Asia's Exciting Cross-Border Payment Innovations: No One Comes Close

Asia's Cross-Border Payments Surge: Doubling To $24T By 2032

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Money 20/20 and FXCintelligence’s survey shows Asia’s cross-border payments are more exciting than ever and no other region even comes close!

What other global region is dominated by real-time payments, digital wallets, QR codes, and soon CBDC?

APAC accounted for nearly a third (32.2%) of all global outbound retail cross-border payments, totaling $12.8tn. By 2032, that number is projected to nearly double to $23.8tn.

This is why cheap, fast, real-time payments are critical to the region’s growth and the star of Asia’s payment show. The ongoing issue is how to make them interoperable.

One of the innovations in use is the BIS’s Project Nexus, and 74% of respondents expect it to help with cross-border interoperability in the near term. Nexus is a single platform that allows users to connect multiple national payment systems rather than individually at great expense.

Nexus is currently in Phase 3, with collaboration by the central banks of Indonesia, Malaysia, the Philippines, Singapore, and Thailand.

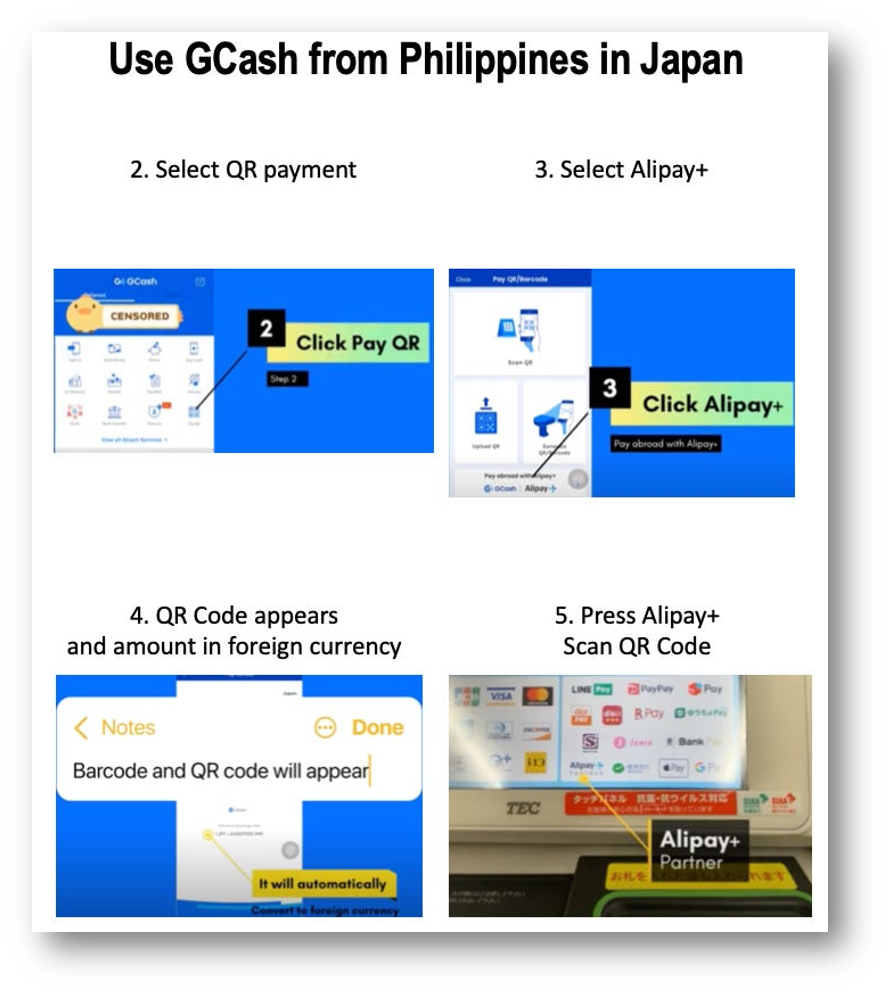

But Nexus is not without competition! Alipay+ has already successfully connected QR-enabled digital wallet providers across Asia, showing how the region will not have a single cross-border solution but likely many that will fight it out for market share.

CBDCs are also in the mix as Asia is a hotspot of activity. China’s CBDC is the most advanced, but pilots in Japan and Korea are now underway. While it’s not likely they’ll interconnect for a few years, they represent a cross-border payment future without parallel.

In the meantime, watch Asia for the latest advances in real-time cross-border payments.

No one else comes close!

👉Asia Cross Border Payment Highlights

🔹 A Future Powered by Real-time Payments and Interoperability:

88% of stakeholders view interoperability as “very or extremely important” to Asia’s payment future. 66% believe real-time payment systems will lead the way, followed by digital wallets (59%), with additional momentum from CBDCs, stablecoins, QR codes, and APIs.

🔹 Consumer Behavior, Policy, and Private Innovation Drive Change:

Stakeholders cited consumer habits (79%), regulatory policy (86%), and technological innovation (79%) as the most important factors influencing future infrastructure. While B2B and B2C continue to dominate in volume, B2C payments are expected to see the fastest growth due to ecommerce.

🔹 Cross-Border Cooperation Accelerates Initiatives:

Initiatives such as Project Nexus, regional policy alignment, and public-private partnerships are beginning to lay the foundation for a more seamless cross-border experience. 🔥However, most industry leaders agree that the region’s diversity makes a single dominant solution unlikely in the foreseeable future.🔥

I did an infographic about Alipay+ when it launched, and anyone who doesn’t understand how it works may enjoy this. Note that the list of participating payment programs is much bigger and even extends into Europe. Alipay+ payment provider list: HERE