CBDC, not crypto, is the monetary system of the future, CBDC cross-border transfer, the Fed warms to a digital dollar, Visa talks CBDC

Crypto lacks a moral compass, podcast

This week:

1. CBDC, not crypto, is the monetary system of the future

2. CBDC cross-border transfers coming soon

3. Fed’s Powell warms to a US CBDC

4. Visa’s take on CBDCs

5. Crypto lacks a moral compass, podcast

1. CBDC, not crypto, is the monetary system of the future

The BIS goes full Muhammad Ali “Rope a Dope” on crypto beating it senseless while boldly proclaiming that “Anything crypto can do, CBDC can do better.”

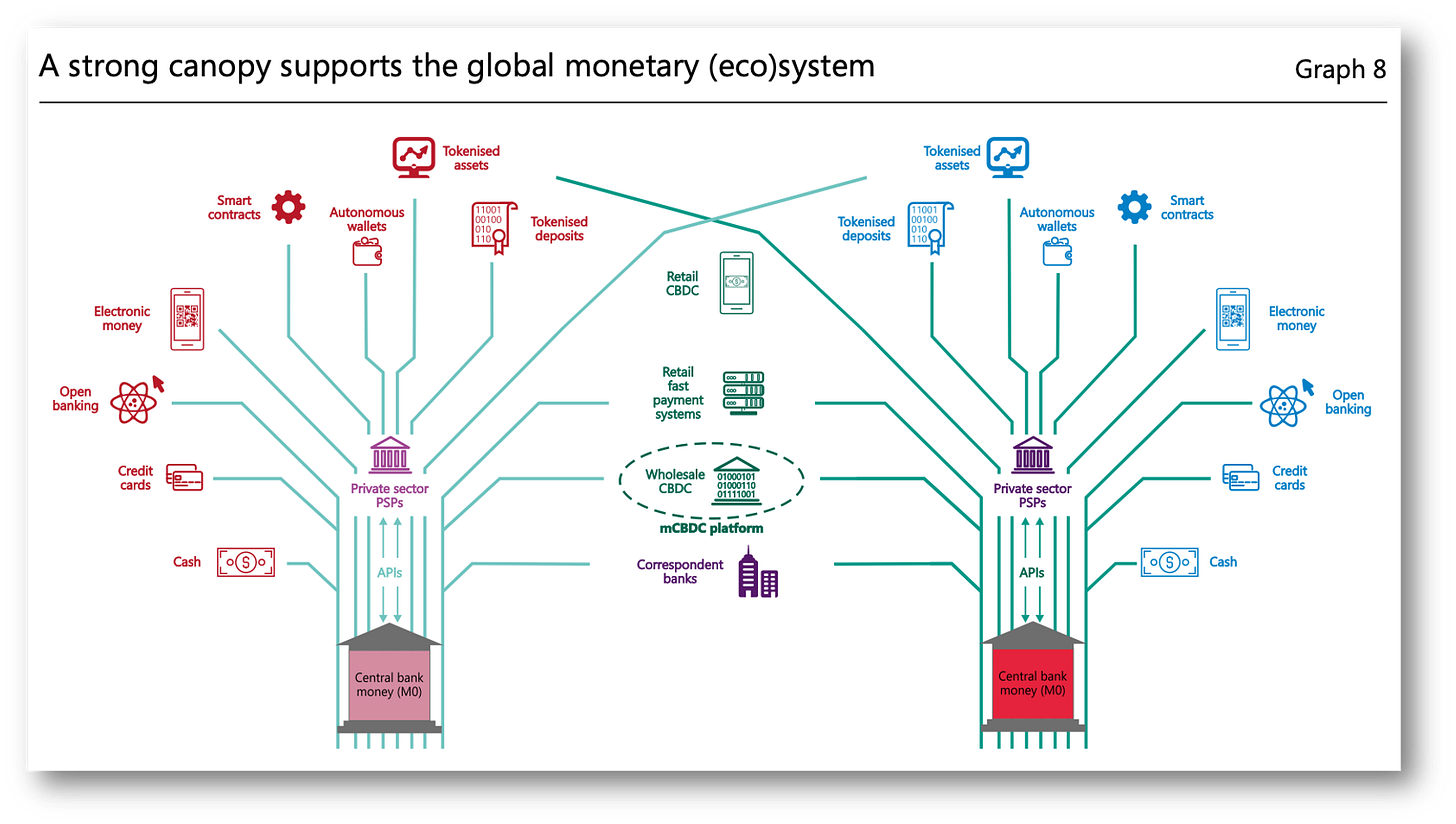

“The global monetary system can then be compared with a forest, whose canopy facilitates cross-border and cross-currency activity.” Download the BIS report: Here

All readers know that the BIS has no love for crypto and in this report, it “floats like a butterfly and stings like a bee” as it lands blow after blow on crypto’s glass jaw just weeks after crypto’s implosion.

Crypto is sold with high ideals that have not been delivered. Promises of “democratizing finance,” “monetary freedom” and being more "ethical" ring hollow.

🔹 The BIS pulls no punches:

“Structural flaws make the crypto universe unsuitable as the basis for a monetary system: it lacks a stable nominal anchor, while limits to its scalability result in fragmentation. Contrary to the decentralisation narrative, crypto often relies on unregulated intermediaries that pose financial risks.” …“Raises serious questions as to the suitability of crypto as money.”

🔹 But the BIS makes it clear the technology is great it’s the implementation:

“Crypto offers a glimpse of potentially useful features that could enhance the capabilities of the current monetary system. These stem from the capacity to combine transactions and to execute the automatic settlement of bundled transactions in a conditional manner, enabling greater functionality and speed.”

🔹 BIS calls for regulation:

Global regulators “need to rigorously tackle cases of regulatory arbitrage”, starting from the principle of “same activity, same risk, same rules”.

“They should ensure that crypto and DeFi activities comply with legal requirements for comparable traditional activities. Stablecoin issuers, for instance, resemble deposit-takers or money market funds. As such, legislation is needed to qualify these activities and ensure that they are subject to sound prudential regulation and disclosure.”

🔹 Decentralisation is “an illusion,” says the BIS and sadly I agree. My take on decentralization is more brutal than the BIS’s.

The Decentralization Myth

How decentralized is this?

1) You use exchanges that are centralized,

2) buy crypto using stablecoins which are centralized and rely on fiat,

3) then use your crypto on DeFi lenders that are more centralized than promised but promise 20% interest,

4) when they collapse they reveal voting structures that are more opaque than the banks crypto ran from,

5) finally as last resort crypto users return to the state asking them to discipline those that ran the Ponzi.

6) Meanwhile, the “decentralized” Bitcoin often at the heart of this activity is 51% mined by only 4 miners that burn excessive electrictity.

🔹 The BIS goes for the kill shot saying:

“Cryptos’ deeper structural flaws render them unsuitable as the basis for a monetary system that serves society”

“CBDCs offer a brighter vision of the future monetary system. The trust provided by central bank money will foster a vibrant monetary ecosystem."

2. CBDC cross-border transfers coming soon

The BIS shattered the dream of crypto in its report above and replaces it with the reality of CBDC cross-border payment and new geopolitical conflicts.

Perhaps the most important financial infrastructure of our time!

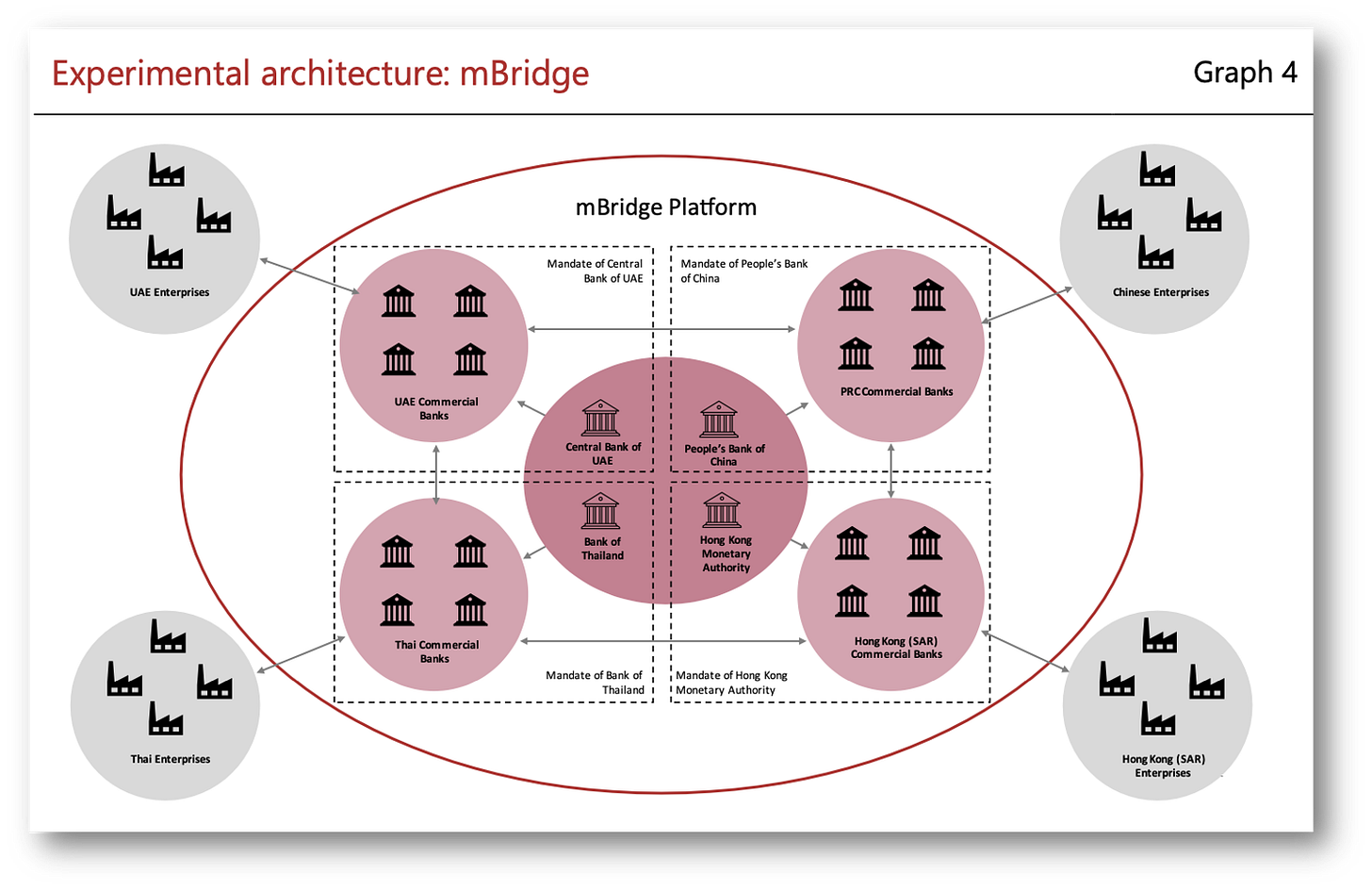

“mBridge” architecture enables a fully connected network of issuing central banks to validate transactions on behalf of their domestic commercial bank participants. BIS PDF download: Here

I have written extensively about the BIS’s project Dunbar in Singapore and mCBDC in Hong Kong and believe that they are the most important financial infrastructure developments of our time. If you think that is hyperbole, I assure you it is not.

The ability to harness “atomic settlement,” or “payment versus payment” PvP settlement is revolutionary. The instant exchange of two assets, such that the transfer of one occurs only upon transfer of the other one, on a distributed ledger is no less important an invention than paper money.

Payments made with CBDC are real-time and final because the token is the money. Compare this to the 1-5 days that SWIFT takes by relying on a series of banks essentially promising one another that they have moved the money.

The BIS makes it clear what can be gained:

1️⃣ Lower costs. A common DLT platform allows smart contracts to automate rules and processes at a system and participant level.

2️⃣ Faster settlement. Reducing the need for intermediaries and enabling direct transactions between participants removes the need for correspondent payment chains that can slow down settlement.

3️⃣ Operational transparency. In an mCBDC system, payments are recorded on a single ledger in one step and participants have full real-time visibility of their holdings.

The BIS’s projects in Hong Kong and Singapore are not just proof of concepts but real prototypes that will be ready to go into trials in 2023.

Geopolitical impact

While these exchanges may be impressive from a technical perspective, from a geopolitical perspective they are the equivalent of an atomic bomb.

When they go into trial the sole two CBDC exchanges in the planet will reside in Asia and will have been built with no assistance from the US.

Now I want to take you back to the now-famous words of Fed chair Powell, who said in 2020 that there was “no first-mover advantage” with CBDCs. He was wrong and now claims that a US CBDC would help maintain dollar primacy.

Why? Clearly not lost on Powell is that by 2023 we will have working CBDCs in India, China, and Russia. All three countries attended a “BRICS” conference on June 23 where a new currency basket was proposed to reduce dollar hegemony. Do you see where this is going?

Cross-border CBDC transfers are not something for the distant future, in 2023 I’ll be writing about successful early uses between Russia, China, and India.

Do you still think it was hyperbole when I said these exchanges are the most important financial infrastructure of our time?

3. Fed’s Powell warms to a US CBDC?

In what can only be described as a miracle, Fed Chair Powell is slowly warming to a digital dollar, while Congressman Jim Himes comes out with a must-read pro-CBDC paper! Could the tide for a US CBDC finally be turning?

Powell has been an outspoken opponent to developing a US CBDC or digital dollar. He if finally softening his stance perhaps because it is out of step with support for a CBDC from his Vice Chair, Lael Brainard, or pro-CBDC efforts like this from Jim Himes. Download Jim Hime’s paper: Here

Fed chair Powell’s dislike of CBDC is the stuff of legend and the Fed's CBDC program is woefully behind. For perspective on US progress consider this:

“16 of the G20 countries are in the development or pilot phase, with only the U.S., Mexico, and the United Kingdom still in the research phase.”

But slowly Powell's anti-CBDC rhetoric is changing from resistance to what I would call begrudging acceptance.

We can’t know why but he is increasingly out of step with presidential executive orders and even his Vice-Chair Lael Brainard. Meanwhile, Congressman Himes actually wrote an excellent report supporting a digital dollar. Perhaps the pressure of CBDC supporters is slowly making him come around? Himes penned these words that were better than anything ever written by the Fed:

“The potential benefits of developing a CBDC meaningfully outweigh the risks, many of which can be mitigated."

Powell’s in his own words on CBDC

Powell's quotes in the last two weeks were actually surprisingly moderate indicating a potential thaw. Still his past comments are the stuff of legend:

June 24

🔹 A CBDC is "something we really need to explore as a country."…. “it should not be a partisan thing.”

🔹 “It’s a very important potential financial innovation that will affect all Americans.”

June 17

🔹 “The development of an official digital version of the U.S. dollar could help safeguard its global dominance as other countries issue their own”

🔹 "As we consider feedback...we will be thinking not just about the current state of the world, but also how the global financial system might evolve over the next 5 to 10 years,"

This final statement is the first I have heard from Powell that is future-looking. It mirrors similar quotes from Fed vice chair Lael Brainard, who is consistantly visionary with her support of CBDC. Her influence clearly is impacting Powell! We all owe her thanks.

2017

🔹 “A digital currency issued by a central bank would be a global target for cyberattacks, cyber counterfeiting, and cyber theft.”

2019

🔹 "The US has no need for a CBDC at this time.”

2020

🔹 “We don’t feel an urge or a need to be first.”

Himes's paper on CBDC calls for a two-tier account-based CBDC that would maintain privacy and benefit all Americans. Frankly, I prefer tokens to accounts, but I’ll take it.

For the record tokens are a superior system and will be required to take advantage of the cross-border transfer systems referenced in the above article. In addition, they make off-line CBDC transfer possible and make for greater disintermediation from banks.

Himes goes one step further and realizes something that the Fed does not in its CBDC paper. Stating:

“To maximize the reach and utility of an intermediated retail CBDC, the system should be open to non‐bank entities and other firms that wish to offer CBDC wallet services.” Kudos to Himes!

So hope for a US CBDC? I think so!

The US cannot make up the time lost due to the Fed’s inactivity, but at least they are slowly changing course to head in the right direction.

Himes’ title says it all. The US should at least try to “Win the Future of Money.”

4. Visa’s take on CBDC

Visa's report on CBDCs does its best to spread FUD, but it's too late, the migration to digital wallets has already begun and is unstoppable.

Download the report: Here

The transition away from credit cards is underway, read this article out recently: “Surging Use of Digital Wallets Threatens Traditional Credit Card Market” in The Financial Brand: Here

“75% of those who were surveyed globally said they have used a digital wallet within the past year…71% in the US…..up from 64% the previous year.”

Then the survey goes for the kill because plastic is losing the “ease of use” battle:

“Mobile wallets were rated highly for convenience when making purchases — 85% in the U.S., 89% in the U.K. and 90% in Australia.”

Visa isn’t stupid. They get that carrying a piece of plastic is anachronistic and that they have to make peace with the future.

Visa spreads FUD and a few good ideas

Still, their report on CBDC does its best to create FUD (fear, uncertainty & doubt) over CBDCs and at times fails miserably by suggesting that:

1️⃣ CBDCs will provide a single source of transaction information.

No Visa it's credit cards that do that, not tokenized CBDCs! And you know it!

2️⃣ CBDC could worsen how cross-border payments operate.

Visa should know that even Fed Governors denounce the system for its expense. You couldn’t make it any worse!

But to Visa's credit they score some practical suggestions:

✅ Interoperability:

“CBDCs should be well integrated and interoperable with the existing payment system to ensure it can be easily accepted” Perhaps this is solely out of self-interest but they make a good point

✅ Offline payments:

“For CBDC to be broadly accessible and transferable in real-time offline capability will be critical.” Visa is correct off-line payments are a critical feature.

Stockholm syndrome

I have no love for the duopoly that is Mastercard and Visa. I claim that our relationship with these companies is a form of “Stockholm Syndrome.”

What most don’t understand is that the US pays 2.1% of GDP for “payment services” and the EU 1.4% of GDP.

As much as I dislike the card duopoly I recognize that interoperability with existing systems will be key for CBDC uptake in the US just as it is for the e-CNY in China.

The e-CNY must be usable on WeChat and Alipay for broad adoption in China just as the use of a digital dollar or euro must be used on Visa and MC networks.

How to pay for the digital dollar program

Visa of course asks how the US will pay for a digital dollar?

I have a suggestion!

The Fed reports that for the US gov’t issued prepaid cards used for social programs Visa and MC make $500mn a year in fees!

My modest suggestion is that the Fed take these savings and repurpose them to pay for a digital dollar! It will certainly help!

I will cry no tears for Visa's losses when CBDCs arrive but acknowledge that they must be able to participate.

5. Crypto’s lacking moral compass, podcast

The crypto collapse showed a lack of moral compass, BTC is not an answer for financial inclusion, and a desperate need for regulation, because people steal!

Podcast links:

Spotify: Here

Apple: Here

Great talking with old friends Theodora Lau and Arunkumar Krishnakumar on the One Vision Podcast!

Timestamp and key themes:

1:00 Blockchain vs Crypto: Crypto is so broad we need to specify which part. If you want to buy BTC I’m happy for you. To tell disadvantaged people that they should use BTC when it bounces around in value and that it improves financial inclusion is unbelievable.

7:39 We are not running experiments: Crypto is not an experiment, remember experiments in science are done in a controlled environment and are repeatable. Calling crypto failures experiments and then ignoring the human suffering they cause shows an incredible degree of callousness among the crypto community.

11:00 The moral compass: 🔥When it comes to money, people aren’t ethical….they have been historically unethical which is why we have regulation. Half the bankers out there would walk away with cash if there were no regulations.🔥

When regulators called out stablecoins as a risk, the crypto community just ignored them and said they were not needed. 🔥We need regulation because hundreds of years of greed show people will rob others if given the chance.🔥

16:30 Stablecoins, regulations, and CBDC: Regulators have been prophesizing the crash of stablecoins for years but were ignored. Now we’re going to get regcoins, regulated stablecoins. If ever you needed an example of why a corporate-issued coin is not the same as a CBDC this is it!

18:55 China crypto and e-CNY: The banning of Bitcoin in China was not a way to promote or help the e-CNY. Bitcoin was always outlawed for retail transactions, and CBDC is primarily a retail payment device. Taking away bitcoin in China has no impact on the e-CNY market.

22:00 El Salvador, Singapore, and Bitcoin: 🔥Love this discussion and Theo talking with a billionaire! 🔥 Singapore did a huge public outreach and education campaign dissuading retail buyers. Then threw out non-compliant KYC/AML crypto exchanges! Tough!

26:30 DeFi: 🔥When you add a CBDC to DeFi to make it legit, you’ll have a great product…..yes I know crypto people will really hate me! 🔥

30:00 Defi Regs: We need regs that are not dissimilar to how financial products are qualified for sale in certain nations today.

31:00 Predictions: I pray for a quiet year and I take no joy in the market collapse we just had. I hope for nothing more than a quiet remainder of the year.

Thanks for reading

Be in control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: