80% of Banks are Looking to AI to Increase Productivity and Profit, But There's No Free Lunch!

IBM makes it clear that 2024 is the year of AI, with 8 of 10 banks looking to AI as their not-so-secret weapon.

But “there’s no free lunch” with AI, and 60% of those surveyed have omnipresent concerns about risk—and client relationships.

The fears float to the top, with 60% of banking CEOs indicating new vulnerabilities for cybersecurity (76%), legal uncertainty related to operations (72%), difficulties in controlling outcome accuracy (67%), and prejudice from model bias (65%).

CEO’s fears are extremely healthy for banking and customers.

👉TAKEAWAYS

IBM’s Ten Guiding Actions

Explore your bank’s AI priorities

1. Define the AI governance and risk profile of the bank.

2. Prioritize the selected use cases.

3. Formalize the AI strategy for the bank.

Integrate data and AI into core operations

4. Establish your data foundation on a data fabric.

5. Choose your AI platform and design appropriate governance.

6. Choose the most adequate AI models to match the selected uses.

7. Infuse generative AI in the software development life cycle.

8. Implement and learn from the first use cases.

Scale AI (AI+) in your bank

9. Integrate the AI strategy with a scale-up approach.

10. Organize an “AI factory” to deploy AI confidence at scale.

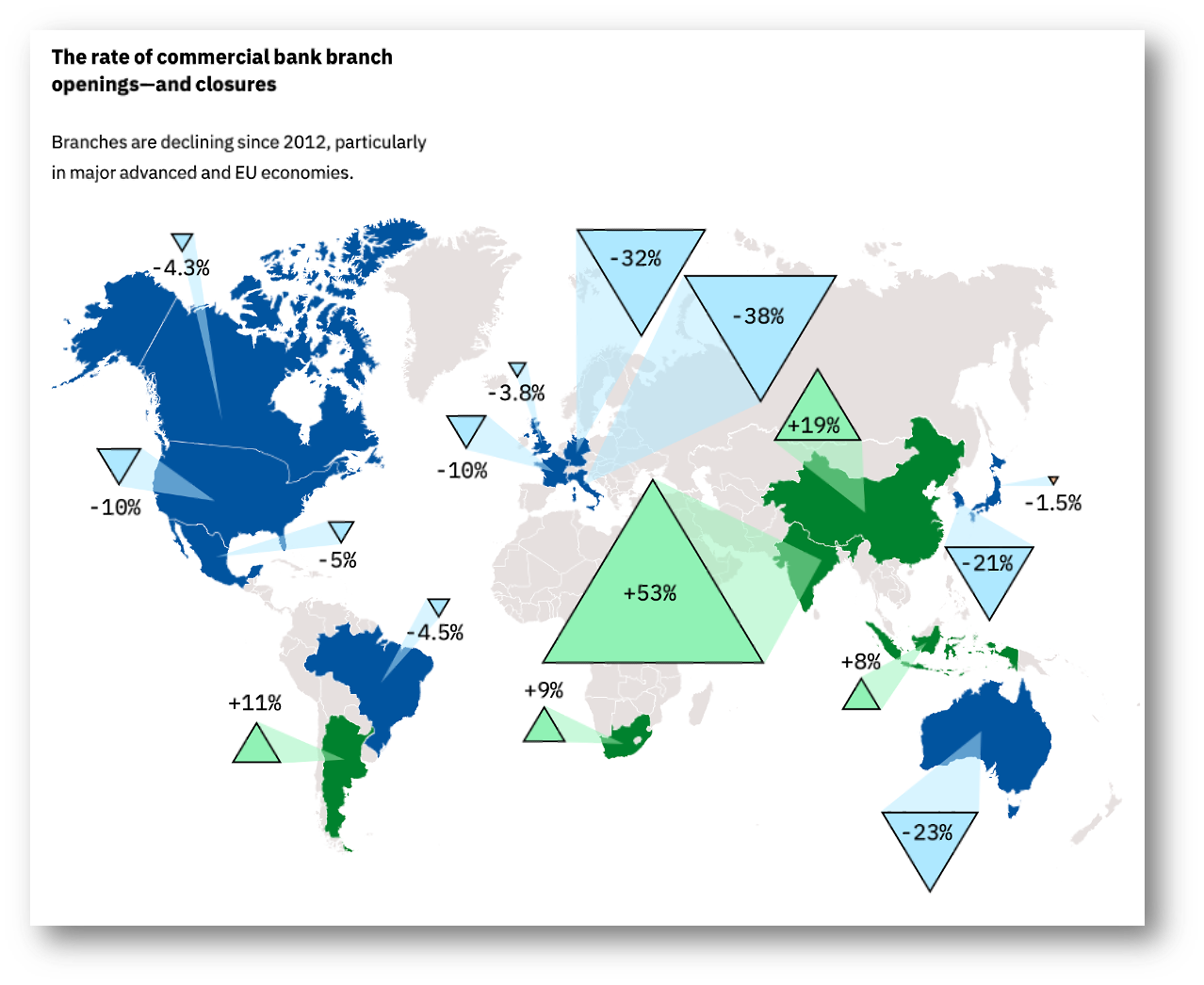

Can AI pick up the slack and provide quality customer service following the closure of bank branches throughout the developed world? Note the branch openings in the developing world.

👊STRAIGHT TALK👊

IBM does a great job on this report in highlighting AI’s risks and rewards.

It would be easy to dismiss IBM as a self-interested cheerleader for AI, but the survey and report show how bank senior execs are not so smitten with AI that they are blind to the risks.

As an ex-IBMer who sold IBM’s Watson AI, I think this is good for both IBM and banks as AI remains dangerously in overhyped territory. This doesn’t serve IBM or banks who shoulder the risks.

IBM’s “Ten Guiding Actions” are solid but not scaled for difficulty. What is readily apparent to anyone working with AI in banks is that Step 4, establishing a data foundation, is the most critical. Bank data silos thwarted many Watson implementations!

A truly Herculean task is finding AI talent for the “AI factory” floor. Undoubtedly, deploying AI at scale is the end game for banks, but the revolution will be delayed without talent.

The AI revolution won’t be easy, and CEOs should focus on the risk.

Thoughts?

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Subscribe! You’ll be glad you did!