Bank of England Digital Pound Privacy Solutions Will Not Assuage Anti-CBDC Zealots

BOE is doing a great job but faces stiff resistance.

The Bank of England (BOE) responds to the comments it received on its digital pound “consultation paper” and tackles the two big concerns: Privacy and Programmability.

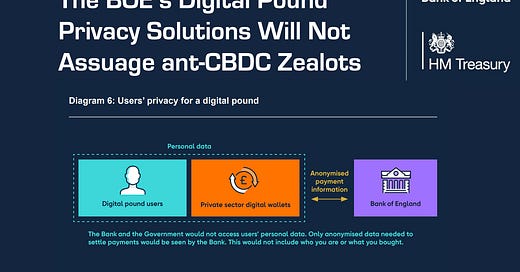

The BOE tries to assure the anti-CBDC lobby that laws and technical means will protect user data from the prying eyes of the government.

The BOE’s solutions are likely not enough for more radical anti-CBDC factions who insist that the CBDCs are nothing more than a way for the government to spy and control your spending.

👉TAKEAWAYS

The BOE’s plans for enhanced protections for Privacy and Programmability.

Privacy

A.1. The Bank and the Government would not access users’ personal data through the Bank’s core infrastructure – and legislation introduced by the Government for the digital pound would guarantee users’ privacy.

A.2. The Bank commits to exploring technological options that would prevent the Bank from accessing any personal data through the Bank’s core infrastructure.

A.3. A commitment to launching a working group dedicated to privacy issues as part of the design phase. This will involve an open call for information to ensure the working group is represented by a diverse group of individuals and organisations.

Programmability

B.1. As with privacy, legislation introduced by the Government for a digital pound would guarantee that the Bank and the Government would not program users’ digital pounds.

B.2. During the design phase, the Bank and HM Treasury will explore further technological safeguards against programmability initiated by the Bank or the Government, including futureproofing any regulatory regime to keep pace with technological developments.

👊STRAIGHT TALK👊

The BOE presents reasonable solutions to privacy and programmability through legislation, and yet to be decided on technical means.

The BOE’s solutions strive to guarantee digital pound users' privacy by providing clear legal separation of personal data from state surveillance.

In the end, it is unlikely that these laws will be enough to assuage the fears of ant-CBDC conspiracy zealots who view CBDC as part of a great government takeover.

The paper also had a few nice surprises with comments broadly supporting “tiered access” to CBDC, meaning that wallets would have less stringent ID requirements for low-value transactions.

Also encouraging is that while programmability elicits strong sentiments, the responses were not all negative, with many respondents supportive of this new technology, particularly if it was left to third parties and not the government.

The BOE is doing a fine job with its digital pound research and is certainly responsive to citizens' and industries’ critiques.

Whether we get a digital pound is another question.

Given the competition the BOE must feel with the ECB’s digital euro and the real need for a digital payment solution to match our digital world, I think it is likely.

Thoughts?

Subscribing is free!

The button says pledge, but Substack adds that, not me.

Subscribe. You’ll be glad you did!