Africa's lessons for CBDC; China: "Should I stay or should I go?"; US Payment apps' data disaster; Asian banks beaten by fintech; EU bank's digital efforts are comical

Commercial banking 2023: "It's the economy, stupid."

1. Africa mobile money’s lessons for CBDC

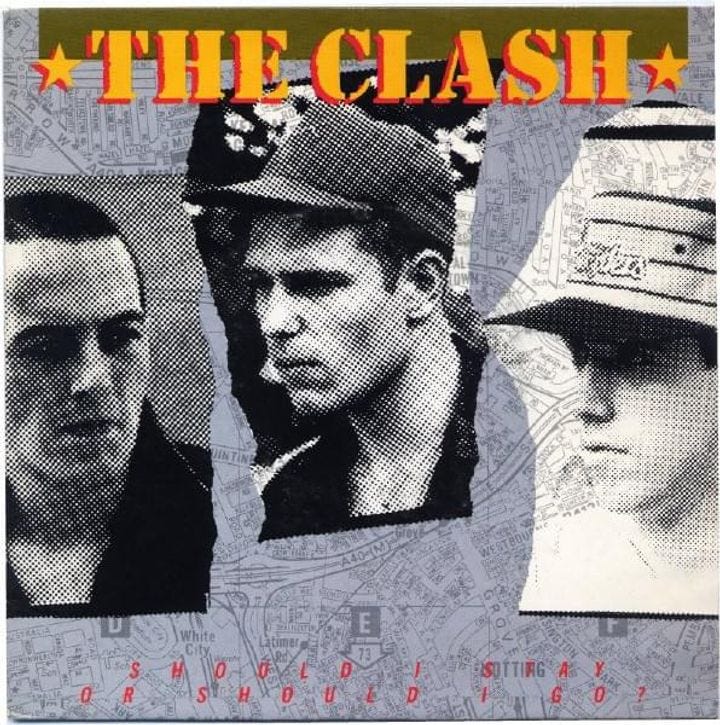

2. China & multinationals: should I stay or should I go? (The Clash)

3. US P2P payment apps’ data disaster

4. Asian banks beaten by fintech in cross-border payments

5. EU bank digital transformation so sad it’s funny?

6. Commercial banking 2023: “It’s the economy, stupid”

Artwork: Claude Monet, 1908, San Giorgi. Venice!

There is no other relation between this art and today’s stories! I used this picture for no other reason than in a little more than a month I’ll be visiting my home near Venice.

I am proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read. If you want crystal clear hype-free discussion on all CBDCs, fintech, crypto, and China’s tech scene, this is the place. All my writing is backed up by curating the best educational PDFs in the business. Subscribe, and you’ll be glad you did!

1. Africa mobile money’s lessons for CBDC

CBDCs have a lot to learn from Mobile Money’s success in Africa!

Download: here

Fabulous read by Amb - Prof Bitange Ndemo and Aaron Thegeya of the Friedrich Naumann Foundation, who take an objective look at mobile money in Africa to find how its successes and failures can be used to make better CBDCs.

It will be no surprise to readers that mobile money is big in Sub-Saharan Africa, which boasts 45% of the world’s mobile money accounts.

While it’s been -mostly- a positive experience for the region, with more than a decade of experience there is ample experience to show where these systems need improvements that CBDCs can potentially adopt.

The authors pull no punches at singling out Mobile Money’s failures and successes:

Mobile Money Successes:

· Contributed a 1-2% increase in GDP in countries with high adoption

· Increased financial inclusion. BUT loans and gambling decreased users' financial health!

· Positive impact on savings habits, particularly female lower-education and income, rural users.

· Tiered KYC regulations based on the size of the user.

· Improved attitudes toward digital financial services.

· Increased transfer of informal cash into the banking system.

Mobile Money Failures:

· Exacerbates social inequality due to no connectivity or high data costs and transaction fees.

· Regressive “slab-based” (fixed) pricing. MPESA: $1 transaction has a fee of 10%. 50x more than a $1500 transaction with a 0.2% fee.

· Domination of mobile payments by major players creates a disincentive for interoperability. (Walled gardens, like China.)

· No protection for funds held in digital accounts and no deposit insurance.

· Decreased user financial health due to abuse of digital loans and betting!

· People didn’t go “cashless” most still use cash due to fees!

· Data privacy issues.

Recommendations for CBDCs:

· Legal and regulatory infrastructure focusing on dispute resolution, risk management, and deposit insurance.

· Regulations allowing leveraging non-financial infrastructure such as mobile operators and their networks.

· Non-regressive pricing! (CBDC is free!)

· Tiered approach to KYC and compliance to enhance inclusion.

· User privacy.

· Financial education to reduce excessive debt.

Takeaways:

— CBDCs are not a panacea but eliminate regressive fees and walled gardens common in mobile money.

—As national currencies, their legal status and user protections are superior.

—CBDCs can't eliminate betting and debt, the twin evils of digital payments!

—Offline transfers with CBDC cards can help eliminate social inequality and improve inclusion

2. China & multinationals: should I stay or should I go? (The Clash)

China and multinationals: “Should I stay or should I go?” Stay! China is too big to ignore.

Look at the graph on the far right showing how big China’s growth may be. It is the size of the combined GDP of Indonesia, Japan and India!

Download: here

McKinsey's report looks at the risks and benefits of MNC's China business and concludes that China is simply too big to ignore despite the risks.

MNCs are huge in China, with total assets and sales over $3tn, around 20% of China’s GDP! With China’s share of global GDP at 18%, equal to the EU’s, and second only to the US with 24%, the opportunities are clear.

Factor in GDP growth between 2-5%, and China accounting for 25-40% of global revenues, and how can MNCs afford to leave?

Still, China is not without risk, and MNCs are indicating that China is no longer a top investment priority. The biggest risks are geopolitical and regulatory, but negative sentiments toward China also play a part.

Regulatory changes are critical, and MNCs risk being caught between conflicting US or Chinese regulations. Chip manufacturers are the best example.

China’s Innovation

It's not just China risk that is changing but also MNCs! MNCs are segregated into winners and losers. High-mid and low-performing MNCs showed diverging growth of 19%, 16%, and 5%.

China’s companies are also innovating and challenging weaker MNCs. MNCs' share of all China’s exports declined from 58% in 2005 to 34% in 2021. Why? China’s companies' R&D spending is three times that of MNCs.

The Clash’s classic “Should I stay or should I go” is the perfect song for MNCs who are not making it big in China.

“Should I stay or should I go now?

If I go, there will be trouble

And if I stay it will be double

So come on and let me know”

“But we’re decoupling from China!”

McKinsey is clear: “The sheer size and complexity of the Chinese market may mean that notions of outright decoupling are simplistic."

MNCs can reduce China risk by considering:

— Capital and ownership. Can MNCs tap into Chinese and global capital and build self-funding business models? Spin off China subsidiaries?

— Supply chains. What should MNCs localize and what should they diversify? How much concentration in each step of the value chain is reasonable, not just in China but globally?

— Innovation. How much innovation, both in process and products, should take place within China?

— Branding. Can MNCs build brands appealing to local customers while taking advantage of the power of their global brand?

— Talent. How should MNCs hire employees from China’s increasingly skilled talent pool while still benefiting from global talent flows?

— Technology and data. How can MNCs localize their data and technology infrastructure while conforming to Chinese laws and global standards?

Takeaways:

— Should I stay or should I go? Stay, MNCs can't afford to leave.

— Low-growth MNCs are now at risk from Chinese companies.

— Geopolitical risks abound both from China and the US.

— Decoupling? No.

3. US P2P payment apps’ data disaster

Peer-to-Peer Payments Apps in the US are a data disaster and show why we need CBDC!

Download: here

None other than “Consumer Reports” (CR) the guardian of the US consumer, makes it clear that the leading US P2P payment apps all fail and need work!

Apple Cash, Cash App, Venmo, and Zelle don’t measure up to their or CR's standards of safety, privacy, and transparency.

SPOILER ALERT: Apple Pay won!

Most disturbingly to me was that these apps are vacuum cleaners for data, and the companies are brazen in their theft. All the P2P providers make it clear who’s the boss in their data policies!

Venmo has no shame, boldly proclaiming that it can collect “additional information from or about you in other ways not specifically described here.” Not to be outdone Cash App declares that they can collect data for “any other reason we may tell you about from time to time.”

Now while CR doesn’t say this I will. As you read the major issues they uncover, particularly with regard to data and privacy, think how much better off we would be with a CBDC that is not mining your data. One thing the digital euro, pound, and RMB CBDCs all share is that they cut the flow of data to 3rd parties.

So the next time you read that “CBDCs are a solution looking for a problem” ask why they conveniently overlooked data privacy.

CR’s findings say it all:

● P2P payment apps collect large amounts of consumer data, often share data with other companies, and often make it difficult for consumers to delete the data.

● Policies for resolving fraud and errors can leave consumers at risk of losing money.

● App disclosures and documentation contain vague descriptions of security measures; there may be discrepancies between companies’ disclosed security protocols and their practices.

● Users must meet sometimes-confusing conditions to ensure that their funds are covered by insurance under the Federal Deposit Insurance Corp. (FDIC).

● Apps make it difficult for users to understand and track updates to legally binding documentation.

● Users are generally required upon sign-up to give up certain legal avenues for resolving potential disputes.

● Consumer disclosures are often difficult to find and read, reflecting a broad concern about transparency.

Given that P2P payments often have high card-related fees and a lack of data privacy, wouldn't we all be better served by a CBDC?

Takeaways:

—We deserve better P2P payments.

—Abusive data practices are the norm, not the exception.

—CBDCs as a standardized "public good" will resolve many, not all, of the above problems!

4. Asian banks beaten by fintech in cross-border payments

Asian banks CANNOT regain their cross-border payments crown, they've already been disrupted!

Two PDFs combined. McKinsey’s report and Robocash Group’s analysis of Asian fintech. Download Mcinsey: here Robocash Group: here

McKinsey’s report on Asian banks cross border payments is a great read, but wants Asia’s banks to do the impossible and regain their dominance in payments.

How can banks achieve this when they've already been “disrupted” by fintech’s specialized transfer platforms and mobile wallets with immediate transfers?

Demonstrating that the war is lost, McKinsey wants banks to focus on SMEs a market sector that fintech is quickly winning! McKinsey acknowledges that Asian fintech and payment specialists are growing at three to four times the rate of incumbent banks.

Compounding the problem, Asia’s SMEs are frugal, and margins banks consider immaterial are big savings for an SME. Can you blame them?

To illustrate the extent of fintech competition, I’ve attached Robocash Group’s FABULOUS NEW "State of Asian Fintech" report. From 2000 to 2022, the total number of fintech grew by 3588%! In what I call “the Alipay effect,” the biggest growth was between 2015 and 2020.

McKinsey knows they are fighting a tough battle, and their advice is excellent! Kudos to the authors!

But McKinsey is like a great boxing coach giving good advice to a boxer who won the title long ago and is now past their prime:

🔹 Building SME-centric solutions

"While most payments volumes emanate from large corporate clients, opportunities are often located among fast-growing SMEs, many of which are expanding internationally."

🔹 Focusing on growth use cases

"A tried-and-tested approach to building capabilities is to focus on use cases. This helps organizations address customers’ increasing demand for solutions adapted to their specific contexts."

🔹 Embracing partnerships and M&A

"If you can’t beat them, join them. As banks seek to rationalize their cost bases and serve SMEs better, they may consider partnerships or acquisitions. A “build vs. buy vs. partner” conundrum."

🔹 Reviewing the operating model

"Banks....need to ensure that their operational capabilities are sufficient to achieve their service ambitions."

All of these suggestions are excellent, but if the boxer is aging won't be enough to regain the title!

Takeaways:

— Incumbent banks in Asia must share the market with fintechs and can no longer reign supreme.

— Asia’s SMEs are frugal, have no love of their bank and will always shop for a “good deal.”

— McKinsey’s advice is excellent, but it can only slow client loss or help capture limited sectors.

— Fintech growth in Asia is astounding and the disruption is real!

5. EU bank digital transformation efforts are so sad they’re funny?

EU Bank Digital Transformation progress is outright comical, as though no matter what they do and how much they spend, they still can’t get it right.

Download: here

Rarely would an #ECB document outlining EU bank digital transformation be considered funny, but I’m sorry to say this one is at times!

The ECB surveyed 105 large banks and the results are simply shocking.

Let’s look at the ECB’s “focus points:”

1. Digital strategy and KPI steering:

43% of banks’ top-5 projects are aimed at revenue/ customer experience enhancement, while 83% of banks see process automation as a key lever to reduce costs.

Most banks still can’t determine the Key Performance Indicators (KPIs) to monitor digital progress. Ironically, when banks’ key digital projects are broken down, the smallest groups focus on customer UX and digitalization. So costs over clients?

2. Digital business:

Monitoring the actual use and contribution of digital channels is outright comical!

Neobanks will have no trouble beating incumbents in the digital game given that:

-50% of the sampled banks do not monitor the number of customers digitally onboarded.

-25% of banks can quantify the volume of digital sales.

-50% of the sampled banks do not monitor the number of digitally concluded loans!

WHAT?!

Let those figures sink in!!

3. Investments and resources:

On average, banks invested 2.8% of their operating income in digital transformation projects in 2021.

Let’s put the 2.8% in perspective. In 2019 the ECB reported that EU bank cost-to-income ratio (CIR) was 64.1%.

This means banks' investment in digital is roughly 4% of their overall costs! Is that a deep commitment to digital?

I consent cost is a poor measure, but EU banks, it's time to “put your money where your mouth is!” Is this comical or sad?

4. Governance and cooperation:

“Top management is often involved in the definition and design of the digital strategy. However, its reporting is heterogeneous across banks.” Management has little top-level control over digital programs, which is hardly a recipe for success.

5. Use of innovative technologies:

The use of technology seems reasonable, but it doesn’t mean they are used for anything, of consequence: 90% use APIs, 80+% use cloud, 60% use AI, and 20% DLT. Crypto-related activities are "insignificant."

6. Risks:

Risks are cyber risk, increased third-party dependency, AML/fraud, and potential loss of customers. Banks can identify the risks but are hard-pressed to manage them.

Takeaways:

—Digital transformation in EU’s top banks will make you laugh or cry.

—Bank's efforts seem underfunded and poorly managed.

—Am I too harsh? Maybe, but digital transformation is no laughing matter!

6. Commercial banking 2023: “It’s the economy, stupid”

Commercial banking in 2023 is facing challenges and unsurprisingly: “It’s the economy stupid.”

Download both on one link: here

A two-for-one PDF evening as we look at Accenture and Deloitte’s predictions for commercial banking in 2023. Both make it clear despite our distraction with spy balloons, UFOs, and ChatGPT, the biggest factor for banks in 2023 is the economy.

It may sound harsh, but whether or not to add ChatGPT or other digital innovations are likely only to have a small impact relative to banks’ bigger problem inflation and a sputtering economy.

I am likely upsetting friends at both Accenture and Deloitte by combining their PDFs into a single read. I am doing this because I think that both are excellent papers and that they are STRONGER when read together.

Accenture and Deloitte do not agree on what to focus on in 2023, but they do agree that the state of the economy is key, and ALL their recommendations are framed around the expectation of a fragile year.

Here's what they both lead with on the economy:

Accenture:

“In the US, deposit levels fell by $370 billion in the second quarter of 2022,1 although they remain above historical norms. Meanwhile, commercial real estate will have to be re-priced to reflect rising cap rates, higher vacancy rates, and increased tenant cash flow risk. In Europe, many businesses that have never faced high-interest rates before are confronted by the challenge of servicing their variable-rate loans. ”

Deloitte:

“Commercial banks are looking at 2023 with caution and heightened sensitivity. Tighter monetary policy and macroeconomic uncertainty are putting greater strain on businesses’ growth across multiple industries. In Deloitte’s Q4 2022 CFO Signals Survey, 41% of cross-industry North American CFO respondents were pessimistic about their company’s financial prospects quarter over quarter, while only 20% were optimistic (figure 2).”

The economy is no one’s friend this year, and this has big implications for banks' digital programs. They will have to focus on cost reduction inside the bank and helping clients to “navigate uncertainty.”

One point both consultants agree on is the rising need to acknowledge ESG and sustainability!

Takeaways:

—2023 will be a tough year not just for commercial banks and their clients!

—Digital will have to focus on reducing costs either for banks or clients.

—Free money is over and funding costs will hammer banks and clients.

—Digital has to prove its relevance, and adding ChatGPT to a bank portal will not do it!

If you’ve read this far, subscribing is the only logical course of action.

And share on Twitter because:

"The needs of the many outweigh the needs of the few or the one."

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter, or Linkedin for more. If you want to learn more about Innovation Labs or China’s CBDC, check out my website richturrin.com which is full of videos, interviews, and articles. The best way to make sure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE