CBDCs are green, will not sing Kumbaya on cross border transfers and have users in two worlds, while stablecoin's new "same risk same regs" strikes a mortal blow

SE Asia launches a regional QR payment system at the G20, and no one cares.

1. CBDCs are greener than cash or crypto

2. Stablecoins “same risk, same regulations” a mortal blow for some

3. Pan-SE Asia QR code payments

4. CBDC cross-border interoperability is a ship that sailed long ago

5. CBDC what users want reveals two worlds

1. CBDCs are greener than cash or crypto

The environmental impacts of CBDC are better than Cash or Crypto which is critical to long-term sustainability!

Download the report: here

The World Bank looks at the environmental implications of CBDC in a critical paper that show how CBDC uses roughly one-millionth of the electricity of Bitcoin and about one-hundredth of the electricity of cash.

CBDC adoption must not be spared environmental assessment just because it’s new and governments think they’re a great idea. Rigorous analysis of CBDC design and its implications for energy use is a critical consideration when 90% of central banks are working on them.

This paper focuses on East Asia and the Pacific (EAP) region which is so sensitive to extreme weather events that the “Climate Risk Index”, puts six EAP nations among the world’s top 20 most vulnerable.

Much of the EAP is comprised of developing nations and island nations where changing climate is an existential threat.

Some thoughts:

🔹 Crypto:

While the energy use of blockchain in Bitcoin and Ether is legendary, the rationale behind these systems is important.

Crypto is designed to be fully public and trustless which requires bullet-proof systems that are notorious for energy consumption. Even with more advanced “proof-of-stake” consensus replacing “proof-of-work,” crypto will still use more electricity in part because of the job it does.

🔹 Cash:

The energy used in the lifecycle of paper banknotes is highly variable because it supports entire industries surrounding printing, minting, transporting, handling, and storing cash.

Figures from Cashless show the enormity of these costs which have energy use embedded in them: The US Treasury’s budget for printing cash alone was an astounding $877mn.

🔹 CBDC and Credit Cards:

Because CBDC will use systems that are more modern than credit cards, the author uses cards as an upper bound for CBDC energy consumption. In a separate publication, the IMF discussed how newer RTGS and distributed ledger technology (DLT) systems are more efficient than legacy card networks by a factor of 10.

Part of this reduced energy consumption is due to the network users in CBDC and card networks being trusted as opposed to crypto’s trustless networks.

Takeaways

The general public harbors a major misconception about CBDCs and conflates their energy use with Bitcoin or crypto. This is very common and one of the more common comments I receive is a concern about the energy use of CBDCs.

The reality is that as this paper shows, CBDCs are in fact quite “green” when compared to cash, crypto, or cards, making them not just sustainable, but preferable in terms of energy consumption.

2. Stablecoins “same risk, same regulations” a mortal blow for some

New stablecoin regulatory guidance hammers all coins with “same risk, same regulations” but delivers a mortal blow to DeFi versions.

The BIS’ Committee on Payments and Market Infrastructures (CPMI) and IOSCO just launched game-changing stablecoin guidance! Download: here

Stablecoins will now have to match the BIS’ existing “Principles for Financial Market Infrastructure” (PFMI) that apply to all other financial market participants.

There will be no room for “regulatory arbitrage” as stablecoins are deemed FMI because they perform transfers (payments) thus must be subject to the same standards that govern other forms of money.

It is important to understand that this is not “regulation,” but guidance for local regulators. Expect the principals to be widely applied.

🔹 Applicability:

All stablecoins will likely be included. Determining which is a “systemically important” FMI is left to the regulator with size, number of users, substitutability and nature of risk and interconnectedness as key parameters.

🔹 Governance:

DeFi stablecoins are dealt a mortal blow! The guidance requires clear lines of responsibility and accountability, with identifiable and responsible legal entities controlled by natural persons such that it allows for timely human intervention. DeFi with human intervention?

“The code is law,” a common claim made by DeFi simply won’t cut it anymore.

🔹 Risk Management Framework

Stablecoins must regularly review the risk not just of their own operations but intertwined functions like, settlement banks, liquidity providers, validating node operators and other node operators, or service providers.

🔹 Settlement finality

Stablecoins relying on blockchains for settlement have “probabilistic settlement” because the exact timing of on chain consensus cannot be exactly determined.

Stablecoins should provide clear and certain final settlement, at a minimum by the end of the value date. This will likely require additional reserving.

DeFi gets hit again because without a responsible legal entity, there is no enforceable legal finality!

🔹 Money settlement

-Here's the hardest part: The stablecoin provider should consider whether the stablecoin provides its holders with a direct legal claim on the issuer and/or claim on, title to or interest in the underlying reserve assets. Also show treatment (eg seniority) in the event of insolvency of the issuer, its reserve manager or a custodian of the reserve assets.

The above may seem simple, but even Circle, considered a “good guy” has difficulty defining the exact claim coin holders have against assets!

Takeaways:

Expect local regulators to follow this guidance closely

Stablecoins particularly DeFi versions are going to get hammered by these laws!

Working out exactly what happens during bankruptcy is not easy but is required for stablecoins to take on a bigger role in society as I fully expect they will.

3. Pan-SE Asia QR code payment system

A long-form read about one of the biggest events in fintech that no one covered. You’d think that a new pan-SE Asia payment system allowing near immediate payments would be news, wouldn’t you? Even more so if it renounced using US dollars?

I guess it’s hard competing with the crypto crash in the news cycle!

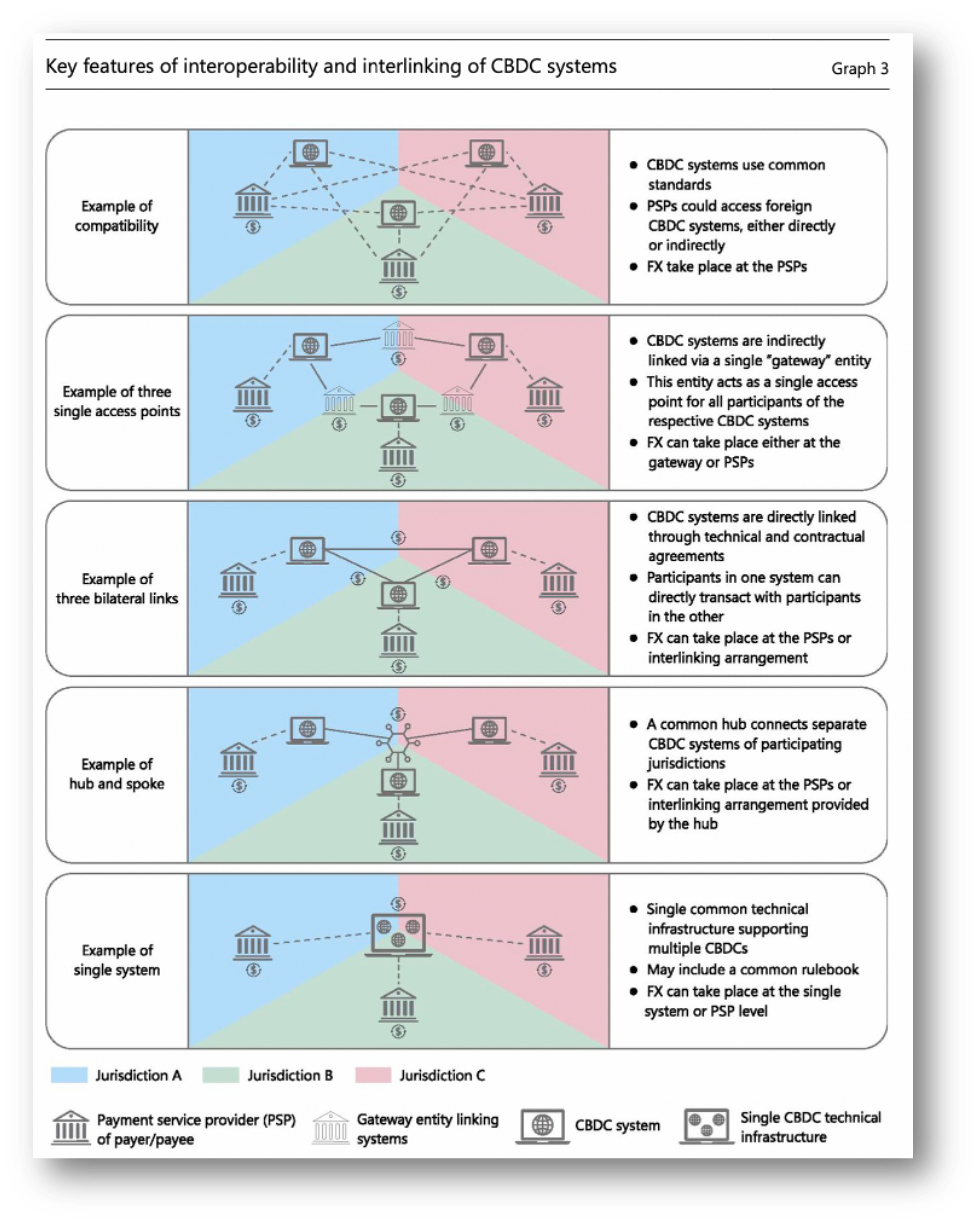

4. CBDC interoperability is a ship that sailed long ago

The BIS, World Bank, and IMF talk CBDC cross-border transfers focusing on who gets access, and interoperability.

The concept that CBDCs are going to miraculously interconnect and everyone sings “Kumbaya” is a dream. The BIS shows many ways to connect though in reality only a few will be used. Download paper: here

CBDCs are not a “silver bullet” that automatically solves cross-border transfers' high cost, low speed, limited access, and insufficient transparency.

In fact, given CBDCs' rapid adoption I would say that the "interoperability ship sailed long ago.” CBDCs have no ‘one size fits all’ model and no plan for working together.

This leaves two important issues that need sorting: who will have access to a CBDC, and what is the transfer mechanism?

All the time following the G20's five CBDC rules which are:

Do no harm,

Enhance efficiency,

Increase resilience,

Assure coexistence, and

Enhance financial inclusion.

The BIS report has to cover all options and it seems that there are dozens of permutations for who will use a CBDC and how they will handle international transfers. In reality, where practicality rules it will be far more simple!

In order to simplify the number of permutations possible simply look at who will use them first within the nation of issue, then what is the easiest way to transfer them across borders.

1. WHO USES IT: (My rank of who will use CBDC first to last, 1-6)

-Wholesale or wCBDC Access:

🔹 Closed to international use, domestic only. This is required before any retail CBDC is launched so will likely be the first real CBDC use in any nation, 1

🔹 Indirect access, access to foreign payment service providers (PSPs) via an intermediary, likely a national bank of the nation issuing the CBDC, 4

🔹 Direct access, foreign PSPs have direct access to a nations CBDC, 5

-Retail or rCBDC Access:

🔹 Residents, as most CBDCs are retail this is likely the group that will use CBDCs after banks themselves use them. 2

🔹 Non-residents, in the country of origin. Think e-CNY use at the Olympics. Logically all nations want to drive tourism through digital access within their nation. 3

🔹 Non-residents, and residents access outside the country. Think US citizens using e-CNY in the USA? While this is unlikely, I picked this example to show how difficult this will be! 6

2. INTERNATIONAL TRANSFER (My rank in order of use)

🔹 “Compatible” CBDCs, where the technology is similar. Very difficult as most will simply be built off of different technology. 3

🔹 “Single system,” CBDCs are built on a common rulebook. Easiest to implement if CBDCs are related such as Hong Kong and PBOC CBDCs as a likely example. Do not expect this to be the dominant system. 1

🔹 “Interlinked,” CBDCs need a shared platform to communicate. Given their lack of interoperability this is guaranteed! Hub and spoke system as in mCBDC in HK will be the dominant system. 2

In reality, there are not as many permutations as envisioned by the report! Remember domestic use always takes precedence. No one is going to try for international CBDC use until it first works in domestic markets!

Now for international transfers, simplicity dictates that the first trials will be direct “single systems” that directly connect country A to B. It is not ideal but is the easiest to implement. This will be followed by interlinked systems.

Takeaways

There are no rules. CBDCs are new.

CBDCs will not use the same technology, however, a few may agree on basic rules of operation.

Where it will get tricky is that we can expect that permutations of these options may be used at the same time.

For example, how the digital yuan connects with Nigeria’s eNaira or whether Nigerian citizens have access to the digital yuan, need not be the same as for the digital euro and EU citizens.

CBDCs present many new options and expect geopolitics to play a major role in the choices made!

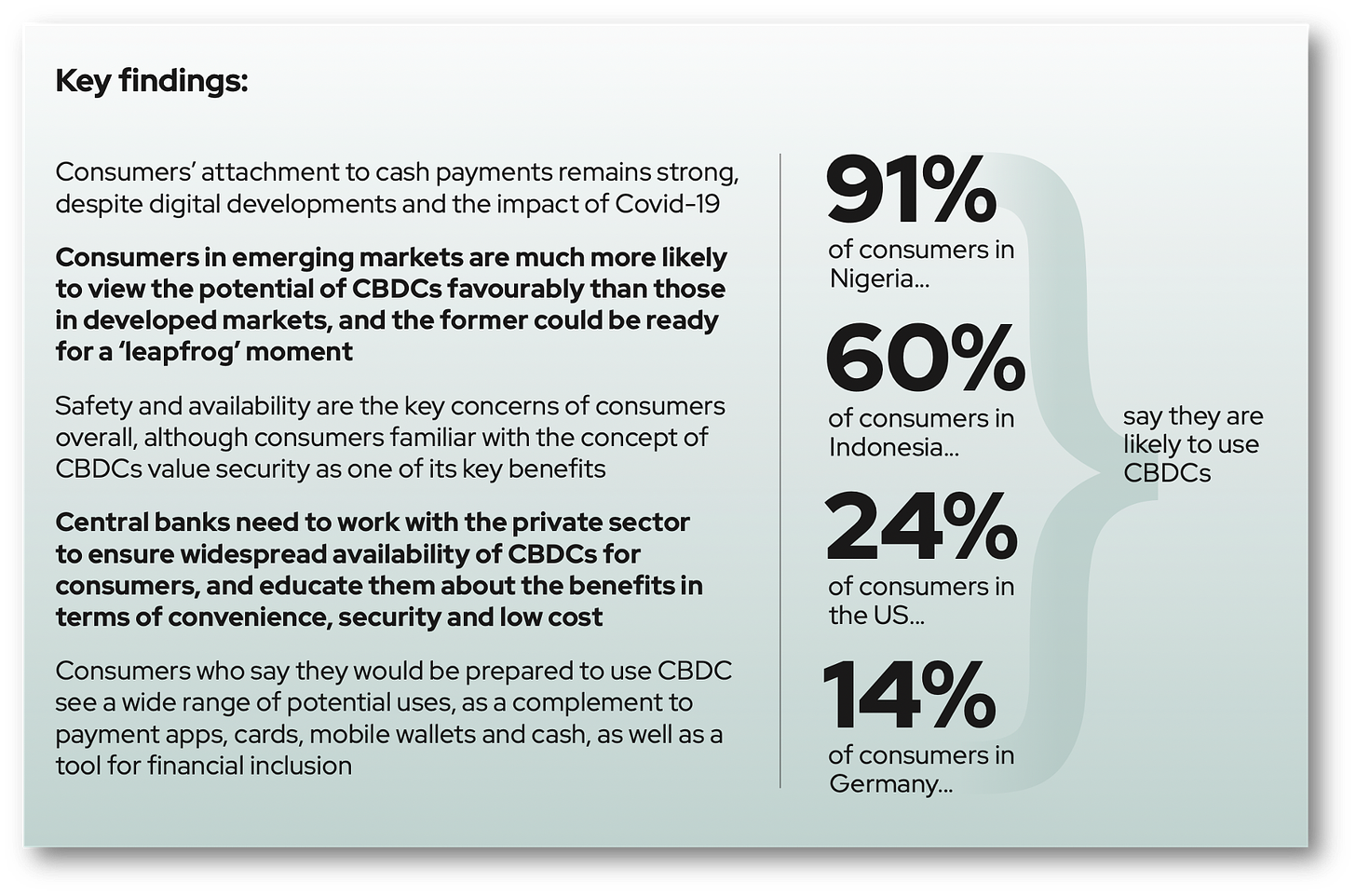

5. CBDC what users want reveals two worlds

CBDC customer survey reveals what customers, in the US, Germany, Indonesia and Nigeria want, with a shocking 40% in US and Germany not wanting them at all!

G+D’s survey is limited in scope but reveals a telling difference between developing and developed economies receptivity to CBDCs! In the developing world CBDCs are seen as “aspirational” because they will bring services that many have simply never had access to. Link to survey: here

This groundbreaking survey by G+D and OMFIF asked 3,000 consumers: 1,000 in each of the US and Germany and 500 each in Indonesia and Nigeria about their CBDC preferences. The goal, of course, is to better understand what kind of CBDC central banks should build.

The survey results are mind-blowing! Showing how developing nations like Nigeria and Indonesia welcome CBDCs with open arms with 91% and 60% of consumers “likely to use CBDC,” compared to developed nations US and Germany having only 24% and 14%!

Now if that wasn’t enough look at these results to “I would not consider using a CBDC”: Germany 43.9%, US 39.4%, Indonesia 7%, and Nigeria 2.7%!

I’ve talked about how CBDCs, are “aspirational” in developing nations and these findings back up this assertion!

Other key findings:

1. Knowledge about CBDCs is higher in developing markets!

Shockingly, despite 24/7 news coverage only 15% of US and 20% of German consumers even know what a CBDC is! Compare this with the 40% of consumers in Indonesia and Nigeria who do know!

The Irony is that with so few in the US and Germany even aware of what a CBDC is, how can they be so sure they wouldn’t want to use one?

2. Security and universality are major positives for CBDC

The top two concerns are security and universal access which beat privacy, in fifth place! While many perceive privacy as the No 1 issue with CBDCs it doesn’t show up in the survey!

In fact, the third and fourth place entrants were “no fees” and “simple to use.” While this isn’t saying privacy isn’t important, it does show that it is beaten by more basic issues.

3. Emerging market consumers are ready for digital payments

This speaks to the contrast between being a “have” or a “have not.” Developing nations see CBDC as a way of providing services that they don’t have, while developed nations are complacent with what they’ve got.

4. CBDC should be as close to cash as possible

Top issues raised by consumers around universal acceptance, resilience, privacy, security, and ease of use top the concerns of users because these are the principal characteristics of cash. Not in the survey, but critical to cash use is offline CBDC transfer!

Takeaways

Developing and developed nations have very different perspectives on CBDCs

The low level of understanding of CBDCs is in the developed world likely leads to a high level of resistance.

Developed nations are both comfortable and complacent with their existing card-based payment system while developing nations see CBDC as aspirational.

Thank you for reading!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: