ASEAN Fintech Powers On With 10X Growth Over the Decade!

No slowdown in ASEAN for “Fintech at the speed of Asia"

Fintech in ASEAN is punching far above its weight, with 10x growth over the last decade and steady funding levels.

This great read was produced for the Singapore Fintech Festival and highlights how fintech is growing and changing the ASEAN-6 nations.

It’s 100% good news for fintech and the region's residents!

While South America and Africa stacked up the biggest gains in funding last year at 15%, ASEAN’s long-term growth is the world's envy.

👉TAKEAWAYS

🔹 ASEAN-6 FinTech funding remained stable

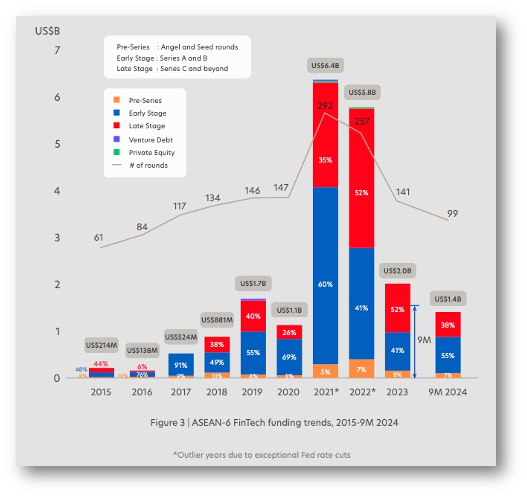

Despite global economic pressures, FinTech funding in the ASEAN-6 economies dropped by less than 1% YOY in 2024, showcasing the region's resilience.

🔹 Early-stage FinTechs dominate investments

Over 60% of total FinTech funding in ASEAN for 2024 went to early-stage start-ups, reflecting strong investor confidence in innovation and the sector's potential to address market needs.

🔹 Shifting country dynamics

Singapore remains in the top spot, but Thailand took second spot for total FinTech funding in ASEAN this year. Indonesia's funding share declined due to fewer large-scale investments.

🔹 A decade of growth

ASEAN FinTech funding has surged more than 10 times since 2015 (9M 2015 vs 9M 2024), fuelling growth in sectors such as payments and alternative lending.

🔥Payments and lending sectors make up more than half of ASEAN’s total funding at US$6.5 billion and US$4.1 billion, respectively, during the last decade.🔥

🔹 Peeking into the future

Beyond more favourable macroeconomic environments, FinTechs worldwide are poised to grow even further with three technologies – Gen AI, blockchain, and quantum computing – potential catalysts to reshape the financial ecosystem.

👊STRAIGHT TALK👊

ASEAN is a fintech powerhouse boasting 16 fintech unicorns, 6 of which are in Singapore.

The region has become a “breeding ground” for innovation and is now surpassing developed nations with its technology, one example being cross-border digital wallet transfers.

But let’s be clear why ASEAN nations are experiencing such explosive fintech growth; over six in 10 remain underbanked or unbanked today within the region.

Fintech growth is tied to inclusion and real GDP growth within the countries adopting it, which is why fintech received high-level government support throughout the region.

Also, note that while this report focuses on the “ASEAN-6,” there are huge differences between these countries, such as Singapore and Indonesia. Each of these nations has its own unique fintech needs.

That fintech is doing so well in the region is good news for everyone!

It is an achievement again showing “fintech at the speed of Asia!”

Please restack!

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!