Citi: West Rushes to Catch Asia's Decade-Long RTP Boom

I'm glad to see the West copying tech that is "Made in Asia."

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

Citi’s report on real-time payments (RTPs) is a “must-read” that preaches their economic benefits, a concept that Asia has been aware of since 2014!

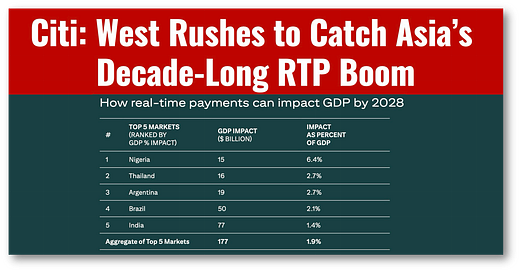

Citi is strongly in favor of RTPs, claiming that they are no longer an emerging technology but the default. Moreover, Citi is adamant that wherever RTPS go, they bring inclusion, economic development, and real GDP growth.

Citi is wise to call out RTP’s economic benefits. I write about them in my book, “Cashless,” as they have contributed significantly to the vast gains in financial inclusion and the meteoric rise in China’s digital economy, boosting GDP.

Sadly, many still see RTPs as nothing more than a toy or fad, as though they aren’t economic growth engines. A BIS research paper, which surveyed 101 countries, claims that every 1% increase in digital payment usage correlates with a 0.10% rise in per capita GDP. (Link to BIS report)

The reason RTPs spread like wildfire throughout Asia was that Asia’s telecoms and regulators saw firsthand the prosperity that RTPs brought to China and wanted to import a winning formula, yet the West never got the message.

Respectfully, I’ve been ranting to the West about the benefits of RTPs for years, even writing a book on the topic.

While I do love Citi’s report on this topic, they are late to the RTP party. That said, I give them credit for acknowledging that it’s time to “catch up.”

I’m glad to see the West importing more tech that is “Made in Asia.”

👉Takeaways

🔹 Shifting consumer behavior, new business models, and technological advancements are collectively driving the need for finance to be 24x7.

🔹 Regulation and policy changes are pushing real-time payments into the mainstream. Asia and emerging markets have historically led the way. The mandatory adoption of SEPA Instant across Europe and the rapid expansion of the FedNow Service in the U.S. mark a fundamental shift. Real-time finance is no longer emerging; it is the default.

🔹 Strategic advantage increasingly depends on how effectively institutions incorporate real-time capabilities. Banks and corporates need to fundamentally rethink business models and infrastructure. A new wave of finance firms will emerge – new entrants, upgraded existing banks, fintechs and hybrids/partnerships.

🔹 Real-time systems like Pix (Brazil), UPI (India), and M-Pesa (Kenya) have demonstrated their ability to drive financial inclusion and support economic development. In some emerging markets, broader adoption could add 1-2ppts to GDP growth.

🔹 Speed brings risk. The finality of real-time payments, combined with increasingly sophisticated AI-driven fraud, presents a rapidly evolving threat. Without robust real-time fraud detection, liquidity controls, and AI-based safeguards, institutions risk falling behind in the fight against this trillion-dollar threat.

🔹 Real-time cross-border payments are unlocking new opportunities for businesses operating globally, enabling faster settlements, improved working capital management, and enhanced customer experiences. However, the complexities of cross-border interoperability and regulation remain a key challenge.