Crypto’s scaling problem, Must-see CBDC trackers, CBDCs use one ten-millionth the electric of Bitcoin, AntGroup’s “ANEXT” digital bank, Terra $2.7bn laundered, justice from the state?

And a fabulous podcast interview where I drop lots of truth bombs!

This week:

1. Permissionless blockchain’s scaling problem

2. Two must-see CBDC trackers

3. CBDCs use one ten-millionth of the energy of Bitcoin!

4. #AntGroup ’s “ANEXT” digital bank

5. Terra $2.7bn laundered, justice from the state?

6. Podcast with lots of “truth bombs.”

1. Permissionless blockchain’s scaling problem

The BIS 💥 blows up💥 the dream of scaling permissionless blockchain crypto networks in this must-read report: Here By dropping a truth bomb on permissionless blockchains the BIS lays bare flaws in scaling crypto that have no easy fix.

Fragmentation makes it harder to use crypto. Having money on one network means it can’t be used on another, kind of like WeChat and Alipay. The need for new networks increases as their transaction fees increase. Download the BIS report: Here or click on the picture

I simplified quite a bit to make this jargon-free and accessible to all.

Here we go:

1️⃣ Network effects are good: “Network effects” mean that the more people use a payment system it either gets cheaper or attract more users due to utility. Look at WeChat or Alipay as examples, the more using them the merrier. Permissionless blockchain can't take advantage of network effects. Why?

2️⃣ Permissionless blockchain needs to pay validators: In order to ensure that “validators,” the people who provide computers, are compensated for their work the number of transactions in a block is fixed to ensure a minimum fee to the validator.

This kills network effects. When network demand is high validators can't discount the price and process more. Instead, with network speed limits (15 TPS) based on computational difficulty, the price is bid up! You need to pay more to access a busy network because space is scarce.

In the Ethereum network, the additional charges are called “gas fees” and ironically create demand for competing networks. Why is that?

3️⃣ Fragmentation: When gas fees get too high another network starts and steals business based on price. Price competition at least in part is why we have so many different versions of Ethereum.

Fragmentation means that crypto can get spread over multiple networks and you can’t spend it on a different network, without help. Just like money on WeChat can't be spent on Alipay, your money is stuck. Then what?

4️⃣ Building bridges: Because no two blockchains are the same they don’t connect with one another, meaning they are not “interoperable.” To connect them the solution is to build blockchain bridges. Confused yet?

Blockchain bridges are often designed by unskilled DeFi companies and are prone to be hacked! So much so that $1bn of funds was stolen from bridges in the past year!

5️⃣ Layer 2 to the rescue: Of course bridges aren’t the only solution, we can also use “Layer 2” solutions that sit above Ethereum or Bitcoin to enable faster transfers and great throughput. The problem is that they are centralized and most are databases not blockchains. They too suffer from hacks and add an additional level of complexity. But wasn’t the whole point of crypto that it was decentralized?

6️⃣ Ethereum 2: To be fair, the new Ethereum 2.0 based on Proof of Stake is likely to reduce gas fees by increasing the network’s throughput from 15 transactions per second to some 150 thousand! Eth2 will solve some scaling problems, but we don’t really know what will happen with gas fees. A network with high throughput is great but how it will attract participants in its “proof of stake” system if transaction fees plummet?

Another issue is that Eth2 has been delayed for years now. In part due to the admittedly complex technical problem but also because of a painfully slow governance process. The same governance exists in many permissionless blockchain projects making change painfully slow.

Conclusion:

Even with Eth2, we will still have dozens of “fragmented” blockchain networks with impossibly slow governance systems and crime-ridden DeFi bridges. Does this sound scalable to you?

The BIS has no fear of the wrath of crypto and permissionless blockchain fans and drops this bomb:

“Fragmentation means that crypto cannot fulfill the social role of money."

Sadly, I think they have a point.

2. Two must-see CBDC trackers

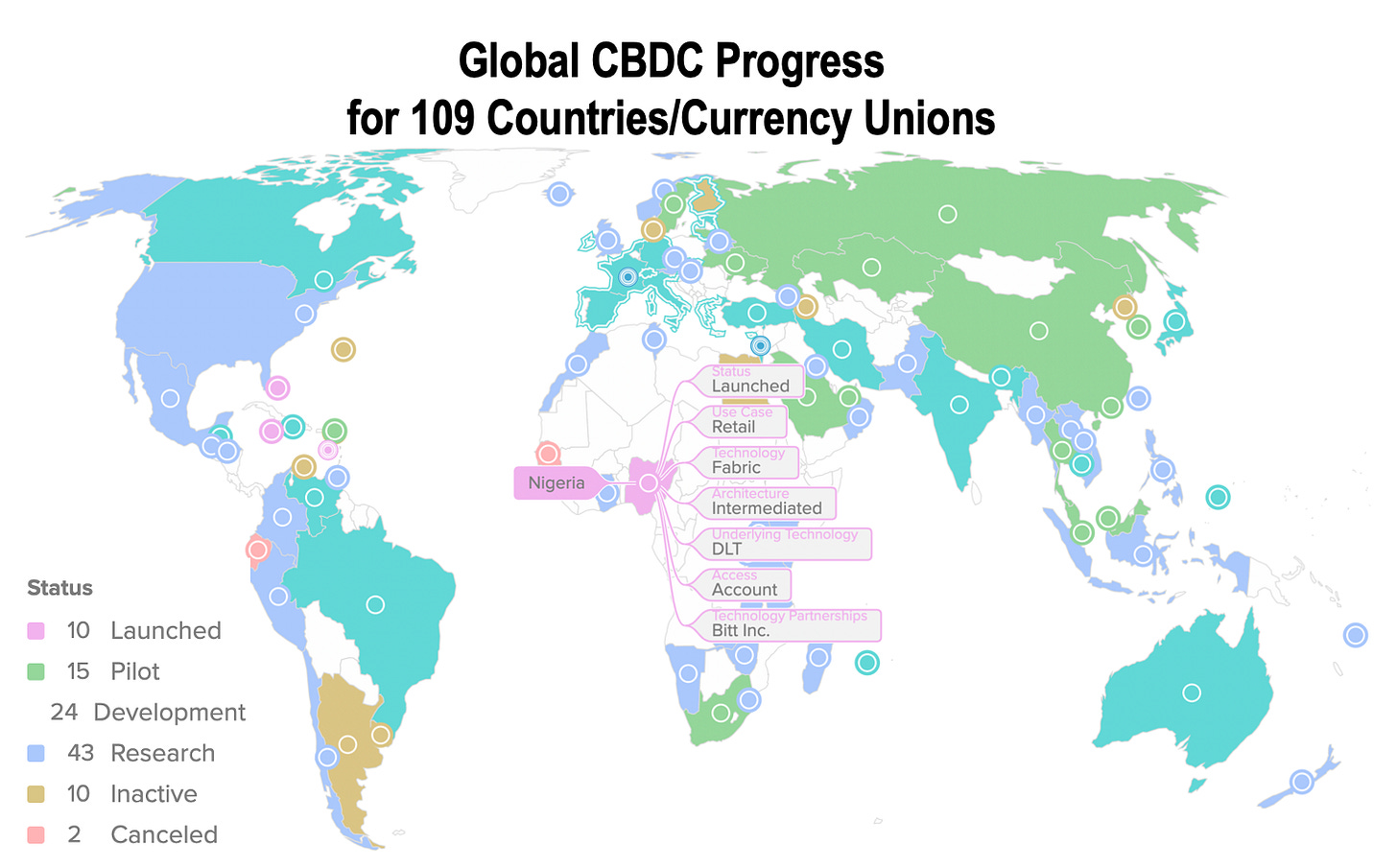

One of my two favorite CBDC trackers just got even better and shows how CBDCs are coming faster than you think!

The Atlantic Council CBDC tracker just got even better check it out by clicking on the image above or: Here

I urge you to visit the site and click around on the various filters.

First, let me say congratulations to the Atlantic Council and researchers Josh Lipsky for producing such a great tracker! I've had the pleasure of corresponding with Josh and even sent him a copy of "Cashless."

So I always say that you need to watch Asia for CBDC development. The East-West CBDC divide lept off the page when I looked at the tracker data (see below). When you sort the tracker data by CBDCs launched and in pilot you’ll see that the majority of pilots underway are in the East.

The East-West CBDC divide. Note that India’s CBDC will enter into pilot and turn green in a few months.

This is a clear indicator that Asia is looking at CBDCs more seriously than the West. So far launched CBDCs are in the Caribbean and Nigeria which are admittedly the West but with China and India building CBDCs the center of gravity will move to the East very quickly!

Two trackers

Now I did say “two trackers” and want to tell you about one more! The other tracker is cbdctracker.org. Both trackers are great!

Which to use?

For a technical look-up of CBDC features go to: atlanticcouncil.org/cbdctracker/

The map that they have shows CBDC technical features in a hurry and it’s my go-to source for details that I always forget!

For CBDC news go to cbdctracker.org as their site has a great news feed by country. So if you want a curated news feed of what’s going on with India’s CBDC program go here!

What can I say other than that our shared CBDC future is coming faster than you think!

3. CBDCs use one ten-millionth the energy of Bitcoin!

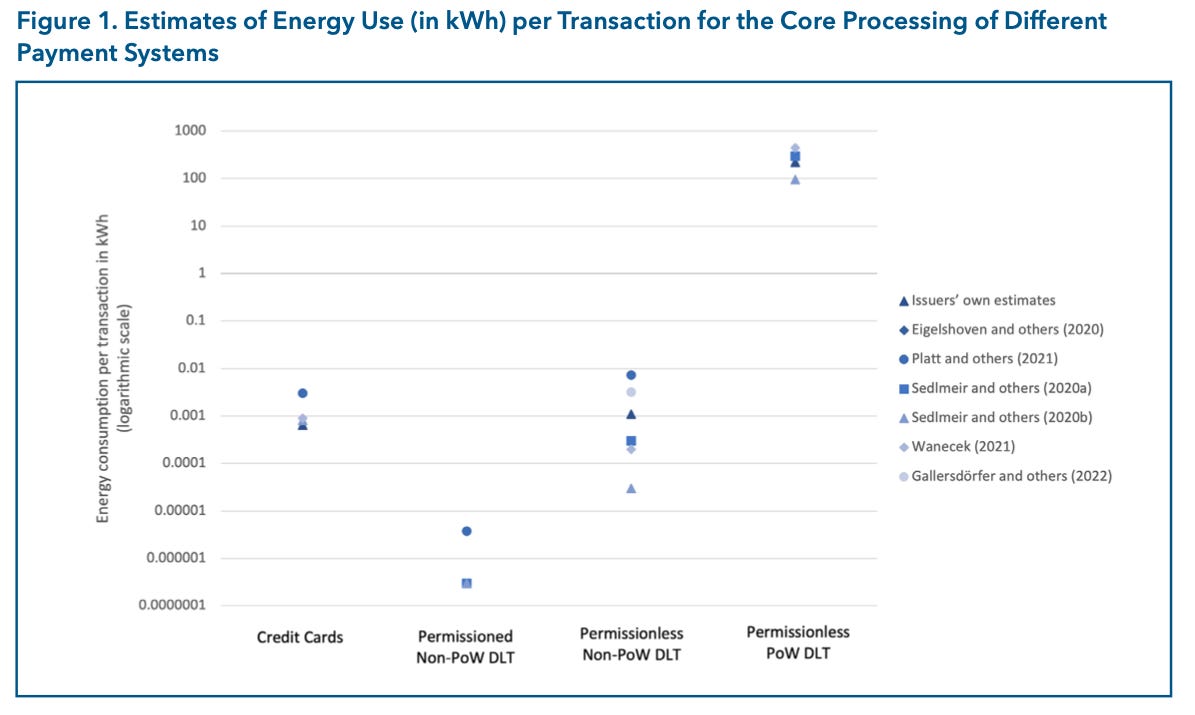

⚡ZAP⚡The IMF shows how CBDCs are environmentally friendly using on ten-millionth (1/ 10,000,000) the electricity per transaction of Bitcoin and one one-hundredth that of credit cards!⚡

Download the IMF report: Here

One of the top questions I get about CBDC is about their energy use from people justifiably concerned about the energy footprint of Bitcoin. Who can blame them?

To answer this question the IMF wrote this great paper with a chart (Figure 1, pg 12, shown above) that is the first of its kind! A comparison of energy use for the leading payment systems. The chart gives us an order of magnitude window into the energy benefits that CBDCs can bring over a Bitcoin world. CBDCs are included in the “Permissioned Non-PoW DLT” section.

These results once more show us that Bitcoin is unique in its ability to consume electricity. The IMF pulls no punches in further showing its gluttony for electricity:

🔵 Bitcoin: as of April 25, 2022, the annual electricity consumption of the Bitcoin network is estimated at 144 terawatt-hours (TWh) per year. ⚡This amounts to about 0.6 percent of total global electricity consumption. ⚡

🔵 All credit cards and cash in the world: The global payment system uses an estimate of 47.3 TWh of annual energy consumption. This amounts to about 0.2 percent of total global electricity consumption.

🔵 Market size: Bitcoin's peak market cap was around $1 trillion, while in my own google searches the amount of global narrow money (M0 and M1) is around $40 trillion with global card transactions adding 34 trillion.

🔥⚡ Are you sitting down? Bitcoin uses 3x the electricity for a market that is 1/70th the size! If we scale it up by 70x Bitcoin would use 42% of all electricity consumed! Now I consent that these numbers are overly dramatic. Still how Bitcoin aficionados can laugh off its insane energy use never ceases to amaze me.⚡🔥

What is interesting is that CBDC will likely use less electricity than credit cards. The IMF claims this is in part due to card companies running legacy systems but also due to the number of systems involved in each card swipe.

One more reason to go with CBDCs!

4. #AntGroup ’s “ANEXT” digital bank

#AntGroup ’s “ANEXT Bank” a fully digital wholesale bank launches in Singapore and wins a number of first prizes as Ant/Alibaba continue their quiet international expansion!

Why Singapore will be a critical market for ANEXT which will reduce the costs of imports and exports to and from China for small and medium sized enterprises!

Ant Group never ceases to amaze and the launch of their digital bank ANEXT in Singapore is big:

🥇First Chinese private bank to go abroad

🥇First Chinese digital bank abroad

🥇First digital wholesale bank in Singapore

Now let me clarify the first statement. There are plenty of state-owned Chinese banks abroad. To the best of my knowledge, however, there are no Chinese private banks that have set up a wholly-owned foreign subsidiary bank. If there is a private bank that I missed please let me know!

Note that ANEXT is a wholesale bank specializing in Micro, Small and Medium (SME) sized corporate clients and will NOT have retail accounts. It is also fully digital!

Now anyone watching Alipay knows that this is their specialty! Alipay was born to work with SME clients and that they are going to continue refining this expertise in a new market makes perfect sense. It also has perfect synergy with Ant's clients back in China!

Chinese state-owned banks operating in Singapore should worry. There is a tremendous amount of imports and export between Singapore and China that goes through smaller companies. Much of this business is carried by Chinese state-owned banks which will likely be up against new pricing pressure from ANEXT. While China’s state banks certainly do the job no one ever said they were “cheap.”

The real thing to pay attention to is how Alibaba and Ant are growing internationally. Their growth is slow, steady, and deliberate.

They are assembling pieces of a puzzle that include eCommerce, logistics, and now banking. There is no telling where they will stop and I give them tremendous credit for this vision.

Now let me ask you a question. Once ANEXT takes off in Singapore, how long do you think it will take to start Indonesia and Malaysian branches?

Not long at all right? My bet is within 5 years ANEXT will be a launchpad for Ant's pan-Asian banking!

5. Terra $2.7bn in money laundered spurs calls for justice from the state!

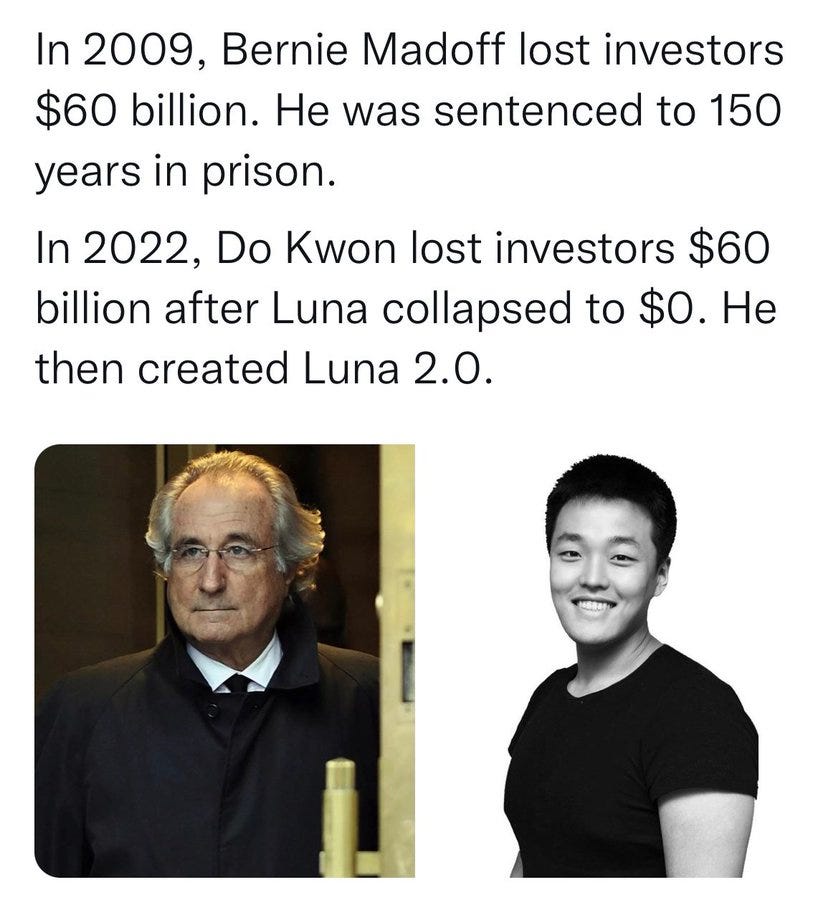

Terra’s $60bn crash “wunderkind” Do Kwon caught money-laundering as many in the defrauded Terra community ironically call for the state to jail him.

Perhaps this meme can help make the case to the crypto community that regulations contribute to accountability.

Reports out of Korea are that the US SEC shook down the Terraform labs team in Korea who revealed a major money-laundering operation. Employees are confirming that Do Kwon transferred some $80 million monthly to dozens of external crypto wallets in the months before the collapse. Separately, the total amount is reported at $2.7 billion! Link to article: Here

We don't have details, but $2.7 bn certainly isn’t “chump change” and Do Kwon has much to explain, including where the $3bn in reserves went. We still don't know.

This revelation is in addition to another US SEC action against Terra and two ongoing investigations in Korea. Do Kwon should enjoy his freedom in Singapore while he can.

That isn’t the part that interests me, though I’m glad to see that progress is being made.

When losses hit crypto users look to the state for recourse

More interesting to me is that once robbed the Terra community ran to the state for recourse. So here’s why if find this so terribly ironic:

Isn't crypto the very infrastructure that aims to separate money and finance from the state?

Six months ago the vast majority of the Terra community would have been among the first to claim that no state intervention in Terra was required. Regulations were of course not needed as crypto’s trustless environment was above the law.

Regulation is generally reviled by the crypto community who see it as an encumbrance to the more ethical innovation machine that is crypto. As though a "trustless" environment alone is enough.

I love blockchain and even many forms of crypto, but the concept that they somehow magically alter human behavior is absurd.

Regulations exist because people steal. That shouldn’t be a surprise or a controversial statement regarding the human condition. Accountability for theft ends up with the state and crypto isn't as borderless as it's made out to be.

Reading through the tweets calling for Do Kwon’s incarceration seems to show that many “Lunatics” may have changed their point of view since Terra’s demise.

When times get tough the Terra community wants accountability and they are looking to regulators and the state however flawed to provide it.

I don’t blame them and I hope that a failure of this magnitude can bring the rest of the crypto community to its senses. Demanding accountability through appropriate non-stifling regulation should be seen as a positive evolutionary step for lawless crypto.

6. Podcast with lots of “truth bombs.”

A very special podcast that covers lockdown in Shanghai as well as the latest developments in CBDCs!

A big thank you to Darren Lee for inviting me back to the “Kickoff Sessions” Podcast! Darren is a frequent contributor to our communities discussions here on Linkedin and I had a blast talking with him again! I dropped lots of truth bombs!

This podcast is different and very special. We did not focus on CBDC but talked a lot about life in Shanghai’s lockdown and what it means for the future. Let’s face it locking down a city of 25+ million for 2 months is a big deal and makes for an interesting discussion!

Timestamp for a fun podcast!

00:00 Preview

00:56 Richard Turrin's newsletter

02:04 What is life like living in Shanghai, China?

03:12 How has China's zero covid policy been felt in China?

07:14 Has there been food shortages in Shanghai?

11:05 Has media in the west caused more conflict with the east?

16:30 The rising inflation rate across the world today

18:56 Will western tourists return to China after lockdowns?

23:30 Have central bank digital currencies (CBDC) become mainstream?

27:44 Will CBDC track a user's transactions online?

🔥MUST LISTEN🔥

31:56 Why would someone want to use CBDC?

Note: I said "credit card" fees I should have said "payment fees" which includes bank and other fees for transfers not just credit cards. EU % is 1.4 not 1.6.

🔥Truth bomb: Regressive nature of credit card fees.🔥

37:35 The difference between CBDCs & Bitcoin

🔥Truth bomb: Decentralization is a myth! 🔥

41:06 Coinbase & exchanges holding positions as collateral

44:33 The two biggest concerns in the crypto market

🔥 Truth bomb: Crypto has a moral problem. 🔥

48:18 What are the risks of Terra Luna & stable coins?

52:30 What have you learned from crypto fraud issues?

56:50 Why will DeFi & TradFi combine in the future?

01:03:22 The disadvtanges of credit cards in economies

01:07:30 Where can people find you?

Podcast versions here:

Apple: https://apple.co/395iKvx

Spotify: https://spoti.fi/3xk7DXS

Thanks for reading

Be in control of your future, subscribe!

More of my writing, podcasts, and media appearances here on RichTurrin.com

Contact me: https://richturrin.com/contact/

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is an Onalytica Top 100 Fintech Influencer and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon: