AI Agents Go Mainstream Fueling Surge In Market Risk. Is the AI Bubble Ready to Pop?

The Top 5 US payment trends and CBDCs where there's smoke, there's fire.

Artwork of the day: “Woman and Birds in the Night,” Joan Miro, 1945

Miró’s career took flight in the early 20th century, influenced by the tumultuous socio-political landscape of his time. His early works bore the marks of Fauvism and Cubism, but it was the gravitational pull towards the surreal that truly distinguished him.

“Woman and Birds in the Night” unveils Miró’s fascination with the mystical and cosmic realms. Painted in 1945, this artwork is a poetic exploration of the connection between the human and the celestial. Ethereal figures and a dreamlike atmosphere beckon us to join Miró on a journey through the mysteries of the night sky.

Miro’s surrealist painting is a study of contrasts, just like AI, with the new technology helping and potentially hurting.

On the one hand, AI promises fabulous advances, with AI agents that can solve problems, analyze data, and independently arrive at an answer—utopia, if there ever was one, particularly for traders.

On the other hand, the Financial Stability Board (FSB) raises alarms about AI’s ability to destabilize markets. The FSB is grappling with a problem: it doesn’t know how much AI is out there, so it can’t know its impact.

Showing that history repeats, the FSB had the same problem with programmatic trading, and I’m sure you remember the “flash crashes.”

These two articles should be read in concert with my final article, in which I ask whether the AI bubble is ready to pop, which is another study in contrast!

My serious question is attached to a fabulous FT report on AI’s Future. The report is a great read, but I think it errs by assuming that AI will keep getting smarter and that investment money will flow without end.

That’s unrealistic, and experts think the AI bubble is about to pop.

Returning to payments, we have a report by Deloitte that looks at the Top 5 Trends in US Payments, which surprisingly does not have instant payments in the running! The US is so card-dependent that fast payments are sadly not even part of the future.

Finally, read the IMF report on how CBDCs are making good progress worldwide. CBDCs are creating a lot of smoke, and the fire will come in a few years.

Thanks for reading!

As always, subscribe, share, and NEW this week, “Buy me a coffee.”

AI Agents: A New Paradigm for Human-Machine Collaboration

Two key reports will help you better understand AI agents

FSB's AI Warning: Amplifies Vulnerabilities Despite its Benefits

Better late than never, the Financial Stability Board (FSB) finally acknowledges that AI may negatively impact stability and amplify vulnerabilities.

GenAI On The Verge: The Tipping Point is Now

AWS with a great read on generative AI (GenAI) with seven fabulous predictions built around the assertion that the GenAI “the tipping point is now.” It is!

For AI fans go straight to the last story on the Future of AI

Deloitte's Top 5 US Payment Trends To Watch In 2025

Deloitte picks five solid trends for the future of payments in US markets, showing that while change comes slowly to the US payment market, it is coming.

CBDCs Make Progress: Thickening Smoke, But No Raging Fire!

The IMF with a fabulous report showing the progress on CBDCs globally that will bring you up to date on the fast-moving CBDC scene!

The Future of AI: If The Massive Bubble Doesn't Pop

Will AI keep getting smarter, and the money keep pouring in forever?

Today's read from the FT has something for everyone and covers AI's impact on six different industries.

This is a solid read and shows how deep AI penetrates all industries. I mean, who would have guessed that AI can inspect power lines?

The problem isn't that it's upbeat, as we should be, but that it seems to assume that the AI market will just roll along steadily.

The assumption is that AI models will get ever smarter, and the investors have no limit to pumping money into what many consider a bubble.

I think that is unlikely.

So yes, AI can do all of the wonderful things that the FT highlights for financial services, healthcare, and energy, but I think these revolutions may take longer than predicted.

Many of you may have read some sobering news about AI this week that LLM model intelligence may be reaching diminishing returns, with larger models only getting marginally smarter.

Amir Efrati, editor of the industry trade journal "The Information" is on record stating that “OpenAI's [upcoming] Orion model shows how GPT improvements are slowing down”.

Meanwhile, famed tech guru Marc Andreesen, commented this week that “we're increasing [graphics processing units] at the same rate, we're not getting the intelligent improvements at all out of it” – saying we've hit a plateau.

As to investors, signs they are becoming more skittish are in the news, with Citadel's Ken Griffith selling AI shares and buying alternative tech investments.

My point isn't to predict a crash or suggest that our AI future is anything but fantastic; I believe it is wholeheartedly.

We do need to acknowledge that easy money and easy intelligence gains in AI won't last forever and that our supplies of electricity and water can't all be used to serve AI.

There are limits, and they apply to AI, too!

Many don't seem to acknowledge this.

Want more? Read my prior post on Goldman’s controversial GenAI report:

GenAI: $1 tn Spent With Nothing to Show For It?

“Tech giants and beyond are set to spend over $1tn on AI capex in coming years, with so far little to show for it. So, will this large spend ever pay off?”

Articles that made me think:

The AI bubble will have to end sometime, and I think that it’s happening now:

CONFIRMED: LLMs have indeed reached a point of diminishing returns

Opinion: The AI bubble is looking worse than the dot-com bubble. The numbers prove it.

And on the payments side, look at Ant using blockchain treasury management just like JP Morgan. I think this is a trend with Citi, JPM and now Ant all using the same trick:

Ant International partners Standard Chartered, OCBC for blockchain settlement

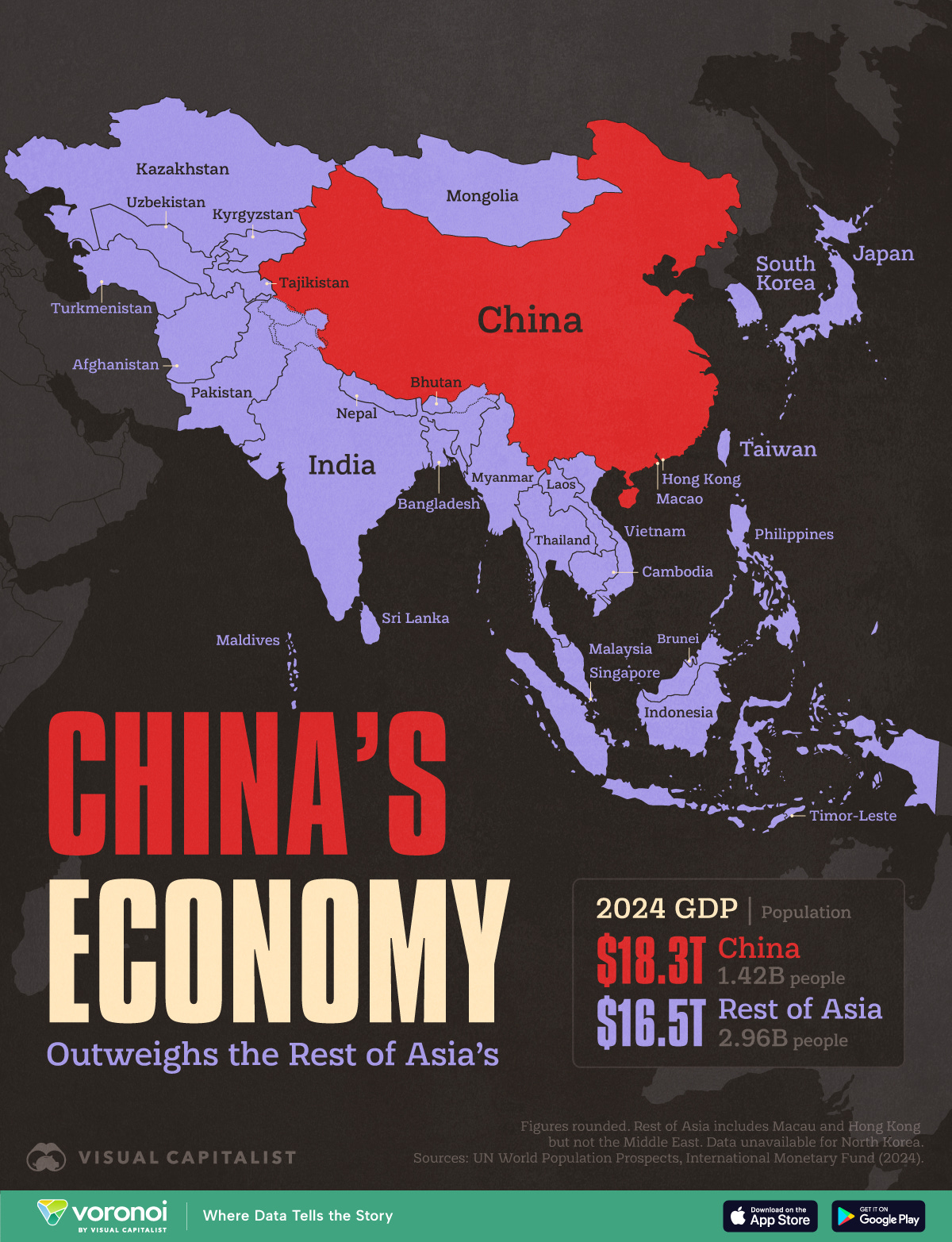

This is the most impactful chart you will see this week. Size matters:

China’s Economy is Larger Than 30 Asian Economies Combined

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee or consider a paid subscription. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!