AI is the real deal and overhyped🔹EU and US Banks will lose big in payments🔹Work from home, or I quit!

Podcast interview with CBDC, China, financial inclusion, and 4 career changes!

1. AI is the real deal and overhyped

2. EU payments report

3. Citi’s US payments survey

4. Work from home, or I quit!

5. Podcast interview

Today’s artwork: Card players, Theo van Doesburg, 1916/1917

The figures in the painting – three seated and one standing – are transformed into arrangements of geometrical shapes but remain intact, rather than dissolving into separate blocks of colour dispersed over the background. The use of round or pointed shapes is more or less in the Cubist manner.

The connection with today’s newsletter is that every story today shows someone making a bet and playing cards! EU and US banks are playing poker with fintechs and big tech over payments. Bank employees are betting against a strict return to work that requires five days a week in the office. And the biggest bettor of all are companies betting big on Generative AI. It will be a tough bet to win!

Hi my name is Rich. I’m a real person, not an AI bot! So subscribe and leave a comment. I write back to everyone. I’m proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read.

1. AI is the real and overhyped

Read: here

AI is the real deal, it’s here and now, but that doesn’t mean it isn’t overhyped!

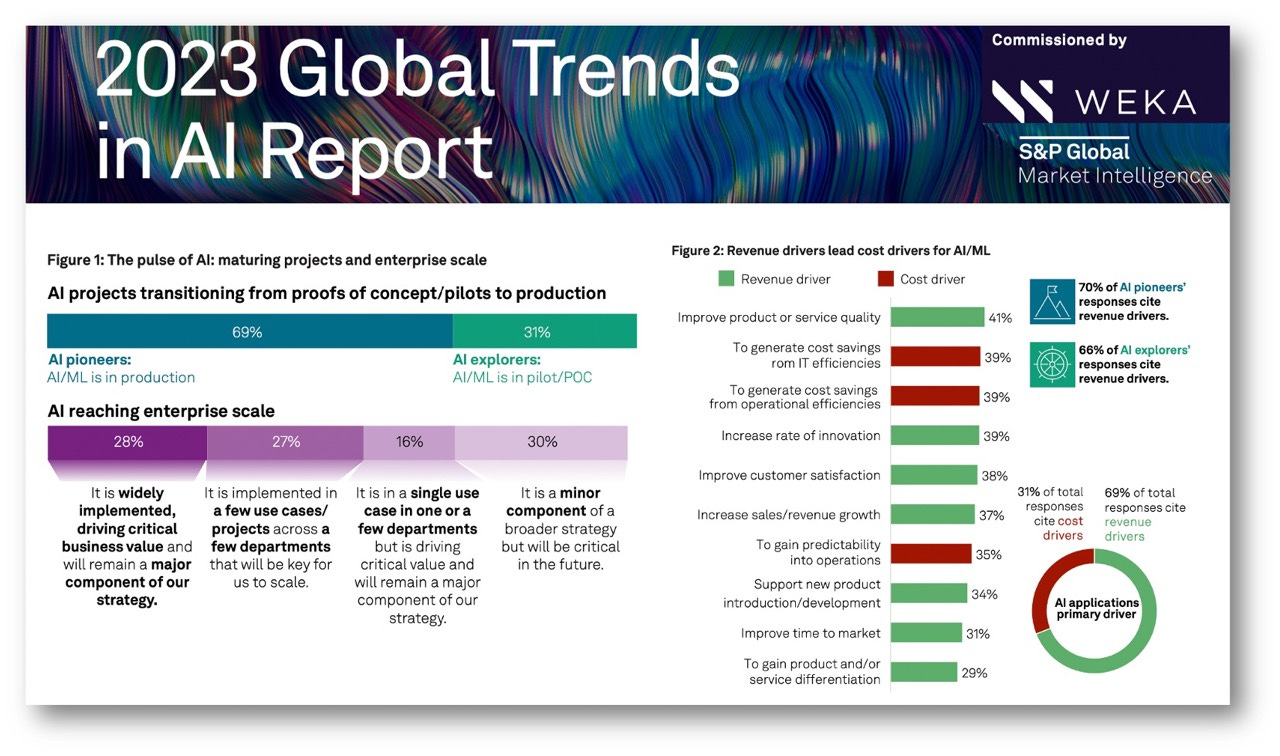

S&P looks at AI and likes what it sees! In its survey, 69% report having at least one AI project in production, while 28% have reached enterprise scale. That shouldn't be a surprise; let me explain why!

Generative AI is making the headlines because we finally have an AI we can talk to, just like in SciFi movies. Early AI adopters were looking for far more modest but infinitely more predictable machine learning systems.

I know because I sold IBM’s Watson AI and saw first-hand around 2015-16 how the buyers of card fraud detection AI didn’t care that it couldn't talk! They wanted accuracy, explainability, and trainability.

Production AI has been around for years. What’s the surprise? S&P calls them “AI pioneers” that's over-romanticized BS. IBM's clients just wanted to get a job done.

Comment on three key points:

🔷 AI has shifted from a cost-saving measure to a revenue driver. 69% cite revenue-focused drivers, as opposed to 31% that are cost-focused.

▶This surprised me! I’m glad to see AI on the revenue side and not just as a human-eliminating cost-reduction machine. There is still hope for humans!

🔷 Data management is the top technical inhibitor to AI/ML.

▶No surprise here! Data killed most AI implementations years ago and is still killing them today. Data isn't a new problem, and it is far too facile an answer to say that it should all be on the cloud.

🔷 Organizations with data and infrastructure “houses” in order will be well-positioned to lead with AI in the future.

▶ Data access will fuel a divide between the AI haves and have-nots. This is a defining moment for banking where the JP Morgans of the world are leaving their non-AI-enabled competitors in the dust!

▶ A quick word about the HYPE! (SEE ARTICLE IN COMMENTS)

AI is terrific, but that doesn’t mean it isn’t overhyped! Gartner just placed Generative AI on the ”Peak of Inflated Expectations” on its 2023 Hype Cycle for Emerging Technologies. Remember that the peak is followed by the “Trough of Disillusionment.”

Gartner’s “Trough of Disillusionment is coming for Generative AI!

How do you feel about AI hype? Too much or just right?

👉TAKEAWAYS:

—AI is transformational tech but do not fall victim to the hype.

—It's no surprise that data access is killing AI use!

—AI will separate the digital haves from have-nots. Many won’t make it!

— The “Trough of Disillusionment” is coming for many!

Click the button. I can tell you want to….

2. EU payments report

Read: here

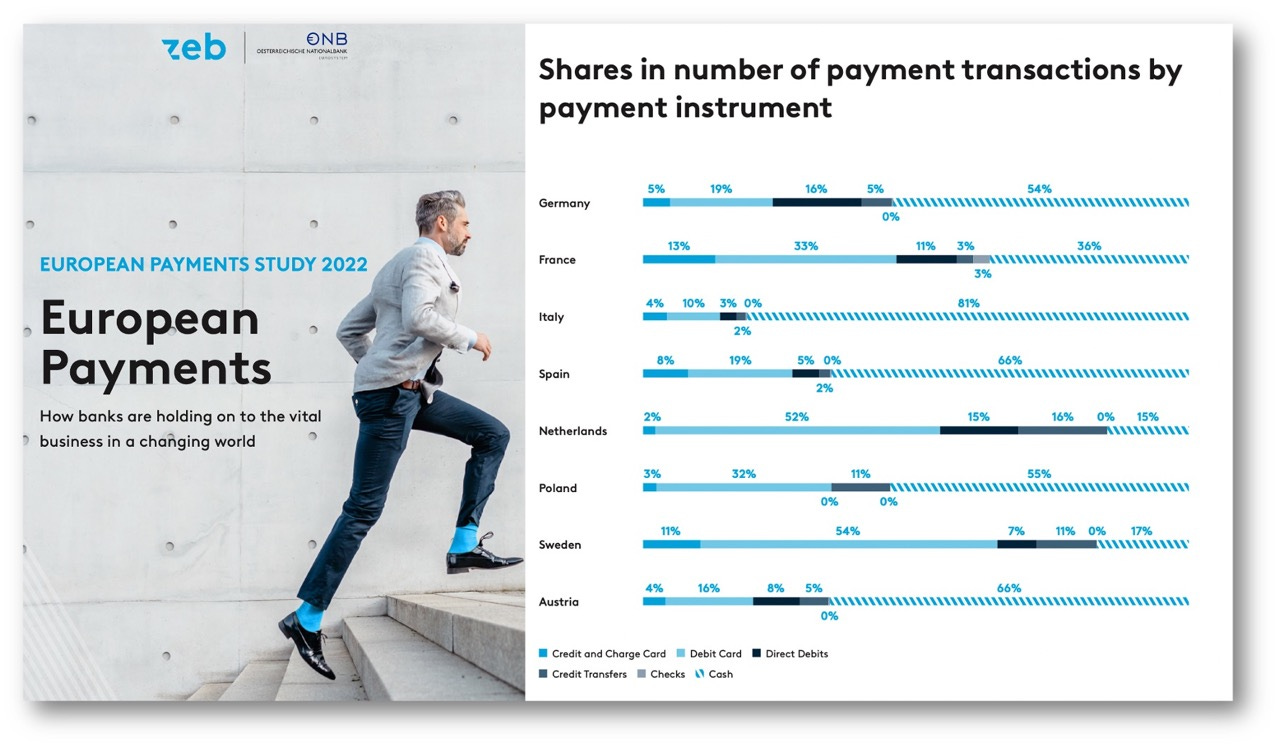

How will banks stay relevant as digital payments take over Europe?

This is a question that Banks need to answer NOW, not later. The European Payment Study shows that in the next 7 years, total market payment fees in Germany will drop from (49 to 41%) and Austria (39-34%.) PayPal and ApplePay are already hammering banks!

When total bank payment fees drop by 10%, do you think banks will wake up?

But that isn't everything. The assault on bank payment fees is increasing, and with a digital euro coming out in a few years, these estimates are likely low.

And why shouldn’t fintech and big tech attack the banks? The banks have been making a killing with high margins on payments that were simply “baked into” the system.

▶ Banks, payment growth will not save you!

One argument used by banks to counter the argument that they are losing market share is that payment volume will grow, allowing banks to maintain revenue if not market share. The problem is that the market share loss to innovators is now outstripping growth!

Germany and Austria provide great examples. The overall pool of fees in Germany and Austria is growing by 6 & 9%, respectively. Healthy growth, right?

The problem is that Mobile Wallets and Payment enablers are growing at roughly 15% in both countries! So innovators are eating into the pie far faster than it's growing.

▶ So how can banks stay relevant?

💥China’s banks faced the same threat by WeChat and Alipay and they lost the payment battle!💥

EU banks like China’s will never regain their payment margins and better plan for them to evaporate.

China’s banks countered by rapidly digitizing their offerings and aggressively IMPROVING the pricing and relevancy of traditional products.

Yes, they embedded products, but more importantly, they made them better through digitization on their own platforms! You can't embed junk products!

Banks in China were forced to get smarter because they couldn't rely on payments, which was good for consumers!

Thoughts?

👉TAKEAWAYS:

—Bank payment revenue dropping means more money for you!

—Banks should plan for the loss of revenue NOW.

—Relevance will be gained by making smarter digital versions of traditional products.

—Banks aren’t going out of business; they'll get smarter, and that's good for everyone!

Subscribe. There’s no reason not to! You’ll be glad you did!

3. Citi’s US payments survey

RE

Read: here

US Banks and the digital payment onslaught; the light at the end of the tunnel is a train!

90% of US banks expect to lose at least 5-10% market share to fintech in the next 5-10 years. Even worse, more than 25% surveyed think they’ll lose more than 20%!

If that light in the tunnel isn’t an oncoming train, what is? The irony is that banks see the light but can't put on the brakes!

This Citi survey of 100 US banks is a follow-up to yesterday’s EU digital payment report. It turns out that US banks are in bad shape, just like those in the EU with fintech and new forms of digital payment taking market share. Surprised? I'm not.

🔷 Ironic point No1: Banks go for APIs, and the metaverse

So 80% of respondent banks are rushing headlong into APIs to elevate their client experience. This is good, right? Yes, but APIs alone won’t solve banks' biggest pain points which are:

1) Cost;

2) Speed;

3) Transparency.

API banking may give users a better UX and perhaps helps with Speed but, in most cases, does little for Cost and Transparency.

Even worse, when banks innovate, they bet more on the metaverse than embedded finance. Sure, I like the metaverse, but embedded finance is happening now; the metaverse is a more distant future. Where would you put your money?

🔷 Ironic point No 2: FedNow reluctance

While community banks love FedNow, the new US retail RTGS payment system, it gets little love from larger banks who see it cutting into their payment margins.

Sure FedNow cuts into margins, but it allows banks to continue to play an active role in their client’s payment business. Without it, they’ll bleed clients to Apple & Google Pay, PayPal, and other fintechs.

💥So banks have a long-term solution to payments but won’t promote it because of the short-term cost!!💥

Banks see the train wreck coming but can't seem to throw on the brakes or change tracks!

So how do you feel about banks’ response to our digital payment future?

Thoughts?

👉TAKEAWAYS:

—Digital payments will hammer bank payment margins; bankers know and can't counter the onslaught.

—Focusing on APIs is great only if you fix transparency and cost issues!

—Banks should learn to embrace FedNow or watch fintechs take their clients.

— Payments are a commodity business with a price tending to zero. Deal with it!

4. Work from home, or I quit

Read: here

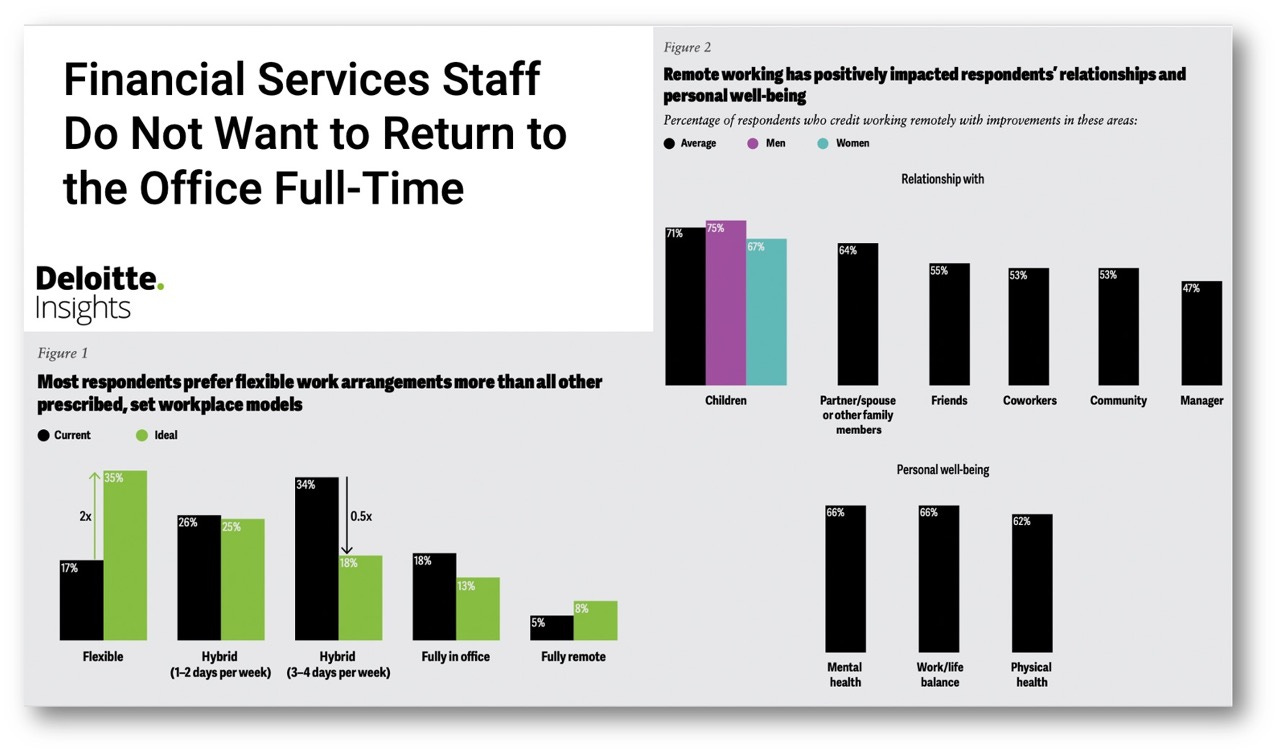

Can you believe a staggering 66% of finance workers would quit if work-from-home were taken away?

Deloitte shows us just how much workers' attitudes have changed after covid! Is your bank or employer ordering people back to full-time 5-day week in the office?

If so, they're taking a big risk that their best workers will bolt, and finding new recruits will be much more difficult.

⚡️Lifestyle matters: About 75% of men and 67% of women said that hybrid work life allowed them better relationships with their children.

Respondents said three things were top of their list, and all impacted family: money saved in commuting (69%), comfort and convenience (49%), and flexibility in structuring their daily tasks (45%).

Key findings:

• Among respondents who still work remotely at least part-time, 66% say they will likely leave their current role if mandated to return to the office five days a week.

• Among surveyed caregivers, those who work remotely or have hybrid arrangements are 1.3 times more likely than responding noncaregivers to say they’ll leave their current role if their ability to work remotely was eliminated.

• Some FSIs now require their workforce to return to the office three to four days a week. But only 18% of respondents say this would be their ideal arrangement.

• While remote working has improved respondents' engagement and well-being, most of those surveyed believe remote work models will put them at a disadvantage.

• 🔥 Almost half of women respondents in senior leadership roles report being likely to leave their current employer over the next year.🔥

Workers accept the tradeoffs, INCLUDING less money:

• More than half of those who responded (52%) admitted that they thought in-office workers were paid more -- it was a tradeoff they were willing to accept.

• 63% thought that in-office workers were promoted more.

• 60% thought employees with caregiver responsibilities working under the hybrid model were less likely to be promoted.

How would you feel if required to return to work 5X a week in the office?

Thoughts?

👉TAKEAWAYS:

—Ordering bank employees back to work full-time won’t cut it.

—Covid tipped the scales toward better family relations and away from money.

—Women are even more sensitive, and half are actively looking for new work!

Just do it!

5. Podcast interview: Careers, Inclusion, Cards losing SE Asia, and AI

There is a great article that accompanies this interview: here

You should expect many careers; I’ve had five so far and am still counting. How about you?

I don’t dwell on it much, but at 62, I’ve racked up quite a few careers, and this podcast with Naqsh Haque of Machinelab Ventures got me thinking of them. How many will you have with AI disrupting work?

Talking with Naqsh was like talking to my favorite cousin Lucia; we could just talk for hours! We covered careers, financial inclusion, China, why social media hones your communication skills, and even my mom!

Key podcast moments: (truth bombs 💣)

0:30 “I am a model citizen for having many careers. We all have to look at the concept that our careers aren't going to be a linear path anymore, and there will be iterations of you, whoever you want to be.”

“We are all going to have multiple careers, and we have to expect career changes, don’t define yourself by a single job and get the sense of being lost if it changes.”

“My career changes were all born of adversity and forced job changes.

💣4:45 "No one calls their mother and says: 'I want to be a social media influencer, are you proud of me?'"

8:50 If you think you’re cashless with Apple or Google Pay, it's you’re not. It's not the same as a super-app experience.

10:50 Digital yuan and financial inclusion!

💣14:00 Central banks aren’t looking at implementing monetary policy through CBDC, no negative rates.

16:50 Financial inclusion in China.

24:20 The look on people’s face when they are astounded by new technology. Digital tech is aspirational.

27:00 Why I am a tireless advocate for inclusion.

💣30:00 Why Visa and MC are losing SE Asia

33:00 When digital payments go bad. Loans can be very bad!

💣35:00 What I hope doesn’t happen with AI is that we get buried with chatbots. Voice is the OS for banking and money!

40:00 Your digital wallet will talk to you and become your coach, and it is critical for inclusion and the illiterate.

💣41:00 I have a fundamental belief that tech can make our world a better place.

42:55 My mom always said I never wanted to lose an argument!

43:25 What social media will teach you! Clarity of thought!! It is a tool for learning how to communicate!

48:45 Be digital; that’s what I told my nephew!

Thoughts?

👉TAKEAWAYS:

—HOW MANY CAREERS WILL YOU HAVE?

—Enjoy the podcast. It was a blast recording!

—Thank you to Naqsh!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written here on Substack with credit given to me and this site (richturrin.substack.com) For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE