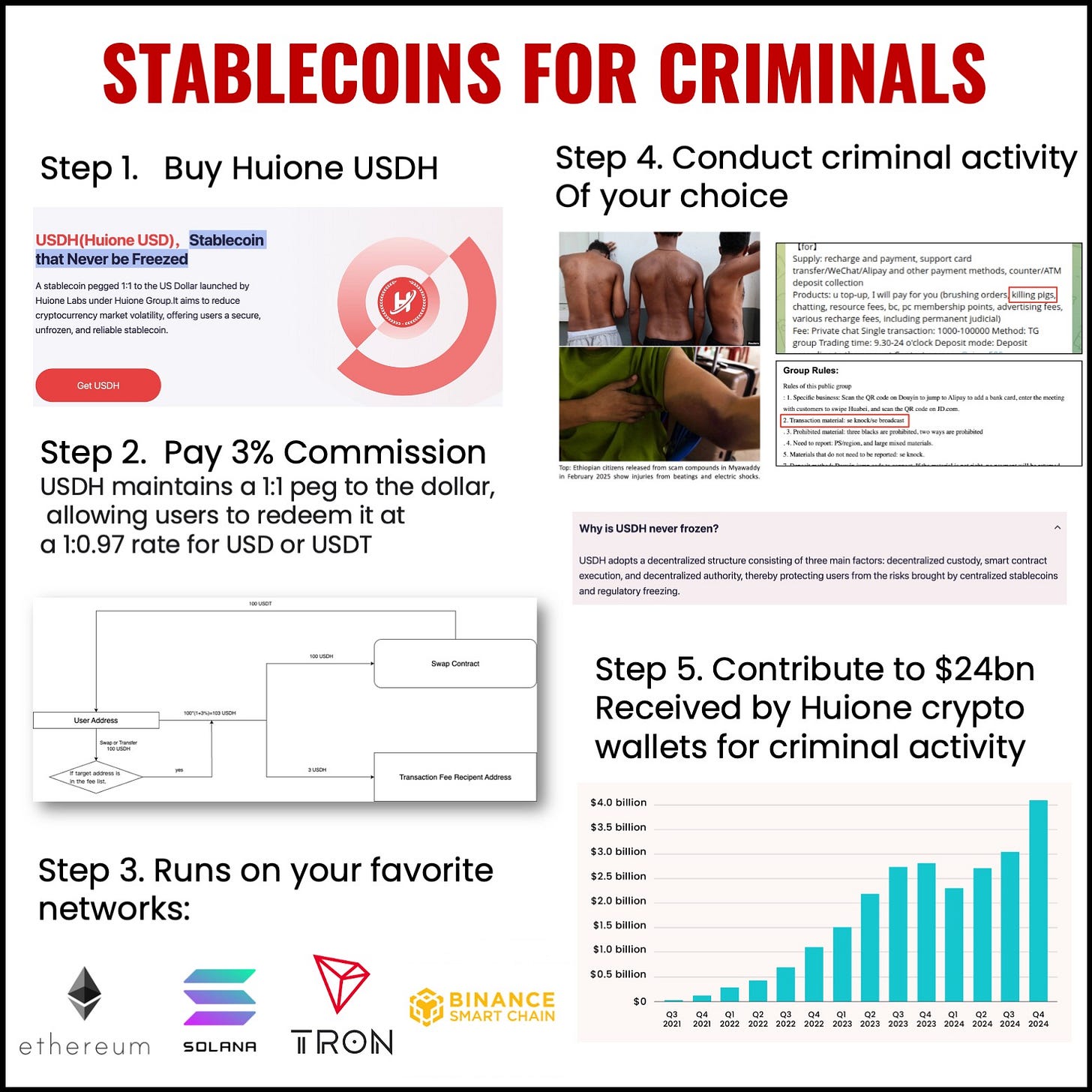

A New Trend: Stablecoins for Criminals—SE Asia’s Huione Shows How It's Done

Stablecoins allow scam centers in Southeast Asia to thrive

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Rather than a PDF, today I’ve got an infographic. The bottom of the page features a list of references and a new UNDP report highlighting the prevalence of organized crime in Southeast Asia. The infographic below can be opened in a new tab and enlarged to read the fine print.

The world is excited about using stablecoins, but so are criminals and Huione Guarantee, and its associated companies, shows what happens when criminal organizations get there hands on them.

➢Why this matters:

I like stablecoins, but remember that they are private money and not under the control of the government. This means that anyone, including criminal networks, can build one. This is in direct conflict with the crypto narrative that stablecoins are good. Some are, some aren’t

➢Who is involved and FinCen Intervenes:

Huione Group, operating primarily out of Phnom Penh, Cambodia, is a conglomerate that includes several subsidiaries: Huione Crypto, Haowang Guarantee, and Huione Pay PLC.

According to the US’s FinCen which is now in the process of banning the group from the US financial system: Huione Group serves as a critical node for laundering proceeds of cyber heists carried out by the Democratic People’s Republic of Korea (DPRK), and for transnational criminal organizations (TCOs) in Southeast Asia perpetrating convertible virtual currency (CVC) investment scams, commonly known as “pig butchering” scams, as well as other types of CVC-related scams.

Huione is a magnet for illegal proceeds of all types and is an equal opportunity money launderer regardless of country of origin.

➢ How big is Huione?

Huione is the largest digital, illicit online marketplace ever operated. It is Telegram-based and serves SE Asia’s and the world’s fraudsters. Merchants on its platforms have received at least $24 billion of cryptocurrency from wallets belonging to the group.

FinCen’s more recent data covers laundered money only. “Huione Group laundered at least $4 billion worth of illicit proceeds between August 2021 and January 2025. Of the $4 billion worth of illicit proceeds, FinCEN found that Huione Group laundered at least $37 million worth of CVC stemming from DPRK cyber heists, at least $36 million from CVC investment scams, and $300 million worth of CVC from other cyber scams.”

➢ The “Stablecoin that Never be Freezed”

In September 2024, Huione launched USDH, a USD-backed stablecoin. The trigger for this launch was that Huione was not pleased when its accounts on Tether were frozen because they were linked to a theft attributed to North Korea’s Lazarus Group.

USDH calls itself “Stablecoin that Never Be Freezed,” yes, including the grammatical error. To add to its legitimacy, it proudly declares that it runs on Ether, Tron, Solana, and the Binance Smart Chain! Public chains that so far look the other way and are unaccountable for aiding crime.

Its website states:

“Unlike 99% of the tokens on the market, USDH has completely removed the commonly used “blacklist” mechanism from its smart contract.“ “The design guarantees both individual and institutional users full control over their assets within a truly decentralized network, free from the risk of third party intervention.”

This is a criminal’s dream, no need to worry about pesky AML, KYC, or FATF issues! Users get all of the benefits of using a US dollar stablecoin with none of the pesky drawbacks.

And the cost of using the network? USDH for USD or USDT at a 1:0.97. A 3% transaction fee is automatically charged whenever a USDH address is used.

Market capitalization from the coin’s third quarter 2024 statement shows $1 billion in issuance on Ethereum, Solana, and Binance Smart Chain, with $10 billion on TRON. The statement strongly suggests that these are real, funded coins since over $4.4 billion in USDT has been laundered into unfreezable USDH!

➢ Will the FinCen Ban Matter?

Not much. USDH is Cambodia-based and doesn’t rely much on the US banking system, even if it keeps reserves in US dollars. Dollar reserves can migrate to Cambodia outside of the SWIFT network via offshore USD Clearing in Manila, Hong Kong, and Singapore. While Hong Kong and Singapore will comply with the FinCen ban there are always banks in SE Asia that will not. So in reality, it can’t be completely cut off.

Another issue is whether USDH has dollar reserves at 1:1 matching. It might not need fiat dollars held in a bank, but stablecoins in its reserve. We can’t know because the level and quality of USDH assets aren’t published.

➢ Just the beginning

Stablecoins are the natural digital evolution of criminal activity, and USDH and Huione Group are just the beginning. You can bet there are others we don’t know about right now.

While some call USDH “dark stablecoin,” I think “criminal stablecoin” is far more fitting. Dark sounds far too sterile when contrasted with the ruined lives of scammed people or the actual human trafficking that occurs on Huione Group sites, which are the global epicenter of online fraud.

While FinCen banning Huione Group may help, rest assured, new corporate entities or other financial tricks will be used to keep the USDH stablecoin alive. So far, there has been no comment from Ether, Tron, Solana, and the Binance Smart Chain, who hide behind the public nature of the service they provide to aid and abet crime.

Meanwhile cryptobros declare on “X” that “dark stablecoin-related assets could have investment potential,” Showing how vile the bros can be.

More criminal stablecoins are coming. The ease with which we can build them makes crime easier, not harder, and that's a feature, not a bug, of stablecoins.

References:

The UNDP: Inflection Point: Global Implications of Scam Centres, Underground Banking and Illicit Online Marketplaces in Southeast Asia.

This report shows just how bad SE Asia’s scam centers are. It’s a sad but important read. Once you see it you can’t unsee it.

Elliptic’s ground breaking article: HERE

USDH Stablecoin website: HERE

USDH Stablecoin explanatory documentation: HERE