Bots Drive 90% of Stablecoin Transactions, Crypto Lies Once Again

The never ending deceit in crypto markets never ceases. SEE NEW ILLICIT CRYPTO FIGURES

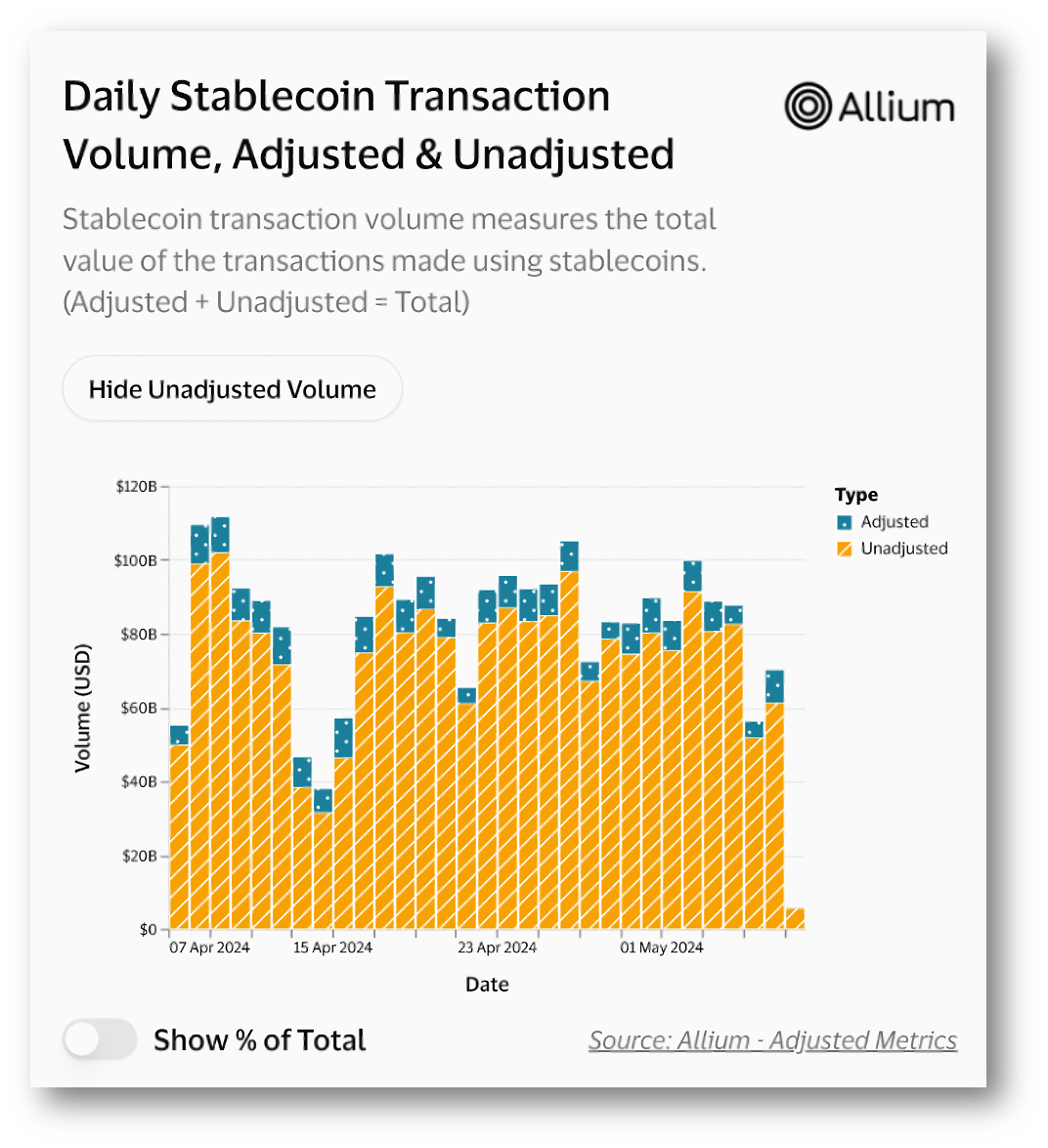

Brace for impact as an analysis of stablecoin volumes by Visa and Allium Labs showed that “adjusted on-chain stablecoin volume for the last 30 days is $265B instead of $2.65T.”

Stunned? In other words, 90% of stablecoin volume is through bots and other large-scale trades that are not associated with genuine payments.

To arrive at this figure, Visa and Allium removed transactions by bots and large-scale traders to “isolate those made by real people.”

Let that sink in for a moment. We have been promised a stablecoin revolution backed by alleged annual transaction volumes of nearly $10 trillion when the reality is a mere 10% of this figure.

The original graph that triggered Visa’s interest shows annual stablecoin volumes nearing Visa’s at around $10 trillion. Given crypto’s poor history of telling the truth, it should come as no surprise that 90% of this volume is bots and not real purchases. Visa must not have been happy when they saw this chart!

What adjustments did Visa make?

Visa worked with Allium Labs to develop an adjusted stablecoin transaction metric. “The adjusted metric aims to remove potential distortions that can arise from inorganic activity and other artificial inflationary practices, and employs the following key filters:”

🔹 Single directional volume filter:

Only the largest stablecoin amount transferred within a single transaction is counted. This removes the redundant internal transactions of a complex smart contract interaction.

Let me explain. Stablecoin transactions are counted twice. If I go to a DeFi exchange and give them $100 in USD Tether stablecoin to swap into $100 USD Circle, the total transaction volume is $200. Like most rational people, Visa believes that the transfer is double-counted because the consumer moved only $100 of volume.

🔹 Inorganic user filter:

Only transactions that have been sent by an account that has initiated less than 1000 stablecoin transactions and $10m in transfer volume (over last 30 days) are counted. This removes various bot activities and automatic transactions from large entities like centralized exchanges.

In our new digital markets, trading bots are the norm. This is not unique to stablecoins; High-Frequency Trading (HFT) is a major factor in securities markets.

These bots produce trades that may be arbitrage, liquidity provisions or market making. Most do not signify any real economic activity between actual users. Compare this with Visa, where paying a merchant generates real economic activity. Where is the economic activity in liquidity provision?

While not mentioned in Visa’s paper, stablecoins are also famed for use in wash trades where high values are transferred back and forth to inflate exchange volumes.

Adjusted transaction data above in green is roughly 90% of the unadjusted data! This shows just how little stablecoin is used for real purchases.

This is very different than what is being advertised by the crypto press!

Visa and Allium developed a fantastic dashboard see this and other charts: HERE

Stablecoins need regulation

Despite my accusations of stablecoin data malfeasance, stablecoins aren’t all bad. I still support the underlying technology, though this clearly signals that they need regulation.

Stablecoins are a useful means of providing fiat currency on Web3, the Metaverse, and other blockchain-based future systems. Their utility is undisputed, even if their volume figures are inflated.

Future uses in trade or interbank wholesale transfers may soon be a reality. JP Morgan and Citibank currently use internally issued stablecoins for internal transfers. The benefits of the tech are very clear, even to bankers.

The stablecoin market is growing and to Visa’s credit, they accurately point this out despite the misstatement in volume figures:

🔹Stablecoin supply is approaching all-time highs. Total demand for stablecoins has picked back up in 2024, with circulating supply approaching $150B.

🔹 Steady growth of monthly active stablecoin users. We are seeing growth in regular users of stablecoins, with 27.5M monthly active users across all chains.

Regulations are coming soon. I recently wrote that: “Dollar-based stablecoins will face tough regulations because the US sees uncontrolled bearer instruments on decentralized exchanges as threatening national security.” (Article below)

Dollar Stablecoins Face The Grim Reaper: National Security

Link to the article on the Brookings website: HERE Dollar-based stablecoins will face tough regulations because the US sees uncontrolled bearer instruments on decentralized exchanges as threatening national security. Stablecoins are a security issue as they can short-circuit the well-developed offshore dollar markets, called Eurodollars, which are desi…

If stablecoins faced the “grim reaper” before, this episode will only make regulators view stablecoins with even more contempt! If they had contemplated tough regulations before, now they will be absolutely draconian.

Let’s take this from the other direction. How can anyone contend that stablecoins shouldn’t be regulated after this serious misstatement of stablecoin volumes?

Don’t mess with Visa and the never-ending crypto farce

There are two morals to this story. The first is don’t mess with Visa!

Visa thought the numbers threatened their payment dominance and did real research to disprove them. Even if we admit that Visa has the most to lose if stablecoins take off in retail payments, there is nothing wrong with them doing the research.

We all owe Visa and the Alium team a debt for shedding light on a problem that seemed to slip under everyone’s radar. Most of us were willing to believe the stablecoin volume number, and I am no exception!

The second moral of this story is very old: “Fool me once, shame on you; fool me twice, shame on me.”

I am sick of the cheats, lies, frauds, and scams of the crypto world.

This is all part of a never-ending crypto farce that unveils new dimensions daily. Rather than be surprised by this, we should ask: “Why should stablecoins be any different?”

From Terra Luna, to Ape NFTs and the pièce de résistance the FTX debacle, crypto never ceases to amaze.

We should all express extreme prejudice over numbers produced by the crypto community. If that sounds harsh, it is intended to be.

Stablecoins are still the future

Stablecoins aren’t going away, but this entire event shows once more why they need regulation and a regulatory body that can at least help them count the numbers correctly.

This entire episode will further damage the crypto industry and stablecoins at a time when US lawmakers are trying to establish regulation.

You can bet that this report will push lawmakers to make the regulations more strict than ever!

Timing is everything, and Visa’s revelations couldn’t have come at a worse time for stablecoins.

Maybe there is justice in that?

Thoughts?

Afterthoughts on Illicit Crypto

After writing this article something bothered me! What do these inflated stablecoin volume numbers mean for illicit crypto and stablecoin use?

As stated in the report, total stablecoin transfers were $10 tn, but only 10% were non-bot related, which means actual stablecoin use is around $1tn.

According to Chainalysis, stablecoin fraud was $24.2 bn in 2023, of which 70% used stablecoins.

That means that in real terms, the amount of fraud on stablecoins is a lot higher than reported. If we have $1 tn in real stablecoins, of which 70% of $24.2 bn were illicit, this means roughly 2% of stablecoin transactions are illicit.

In comparison, Chainalysis reports that $24.2 bn represents a tiny 0.34% of total on-chain transaction volume.

The reality is that if many of these crypto transactions are bot-driven, as they are with stablecoins, the real number of illicit crypto transactions is likely much higher, and closer to 2% of stablecoins!