Banks Need a Competitive CBDC Strategy Now!

CBDCs will make it easier than ever before to switch banks!

CBDCs are coming, and banks in the EU and worldwide would do well to have a CBDC strategy now or be ready to bleed customers later.

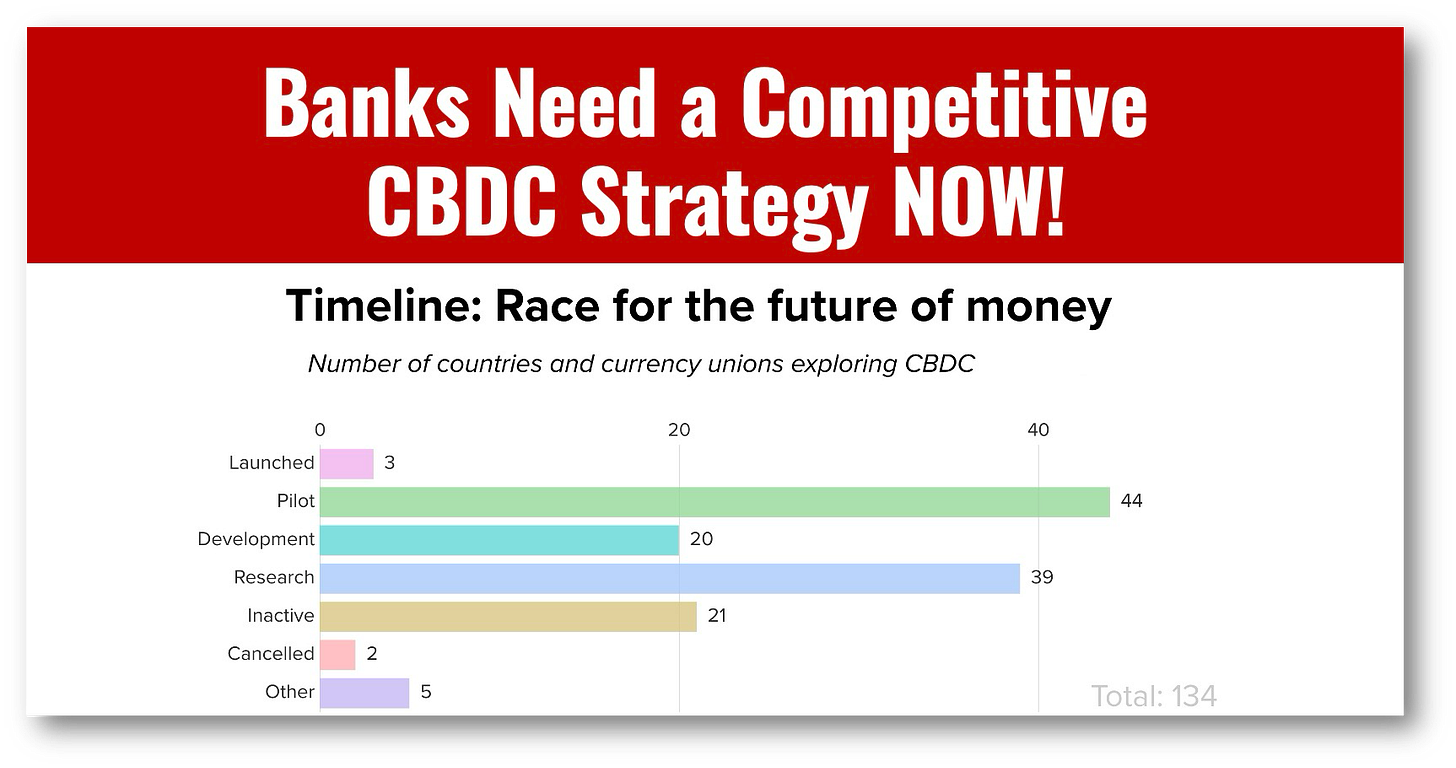

With 70% of central banks looking at issuing a retail CBDC and the Digital Euro with a potential launch in 2027, it’s time for banks to understand exactly how they will deal with the opportunities and threats they bring.

CBDCs can’t just be “bolted on” to existing bank infrastructure. They will require IT infrastructure upgrades and integration into digital bank apps, which will spur significant product innovation.

European banks must get their CBDC strategy right because once money goes digital, customers can move it from one institution to another in a heartbeat!

Say goodbye to customer loyalty!

👉TAKEAWAYS

Understand the regulatory environment. With many jurisdictions still working on the underlying legislation, such as in the EU, their associated central banks have yet to finalize regulations.

However, the most essential regulatory elements are already well established, giving banks a solid starting point for developing a strategy and beginning their execution phases.Develop a comprehensive CBDC strategy. Like any transformation, successfully preparing for CBDCs requires a comprehensive business and technology strategy.

Critical decisions start with whether to merely comply with CBDC mandates or leverage digital currencies for competitive advantage by layering value-added services on top of basic digital currency offerings. As this determination affects all others, successful banks will make this decision their highest strategic priority.Address the top IT gaps. Unsurprisingly, CBDC introduction is spawning a host of unique technology requirements, adjustments, and modernizations. The most critical are:

Architectural modifications, as digital currency accounts will be a mirror of the central bank, rather than actually holding funds. This is fundamentally different than the current architecture of most banking core systems, necessitating a considerable overhaul.

Account number adjustments to accommodate changes in the naming system for digital currencies. For example, the Digital Euro includes a unique identifier called a Digital Euro Account Number (DEAN).

Processing speed improvements to attain velocities of less than three seconds.

Payment engine modernization, due to all CBDC settlements occurring in the central bank’s ledger.

👊STRAIGHT TALK👊

CBDCs like the digital euro haven’t launched yet, but banks are already competing to see what innovations they can bring to improve margins and client retention.

The problem is that many don’t know it yet!

If they don’t get it right and lag behind their competitors, CBDCs will be their worst nightmare.

CBDCs will decrease customer loyalty as clients will be able to easily move their money in seconds to try out a competitor’s offerings.

If you don’t believe this, talk to bankers in China, where the ease of digital transfers allows clients to open new accounts with more sophisticated digital players in minutes.

Watch as the CBDC games begin!

Readers like you make my work possible! Subscribing is free, and I operate by the “PBS model.” Like public broadcasting, everything I write is free, but if you like the content, please buy me a coffee by subscribing.

Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!