than ever.”

✅YU YONGDING

“The current weaponization of the dollar certainly will speed up the greenback’s decline as the dominant international reserve currency. However, the network effect means that the dethroning of the dollar is a long-term process.”

Differing perspectives but most agree that sanctions are ratcheting up a desire for change, even if slow.

Thanks for reading

CBDCs and digital payment are changing our world at a blazing rate. Some 90% of central banks have CBDC projects. Like it or not, CBDCs are a shared future. Subscribe to be in control of your “cashless” future and to watch China change before your eyes.

More of my writing, podcasts, and media appearances here on RichTurrin.com

Contact me https://richturrin.com/contact/

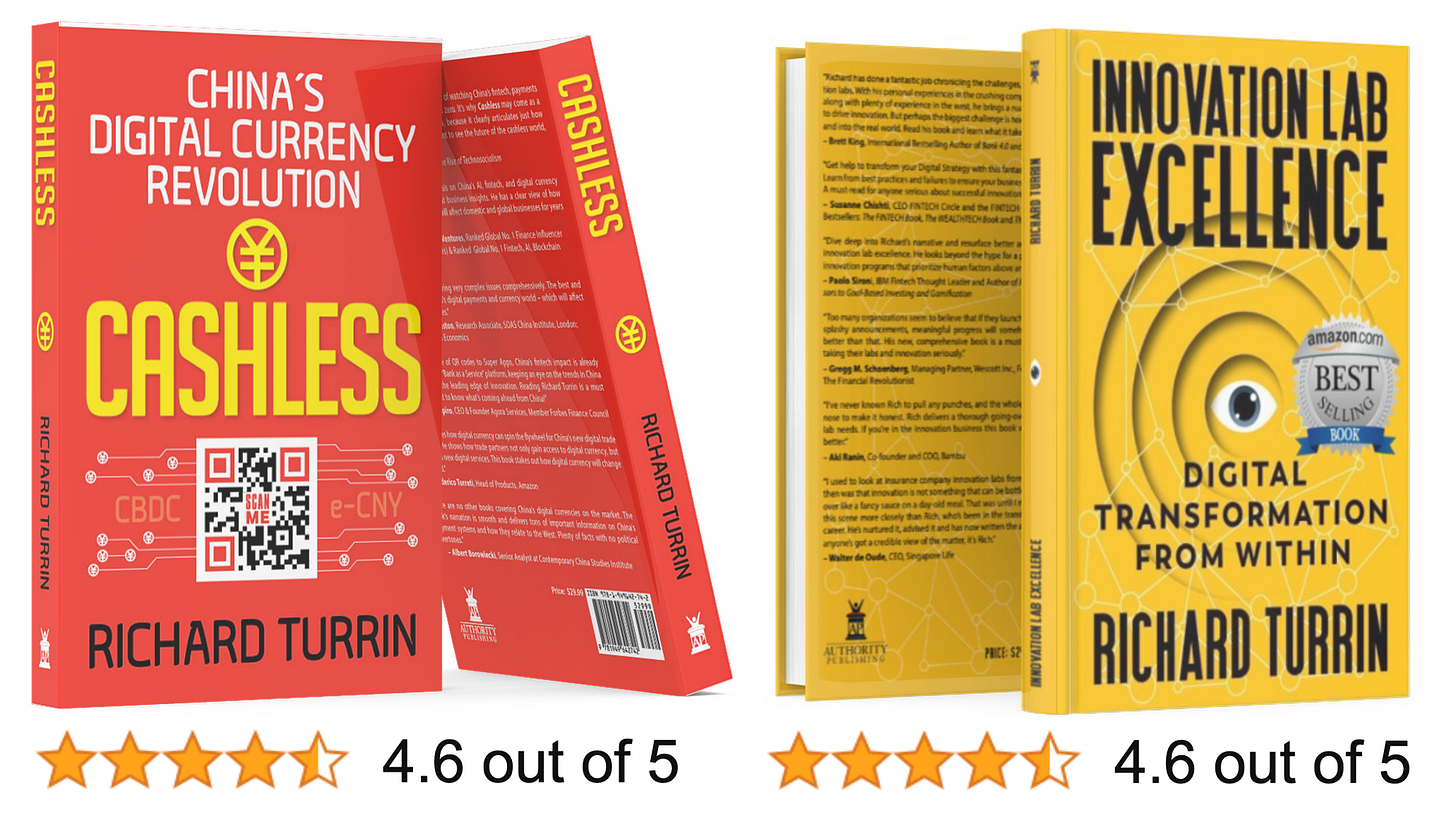

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: