Central Banks: AI and FinTech on The Rocks, CBDCs Set Sail

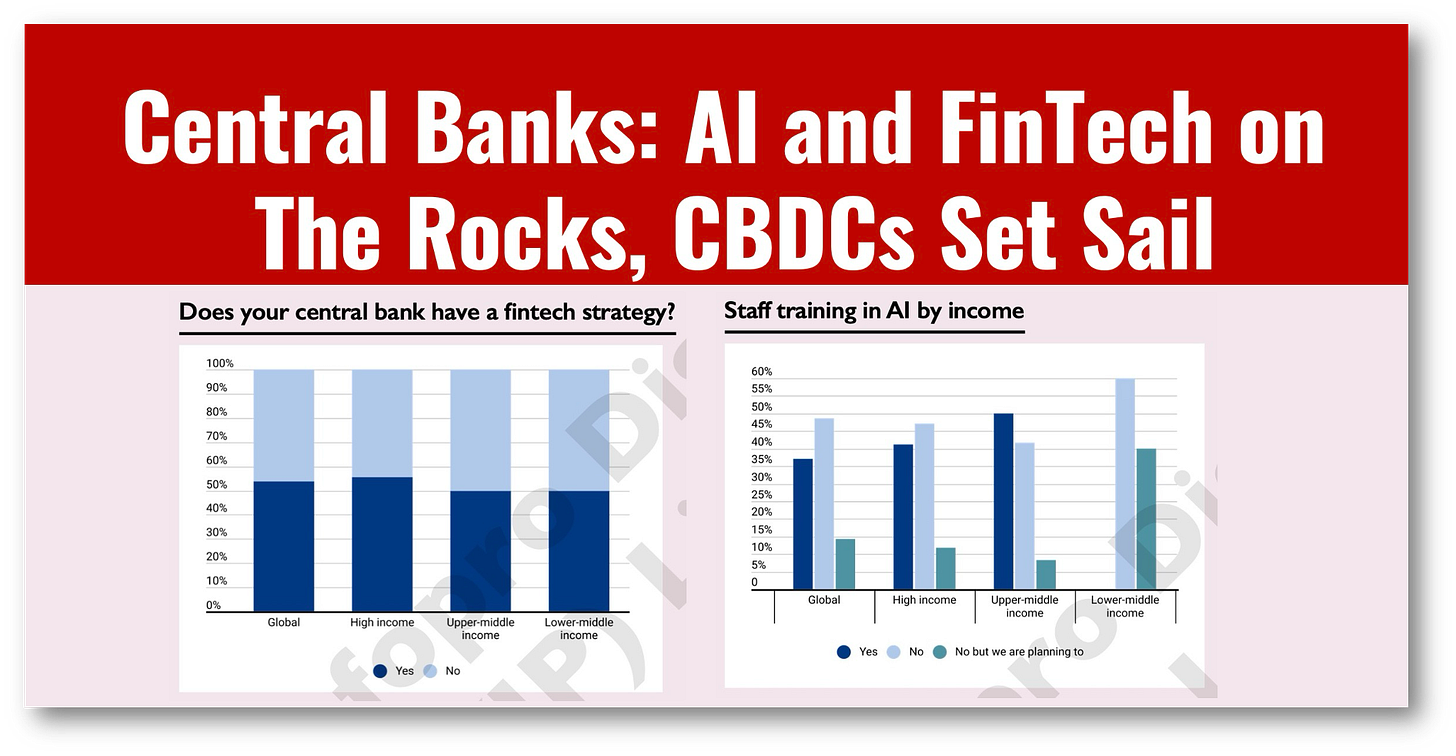

Only half of central banks globally have a fintech strategy.

Central banks have never been known as innovation powerhouses, but their lack of preparedness for the fintech revolution remains a weak spot as does their lack of AI training.

Showing just how challenged they are, only 52% of central banks worldwide have a fintech strategy, even though it is in the midst of disrupting finance!

The only bright spot in this report is that central banks are committed to CBDCs, with 77.5% of the 40 central banks surveyed working on them! Even more interesting is that of this group, 48,7%, were working on a wholesale CBDC.

But for a real stunner, look to AI. Only 37% of central banks have AI training, with the remainder saying they have nothing or have training in planning. ,

If central banks don’t train their staff for AI and have difficulty finding competent hires with AI skills, the “threat” of an AI accident remains large.

👉TAKEAWAYS (my favorites)

AI adoption: The use of AI at central banks appears to be on a steady upward trend, as 56.8% now use some form of AI, up from 51.4% in 2023. (But only 37% of central banks have AI training!)

CBDC mandates: Legal mandates to issue central bank digital currency remain elusive. Nearly two-thirds of respondents say they do not have legal backing to issue CBDC. (Yes, but this is to be expected! Research first, mandate later. )

Retail versus wholesale CBDC: Despite the lack of clear legal backing in many jurisdictions, the majority of central banks (77.5%) are working on retail CBDC. By contrast, less than half (48.7%) are exploring the wholesale version of the technology.

Research focus: 🔥Most respondents mentioned payments innovation (79.5%) and CBDC (79.5%) as top research priorities.🔥 Cyber security (69.2%), suptech (59%) and regtech (48.7%) are also being studied widely.

Hiring: Finding fintech staff remains a major challenge for the majority of central banks, as nearly two-thirds of respondents say they struggle to attract fintech talent. Finding the right skill set is the number one hiring challenge, followed closely by the need to pay a competitive salary.

Tech challenges: Cyber security is the top challenge for central banks, a finding that echoes the Risk Management Benchmarks. Over three-quarters of respondents, 78.9%, considered cyber as their top challenge. In second place, adapting legacy systems is also a major challenge.

Please share on Substack with a restack!

Readers like you make my work possible! Please consider a paid subscription, or if you’re a commitment-phobe, buy me a coffee.

Your contributions support independent writing that is beholden to no one! Thank you!

Sponsor Cashless and reach a targeted audience of over 55,000 fintech and CBDC aficionados who would love to know more about what you do!