BANKING SPECIAL: Banks' digital transition represents an existential crisis❗ Will they become dumb pipes or ecosystems?

Banking's fight for relevance is just beginning, and AI alone won't save them.

1. The “Great Banking Transition” to digital

2. Bank ecosystems and embedded finance

3. AI’s “incremental” impact on banks no boom coming!

4. Real-time payments go mainstream and hit banks

Today’s art: Pop Shop Quad II By Keith Haring, 1987

“Here’s the philosophy behind the Pop Shop: I wanted to continue the same sort of communication as with the subway drawings. I wanted to attract the same wide range of people and I wanted it to be a place where, yes, not only collectors could come, but also kids from the Bronx… this was still an art statement.” – Keith Haring

I chose this artwork because each panel represents a bank's digital strategy! From top left clockwise: 1) The banks in yellow and blue try embedding their products and solutions on a third-party platform in green, 2) The bank in yellow promotes it’s AI customer-facing solution in red to clients, 3) The bank in yellow partners and makes friends with real-time payments in red, despite its loss in revenue, 4) The bank in red tries to create its own digital ecosystem by climbing over BigTech ecosystems in yellow and green with success in doubt!

1. The “Great Banking Transition” to digital

Banks must go digital or become dinosaurs as the “great banking transition” forces a fight for relevance!

Banks are at a tipping point in what McKinsey calls “the great banking transition,” a fight against non-traditional players, including fintech, which is leaving traditional banks struggling for assets!

The problem is so severe that between 2015 and 2022, more than 70% of the net increase of financial funds ended up with non-traditional players, not banks.

The solution for banks? Go digital or go home!

👉TAKEAWAYS:

Banking priorities: (see Pg 40)

Exploiting technology and AI to boost productivity, utilize talent better, and improve the delivery of products and services. …. operating more like a tech company to scale the delivery of products and services.

Flexing and even unbundling the balance sheet. Flexing implies active use of syndication, originate-to-distribute models, third-party balance sheets (for example, as part of banking as-a-service applications).

Scaling or exiting transaction businesses. Scale in a market or product is a key to success: institutions can find a niche in which to go deep, or they can look to cover an entire market.

Leveling up distribution to sell to customers and advise them directly and indirectly, including through embedded finance and marketplaces and by offering digital and AI-based advisories

Adapting to changing risks. Financial institutions everywhere will need to stay on top of the ever-evolving risk environment: inflation, an unclear growth outlook, and potential credit challenges

👊STRAIGHT TALK👊

Banks are having a good year despite their need to compete with non-traditional competitors. Despite the noteworthy failures of Silicon Valley Bank, Credit Suisse, and others, interest rate rises have made for a booming business for most.

In fact, it was such a good year for banks that: “2022 and 2023 have been the best years for banks’ ROE in more than a decade.” A welcome change following a decade of compressed margins due to zero interest rates. So, no tears for banks!

Banking’s best performers, unsurprisingly, were in booming Asia. The "Indo Crescent" is home to 8% of global banking assets and 51% of the top-performing financial institutions globally!

Still, despite making money due to interest rate rises, banks are fighting a real existential challenge for Assets Under Management.

Money is flowing like water along the path of least resistance to payment systems, financial data and infrastructure businesses, standalone wealth and asset managers, private capital and equity businesses, and fintech. Everyone but banks! That 70% of funds since 2015 have gone to everyone, but banks shows the magnitude of the problem.

Note that systems now define business models and margins. So it’s no longer enough to say “We’ve got the model,” unless the bank has the systems to back it up.

So banks must get their systems up to the standards of their competitors, or they go the way of dinosaurs.

That’s why three of McKinsey’s five suggestions are digital, and they call this the Great Transition!

2. Bank ecosystems and embedded finance

Banks will create a digital ecosystem with embedded finance “when hell freezes over.”

The Economist and Temenos make it clear that with payments, big tech, and e-commerce cutting banks out of embedded finance solutions, they better start building their own if they want to remain at the center of the banking universe.

I wish banks the best of luck!

NOTE: This is the PERFECT follow-up to yesterday’s McKinsey report that showed how banks’ trouble attracting assets due to “non-traditional” players. This report shows just how big a problem that is!

👉TAKEAWAYS:

🔷 New technologies will have the biggest impact on banks in the next five years—more than customer demands and evolving regulation.

🔷 More than 71% of survey respondents see unlocking value from AI as a key differentiator between winners and losers. While 75% expect generative AI to impact banking.

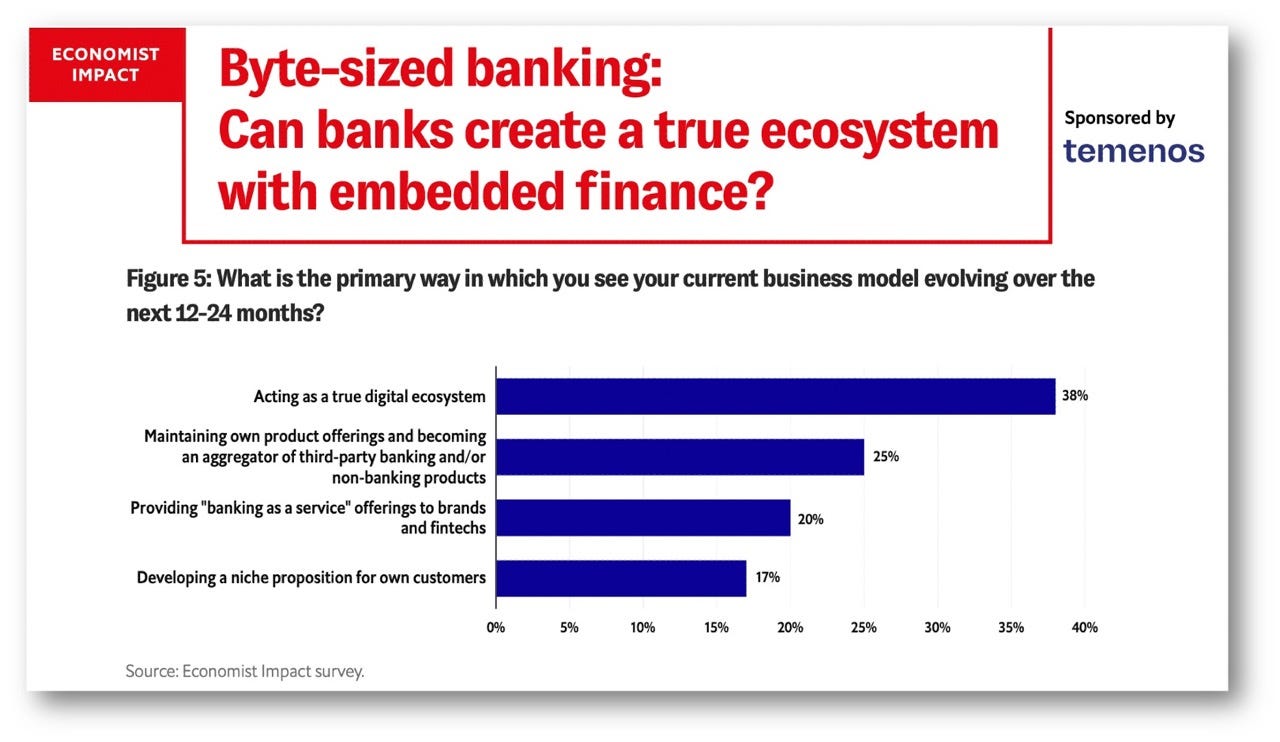

🔷 Banks see their business model evolving in the next 12-24 months, offering banking-as-a-service to brands and fintechs (20%).

🔷 However, twice as many (38%) banks foresee acting as a true digital ecosystem themselves.

🔷 Customer centricity is driving banks to offer more embedded ESG propositions to their customers (73%).

🔷 With the focus on lowering their carbon footprint, as well as the increasing use of data-intensive AI, banks are inevitably moving to the public cloud—51% of respondents agree that banks will no longer own any private data centers after moving to the public cloud.

👊STRAIGHT TALK👊

This is a great read and clearly shows that bankers surveyed recognize they have a problem with going digital! But is it too late?

Banks’ problem is that they have already lost business to fintech and “non-traditional” players and do not want to be cut out of the equation entirely or to lose more ground in terms of the consumer-facing experience.

To keep this direct connection with the consumer, banks recognize that they must become true digital ecosystems (38%) offering their own and third-party products and services.

That sounds great, but shockingly, about one-in-five survey respondents say that they are prioritizing building a banking super-app or ecosystem.

👊They will fail.👊

Banks will build superapps when “hell freezes over.”

Don’t get me wrong, banks seeking to offer more on their existing platforms is good, but building a super-app is not a realistic objective for most.

The more likely scenarios that will lead to success in embedding are: becoming a product aggregator, providing BaaS services, and the old-fashioned method of providing niche services.

Expecting bank websites to become super-apps shows just how little bankers know about what a super-app really does.

3. AI’s “incremental” impact on banks no BOOM is coming!

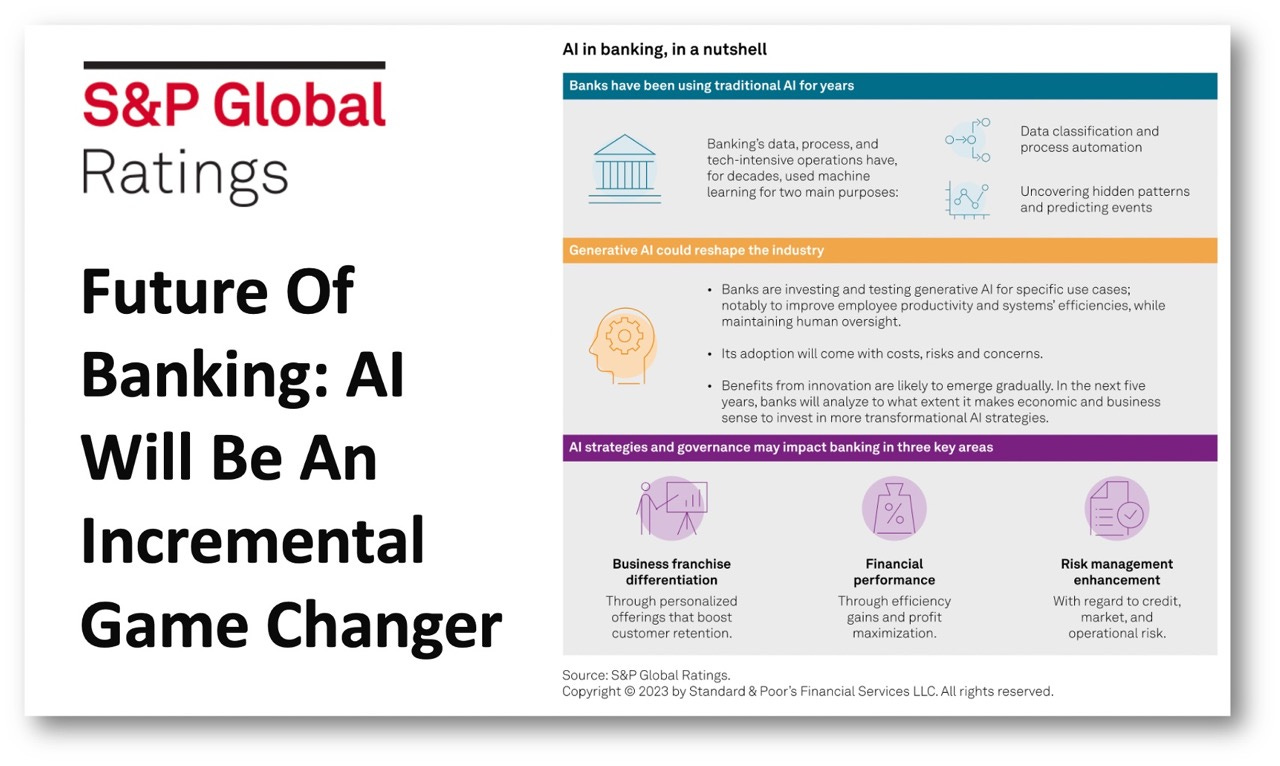

S&P is an AI hype-buster claiming AI's impact on banks will be “incremental” in the next 5 years!

S&P Global Ratings writes one of the best retorts against AI hype I’ve seen. While S&P agrees that AI is a “game changer,” it sees only incremental gains in the near term for banks, no boom!

👉TAKEAWAYS: (READ pages 6-7, 12-14)

🔷 “It remains to be seen to what extent banks that successfully deploy AI strategies materially outperform those that are AI laggards.”

🔷 “It remains to be seen at what speed and to what extent, it makes business sense for banks to invest in transformational AI strategies.”

🔷 “Notable changes due to the application of generative AI in banking are unlikely to be immediate.”

🔷 "The bulk of banks' near-term use cases will likely focus on offering incremental innovation (i.e., small efficiency gains and other improvements across business units)."

🔷 “A 10% reduction in bank staff costs would, on average, improve return-on-equity by about 100 bps and cost-to-income ratios by about 3% points. “

🔷 The [above] potential gains would have to be balanced against the investment in tech that they require, and against the opportunities for banks 🔥 to reduce employee numbers🔥.

👊STRAIGHT TALK👊

S&P’sobering analysis of AI impact stands in refreshing contrast to the hype predicting near-term AI disruption.

Yes, AI is big, but banks will proceed cautiously. Anything else would be foolish! Can you imagine the scenario where a bank rolls out Generative AI and it “hallucinates” and gives the client the wrong answer? Even if the dollars involved are small, the reputational risk is enormous.

Given bank’s proclivity not to “move fast and break things,” those predicting near-term disruption or transformation of banking activities due to AI will likely be proved wrong.

I also note that some of the most outrageous predictions for AI adoption in banking come from either management consultants seeking engagements or AI firms trying to sell their LLMs! The glaring self-interest in hyping AI is clear.

This doesn’t mean that AI isn’t a game-changer, it most certainly is! It’s just that the time required for banks to set up AI systems and offset the expenses with gains that are more than “incremental” will be longer than many predict.

Hype is the norm, and in this case, to quote the rock band “The Who,” “We won’t get fooled again.”

Or will we?

4. Real-time payments go mainstream and hit banks

Real-time payments are no longer “emerging” but going mainstream, don’t miss out!

What is your company's or bank’s real-time payment strategy? As real-time becomes the global payment norm, there will be winners and losers. Don’t be on the losing side!

Businesses and banks will use them not only because customers demand them but also for a competitive advantage and to cut payment costs.

👉TAKEAWAYS:

🔷 Businesses are investing in payments:

92% of businesses expect payments improvement to be a significant area of investment in the next 24 to 36 months.

🔷 Businesses are seeking providers with real-time capabilities:

About half of businesses globally have changed or will change financial services providers to be able to access real-time payments.

🔷 Real-time payment volume is growing:

Regardless of region, real-time transaction volume is growing rapidly. Real-time payments, alone in the US, are growing in the double digits quarter over quarter.

🔷 Real-time payments are not just for emergency payments:

The number one reason businesses utilize real-time payments is to improve the customer experience.

🔷 Some businesses do not understand the value:

43% of businesses not utilizing real-time payments believe that faster payments require too much manual processing.

🔷 Cross-border payments are ripe for innovation:

More businesses are transacting cross-border payments, and 80% of them believe they will have increased volume in the next 12 to 24 months.

👊STRAIGHT TALK👊

Real-time payments are fast becoming the global norm and are no longer optional as clients demand them.

But it isn’t just retail clients driving the process. Businesses are using real-time payments to save on reconciliation, reporting, and payables, providing them greater efficiency and making them more competitive.

So, who are the winners and losers?

The biggest losers are banks and credit card companies, whose monthly reconciliations are a nightmare for many businesses.

Real-time payments, which in most parts of the globe undercut credit cards in fees and speed, will force banks to adapt to a new world. It will be painful for them as card revenue drops.

The biggest winners are fintechs and tech companies that have enjoyed explosive growth to become major national payment providers in countries like China, Brazil, and India.

There is no going back, and while nations may differ technically in how they implement real-time payments, the results are the same.

This bodes well for CBDCs and other payment innovations like FedNow in the US.

One thing is clear, after businesses and customers get their hands on real-time payments, there is no going back!

Subscribing is 100% free, you’ll be glad you did!

In the unlikely event you don’t like my newsletter, click unsubscribe at any time to “invite danger!”

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE