Clients Seek Better Cross-Border Payments, Banks Stick to Their High-Margins

Banks will lose more than 10% of the transfer market to fintechs in the next 5 years!

What is shocking about this CitiGPS report is that 70% of clients are looking for alternative cross-border payment methods, yet only 30% of banks see “substantial room for improvement!”

Once again, banks are tone-deaf to their clients' needs and will continue with slow, high-margin cash transfers as long as possible.

Banks are so tone-deaf that more than half believe there is only “some room for improvement” in their cross-border transfers.

It’s as though banks live in an alternative reality where client needs can be ignored.

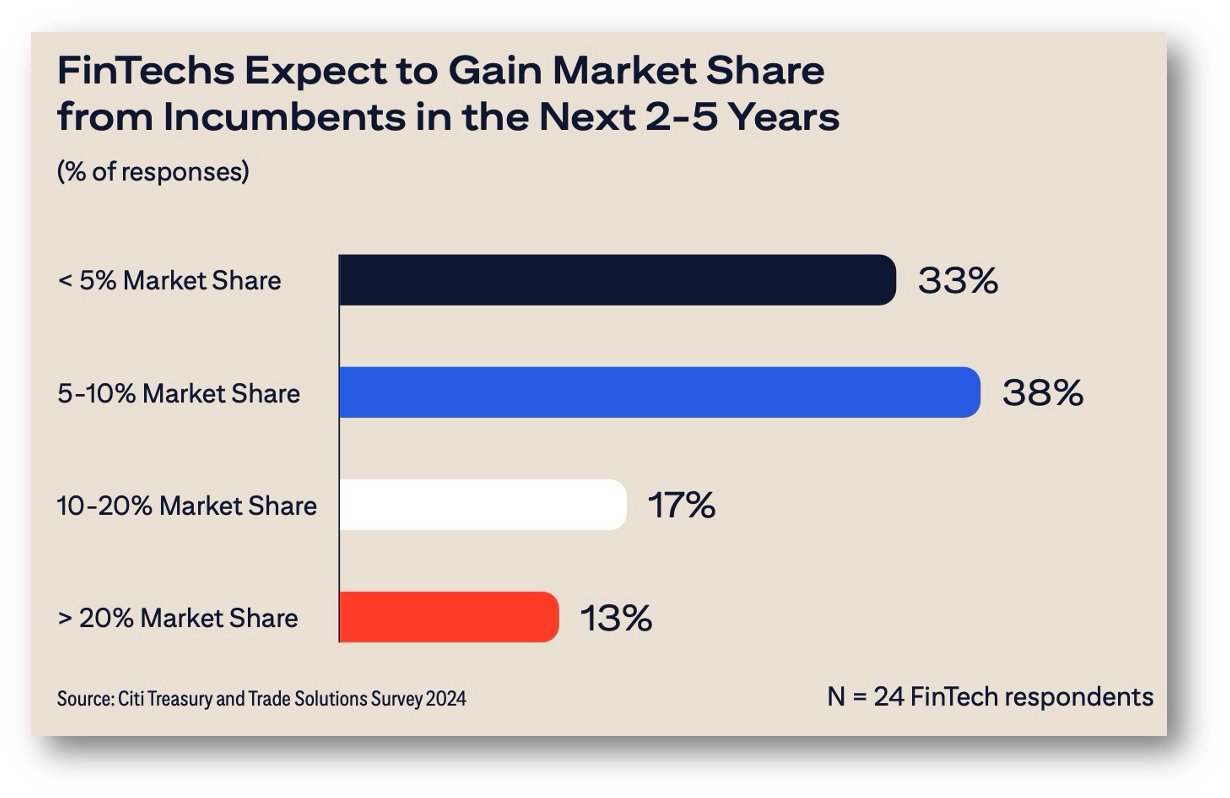

The problem for banks is that Citi reveals that 68% of those surveyed think that fintechs will take 10% or more of their market share in the next 2-5 years!

Like them or not, the key driver for banks to change is CBDCs!

👉TAKEAWAYS

🔹 Acceleration of Interconnectivity in Domestic Payments:

The industry is shifting towards multilateral connectivity to achieve scalability and efficiency with projects like the BIS’s Project Nexus. Meanwhile, more than 70 markets are now operational on instant payment systems.

🔹 Continued Exploration Money and Payment Infrastructure:

Several banks are experimenting or piloting new market infrastructures based on tokenized deposits and CBDCs to enhance cross-border payment efficiency through real-time settlement mechanisms. Currently, 66 countries are in the advanced phase of exploration – development, pilot, or launch.

🔹 Leveraging Artificial Intelligence (AI) and Data:

AI, and specifically Generative AI (GenAI), is increasingly being explored to streamline cross-border payments. As transaction messaging shifts to structured ISO 20022 formats, institutions also realize tangible efficiencies in their compliance processes.

🔹 Industry Realignment Continues:

Many banks are streamlining their correspondent banking relationships, opting to work with a reduced number of partners and concentrating their transaction flows to fewer corridors. Some banks are introducing their own brands to directly compete with emerging FinTechs in the consumer-to-consumer cross-border payments space.

🔹 Exploring Innovative Market Infrastructure:

Public and private sector players are considering new market infrastructures, often based on tokenized deposits and CBDCs.

👊STRAIGHT TALK👊

Sadly, most banks loathe innovation and would rather crash their institutions into a brick wall than innovate in cross-border payments.

There are indeed a few banks like JP Morgan and Citibank that are great innovators.

Both are leading cross-border transfer innovations with their proprietary blockchain 24x7 treasury transfers, but they are the exception, not the rule.

Most banks think everything is fine and are not in a rush to innovate despite their clients' demands for better services.

The overriding bank sentiment seems to be: “Why innovate and potentially reduce juicy margins on cash transfers?”

Meanwhile, while most banks sleep, fintechs will take market share from them as the penalty for inaction.

The greatest irony is that banks loathe CBDCs, but the looming threat of CBDCs has forced them into action.

This is why, whether you like them or not, we all owe a debt of gratitude to CBDCs for forcing at least some banks to address terrible cross-border transfers.

Please thank the CBDC nearest you!

Please restack!

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!

Great insight and sharing, but I think we have stablecoins and the underlying public permissionless ledgers they operate on to thank far more than any CBDC — most of which remain in limited POC or pilots, and have yet to demonstrate product market fit in their limited architecture. I can only hope that CBDCs begin to address these architecture deficiencies and inspire banks to compete too.