Bank Payments And GenAI: A Toyota with an F1 Engine Is Still a Toyota

Banks have high-cost payments, and AI hype won't change that.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

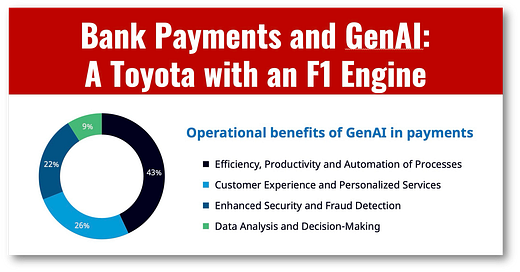

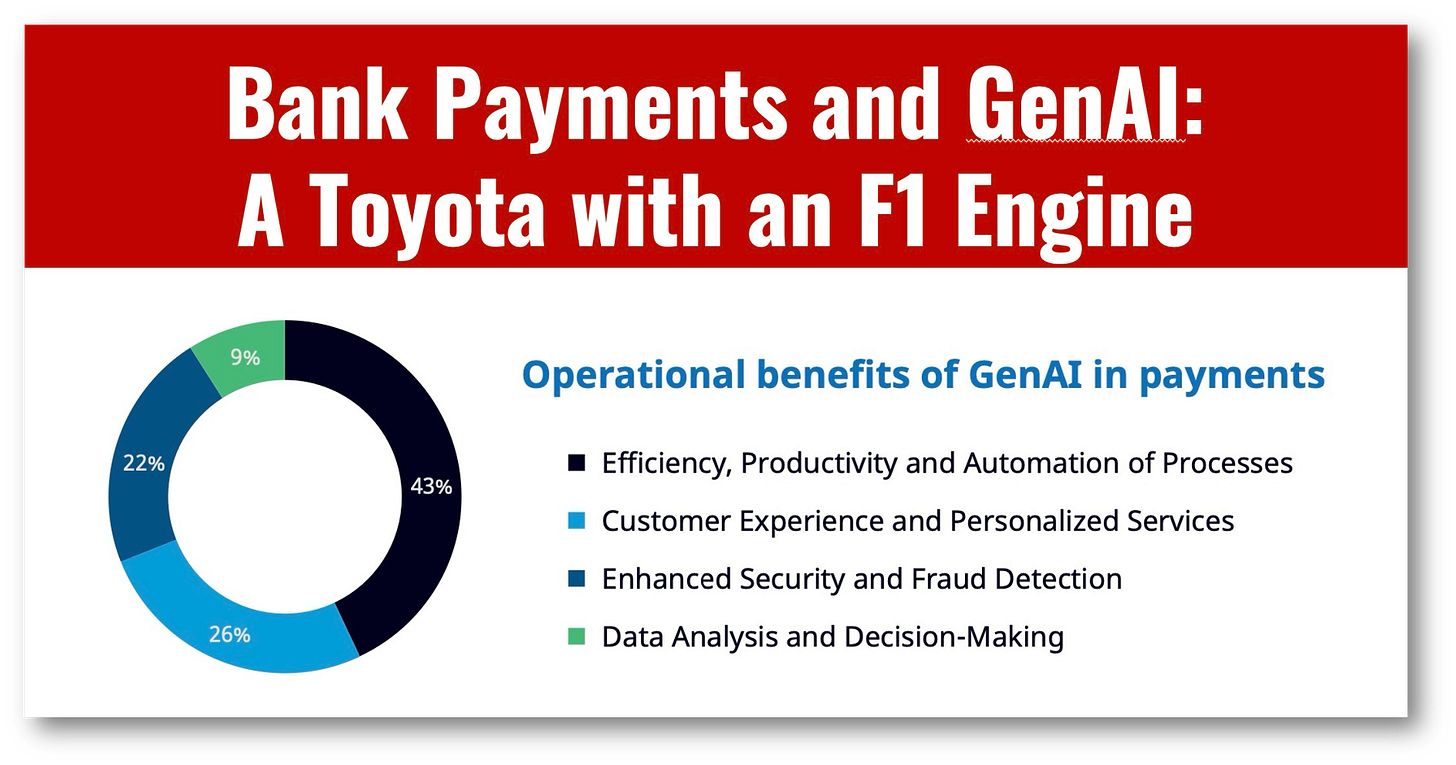

Yes, Gen AI will revolutionize banking, but it will not change payments as advertised in this and many other publications.

Saying that GenAI will change payments in banking is like saying that bolting a Formula One engine to a Toyota Corolla will turn it into a race car. It’s still a Toyota.

Let’s separate the hype from reality: GenAI won’t change bank payments; only substantive changes to the “payment rails” can change payments.

The hard reality is that most people don’t have access to instant payment systems, and most banks have the business's highest fee and least convenient payment systems. Yes there are exceptions.

Until bank payments are “free and fast,” AI-generated personalization will not compensate for these deficiencies.

People will simply switch to better digital wallets.

Blunt enough?

Now, let’s talk about two other areas of bank payments that GenAI is supposed to disrupt: credit and fraud detection.

Machine learning models have been commonly used to address both since around 2015. Alipay and Visa are good examples of companies using them. AI in card fraud goes back to the early 2000s.

Does GenAI bring a “secret sauce” to the mix? Not really, as both use cases rely heavily on internal data sets that lack large amounts of unstructured data (text).

GenAI may help, but as both are mature AI products, don’t expect a dramatic performance leap.

I’m not saying GenAI won’t change banking, but be careful which areas you pick and stop the BS.

👉TAKEAWAYS

🔹 96% of banks are already implementing GenAI at some level, driven by highly ambitious plans and C-suite leadership.

🔹 71% of banks are increasing their IT budgets for GenAI, with an average rise of 11%.

🔹 63% of banks say they have highly ambitious GenAI strategies.

🔹 50% of banks measure GenAI success based on improved productivity and efficiency, while

🔹 49% focus on reducing IT costs and 48% on gaining a competitive advantage.

🔹 38% of banks are looking to external consultants or advisors to guide them through their AI implementations.

🔹 51% are integrating GenAI through collaborative AI-human workflows to enhance productivity and decision-making. 47% are looking at hybrid integration, and 45% are using API integrations for AI.

🔹 4x The proportion of European banks which report the CEO drives GenAI strategy compared to the US (20% vs 5%).

🔹 59% of US banks prioritize GenAI for cost-cutting, while LATAM banks (48%) focus on gaining competitive advantage, and APAC banks (54%) emphasize improved productivity.

If you know someone who would like this newsletter, please share it with them and help grow our Asia, CBDC, and AI aficionados community!

Readers like you make my work possible! Please buy me a coffee or consider a paid subscription to support my work.

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!

Cashless: Fintech, CBDC and AI at the speed of Asia is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.