Crypto corruption calls for a fix, miners corrupt the "sacred" blockchain, DeFi brings no democratization.

Meanwhile CBDCs make progress, with ID systems, security and the e-CNY is coming

This week:

1. Corruption in crypto calls for a fix;

2. Miners corrupt crypto’s “sacred” blockchain;

3. DeFi lending “democratizes” nothing;

4. Digital corporate IDs are critical for CBDCs;

5. E-CNY is coming like it or not!

6. CBDC cybersecurity

1. Corruption in crypto calls for a fix

Crypto needs serious soul searching to fix the rampant corruption. Like you, I’m reading quite a bit about the collapse of crypto with camps dividing into two distinct groups, one saying “I told you so, let it burn,” and the other saying “never give up and HODL.” Neither of these positions is doing us any service.

There is too much good in crypto to simply throw it away. It needs to be fixed. Products like stablecoins and even notorious DeFi will make our world a better place. This can only happen after crypto accepts regulation.

I’m not fond of either of these discussions as both ignore the elephant in the room “corruption.” When reading articles in either camp many simply do not deal with corruption. Those from the crypto HODL camp who say that the crash is good for the market because crypto firms will come back stronger ignore that even the corrupt can withstand a downturn. While those who say “let it burn” don’t factor in the good crypto market that un-corrupted could do.

So let me propose a third option that keeps the good in crypto:

Crypto needs a period of soul searching to better understand what it wants to be and then fix it.

Fix the rampant corruption, fix the DeFi protocols that encourage leverage, fix the scams, and fix the culture of greed. There is a lot worth saving in crypto, too much to simply wish for it to die. Stablecoins and even notorious DeFi will change our future for the better.

The irony of course is that many fled to crypto looking for a more ethical system than that controlled by the banks. Now defunct Celsius’ advertising boldly proclaimed: “Banking is broken.” In reality, what many crypto holders fled to is a system that is so lawless that it makes bank transgressions seem tame by comparison.

So take a time out, and do some soul searching about the real lives that have just been ruined due to excessive leverage, optimism, and absurd promises.

Then come back and accept this one simple but unavoidable fact, regulation of crypto is required. There is no way you are going to fix cryptos’ numerous problems through self-regulation. There is no way to fix crypto if crypto zealots deny the critical role that regulations play in maintaining order in financial markets.

Crypto must accept one simple and unavoidable fact, regulation is required.

2. Miners corrupt crypto’s “sacred” blockchain

The BIS drops another bomb by explaining how even crypto’s sacred blockchain can be corrupted.

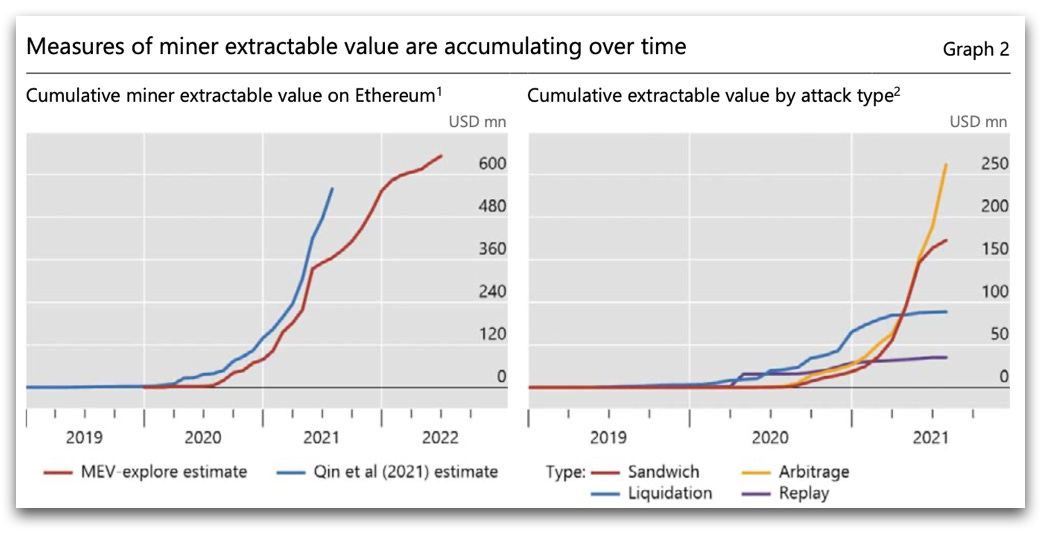

Miners corrupt the “sacred” blockchain by pulling far more than half a billion dollars out of the Ethereum blockchain in MEV. This is a severe undercounting of its impact as it doesn’t count all the losses encured. How much does a forced liquidation cost the owner. Download BIS report: Here

This article on “miner extractable value” or MEV was a bit of a surprise for me. I had heard of sandwich attacks and other techniques for manipulating prices on blockchains but had no idea they were as prevalent as reported.

The numbers are huge:

“Since 2020, total MEV has amounted to an estimated USD 550–650 million on just the Ethereum network, according to two recent estimates."

The basic trick of MEV is simple. Miners are able to pick the order of transactions on a block and are able to put their own trades in the sequence in order to profit from price movements. Sure there’s more to it but by making their own rules they can not only profit from mining but from manipulating trades.

To be fair in our “regulated markets” we allow front-running of your stock purchases on Robinhood by high-frequency trading firms. “Pay for order flow” is sadly 100% acceptable with Citadel Securities providing 43% of Robinhood's 2021 revenue!

Still, if we are to believe the propaganda, the blockchain is a sacred source of truth. Crypto fans were supposed to be escaping dirty Wall Street for clean and ethical blockchain secure crypto. Remember those days?

Forgive me if I lift some key quotes:

🔵 On legality:

“Regulatory bodies around the world need to establish whether value extraction by miners constitutes illegal activity. In most jurisdictions, activities such as front-running are considered illegal."

🔵 On decentralization:

“MEV also poses a quintessential problem for the industry itself, as it stands at odds with the idea of decentralization. A range of new DeFi applications seeks to build financial services on permissionless blockchains. Yet MEV can directly limit the usefulness of these applications.”

We’ve had a month of failed Ponzis, crashing DeFi Lenders, and now a crypto hedge fund going into receivership. Bitcoin's price drop below 20k seems anti-climactic.

And now we learn that even the blockchain isn’t a sacred truth machine.

Have you lost faith yet?

3. DeFi lending “democratizes” nothing

Time to stop the bull sh*t. DeFi loans that require 130% collateralization that buy more crypto do nothing to help the poor or the “real economy.”

DeFi lending does nothing to democratize finance. It does however promote boom and bust cycles like we’re seeing now through leverage. The right-hand graph shows how $100 in crypto run through multiple DeFi lending platforms can be leveraged three to four times. Link: Here

Tell me what exactly is being democratized?

This is not Alipay’s big data lending or even a bank that seeks data on the borrower's worthiness and finances real operations. DeFi simply says "show me the money.”

Before dumping more on DeFi, there is GREAT POTENTIAL in DeFi:

“The limitations of DeFi lending mask elements of genuine innovation. Smart contracts can complement automated underwriting in traditional finance and help to bring down the costs of financial intermediation.”

Now that we’ve established that the tech is good but the implementation is bad, let's look at what's wrong:

1️⃣ Inefficient use of capital: Over-collateralizing a loan is expensive! Most importantly it is the ultimate expression of exclusion: “it takes money to make money”

This isn’t for the poor who lack capital and are excluded from this market. And the loans are used to buy crypto not fund new businesses. Democratization?

2️⃣ Fosters procyclicality: In an up market, your collateral is worth more meaning you can borrow more for crypto investment, but in a down market collateral calls only hasten liquidation of positions and further declines in crypto value.

To make matters even worse many borrowers take their loans and borrow on them (rehypothecation) giving rise to a collateral chain. With so much leverage a crash is eventually inevitable.

3️⃣ Democratization for the lender? So far we’ve covered democratization for the borrower, but some will say this gives the little guy a chance to make 20%! What could be wrong with that?

Easy, these are not simple interest-bearing CDs or term deposits. Far from it, lenders can be “rekt” when collateral values plummet. The risk is off the charts!

The way forward for DeFi is clear:

“DeFi lending must engage in large-scale tokenization of real-world assets unless it wants to remain a self-referential system fuelled by speculation.”

This, of course, means making peace with TradFi which as I have said in prior articles has a bright future.

"To serve the un- or underbanked, DeFi will need to abandon anonymity and use real names, and ultimately to fall within the regulatory umbrella."

The BIS goes for the kill shot:

"The implication of both is that, once more, decentralization proves to be an illusion."

4. Digital corporate IDs are critical for CBDCs

Digital IDs for corporates are a critical piece of infrastructure in our shared CBDC future with instant cross-border transfers.

While “self soverign” digital ID remains a desireable long-term goal, corporates and private citizens will more likely continue to work with banks as the verifiers of their ID. Banks already have the infrastructure built for this service. Download: Here

The dream of nearly instant and free global transfers of money with CBDC, or any other system, will be dependent on knowing who gets the money. And yes this means crypto too, you will not be immune.

Personal IDs and business IDs are very different. There is only one you, but there are hundreds of subsidiaries for a big company like Apple all in different jurisdictions, each with multiple officers which makes digital business IDs tricky.

It's so ticky that Digital IDs will likely come from multiple sources rather than a single massive global database. Much of the work will be aggregating data from multiple sources into a single accessible entity. This leaves a clear role for private sector participants.

For those thinking that digital IDs are dystopian, note that we already have many ID systems and they are saving us all millions. As an example take the Legal Entity Identifier or LEI program favored by banks which is estimated to save some 10% of total operational costs for client onboarding. Estimates are that for Investment banking this is $150mn in savings annually.

Let's look at why digital ID is important:

🔹Operational efficiency: As with the example above a digital ID system can save many millions. The Aadhaar digital ID system in India reduced bank account opening times from weeks to minutes and from $15 to $0.07 per account.

🔹Financial inclusion: Interestingly it isn’t just people who are excluded from the financial system. Small and Medium Enterprises (SMEs) are as well. As usual, the little guys can’t afford costly KYC and AML and get cut out of financial access.

🔹Financial stability: Want to reduce excess concentrations of risk? Digital ID can show the interconnections of money flow. The 2008 financial crisis is perhaps the best example as banks accumulated massive exposures to entities that were unknowingly related.

🔹Market integrity: In short, keep criminals and terrorists out of the financial system and combat corruption and tax evasion. Good luck with that! We do AML and KYC so poorly today that there is nowhere to go but up!

Longing for “Decentralized Identifiers” or DIDs as proposed by W3C? I am too! This is the future we’ve been promised so where are they?

Easy, up-front costs for establishing new infrastructure in the form of ID wallets, and ID services and registrars don’t come cheap. Who pays?

Also achieving global adoption with competing standards makes DID adoption harder than it might at first seem.

This is why gov’t or banks will be key for corporate IDs for years to come.

Want that CBDC transfer magic?

You'll need a digital ID!

5. E-CNY is coming like it or not!

Great article on China’s e-CNY with actual citizen surveys showing that while e-CNY may be coming “like it or not,” most will like it!

Kudos to Sonnet Frisbie of the Morning Consult for one of the best pieces on China’s CBDC that I’ve read in ages! Link to origninal article: Here

1️⃣ E-CNY popularity: While e-CNY is still behind WeChat and Alipay in favorability scores, what is essential is to see how many don’t have an opinion. Let’s face it, most of China doesn’t have access to e-CNY, so it’s an unknown.

The favorability scores are interesting: WeChat 84%, Alipay 83%, and e-CNY 60%. That e-CNY can do this well, with 35% of respondents having no opinion/don’t know, shows how it's doing very well. That 35% can swing to favorable once they use it.

By the way, look at the unfavorable ratings. I was surprised to see that Alipay is winning! Not quite sure why they are so high compared to WeChat?

2️⃣ About 20% have the e-CNY app: (first graph above) For those that don’t have it, 53% are in the “I don’t need it” or “I don’t know how to use it” camp. Both of these will convert to users once there is a need.

Right now in Shanghai, there is no need whatsoever for users to switch over to the e-CNY app. So who can blame people for not wanting another app on their phone? Start paying them in e-CNY, and they’ll figure it out!

The new app is easy to use, but because few stores in Shanghai take digital yuan, there really is no need to use it. So I have it……and bought one bottle of water in the subway! (Sadly, the video I shot was unusable here on Linkedin!)

3️⃣ Advantages for e-CNY: This result delivered a shocker! The top advantage for using e-CNY will be investigating corruption and money laundering!

Think about this for a moment. Most of the West is in a state of terror worrying about CBDC surveillance, while in China, the leading advantage of a CBDC is tracking crooks! If ever there was a beautiful illustration of how differently the West and China see things, this is it! By the way, the other prime example is social credit, which is reviled in the West and seen as a boon in China.

I would add one more key fact to the “e-CNY is coming like it or not” narrative. While still in trials, we now have several companies and municipalities paying employees in e-CNY.

So there is a sort of inevitability to e-CNY use for most of the population in that they will receive either salary or bonuses for health or transit in e-CNY.

CBDCs, not just E-CNY are coming, "like it or not!"

6. CBDC cybersecurity

The first-ever dedicated report on CBDC Cybersecurity also makes big policy calls that just might shape the digital dollar!

The CBDC tech stack is on the left column with potential attackers along the top. Note that nation states will be primary CBDC adversaries. Solid circles indicate (the potential for) full access, whereas outlined circles indicate the potential for partial access. Download: Here

This report by the Atlantic Council is two reports in one. The first half covers cybersecurity while the second half lays out policy considerations that the US will likely consider on the road to digital dollar development.

First I want to highlight Finding 3 on page 4 which debunks the CBDC as "spyware" myth:

“It is possible to design systems where users enjoy reasonable levels of payment privacy and regulatory authorities can at the same time advance other important policy goals.”

When reading Chapter 1 make note that the six design variants (pg 16) for CBDCs are idealized. Most real CBDCs are in fact hybrids of these 6 types.

As an example take China’s digital yuan. Lower value transactions are completed solely with “secure hardware on clients device,” while high-value transactions are via “encrypted tokens.”

While I normally focus on tech what piqued my interest the most were the policy guidelines in chapt 2:

Principle 1: Where possible, use existing risk management frameworks and regulations.

While CBDCs are new the vast majority of laws in place will work fine. The change will be in adding new participants. What happens if Walmart becomes a CBDC wallet management spot?

Principle 2: Privacy can strengthen security.

My favorite section! This is a direct rebuttal to anti-CBDC proponents who claim the gov’t wants to spy on your data. In fact, it is the opposite, the gov't would prefer to build a system where their ability to spy is minimized.

The gov’t doesn’t want your KYC data! The less data it holds the better both for security and snooping. The gov’t and people's goals are more aligned than most think!

Principle 3: Test, test, and test some more.

Many ask me why China’s e-CNY rollout is taking so long! Very simple they are testing every conceivable permutation of use and setup. It is painstaking and will be a feature of the digital dollar and euro as well.

Principle 4: Ensure accountability.

So when your smart contract goes wrong, who pays!? I confess I never gave this much thought but the authors are correct. Laying out liability for system failure is an important step.

Principle 5: Promote interoperability.

Anyone following e-CNY trials knows that WeChat and Alipay accept e-CNY. Expect the same with Visa and Mastercard! While the card companies can kiss interchange goodbye their role in our CBDC future is guaranteed.

Principle 6: When new legislation is appropriate, make it technology-neutral.

Gov’ts aren’t in the business of picking tech but outcomes!

Thanks for reading

Be in control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Contact me: https://richturrin.com/contact/

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: