Credit Cards and Stockholm Syndrome; Musk and McCarthyism's Return, "Alibaba.com Pay"; and Hong Kong's e-HKD!

Today’s reads:

1. Stockholm Syndrome and Credit Cards are our Captors

2. McCarthyism returns with Musk’s guilt by association

3. ”Alibaba.com Pay” launches and Alibaba’s quiet international expansion

4. Hong Kong’s e-HKD is coming

1. Stockholm Syndrome, Credit Cards are our Captors

Stockholm syndrome for credit cards? Our love affair with cards costs $700 per year per family in the US. This is precisely why we need a CBDC now!

There is a revolt brewing against credit card interchange fees. In my view, it’s about time when interchange fees on debit and credit cards in the US total $105bn in 2021.

The $105bn figure should outrage you but it’s only interchange, total fees are even more astounding.

In the EU Europeans pay 1.4% of total GDP for payment services, while in the US and Canada the figure is an astounding 2.1% of GDP! A “tax” on every citizen that should be going in your wallet, not Visa and MCs!

What really interested me was a recent letter from congresspersons that outline the raw costs of the Mastercard and Visa monopoly that I used above.

I would like to point out one error in the congressperson's letter. They correctly claimed that Visa and Mastercard’s interchange fees in China were capped at 0.45%.

While this is true they should know that mobile payment which covers some 87% of personal payments in China. The fee for these payments is free!

Unsurprisingly this takes me back to CBDC. I ask all fair-minded readers why US and EU citizens should be paying 2.1% and 1.4% of GDP to a duopoly of card companies? How can we justify this and will we pay these fees for an eternity?

Visa and MC argue that these costs are partly due to theft! Well fine adopt passwords like Alipay whose losses are 1/10,000 that of Visa's in the US. Shocked? You shouldn’t be! Who thinks a piece of plastic with your name on it and 4 digits "security code" on the back is secure?

The US is getting a “raw deal” on credit card acceptance costs when compared with many other nations!

Oh and by the way, if you’re using Apple Pay you are using an “elite” card and your coffee shop pays more in interchange fees than the “Luddite” next to you who uses a regular card. Innovation is supposed to reduce cost not increase it.

Stockholm syndrome occurs when a hostage forms a sympathetic bond with their captor. We are all being held captive by the duopoly of Visa and MC.

And just like a captor, card companies play on our emotions with “cash back” and “points” to make us love our cards. If that isn’t Stockholm syndrome what is?

Yet another reason why we need CBDCs.

2. McCarthyism returns with Musk’s guilt by association with China

Elon Musk is working for China, at least according to Jeff Bezos, who asks: “Did the Chinese government just gain a bit of leverage over the town square?”

The feuds between billionaires don’t interest me in the least, but the continued use of “China” as a means of character assassination is dangerous and a sign of creeping paranoia.

The US now sees successful US companies in China not as the crown jewels of its corporate empire but as suspicious entities tainted by China. If this isn’t a new nascent form of McCarthyism, what is?

It’s also personal, as I’m on the receiving end of this paranoia more and more often. Instead of being seen as a China expert, I’m considered a sympathizer or a “paid spokesman.”

Bezos is a smart guy, I knew him a lifetime ago and liked and respected him. His comment about Musk was no accident, it was carefully chosen to discredit Musk by associating him with his successful China Tesla operations.

This isn’t the first time this has happened. Last year Tim Cook got slammed for Apple's operations in China with some calling Cook a “collaborator” and “apologist.”

Cook must be used to it by now and just last week FCC commissioner Carr called out Cook for “censoring apps at the behest of the CPC.”

The FCC was irate that Apple pulled “The Voice of America” (VoA) App from the App Store in China. Note that the VoA is the US’s propaganda radio station! Any wonder why China demanded the app be pulled?

Let’s make it clear Apple and Tesla are both incredible successes in China and should be celebrated for helping the US show off its industrial genius. Their CEOs should not be held in contempt as collaborators.

This is a dangerous trend as the US needs to promote business in the world’s second-largest economy, not hinder it.

If you think it doesn’t have any impact, you’re wrong. When LinkedIn pulled out of China last year a small contributing factor was the harassment it received from Washington. Microsoft thought it just wasn’t worth the hassle.

Tesla’s success in China should be the stuff of legends! Tesla is the market leader for full EV cars in China with 182,000 units sold in Q1 2022. Tesla’s China sales are 23% of total sales or half of US sales! All of this from its Shanghai plant which opened in 2019!

I’m not a big Musk fan but good God you’ve got to give him credit!

Apple and Tesla showcase American industrial genius!

Apple is just as impressive! Last year it became the largest OEM cell phone in China ahead of Vivo, Oppo and Huawei! Apple has 42% of all of its manufacturing and 20% of its global sales in China market.

That heroes like Musk and Cook can have their characters assassinated because they work with China shows just how pervasive anti-China rhetoric is becoming.

It's scary.

3. Fintech meets logistics with ”Alibaba.com Pay” and a quiet international expansion

“Alibaba.com Pay” just launched and is using Ant Group’s fintech prowess to attack high foreign exchange fees as Alibaba continues a quiet international expansion.

“Alibaba.com Pay” is a new service for small and medium-size enterprises that give them access to heavily discounted foreign exchange services to and from China. What is interesting is that while it supports AliExpress, Alibaba’s international store, it also can be used independently.

Fees of 0.125% or Zero for volumes over $300k,

20+ currencies online instant exchange

Real-time foreign exchange settlement at the listed price of cooperative banks, open and transparent

0 exchange fee

No US$ 50,000 FX limit for Chinese Companies

I don’t have details yet on the full sign-up procedures and how foreign SMEs use it. I confess I wasn’t in the mood to go through the full procedure. Still, with 20 currencies and low fees, this shows how fintech is continuing to make money transfer cheaper and easier.

The real story though isn’t the new foreign exchange service. Instead, it’s how many international moves Alibaba has been making!

Watch the following:

🔵 Alibaba’s Lazada pushes into Europe and piggybacks on Alibaba’s Cainiao logistics.

🔵 Ant Group buys Singapore's 2C2P to expand its cross-border network.

Don’t forget Ant already has a wholesale digital banking license in Singapore! Now it has retail payments in Singapore as well.

🔵 Alipay+ a unified retail network of global payment providers.

One QR code means payments are transferred across network participants. More on this later this month. This is really impressive and the future of cross-border mobile payment! I’m invited to an Ant presentation on this next week. Watch as this makes Alipay a global success.

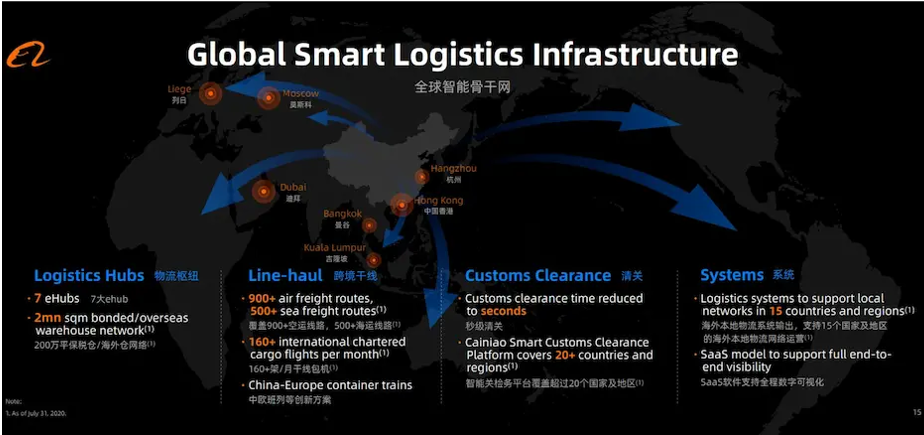

🔵 Cainiao is now a robot-operated logistics superpower.

Cainiao Ships within 24 hours to the PRC and within 72 hours to anywhere in the world, 190 countries! Amazon 21 countries! Not pictured new centers in Mexico, Brazil and Nigeria.

So what’s interesting is that none of these stories is front-page news. But when combined they show how Alibaba and its associated companies Ant and Cainiao are all making big moves internationally.

I think this is something to watch and may have slipped under the radar for many.

4. Hong Kong’s e-HKD is coming

Hong Kong will get the e-HKD CBDC and here’s why:

1) It’s next door to China and will use it for cross-border payments with the e-CNY to stimulate small and medium enterprise trade between the Greater Bay Area.

In 2018 Hong Kong exported $25.3 billion to China, which was Hong Kong’s top destination and accounted for 20% of all of its exports. SMEs (small and medium enterprises) make up 98% of Hong Kong’s businesses with nearly 50% of their market in China!

2) Singapore doesn’t have one!

This may seem an odd reason but a CBDC that connects to e-CNY and other digital products gives Hong Kong a leg up in the fintech competition with its rival. It will cement Hong Kong’s role as an e-CNY transfer point and give it unique capabilities that Singapore simply can’t match.

But what is unique relative to all of the CBDC papers I’ve read is that HKMA is positioning e-HKD as a direct result of stablecoins. This is a first for me and I think proves how central banks view stablecoins as a bigger threat than crypto!

E-HKD is all about futureproofing HK for the arrival of stablecoins:

“While widespread use of stablecoins in Hong Kong remains a remote possibility, it would be prudent for Hong Kong to better position itself for future challenges. In this regard, the introduction of e-HKD could help the HKMA support the continued use of Hong Kong dollar as the single unit of account in Hong Kong and reduce the risk of alternative units of account dominating.”

Link to e-HKD Paper and FAQ with my markups: Here

Thanks for reading!

Take control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Hi Rich, can you give a bit more detail on the Apple Pay elite card comment and the higher fees for using it. The point is that most users have no idea that they're paying for the privilege of cashless payments. Going to a phone intuitively feels like it should cost less because there's less effort ..when the opposite is in fact the case. I'd like to know more 🙏