Banks' Abusive Relationship With Big Tech

Big Tech is calling the shots, and banks are powerless to change the power dynamic

Banks and tech firms aren’t in a "two-sided affair," as the BIS claims, but an abusive relationship where big tech calls the shots.

Let’s be clear: outside of regions like APAC, where regulations are more accommodating, big tech has no interest in becoming a bank.

The reason is simple: the average return on equity of US banking in 2024 was 11%, while the ROE for Apple was 156%, Microsoft 38%, and Nvidia at 115%.

There is no pot of gold awaiting tech companies who become banks in the West.

Partnerships are a different story, and nothing makes big tech happier than reselling its existing data and distribution capacity at a high markup to banks.

Banks can also partner with tech, but in most cases, tech is calling the shots. Look to Apple Card as an example.

This is why I call this an “abusive relationship.” If we look at the power dynamics, banks desperately need partnerships with big tech more than vice versa, and big tech will extract its price!

👉TAKEAWAYS

Types of “front-end” partnerships between banks and tech firms:

Deposit-taking partnerships

Tech firms use digital platforms to deliver depository products to customers, while the bank holds the deposits on its balance sheet.

Lending partnerships

Tech firms use digital platforms to help customers access credit, while banks and tech firms work together to originate the credit.

Credit referral arrangements

Tech firms act as brokers, introducing customers to lending products offered by banks.

Payment partnerships

Tech firms use payment infrastructures that are usually only accessible to banks to provide payment-related services.

Tech’s new value chain

New value chain

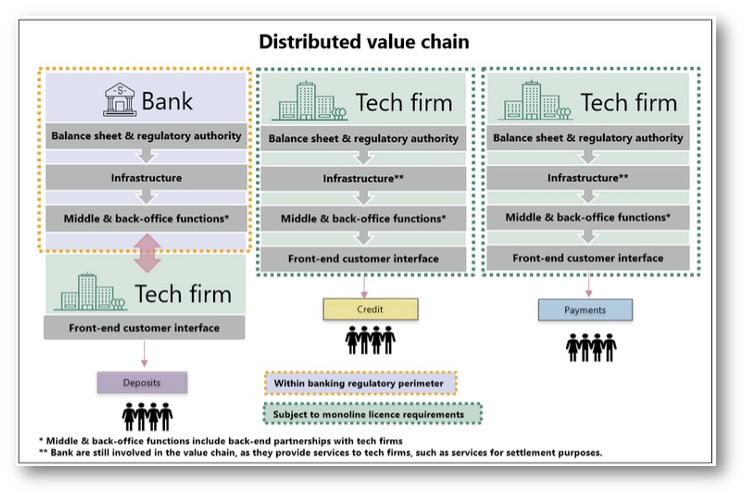

As tech firms offer banking services by forming partnerships with banks or securing monoline licenses, they create a new value chain, one that is further extended and expanded.

Banks pushed away from clients

While banks are pushed further away from the direct customer relationship in this new banking value chain, they continue to play an important role.

Distributed value chain

A more distributed value chain offers several potential benefits, such as fostering competition and efficiencies in the delivery of banking products and services; however, it also presents challenges, particularly with accountability.

Regulatory issues

The distributed value chain may also give rise to data privacy and security concerns. The complexity of partnerships and interdependencies within a distributed value chain may increase banks’ data governance risks.

👊STRAIGHT TALK👊

The partnerships above, with a “new distributed value chain,” fundamentally change how banks relate to their customers.

In general, tech firms are becoming the front-end customer interface in banking relationships, which galls bankers to no end.

That said, banks have little choice in the matter. In many partnership examples, though clearly not all, big tech holds the power position with its ability to use data and platforms to promote banking services.

What angers bankers the most isn’t just the reduction to banks' revenue share as they pay big tech but their loss of relevance to consumers and increased regulatory exposure.

Banks can’t afford to go elsewhere and are stuck in an abusive relationship with big tech because they desperately need big tech’s access to the digital world.

The only question is how much big tech can make them pay.

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!