CBDCs in emerging markets bring financial inclusion, Cash should NEVER go away, DeFi and CBDC?

Five big topics this week!

1. The two most important BIS CBDC reports EVER: Read on for the definitive reports on CBDC use in emerging markets and financial inclusion.

2. Keep Cash! Cashless means “less cash,” not “no cash”: Yes, the guy who wrote “Cashless” wants to keep cash!

3. Gas Fees make CBDC use in DeFi almost guaranteed: DeFi has lots of problems (recent hacks are proof) but CBDC might just help with two of them.

4. Podcast: “CBDC why should you care?”: The most painless way for you to catch up on everything going on with China’s digital yuan!

5. Metaverse Report Download: The best no BS report on the metaverse and Web 3.0 I’ve ever seen.

1. The two most important BIS CBDC reports EVER!

Let me start by saying that the BIS and its Innovation Hubs are doing more than any other organization on the planet to research and develop our digital currency future. There simply is no one else producing such relevant and critical research as the BIS, and we all owe them a debt of gratitude.

I have long written that emerging market nations look at the risk-reward balance for CBDCs far differently than those in developed economies.

Wealthy countries like the US and UK see the benefits of CBDCs as ill-defined compared to the potential risks of disturbing a system they erroneously believe to be at the pinnacle of cash transfer efficiency.

In contrast, emerging markets see CBDCs very differently, with many considering digital services both aspirational and a key to further advancement through financial inclusion. This is why the first CBDCs launched are all in emerging market economies: the Bahamas, Nigeria, Eastern Caribbean, and China.

This week the BIS produced two documents on CBDC that will be “bibles” for developing nations moving forward with CBDC.

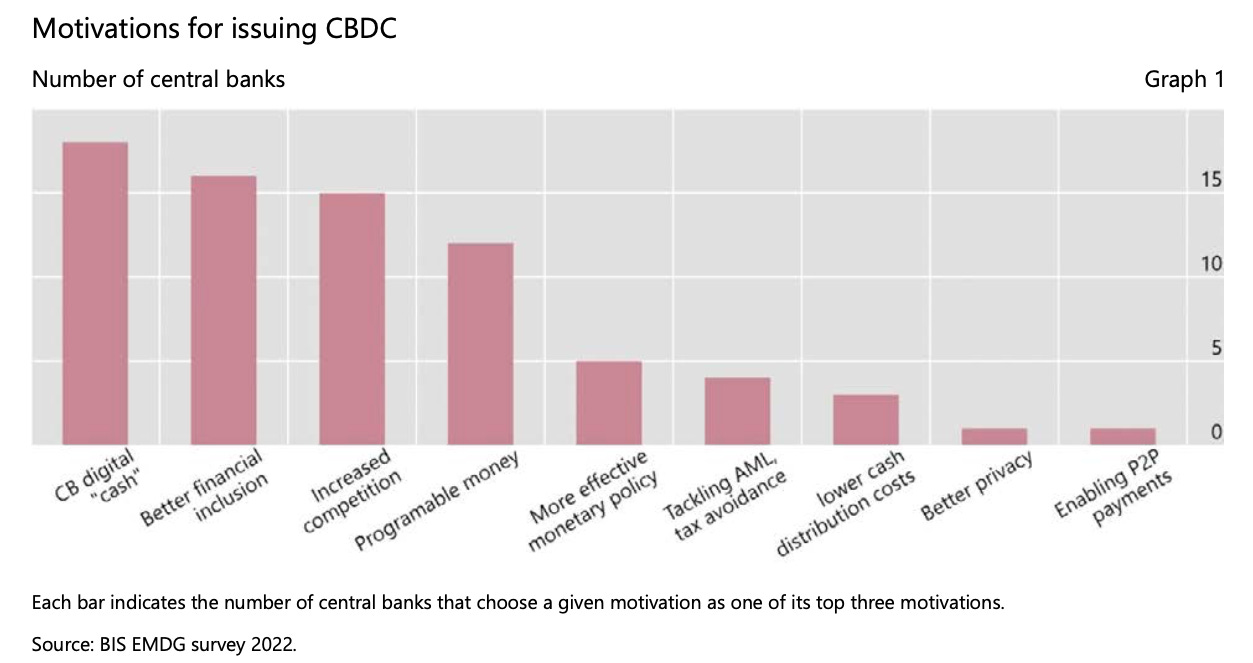

The first entitled “CBDCs in emerging market economies,” surveys 26 emerging market economies and breaks out what all of their CBDC projects have in common. An instruction manual for others to follow.

The primary motivations for issuing a CBDC found among twenty-six emerging market economies. Source BIS

The second is entitled “CBDC: a new tool in the financial inclusion toolkit.” This report outlines what design features CBDCs need to have to promote financial inclusion.

These two documents will without question make it easier for others in emerging markets to understand what goes into a successful CBDC.

Still, always remember that CBDCs are not a “panacea” for financial inclusion in emerging markets, but a tool that we need now to help the 1.7 billion excluded globally.

The Six Barriers to Financial Inclusion found in common among nine emerging market economies. CBDCs need to overcome these barriers to be successful.

Detailed summaries and what to look for in these documents can be found here in my LinkedIn posts:

Linkedin summary CBDCs in emerging market economies

Highlighted PDF Download: CBDCs in emerging market economies

Linkedin summary CBDC: a new tool in the financial inclusion toolkit

Highlighted PDF Download: CBDC: a new tool in the financial inclusion toolkit

2. Keep Cash! Cashless means “less cash,” not “no cash.”

Many ask me if I want to eliminate cash? The answer is an emphatic: NO! I strongly believe in keeping cash!

Cash will serve an important function for years to come. Reducing cash use is great, eliminating it is foolhardy. Ask anyone living in a hurricane zone.

An excerpt from “Cashless,” page 323, proves my conviction:

"As the strong proponent of CBDCs and a “cashless” lifestyle that I am, it may come as a surprise to learn that tucked away in a back drawer in my home are envelopes containing cash in euro, dollars, and RMB. While I quite enjoy my cashless lifestyle, I am in no way in favor of eliminating cash…….

Cash simply works, and ridding myself of it entirely would be folly. The opportunity to use cashless payment more frequently, with CBDCs as one payment option, does not preclude the maintenance and use of cash in the financial system. China is an excellent example of this philosophy. For all its advances in going cash-free, no one at the PBOC talks about removing cash from circulation……

….Holding onto cash makes us feel good and provides some small amount of comfort in the event of a catastrophe. Anyone living in hurricane- or typhoon-prone areas, where storms can send society back to the Stone Age, understand this better than most.

The Swedish Civil Contingencies Agency went so far as to advise all residents to keep “cash in small denominations” at home in case of emergencies. The idea that a power cut, cyberattack, or major technology disruption would cripple the nation because of residents’ reliance on digital payment is a real concern.

Anyone in the UK who had a credit card attached to WireCard payment systems experienced this firsthand when the company failed, and cards went offline for forty-eight hours.

To say that cash has no place in our future is to deny the fragility of our digital systems, which, time and time again, fail spectacularly.

So for the record, cash will be with us for some time to come. It provides a simple analog solution to payment in an increasingly digital world. To say that it has no place in our future is to deny the fragility of our digital systems, which, time and time again, fail spectacularly.

Their failures are reminders of how new we are to this digital revolution and that cash, which has been around for millennia, will still be an integral part of our modernized financial system.

I would go as far as to say that hearing the call to eliminate cash should make readers, even the most “cashless,” become wary.

3. Gas Fees make CBDC use in DeFi almost guaranteed!

DeFi and CBDC may seem like opposites, but what’s the old saying about opposites attract?

I have been a proponent of DeFi’s use with CBDC for some time. The technology most closely associated with being hacked and crypto is going to make its way out of crypto’s boonies and into the mainstream. CBDC is going to take it there. It's not if, but when.

Before my crypto friends go apoplectic, let’s look at the problems that need to be solved.

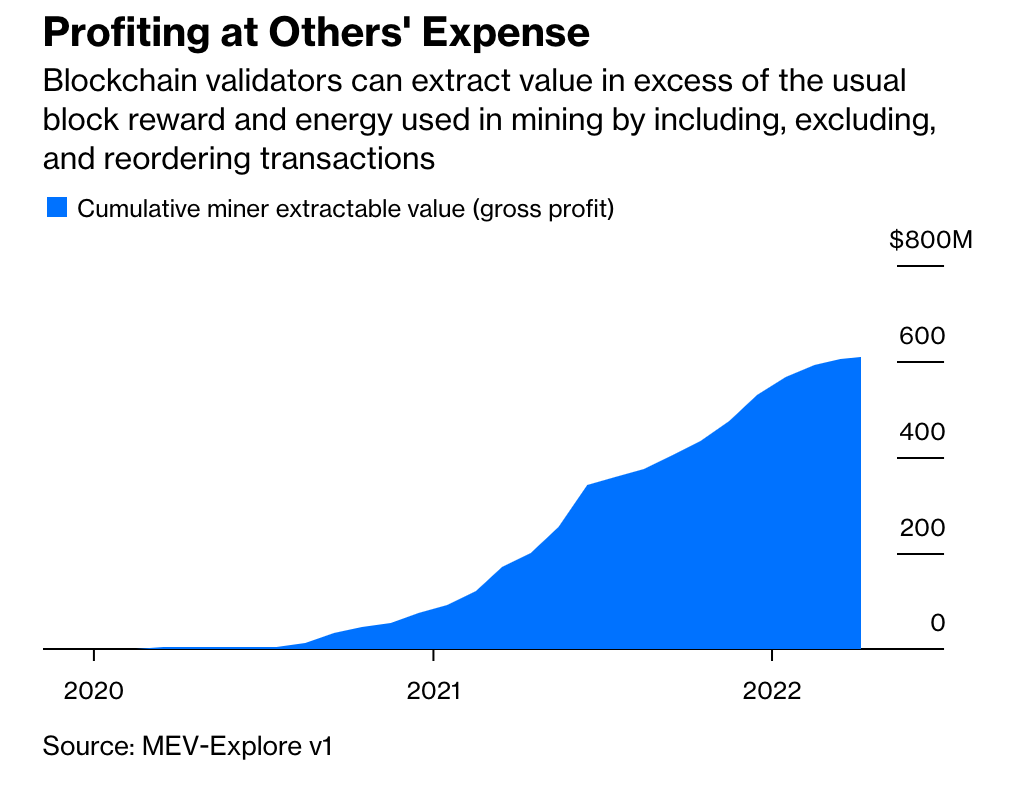

The first is that the crypto networks DeFi run on aren’t cheap, and there is a real problem with transaction costs shown in the graph below. “Gas fees, backdoors, kill switches, sandwich attacks all make transacting on blockchain networks expensive.

Public crypto networks aren’t cheap to transact on. It’s not just the network fees but fees imposed by cheats and fraudsters who unsurprisingly want to profit from a public utility. If you had a utopian view of public blockchains it’s time to reevaluate!

Those who think that blockchain is somehow more pure or clean than banks and Wall Street should reconsider their point of view. Public blockchains are not always the knights they are made out to be.

CBDCs can solve two problems for DeFi. The first is that stablecoins may or may not in fact be stable. CBDCs would provide DeFi platforms with a risk-free asset whose value is uncontested and would be subject to KYC and AML requirements. KYC and AML are required if DeFi is ever going to come in out of the cold.

The second is more controversial. CBDCs may eliminate the high cost of transactions on blockchain because they will hasten the move of DeFi off of “public chains” and onto hybrid public-private chains with higher transaction throughputs.

Pulling a DeFi company off a public chain is anthemic to many, but what if it's required because public chains can’t handle the volume or are too expensive? That’s not hypothetical but a genuine possibility.

Public blockchain is not the “only” flavor! Hybrid and consortium models may provide more reliable alternatives to pure public blockchain. I know that is anathemic to purists, but to go mainstream DeFi needs security and performance.

4. Podcast: “CBDC, why should you care?”

Why should you care? Because CBDCs fundamentally change the nature of money!

Thanks to Waheed Rahman of Empasco and founder of the Innovation Civilization Podcast for a discussion that helps bridge the gap between crypto and CBDC!

Waheed read Cashless and gets #crypto, which made this very special. In this episode, I try to build bridges with the more open-minded crypto community members. For the record, I support CBDC, crypto, and CBDC. Our future won't be one or the other but all of them.

Also, check out his perfect editing! As a guest on many podcasts, I can tell you honestly that good editing makes all the difference!

Each of the links below has a complete timestamp with Questions!

5. Metaverse Report Download

The best no BS report on the metaverse and Web 3.0 that I’ve seen. But that doesn’t mean that you’ll understand precisely what the Metaverse is after reading it!

I read a lot about the Metaverse and Web3, and I’m sure you have too. The metaverse, of course, is built upon Web3, a brave new world that is decentralized, permissionless, and has sovereign ownership of data.

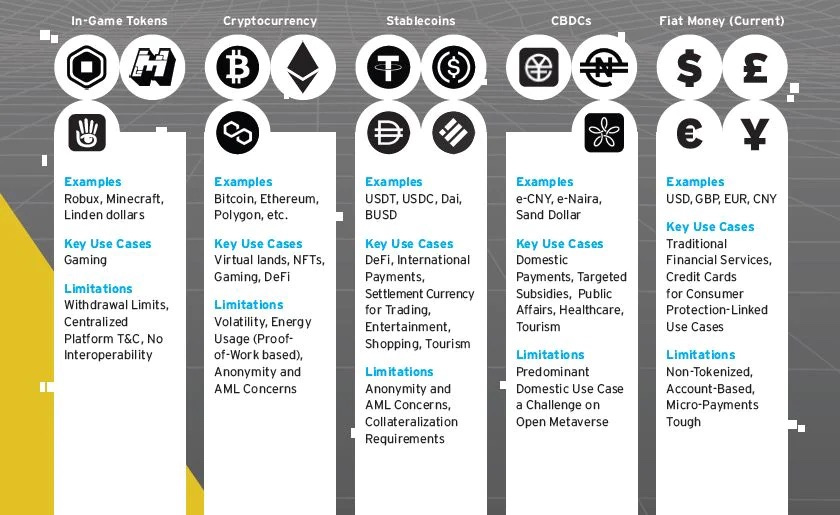

And wherever you go on the Metaverse, there will be lots of crypto! Unfortunately, most metaverse discussions don’t even acknowledge that tokenized CBDCs would work. It's as though they're dirty! One expert stated: “The operating system of the metaverse is Bitcoin.”

Forms of Money in the Metaverse. Many see it as “crypto-only.” While that may please “crypto-maximalists” it’s hard to see how the Metaverse can go mainstream without CBDC and stablecoins.

But there is hope even Metaverse experts see the problem:

“The beauty of the Metaverse as a narrative or a meme, is the fact that it can be interpreted in different ways.”

So if you're confused and what you read is inconsistent, it’s not you! Everyone writing about the Metaverse is “shilling” their product, whether NFTs, DAOs, or Bitcoin. If that sounds harsh, it is intended to be.

Let me be blunt and say that after I read about the Metaverse, this report excepted; I'm often ill. On the one hand, I’ve got Zuck with his “trust us” version of the future, and on the other, Bitcoin maximalists who seem like religious zealots.

I'm sure you're familiar with the parable of the blind men and the elephant, all of whom, after touching it, describe it differently? Well, it fits with the Metaverse.

Read these three radically different perspectives from the report:

🔹 “The Metaverse is not a destination, but rather a point-in-time….where people value digital assets more than physical assets.”

🔹 “The Metaverse is a universal economic system that enjoys supremacy.” Try telling your national tax authorities!

🔹 “The Metaverse is an exponential playground to showcase the power of DAOs.”

So what we're left with is that the Metaverse is "a dream of the future." Unfortunately, even the visionaries can't quite agree on what it's for other than to say that you'll love it, won't want to leave, and will spend hard-earned crypto on it to buy your dream beach house.

Don’t get me wrong. I want the Metaverse and Web3, even if I’m not sure if its creators or I know what it is.

But whether it has a jaw-dropping top value of $13tn by 2030 is anyone's bet.

One question before you bet: Do you have 5G or access to it yet?

Now place your bet.

What’s in it for you?

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

My books: