Banks Embrace AI: The Challenge, Standing Out From The Competition

AI is table stakes in banking and will not convey a sustainable advantage.

Oracle nails it with this report acknowledging that banks must become more like tech companies by building out data and AI capabilities, to become more than a “utility bank.”

Mastering AI and data is simply the only way banks can become something more than pure utility providers offering commoditized, low-profit financial solutions.

This is a solid message, but Oracle and all of the other reports like this don’t mention that all banks are scaling up their AI offerings!

What isn’t unclear is whether your newly AI-enabled bank will have an advantage over others! Is the AI advantage sustainable?

👉TAKEAWAYS

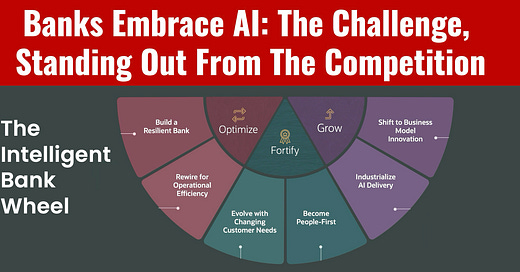

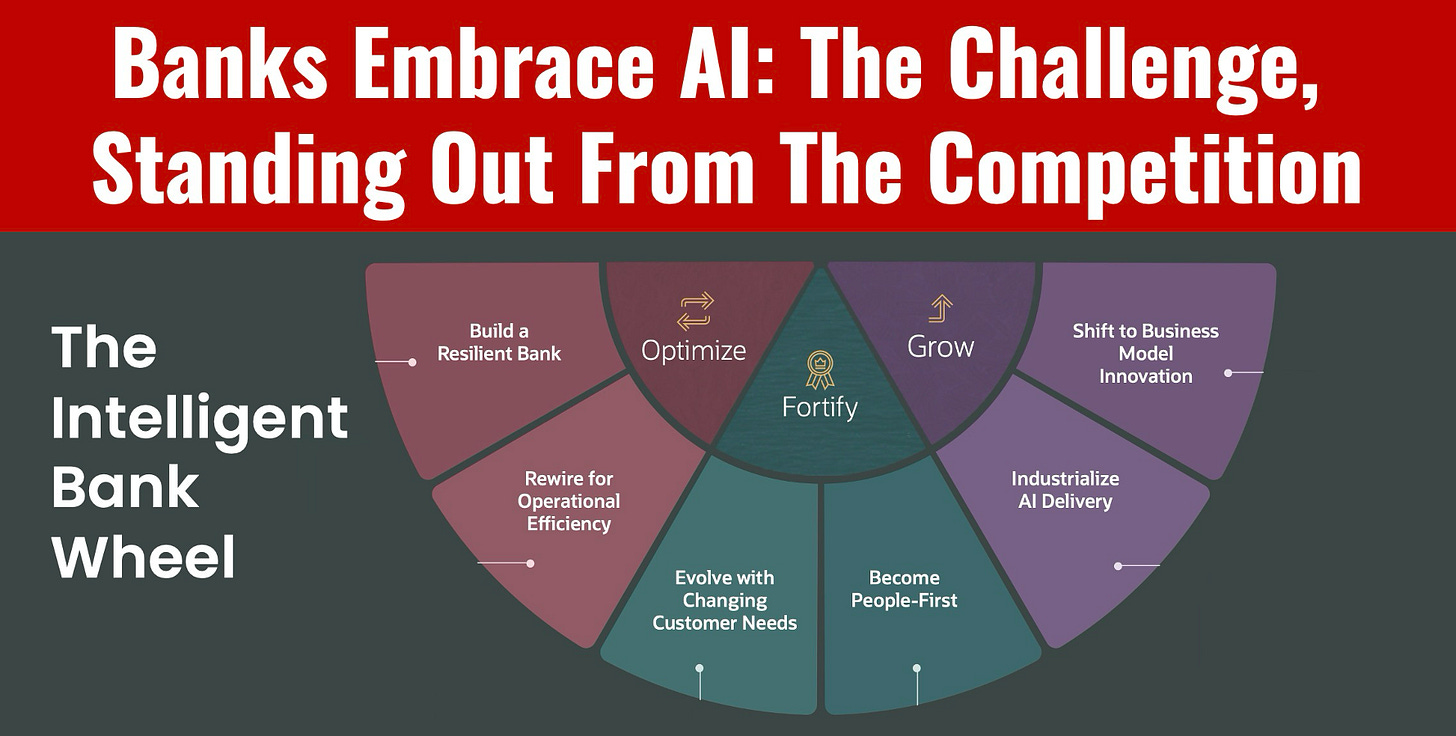

🔹 Rewire to drive operational efficiency

Complex, siloed systems, aging technologies, and a lack of internal expertise impact a bank's agility and ability to act—and react—in real time. A data-first and insights-driven approach to key initiatives that support new revenue creation is a must.

🔹 Build a resilient bank

To build resilience, both in terms of operations and performance, banks must make a multifaceted effort to industrialize data and scale Al.

🔹 Shift to business model innovation

As profitability lags, high-value offerings and new revenue streams to offset commoditization become critical growth drivers for banks. Banks will need to innovate to diversify and discover new revenue streams while optimizing pricing.

🔹 Evolve to meet changing customer needs

Disconnected data prevents banks from accessing the insights they need to deliver intelligent, hyperpersonalized, truly omnichannel solutions that are accessible from anywhere and distinctive customer experiences at scale.

🔹 Become people-first—attract, train, and retain top talent

A bank's main capital is its people. However, many banks face employee turnover as younger generations demand work-life balance, values alignment, and fair pay.

🔹 Industrialize Al delivery

Banks must learn how to industrialize data and use it beyond standalone use cases, including standardizing processes to build, test, deploy, and monitor models in a repeatable and industrial way.

🔹 Get on the path to sustainability

Sustainability affects the entire bank's value chain—both strategically and from an operational perspective.

👊STRAIGHT TALK👊

AI providers are all urging banks to jump on the AI bandwagon as soon as possible, dangling hopes of increased profits and decreased costs with each AI application.

Who can blame them?

The problem is that AI is now “table stakes” for the banking business, and it will not convey a sustainable advantage over competitors.

This is perhaps a replay of the early 1960’s when banks all bought mainframe computers or 2007 when the Bank of Scotland launched the first mobile banking app.

By the mid-60s, all banks had computers, and few banks would now say that their mobile banking offers them a major competitive advantage. Both became “table stakes,” the cost of playing the game, just as AI is now.

Banks’ AI transformation is inevitable, but if bankers believe AI will convey anything more than a temporary advantage, they are deluding themselves.

All AI-enabled banks will be nothing more than “utility banks.”

Did you make it this far? There are even more benefits waiting for you when you subscribe.

Don’t get left behind: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion, that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

See the future: Profit from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing us the future.

Be independent: My message doesn’t follow corporate diktats it’s a message that’s often controversial and does not conform with mainstream outlets;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Understand AI: In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Trust: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!