BRICS SPECIAL: BRICS ADDS SAUDI ARABIA AND DEDOLLARIZATION GETS A BOOST AS THE PETRODOLLAR IS WOUNDED

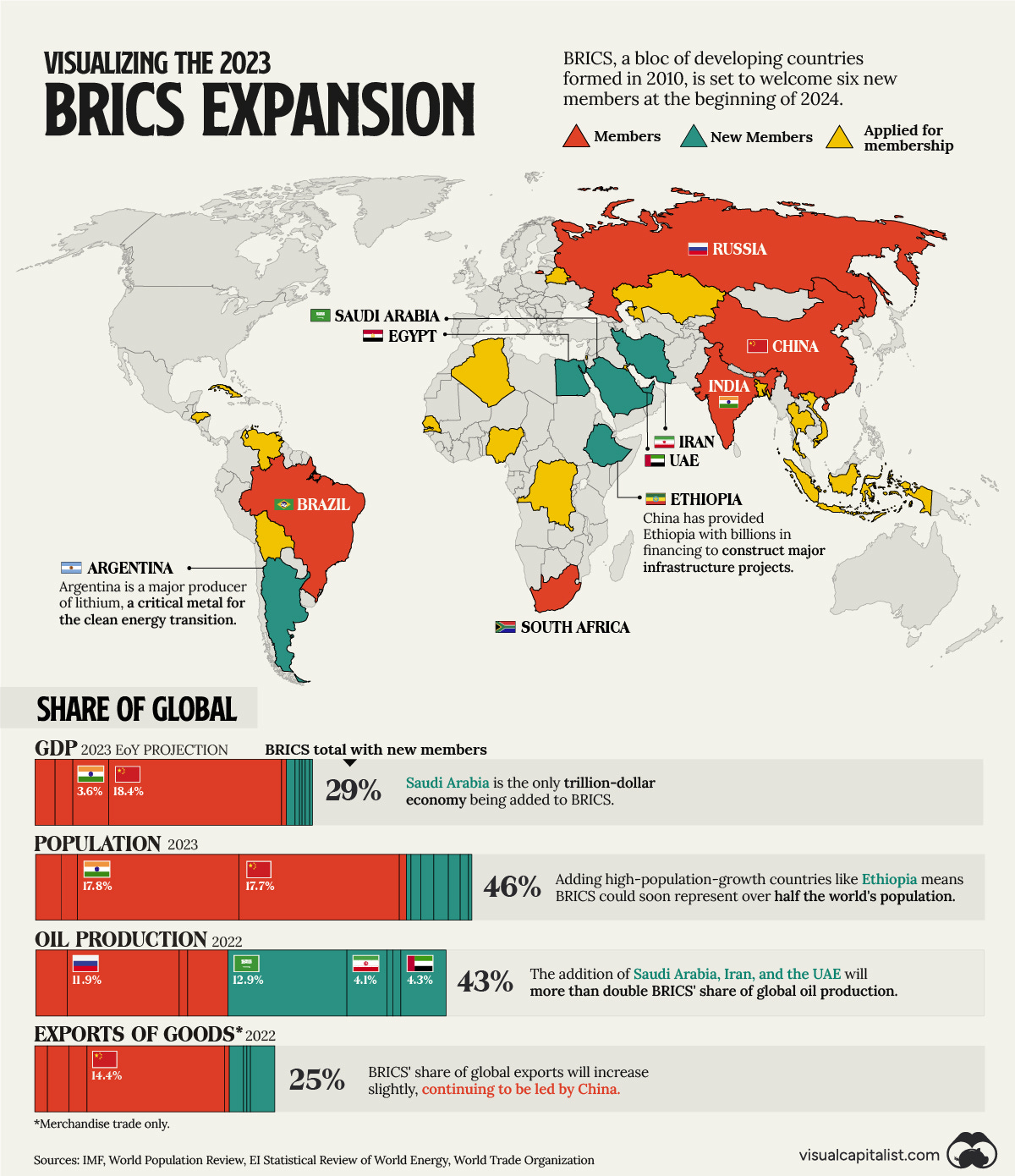

Petrodollar is in play as BRICS control 43% of global oil output!

1. Infographic: The new BRICS

2. Saudi Arabia joins BRICS: petrodollar and dedollarization

3. BRICS in Charts

1. Infographic: The new BRICS

Note the newly expanded BRICS possesses 37% of global GDP on a PPP basis. It is unclear if the figures above from Visual Capitalist are nominal, which might account for the lower figure.

2. 💥SHOCKER: Saudi Arabia joins BRICS: petrodollar and dedollarization💥

Download the ING report: here

BRICS ADMIT SAUDIA ARABIA, dedollarization gets a boost, the petrodollar is wounded, and the world order reshuffled.

The world order just changed. Yesterday the BRICS Summit announced 6 new BRICS members - Argentina, Egypt, Ethiopia, Iran, Saudia Arabia and UAE. All are logical additions to BRICS, though all eyes are on Saudia Arabia and the UAE.

These middle east powerhouses will fundamentally change the debate over dedollarization and wound the petrodollar, the term given for US dollar-denominated oil exports.

The maintenance of the petrodollar is a key US strategic interest as it allows the US to maintain its deficit spending. US dollars used for the purchase of oil are recycled into US debt holdings.

It is so important that just two weeks ago, as part of negotiations for Saudi Arabia to recognize Israel, the US demanded that Riyadh keep pricing its oil in dollars, not China’s RMB or other currencies. (link below)

The US now has its answer!

So here’s how this will play out over the coming years:

BRICS now control 42% of global crude output with the addition of the UAE, Saudi, and Iran.

This year Saudi and the UAE will start selling small amounts of oil in something other than dollars. Expect these sales to be modest but grow in 5 years.

Note that Iran and Russia already sell oil in RMB, rupee and UAE dirhams to avoid US sanctions.

Because there's nothing better, the RMB will be used for some of this trade because oil exporters can readily use the RMB to purchase goods from China. To its displeasure, India is paying Russia in RMB for recent oil imports for this reason.

UAE, a major financial center with strong ties to China, will facilitate RMB oil trade. And the UAE is a participant in the mBridge CBDC transfer system!

This is not the “death, toppling, or ditching” of the US dollar but is a starting point for BRICS nations to dedollarize. Oil is king, which is good for BRICS and bad for the US.

How do you feel about the world just changing without a shot fired?

Thoughts?

🚀TAKEAWAYS:

—The Western world order just changed with the expansion of BRICS.

—Saudi Arabia's addition to BRICS is a game-changer.

—Saudi will still use the dollar for MOST oil sales but even a small change will wound the petrodollar.

—Do not underestimate this event!

2. BRICS in Charts

The BRICS Summit is underway and a major expansion is on the table even if a BRICS currency is off.

The BRICS Summit is underway in South Africa and the big question is who will be admitted and how much will BRICS grow? For now, no one knows, but BRICS received interest from some 40 nations, with around 20 being considered seriously.

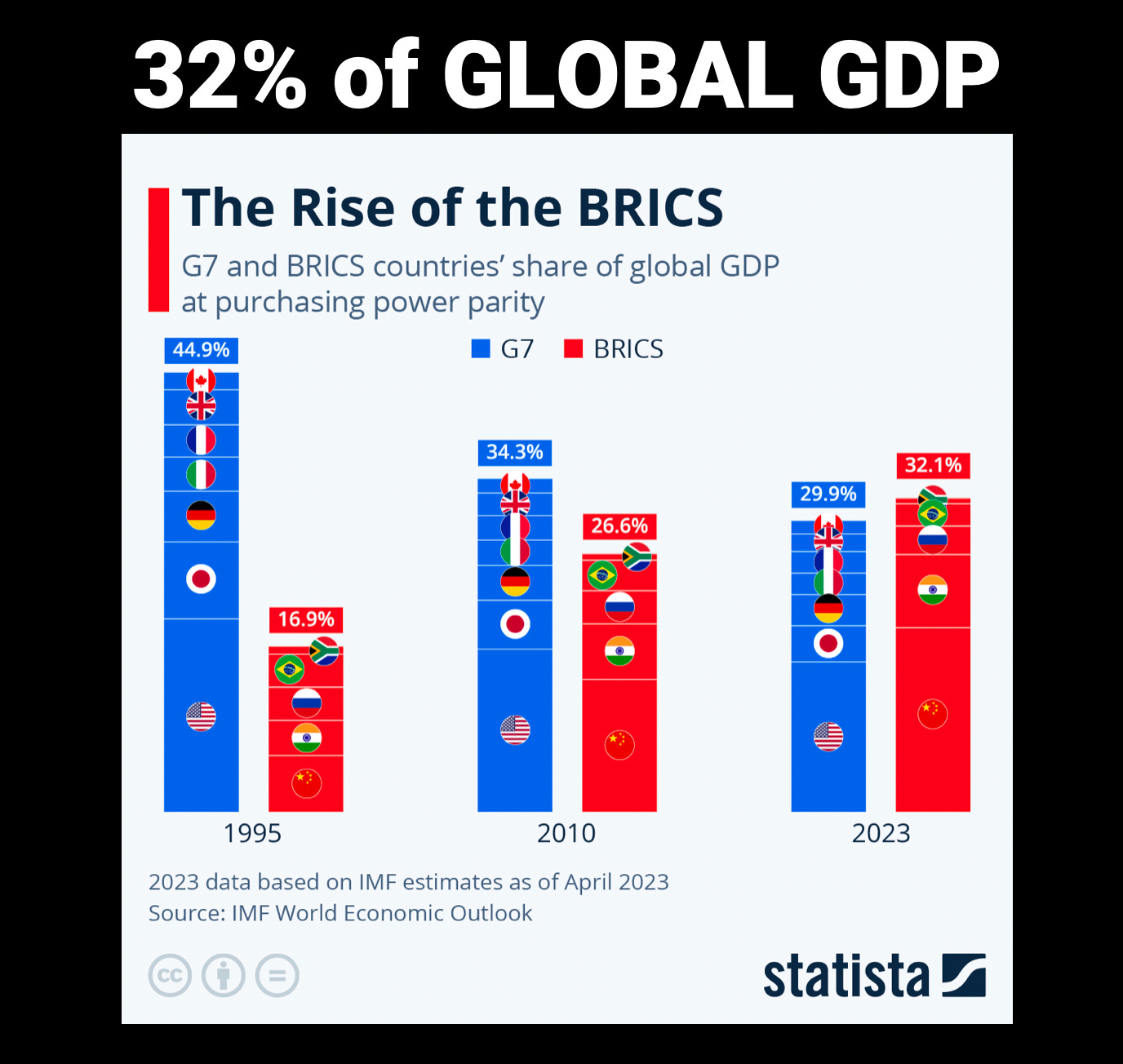

The first two graphs in my summary of BRICS charts are jaw-droppers. BRICS currently have a 32% share in global GDP and 41% of the global population, which says more than I can about why this meeting is so important.

Even more stunning is the Financial Times's graphic showing that if 22 new applicants are admitted, the BRICS share of GDP would climb to 45% with 58% of the global population.

What is important about these figures is that they show how much the world wants different representation, a direct rebuke to the US, EU, and G7.

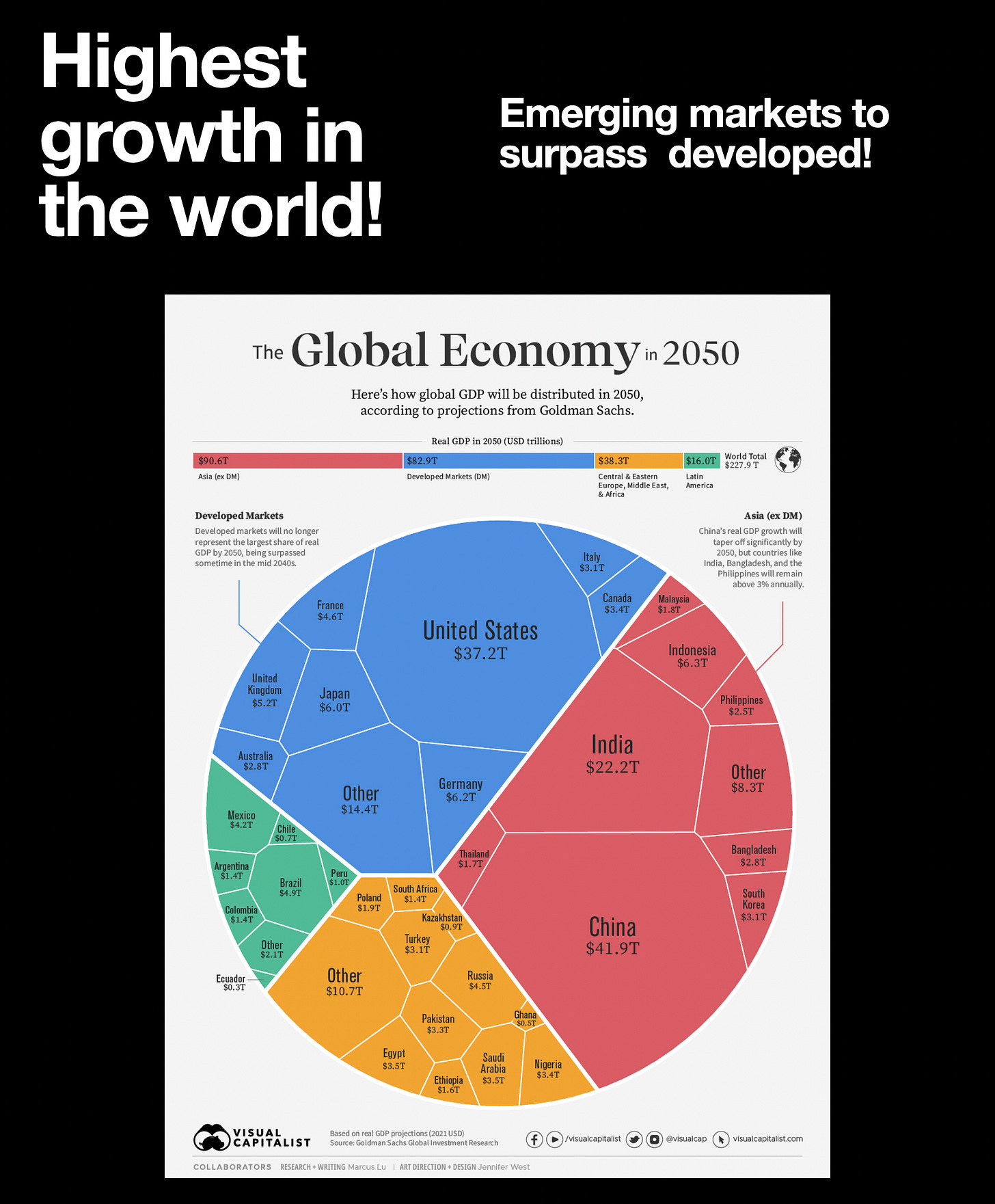

Still BRICS nations are poor, but have tremendous growth potential. It’s important to think about where they will be in 25 years rather than where they are now.

The most obvious critique of the meeting is that BRICS members are hardly best of friends! With obvious tensions between India and China and Russia's war on Ukraine, political discussions are not on the table.

What binds these disparate nations is a focus on trade and investment and a sense that the West is not treating them fairly. No one can say if this is enough to bind them, but it seems likely.

The key is that while G7 nations were once far ahead of BRICS nations economically, the gap has closed! This is a significant factor behind BRICS, the sense that emerging markets have changed, but the attitude toward them and their representation has not.

Dedollarization is in the news daily with the BRICS summit, and a discussion about a new BRICS currency is not on the agenda. Still, make no doubt about it: BRICS nations and applicants yearn for a dollar alternative. Instead, there will be a discussion on how BRICS nations can use their own currencies in trade.

The quote of the day award regarding the BRICS summit goes to Zoltan Pozsar:

“The global east and south are renegotiating the world order.” “The west dreamt of the Brics as a lapdog, that they would accumulate dollars and recycle them into Treasuries, but instead of that, they are renegotiating how things are done.”

His comment is harsh, but the renegotiation part is true.

Thoughts?

🔺Please leave a comment, repost♻️ and like! One comment equals 10 likes, and it takes only 3 reader comments to boost this post 50%.

🚀TAKEAWAYS:

—The BRICS expansion is a game-changer.

— It gives members of the global south, alienated by the West, a platform for economic development and trade.

—Political differences between members are severe. Economics not ideology binds them.

—DeDollarization was taken off the agenda but is a clear goal of current and future BRICS members.

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written here on Substack with credit given to me and this site (richturrin.substack.com) For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

Yes This may be a marker. Expect BIS etc. to hurry to establish some 'control' on mBRIDGE and note that Indonesia did not join despite an invite. It would be important for the BRICS to also help the Western alliance members especially South and North Europe to become more aware of their vulnerability on King Dollar and the long term benefits to reduce that dominance.

Else they will have a hard time staying united against the Empire

This was an extremely well written article. I wish I could be this articulate, but I personally disagree that BRICS will lead to any serious chance. The geopolitical insatiably in these countries is a serious problem. Russia is fighting a war, China & India have a serious border disagreement. The Saudis aren’t trustworthy at all and are also ruled by a dictator. South Africa is on the on the brink of collapse. Personally I think de-dollarization will happen but not because of BRICS.