BUSTED: Bank of Canada shows CBDC will not kill banks

The bank narrative that CBDC will cause massive disruption is busted once again!

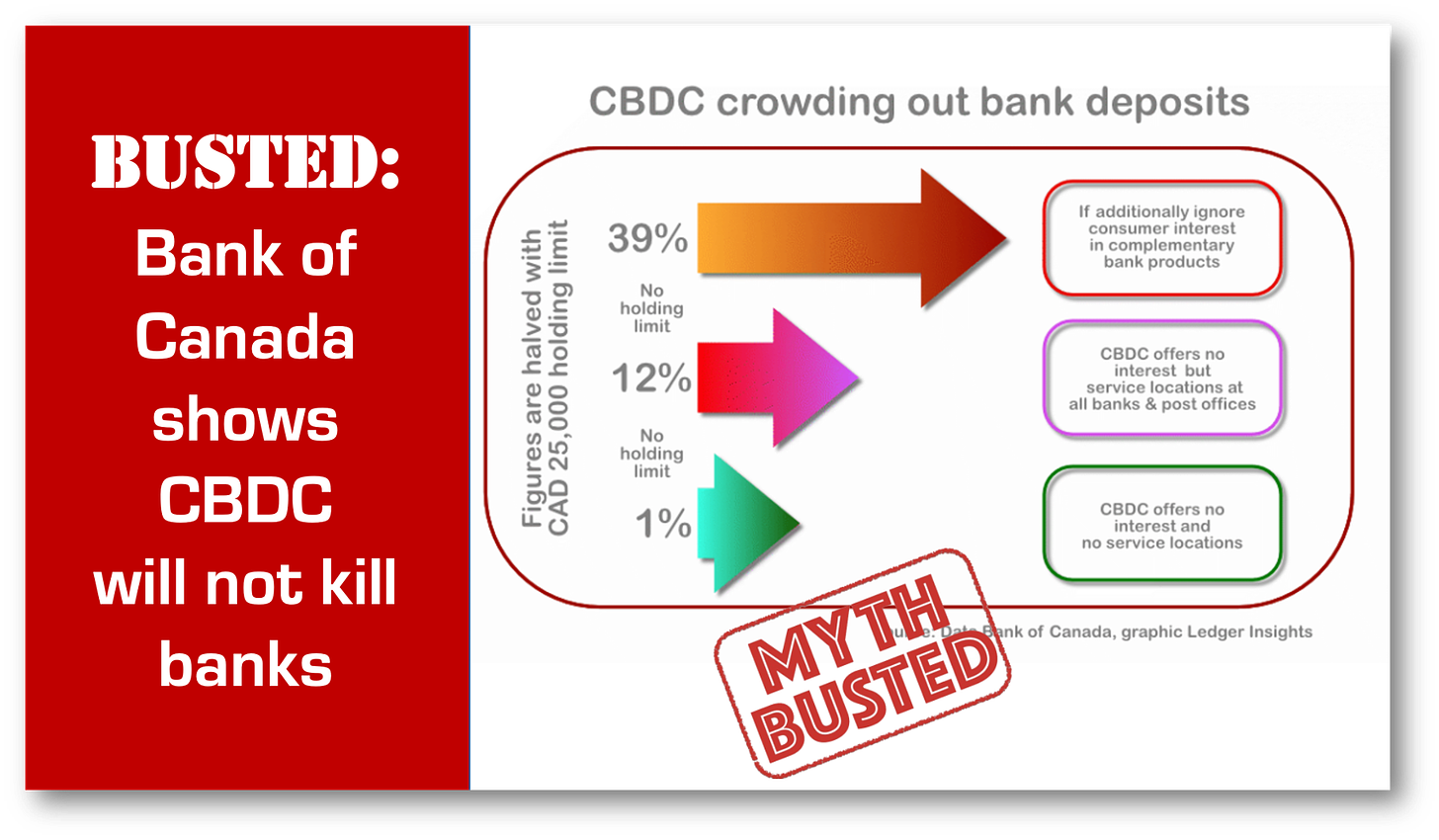

The 39% impact to bank deposits shown above is considered a "mistake" and an overestimate. This is what banks do all the time to stir fear of CBDC disruption!

”Under this extensive network design, if we misspecify the model by neglecting the complementarity between deposits and other financial products, we would significantly overestimate the impact of a CBDC and conclude incorrectly that a CBDC can crowd out 39% of bank deposits. Therefore, it is crucial to account for these two differentiating factors when quantifying the effects of the CBDC on bank deposits.”

Once again, the bank-promoted myth that CBDCs will cause massive disruption to the banking system is BUSTED!

This time, The Bank of Canada (BoC) uses a model to show that CBDCs will not disrupt bank deposits significantly.

Banks argue that CBDCs will take massive amounts of bank deposits and destabilize the banking system. While it is true that CBDCs will “disintermediate” deposits, the question is how much?

The BoCs model shows that with 12% of deposits impacted, it is far from the fatal blow that banks predict.

See my article on for more on “myth busting” banks absurd claims about the digital euro last week

👉TAKEAWAYS

The BoC model takes into account three critical components:

That banks provide financial products that are complementary to deposits, which cannot be provided by the central bank.

This is the CRITICAL FACTOR not included in most analyses!! Your bank provides you with mortgages and other services that attract deposits that are immune to CBDC.

That consumers value physical service locations.

CBDC holding limits which effectively limit takeup.

Results:

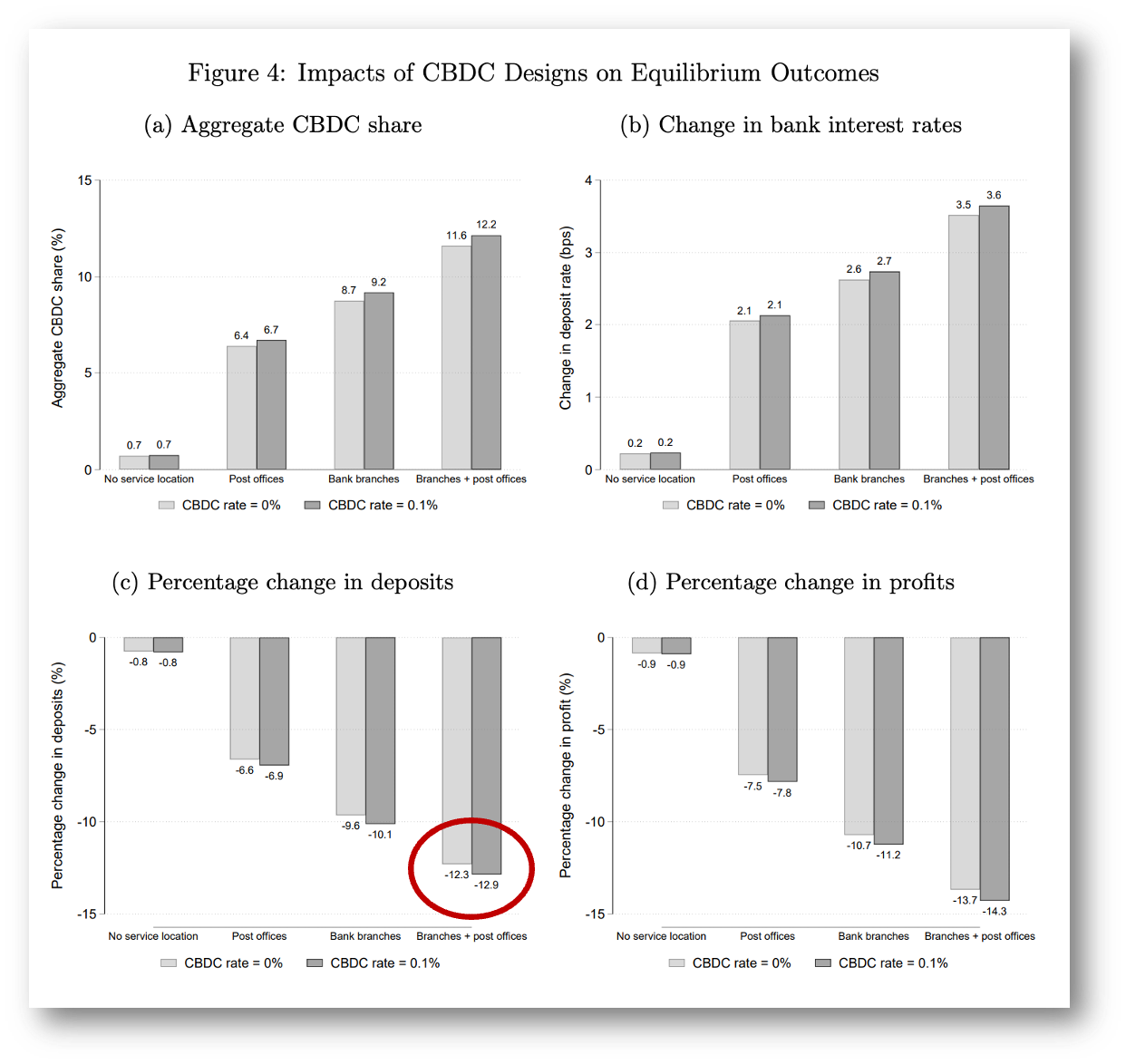

The impact of a CBDC is much lower after taking into account that households enjoy the complementarity between deposits and other financial products within the same bank, which gives banks a competitive advantage over the CBDC.

The impact of a CBDC depends crucially on its service location network. A CBDC that has no service location can barely gain any traction.

A CBDC that uses Canada Post offices as service locations would lead to a take-up that is similar to the market share of cash and benefits rural households more than a CBDC that uses bank branches as service locations.

Banks with larger market shares tend to respond more to the CBDC and hence retain more deposits.

We find that while a holding limit can significantly reduce the take-up of the CBDC, its effect on consumer surplus is relatively smaller.

Percentage change in deposits for banks is 12.3% for a non interest bearing CBDC! This is not the disaster that banks regularly predict! This is without CBDC holding limits. The paper estimates that a CAD 25,000 holding limit would reduce this figure by half!

👊STRAIGHT TALK👊

Once again, the myth that CBDC will disrupt bank deposits is busted.

In the worst-case scenario where the paper shows bank deposits were disrupted by some 39%, this ONLY occurs when the model does not factor in banks’ complementary services.

This is an unreasonable expectation. People stick with banks due to many other financial services beyond cash management, and this provides the glue that will limit CBDC adoption.

Now, for those in the banking world who say that this is just a model, you can examine the uptake of WeChat and Alipay in China, which had a net impact on bank deposits of around 3% (from my book Cashless).

So once again, I’ll say it: banks are terrified of CBDC and will do and say anything to stop or slow adoption.

Don’t fall for it!

If you’ve read this far, there had to be something that made you stick around to the end! So do yourself a favor and subscribe, it’s free!

What do you have to lose? If you don’t like my newsletter, just unsubscribe.

The button says pledge, but there’s no need. Substack adds that it's not me.