Blockchain and AI Break Payment Paradigms, Web3 Not Yet

Web3 is still a work in progress and needs to prove itself.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Deloitte proudly proclaims that blockchain and AI are the new payments paradigm, and I couldn’t agree more, but Web3 is not.

There is no doubt that the forthcoming use of US dollar stablecoins will change the paradigm for payments, despite their need for better infrastructure for use by the general public.

Similarly, AI is already hard at work bringing additional security to payments, and soon, with the arrival of agentic “do-it-for-me” systems, AI will further change the paradigm of payments.

Both technologies are proven and ready for implementation within the next year or two.

Web3, however, is still in development, and Deloitte’s assertion that direct payments without an intermediary constitute Web3 sells its vision short by focusing on only one element of its ambitious goals.

Web3 does indeed need disintermediated payment, but its broader goal is a decentralized vision of the internet, shifting from centralized platforms to user-controlled, community-run networks, empowering users with greater control over data.

Web3’s broader goal of decentralized platforms and user control over data still seems far off, and untested even if provided with the semi-disintermediated payments that stablecoins may bring.

Payment disintermediation, too, is only partially complete. Note that stablecoin users will still need accounts at exchanges.

While the payment itself is disintermediated, which I grant is a welcome revolution, we will still need intermediaries to exchange stablecoins for fiat currency you can put in the bank.

I am ready to pop a champagne cork for stablecoins and AI, but celebrating Web3 is still premature until more of its broad vision is realized.

👉 Use Cases:

🔹AI agent for financial services

Leading cryptocurrency exchange platforms are integrating AI in various new ways to enable seamless cryptocurrency purchases and facilitate faster trades, swaps, and staking for their investors. One of the largest crypto firms recently launched a new product allowing users to create their own AI agent with access to a crypto wallet, enabling investors on a digital currency exchange to start building investment strategies based on certain parameters.

Great and happening NOW!

🔹 AI-enhanced fraud detection in banking

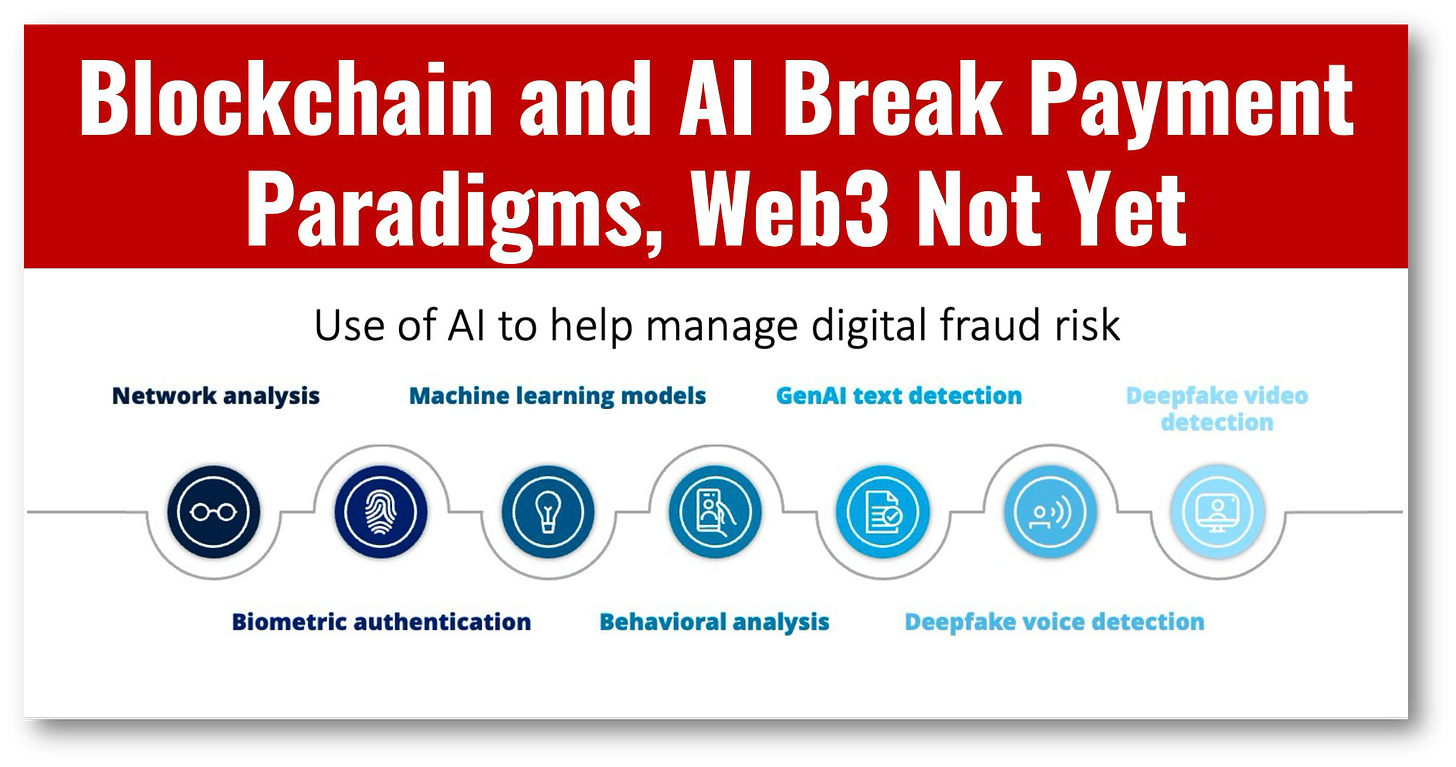

Fraud detection presents a significant challenge for banks, as traditional methods frequently fall short in identifying sophisticated schemes. But with AI, banks can analyze vast amounts of transaction data in real time, identifying patterns and anomalies indicative of fraud.

Banks are doing this NOW!

🔹 Transforming global remittances

The global remittance market is projected to reach $913 billion in 2025, while the cross-border payments volume is projected to hit $428 billion in 2025. The integration of blockchain and AI has the potential to revolutionize this landscape by offering benefits such as cost reduction, real-time transfers, enhanced security, improved customer experience, and automated compliance.

Ready to happen in the next year!

🔹 Web 3 Platforms

Web3 platforms can offer more intelligent and responsive interactions, improving user experiences and operational efficiencies on decentralized applications. The synergy between AI and Web3 could lead to true innovations such as automated financial advising, personalized content delivery, and advanced cybersecurity measures.

True, but decentralized applications are not here yet at scale!