China's Yuan Rising?

Where there’s smoke there’s fire.

Where there’s smoke there’s fire, as the Chinese yuan is used in a major cross-border trade deal the IMF and central banks note a shift, as sanctions give a boost to internationalization.

The use of Chinese yuan in a cross-border India-Russia trade deal for coal is an interesting story but it’s only one part of an accumulation of stories that have piqued my interest as they signal a changing role for the yuan.

Let me say at the start that none of these stories points to a sudden or dramatic change in the dollar’s dominant role. There is no fire, no burning down the house, but there is smoke and I think this is signaling that change is underway.

🔹The story that kicked this off was the use of yuan in an RMB 172 mn (US$ 26 mn)deal between UltraTech, India’s largest cement producer to pay for Russian coal. While India has been buying oil from Russia this is one of the first major trade deals done in yuan.

"I have never heard any Indian entity paying in yuan for international trade in the last 25 years of my career.” Article: Here

🔹That alone would be interesting but the IMF on July 1 reported that the yuan’s share of global reserves was up from 2.5% one year ago to 2.9%. Interestingly the yuan’s 0.4 rise offsets the dollar’s 0.4 decline to its sizable 59% lead. Hardly a raging fire but the yuan is making progress.

Article: Here

🔹 Also on July 1 the FT showed how central bank reserve managers investing in yuan increased from 81% to 85%. The sense is that central banks want to manage the risk that a geopolitical flare-up, code for US sanctions, could impair the use of the dollar. Risk management 101 makes it clear that the dollar's risk isn't its value, but whether you can use it.

The FT article uses new data sourced from a UBS survey of central banks. The graph is from IMF data showing the decline in dollar from 60 per cent of allocated reserves at the end of the first quarter of 2022, down from 65 per cent in the same period in 2016. The RMB still holds a tiny 2.9 per cent share, so don’t expect miracles.

Article: Here

🔹Still there is the sense that coal is the tip of the iceberg, oil markets have been reported to use yuan to hide the purchase of oil shipments. With Russian oil paid for in yuan making it to the EU and US. Transfers were likely in local trading accounts and need never touch Swift. This isn’t new, Iran mastered these techniques when it came under severe sanctions in 2012.

It is important to understand the buying oil from Russia is not in violation of sanctions. The question is really how do you buy it? On systems that are subject to sanctions where Russia cannot use the money or in more surreptitious ways? Article: here

🔹Backing up the expanded use of yuan and ruble is the volume of trading of the ruble-yuan has gone up some 1,000+% on Moscow Exchange’s spot market. Here again, we have a local market unaffected by sanctions.

The increase in trading activity is a clear sign that Russia is replacing goods imported from the West with Chinese imports. Article: here

🔹For all of this yuan use China has been careful not to evade sanctions, and just today the US confirmed this once again. China is being very careful not to upset its trading partners and risk being sanctioned while maintaining its relationship with Russia.

Article: Here

🔹Then finally we have this week’s announcement of a new yuan liquidity pool and the call at the BRICS summit for a new payment system. The liquidity pool ensures that central banks can access RMB in case of any “market shock.” Market shock is perhaps code for sanctions or other financial disruption at the hands of other nations. A signal that China means business.

China is doing all it can to make it easier to use the yuan in international commerce through the creation of liquidity pools. Meanwhile watch as BRICS develop a digital payment system. All BRICS nations are launching CBDC trials.

Articles: SCMP , Global Times

Takeaways:

None of these stories individually signals dramatic change for the dollar but combined they give us a sense that sanctions caused a shift in yuan usage that will likely persist.

Efforts to create a BRICS payment system should not be seen as far-fetched or outlandish. Next year China, Russia, India and Brazil will all have CBDCs in trial form. They have already discussed using a digital currency transfer system.

The speed of change for yuan adoption will likely be slow, this will bolster the position of those who say nothing is happening.

Sanctions are a double-edged blade, cutting at both the sanctioned Russia, and the US wielding the knife. There is a cost and it appears likely to hit dollar use and benefit China’s yuan internationalization efforts.

We're entering a multipolar currency world, the question is with all this smoke how long will it take to catch fire?

Thanks for reading

Be in control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

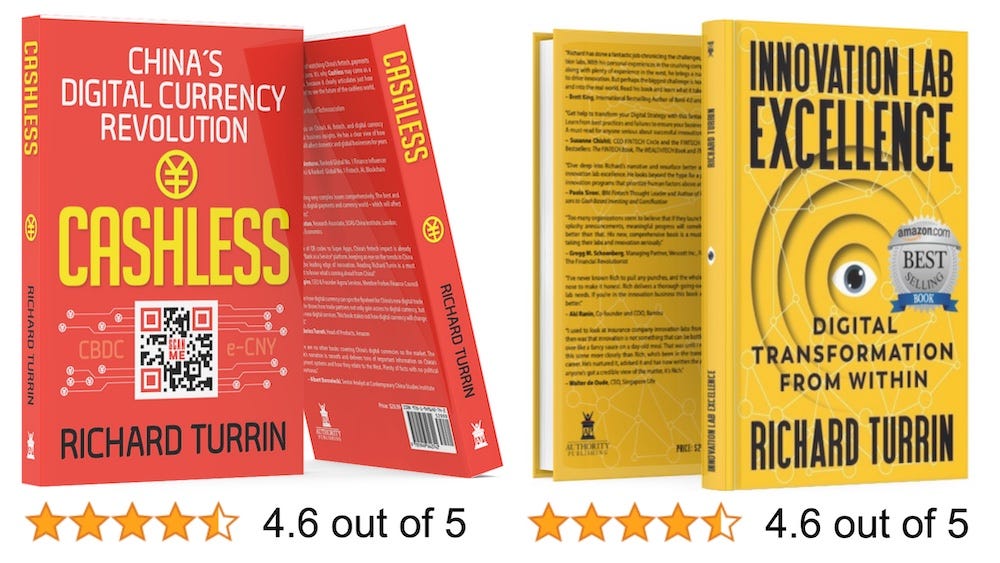

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: