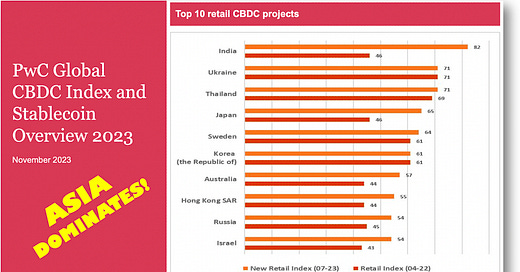

Asia takes 5 of 10 spots in the top 10!

The 2023 CBDC index shows ASIA dominating the listings!

CBDCs and stablecoins are making big progress in 2023.

PWC summarizes the state of the market and provides country-by-country breakdowns!

👉TAKEAWAYS:

➣CBDC

🔹 93% of central banks are engaged in CBDC development, 20% are expected to issue a digital currency in the near term.

🔹 Three jurisdictions have a fully live retail CBDC: the Bahamas, Jamaica and Nigeria. Eastern Caribbean and Mainland China projects remain at near-live stage

🔹 Top 10 Retail CBDC: 7 out of 10 in Asia (if we include Russia and the Mid-East.)

🔹 Top 10 Wholesale CBDC: 7 out of 10 in Asia.

🔹 Leader in the CBDC index is India, with Ukraine in second.

🔹 BIS predicts 15 retail and nine wholesale CBDCs circulating publicly in 2030.

➣STABLECOINS

🔹 Market capitalization of USD$180 billion in 2022

🔹 Cumulative volume of more than USD$7 trillion

🔹 Regulatory oversight is maturing with Singapore, EU, UK, New York and others, providing increased clarity.

🔹 Yet still, Tether, which remains unaudited, is the uncontested leader giving rise to financial stability concerns.

🔹 Moody’s analytics reported 609 depegging events for stablecoins in 2022.

Asia also dominates the wholesale CBDC project listing!

Note that China is not included as its CBDC is in trials.

👊STRAIGHT TALK👊

Digital currency is coming as money evolves, and no one can stop it.

This is a future to look forward to. The ability to send money as easily as an email is a boon for all of society, and it's coming to Asia first!

Here’s how I think it’s going to play out.

CBDCs will easily win the digital cash race. They are furthest along in this race because they are backed by governments who built them to conform with national regulations.

When India and China launch CBDCs in the next few years, 35% of the world’s population will have access to them. This is the game-over moment!

Contrast this to stablecoins, whose usage numbers currently exceed CBDC but have questionable regulatory status and aren’t ready for mass use. Stablecoins terrify regulators who don’t trust their stability or KYC.

Next, we have deposit tokens already at work carrying bank wholesale payments. While I see them making wholesale transfers more efficient, they require a bank account, so do nothing for financial inclusion. They are also a tough sell for mass distribution as deposit tokens are not yet standardized.

Fasten your safety belts; in the next 3 years, you'll be using CBDC and stablecoins if you aren't already!

Thoughts?