94% of Central Banks Exploring CBDCs, Interest in Wholesale CBDCs Beating Retail

CBDCs are an irreversible trend and will be the payment rails of the future.

The BIS’s annual central bank (c-bank) survey is out, and 94% of 86 surveyed central banks are exploring a central bank digital currency (CBDC). A full 31% of C-banks are now working on pilot-stage CBDCs.

This trend is not to be underestimated. The Atlantic Council reports that these C-banks, now exploring CBDCs, collectively represent a staggering 98% of global GDP! Big enough for you?

What is interesting to me, and hopefully, you, the reader, is how each C-bank envisions its CBDC very differently from a technical and societal perspective.

These differences mean that no two are the same, with many subtle differences in design and market integration standards.

👉TAKEAWAYS

🔹 No two CBDCs are alike and c-banks are moving at their own speed, taking diverse approaches and considering different designs.

🔹 2023 saw a sharp uptick in experiments and pilots with wholesale CBDCs – mainly in advanced economies (AEs), but also in emerging markets and developing economies (EMDE).

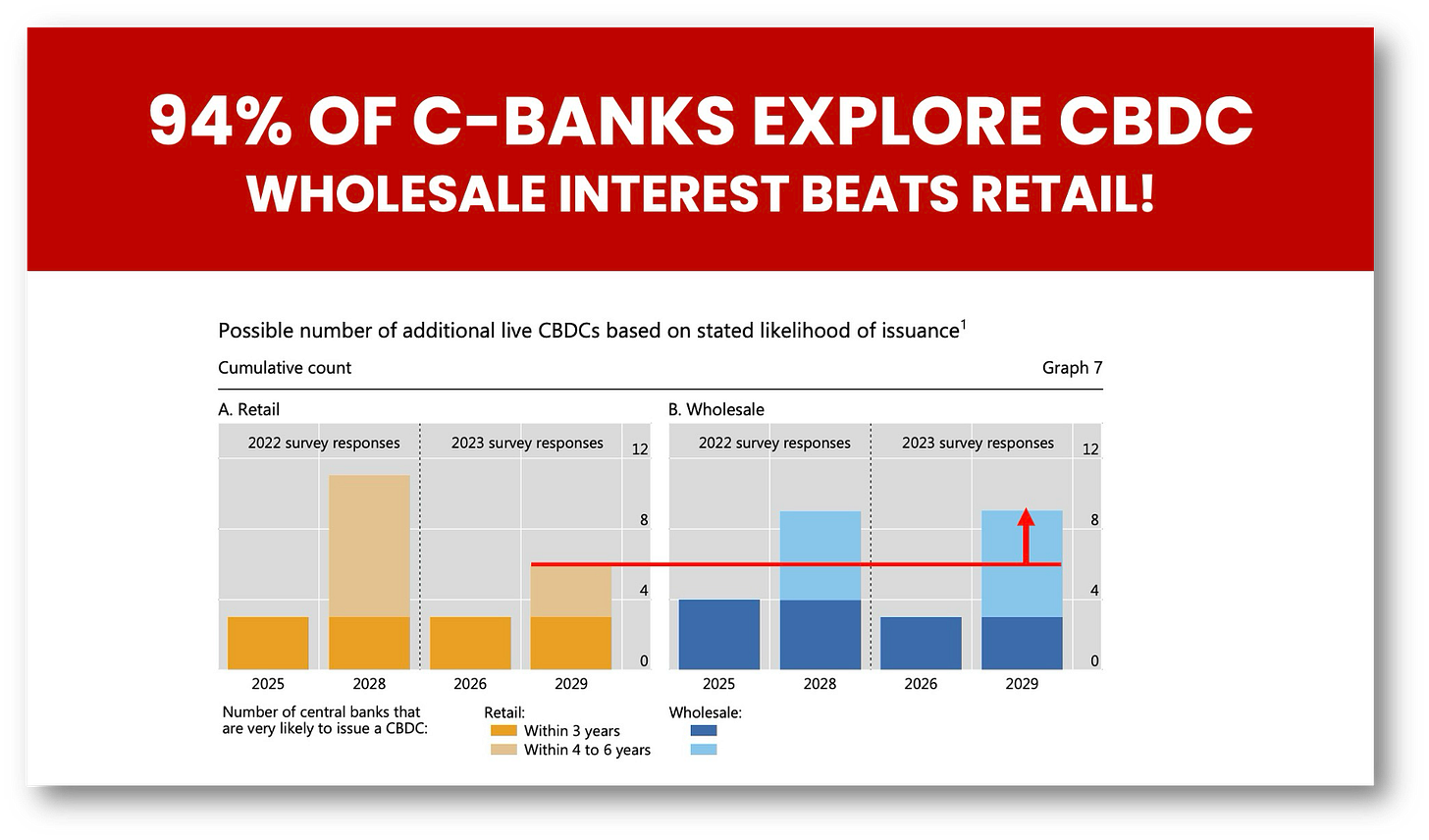

🔹 The likelihood that central banks will issue a wholesale CBDC by 2029 stands at 9 beating retail CBDC predictions of 5! (Chart above)

🔹 Central banks further enhanced their engagement with stakeholders to inform CBDC design. Many CBDC features are still undecided.

🔹 Yet, interoperability and programmability are often considered for wholesale CBDCs.

🔹 UNSURPRISINGLY: for retail CBDCs, half of C-banks want holding limits, interoperability, offline options, and zero remuneration. (China had these four years ago.)

🔹 Stablecoins are rarely used for payments outside the crypto ecosystem.

🔹 60% of c-banks are working on a framework to regulate stablecoins and other cryptoassets.

The one thing that 80% of central bankers can agree on is that none want to surrender cash to either crypto or stablecoins. That shouldn’t come as a surprise, but it highlights just how difficult it will be for crypto or stablecoins to break into central banks’ monopolies.

👊STRAIGHT TALK👊

As the author of a book on CBDC, I find this report to contain only good news, and I’m pleased to see these developments.

For anyone watching CBDC developments in 2023, it’s no surprise that wholesale CBDCs started to catch on and are taking the lead.

According to BIS statistics (Graph 3), in 2023, roughly 41 Retail CBDCs actually proceeded to the pilot phase compared with 56 wholesale pilots.

The reason is clear: it is far easier for a C-bank to run a wholesale CBDC pilot.

Wholesale CBDCs are less controversial and do not attract protestors as do their retail cousins. They have also not been branded “the enemy” by banks across the globe which allows c-banks to explore wholesale versions without alienating bankers.

Of course, the best example of retail CBDC controversy is in the US, where a ban on CBDCs seems likely to be passed into law. The law's broad wording can also encompass wholesale CBDCs, which will put the US at a severe disadvantage in developing CBDC systems and standards.

I still look to a future where cash transfers flow effortlessly on fast and inexpensive CBDC rails.

I can dream, can’t I?

Joining our community by subscribing. It will be an exciting journey down the rabbit hole to our future, and you’ll be glad you did!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!

https://www.ecb.europa.eu/pub/pdf/scpwps/ecb.wp2926~a61b033b8b.en.pdf you might find this interesting.