Banking has FIVE BIG SHIFTS coming, many are because they didn't keep up with tech.

I do not feel sorry for them!

With an end-of-year report on Commercial and Investment Banks (CIB), McKinsey lays down five major shifts impacting bankers in 2024.

It’s a sobering read and shows how many of their problems are digital and are born of their reluctance to adopt the latest technology.

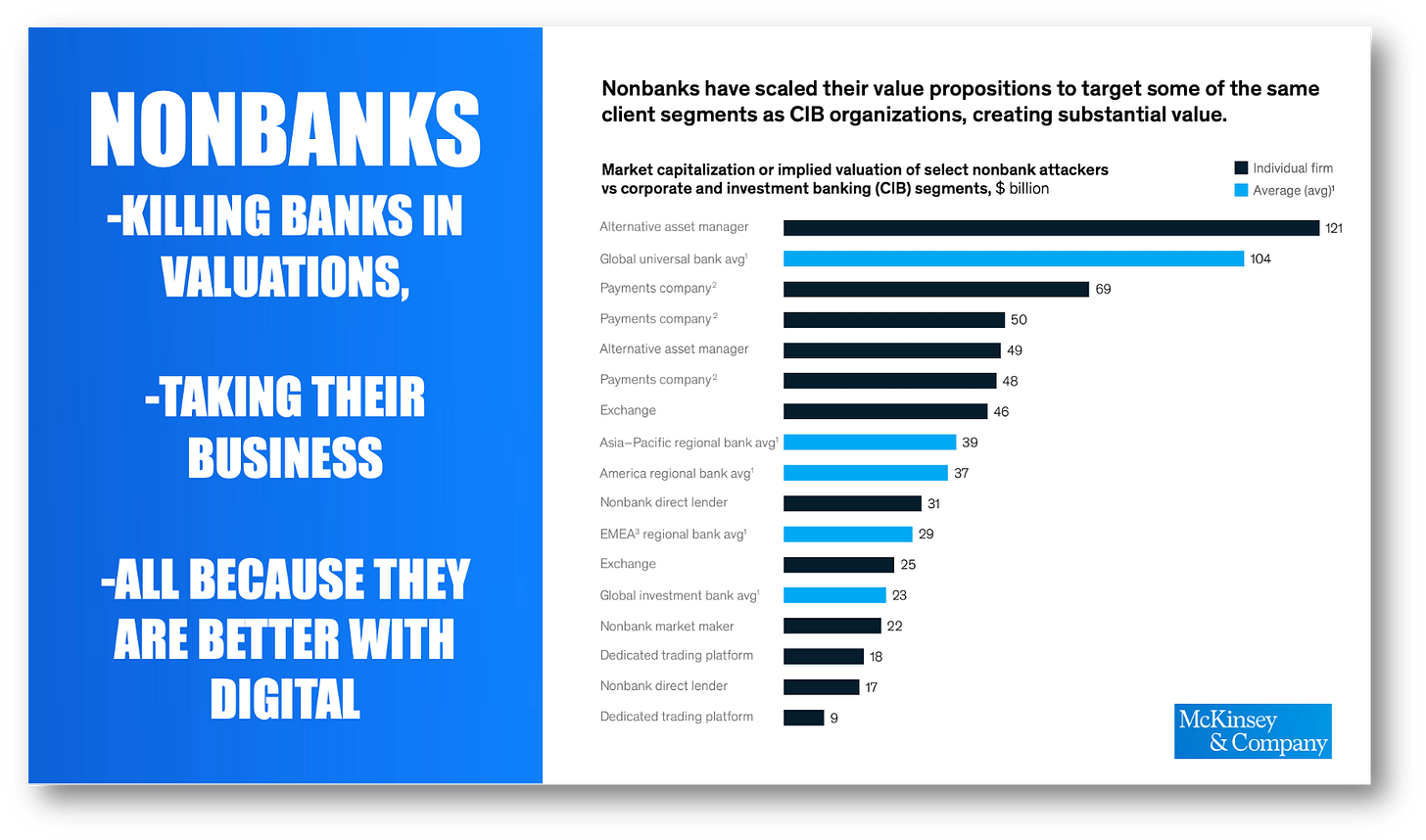

What I found most interesting is that nonbank competitors are eating banks’ lunches because they are more digitally focused. See the graph above showing how bank valuations are way behind nonbank competitors.

While I agree that some of the five shifts like macroeconomic trends and the Net Zero are not digital, the rest of the bank’s problems most certainly are.

👉TAKEAWAYS:

Banks will be subject to five major “shifts” that will rock their world they are:

Radically different macroeconomic environment,

Rising interest rates allow banks to make more money on lending portfolios going forward, but they are getting killed on legacy deals made in a zero-rate environment.

A new, technology-led ‘art of the possible’

Banks can finally get that "digital front office" they always dreamed of, meaning they can transact digitally without paying front office salaries! GenAI is, of course, a part of the new tech plan.

Changing regulatory and risk environment

This part never changes, and as McKinsey doesn’t reference a specific new regulation, I don’t see why this is a “shift.” Here, too, better bank digitization would help!

New market structures

Tokenized assets will create a new market structure. Banks are advised to seek relationships with existing market players to enhance their digital asset and tokenization skills. Most banks never acquired these digital skills, so they now have to outsource them.

Nonbanks like Alternative Asset Managers, Payment companies, and Trading platforms encroach on banks' territories. These nonbanks are killing bank valuations and taking their high-margin business. Unsurprisingly, the majority are DIGITAL!face

Long-term trends in certain sectors and products

McKinsey is correct that net-zero, infrastructure, energy and unfunded pension liabilities represent long-term challenges but are definitely not digital!

Asia is where the money is! How’s that for Asia rising?

👊STRAIGHT TALK👊

Banks face big changes, but I don’t feel sorry for them.

Three of McKinsey’s five major shifts directly result from the rise of digital services, and as banks have not been fast to move on digital, they’ll have to pay the price.

They are already paying if you look at nonbank competitors; many are digitally savvy and beating banks at their own game. Banks have no one to blame but themselves.

Nonbanks are just one problem. Tokenization and other institutional DeFi are coming, which will reduce transaction costs. This will have a devastating impact on bank revenues that can no longer be postponed. Banks have been trying to delay CBDCs, tokenization, and crypto because they all cut into margins.

Banks have, for the most part, tried to delay the shift to digital assets. Their dislike of everything from CBDC to crypto isn't exactly a secret. The problem is that, having tried to delay it for so long, most don't have the skills to harness the technology. This leaves them, ironically, looking to partner with crypto companies as a way of acquiring digital skills.

Banks are so slow at adopting digital that I suggest that they keep their front office employees very happy. It will be quite a while before banks get the “digital front office” that they dream of and can replace high-salaried employees with digital services.

The problem is that tech is always a few steps ahead of banks.

It takes two seconds to forward this newsletter and even less to subscribe!

How can you say no?

Subscribing is free! I know the button says pledge, but the substack adds that, not me. Don’t be afraid to click, as there is a free option available