DeFi in the spotlight: institutional use is now not tomorrow, and why it won't be crypto's savior. The war on cards heats up! 3 things to help your treasury get ready for CBDC and Stablecoins!

Digital ID, is $20bn a year in losses enough to get working on the problem?

1. Institutional Defi is now, not tomorrow!

2. DeFi will not be crypto’s savior, and its role in crypto winter is damning

3. Three things your treasury MUST DO now to get ready for CBDC and Stablecoins

4. The war on cards heats up as payments go personal

5. Digital ID is long overdue and costs $20bn a year!

This week’s art: Dall-E generated! Sorry, but try as I might, I couldn’t come up with any classic art that would somehow capture this week’s emphasis on DeFi! With two articles on DeFi and the industry at a crossroads, I thought I’d keep it simple!

I am proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read.

If you want crystal clear hype-free discussion on CBDC, fintech, crypto, and China’s tech scene, this is the place. All of my writing is backed up by my curation of the best educational PDFs in the business. Subscribe, and you’ll be glad you did!

1. Institutional Defi is here now, not tomorrow!

“INSTITUTIONAL DEFI IS FEASIBLE,” don’t let anyone tell you it isn’t; the future is coming sooner than you think!

Download: here

A game-changing report by Oliver Wyman, MAS, DBS, Onyx/JPM and SBI Digital Asset Holdings delivers a STUNNING outlook for "Institutional DeFi's" ability to “streamline transactions” in “real world assets.”

Monetary Authority of Singapore’s (MAS’s) “Project Guardian” proved that DeFi is real, and that's why it's a game-changer!

First, let’s make this crystal clear that this is NOT crypto Defi:

“We define Institutional DeFi as the application of DeFi protocols to tokenized real-world assets, combined with appropriate safeguards to ensure financial integrity, regulatory compliance, and customer protection.” Note: it isn’t just institutional participants.

Project Guardian

Project Guardian’s achievement was to set up a functioning "Institutional DeFi" network on the public Polygon network, with verifiable credentials for all users.

Don’t be afraid of the word “public” this isn’t Bitcoin. Access was tightly controlled by "trust anchors." Then they then used standard ERC 20 contracts to pass around the three distinct tokens: 1) DBS issued tokenized SGD, 2) JPMorgan issued SGD deposits, 3) SBI issued Japanese government bonds.

It worked and should move into production! Proving that blockchain is not a pipe dream and that detractors should start reconsidering their positions. There is still a pile of details to work out on the legal front and critically how to work out recourse and disputes. In addition, standards need to be worked out as well as an overall market structure.

Trust anchors

Two factors were considered critical to Guardian’s success, with the “Trust anchors” unsurprisingly coming first. This means that verifiable credentials were used to authenticate identity-regulated financial institutions providing a trusted gateway to the system. The second was that the tech standard of ERC-20 tokens allowed interoperability among pilot participants.

So what comes next? “The rapid evolution of blockchain technology and the potential disruption it can bring requires institutions to get ahead of the curve to avoid being left behind.“

The report's recommendations are a STUNNING call to action to build BUILD DEFI NOW and will serve as my take aways:

Take aways:

These are taken directly from the document and show that institutional DeFi is NOW not tomorrow:

“Focus on business impact and getting production-ready.” No more PoCs or feasibility studies!

“Collaborate with like-minded peers and clients to advance solutions and set tokenization and DeFi standards for interoperability as the foundation of scaling and mass adoption.”

“Assess improvement areas with multiple teams to build new businesses rather than siloed efforts.”

“Proactively work with regulators to co-create environments that protect clients and financial stability.”

2. DeFi will not be crypto’s savior, and its role in crypto winter is damning

DeFi will not be the savior for crypto, and its role in accelerating the crypto crash is damning!

Download: Here

Authors note: I do not hate crypto or DeFi. I do hate the culture of greed and fraud that crypto markets seem to sadly embody, and I will not shy away from calling out crypto’s flaws. Hopefully, this will make markets better for all!

That said, we all owe a debt to crypto and its innovators for developing the tech that we use in CBDCs and “Institutional DeFi” and forcing change on a financial system that fundamentally doesn’t want to!

The OECD has a FABULOUS analysis of what went wrong in crypto leading to our current crypto winter. It dispassionately lays the blame on DeFi!

This will come as a shock to crypto supporters whose mantra is that everything bad that happened was due to centralized finance or CeFi and that the “real and good crypto” is DeFi.

Sorry but that is simply BS, here's why:

🔹 DeFi doesn’t stand alone:

CeFi is the lifeline of DeFi! The primary source of funds and collateral flowing into DeFi is from centralized stablecoins and exchanges!

You simply can’t detach DeFi into entities that do not interact with CeFi systems, so please stop with the “savior” complex. DeFi doesn't work without CeFi!

🔹 DeFi survived by bleeding crypto:

Crypto proponents say that DeFi protocols survived volatile markets, and that is proof that they work. It is true, most survived, but they sacrificed crypto markets to do it!

Their algorithms successfully liquidated collateral but, in doing so, contributed to volatility spikes and exacerbated market stress.

🔹 How DeFi bled out crypto markets:

DeFi loans liquidate in return for collateral when collateral drops below amounts specified by the protocol,

Platforms are incentivized to maximize the number of positions they can liquidate, and bots monitor positions to enforce liquidations,

The price movements due to liquidation spread to other exchanges,

Aggregated prices used to determine collateral values on loans on other platforms are also impaired and cause further liquidations,

Finally, the coup de grace! DeFi arbitrageurs bid for liquidated positions but are incentivized by lower prices! A vicious cycle!

🔹 DeFi added leverage:

DeFis provided the opportunities for unrestricted leverage that was the key driver for CeFi’s high yields, as crypto-assets could be re-hypothecated numerous times, exacerbating the risk in times of a downturn. It was DeFi’s leverage that CeFi’s abused to eventually burn down the house. DeFi is every bit as complicit in the crypto winter as is CeFi.

🔹 DeFi's DINO problem:

‘Decentralised in Name Only’ (‘DINO’). “The vast majority of DeFi protocols are DINO.” Three examples include Solend, MakerDao, and Aave, all of which used human intervention during the crash. So, stop the DeFi worship!

🔹 Whales always win:

"Informational asymmetries between DeFi and CeFi exchanges gave an advantage to whales trading on DeFi to the detriment of unsophisticated or retail investors!" Whales got out before Terra collapsed! Is that fair?

Takeaways:

DeFi does not work without CeFi. It is not standalone.

DeFi is not the “real crypto” or its savior.

Leverage on DeFi lending platforms is still a problem.

Crypto must acknowledge DeFi's role in causing the crypto winter.

DeFi should be saved through rehabilitation!

3. Three things your treasury MUST DO now to get ready for CBDC and Stablecoins

What your CFO and treasury MUST DO NOW to prepare for CBDC and STABLECOINS.

Download: here

McKinsey’s report on how to prepare for the coming payment revolution bombs because it doesn’t go far enough! It’s not a bad read and they are right in saying that its time to prepare. I’ve been saying this for the last 2 years, and was perhaps too early?

I love this topic and go much further than McKinsey does in my recommendations! This is what I advise corporate audiences to do now to prepare!

I advise clients to do three things:

1️⃣ Buy some stablecoins!

Yes, buy them and sit on them! Figure out how they work, it’s not rocket science, but by doing it for real, your teams will uncover real-life issues BEFORE you need to use them.

2️⃣ See if CBDC is available in foreign operations!

Operations domiciled in China, Nigeria, Bahamas, Jamiaca or the Eastern Caribbean all have access to CBDCs. If your company has operations in these nations have locals get their hands on them and report in to learn from these units!

3️⃣ Get your INNOVATION lab or team on this!

This is what they’re good at! Believe me, they’ll love it and likely come up with uses that rigid-thinking finance teams will not!

Your company’s best investment

The best investment any multinational company can make right now to further its understanding of CBDC and stablecoins is to use them!

A USD 10k position in either product will teach you more than 100 hours of McKinsey consulting ever will! Sorry, McKinsey!

You’d be surprised how many multinationals in China are CLUELESS about China’s e-CNY even though wallets have been available for the last 10 months. Companies need to learn how to work with e-CNY wallets and how to make basic payments and account for them properly.

The good news is that as CBDCs are gov’t sponsored, they are easier to work with than stablecoins, and accounting, payroll, and other systems in China are already being modified to use e-CNY. Still, get on it early, not late!

Stablecoins are coming and will be available before CBDCs! It’s not “if stablecoins become regulated, but when,” and regulated stablecoins will be a breakthrough in cross-border payments.

Managing them is a skill that can be mastered now! Work out the entire chain of stablecoin usage so that they can get a real leap on the competition.

McKinsey leaves readers in flux

McKinsey is smart but leaves readers in a state of flux with recommendations to “consider” or “think about” the following:

Products,

Technology,

Risk management,

Accounting and reporting.

No one could possibly disagree that these are the major issues to overcome! But the reality is that you can do better than making this a moot exercise with hours of meaningless meetings thinking about the problem. Make it real!

I dare your CFO to go and buy $10K of USDC and have his team take it from there!

Takeaways:

Get your hands on CBDC or stablecoins now! Try them out.

Your teams will learn more with real positions than they will with mock entries.

Acknowledge that stablecoins and CBDC are the future, those that master these skills first will have a definite advantage!

4. The war on cards heats up as payments go personal

Personalized payments means CHOICE, and that means a war on cards!

Download: here

Payments are changing fast, and in this Accenture survey of 16k customers in 13 countries, the trend is clear, they’re ditching banks and card-based payments.

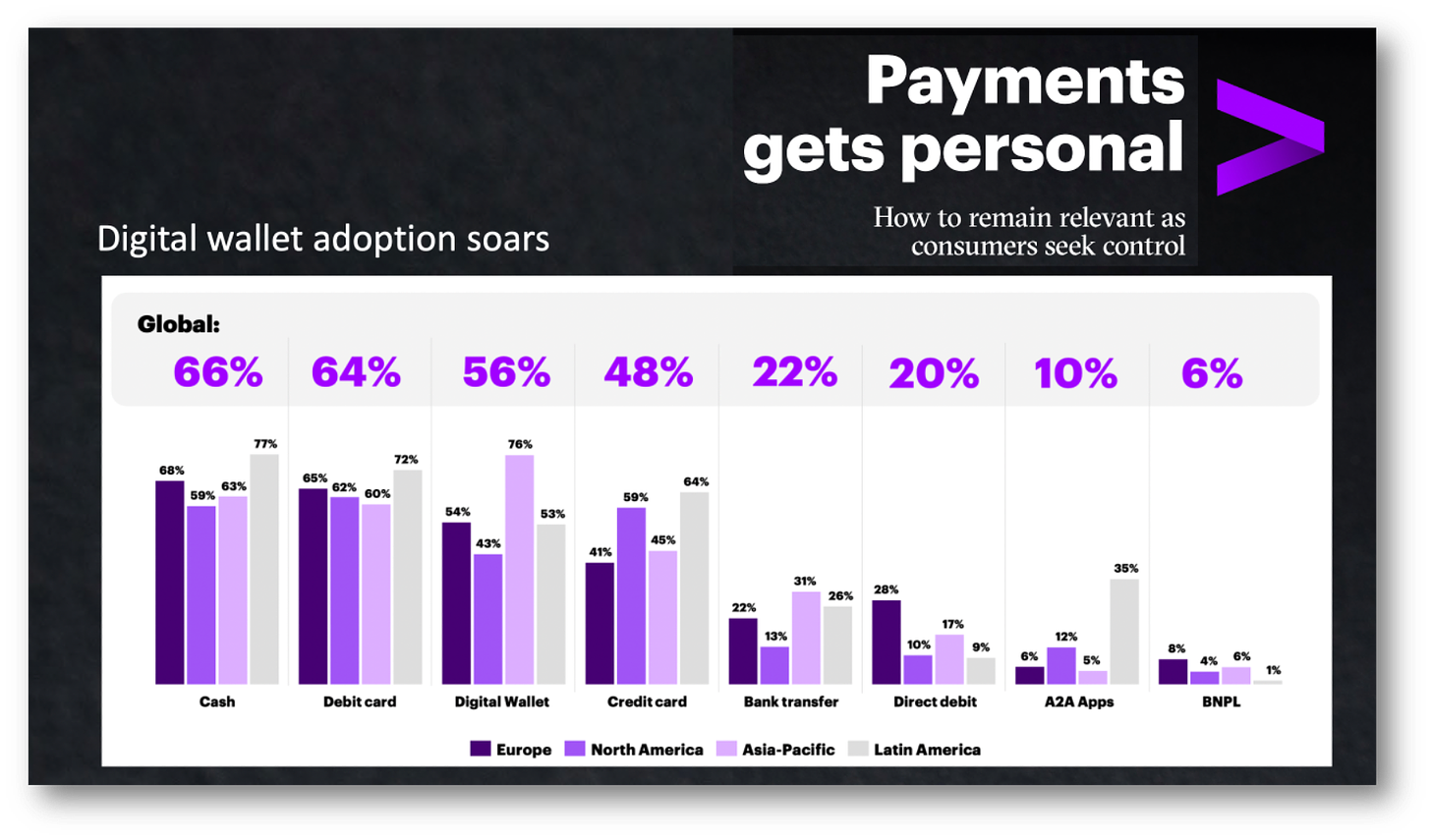

“When we asked consumers which next-generation payments they use at least five times a month, we found that 56% use digital wallets, 10% use A2A payment apps and 6% use BNPL.” Cash and debit cards are still 1 and 2 with 66% and 64%, but the migration pattern is clear, particularly in APAC and LatAm markets.

Cards lose their lock

The real shocker was that cards have lost their lock on payments, with 56% using digital wallets more than 5x a month and 48% using cards that often! If you work for a card company, be afraid! Cards are now the second choice.

The reasons for the migration are clear, of card users considering switching, half want a better deal. With BNPL rates lower than cards, how can you blame them? The other half simply prefers the convenience and control of banking apps, digital wallets, or A2A payment apps. Even worse news for cards!

Regular readers could have guessed that APAC was the leader in digital wallets, but in what should be a shocker for card companies, the EU is now the No 2 user of digital wallets! Anyone dismissing digital wallets as an “Asian thing” needs to rethink their strategy.

Follow the money

Astute readers will point out that most digital wallets are linked to cards, and this is true for 75% of the digital wallets out there. Still, the margins banks make are smaller as they have to share fees with big tech and fintechs. Cards loathe being the second choice!

There is nowhere for cards to hide. Even in the US, where cards are still reigning champions, Account to Account (A2A) payments will hit next year with the launch of FedNow. Globally 10% are using A2A payments, with the sector growing fast.

Accenture calculates that $89bn in payment revenue is at risk, which means banks need to jump on new payments without delay. Trust in banks will not overcome these challenges because consumers are already voting with their phones to try new solutions.

Takeaways:

Greater choice in payments is a good thing for all consumers! How can bringing costs down and convenience up be bad?

Cards are fighting a losing battle. They can’t compete on rates or convenience, but they aren’t going away; they are just becoming less profitable. (Few of you will shed tears for Visa and MC.)

Yes, superapps may be coming, but they are a diversion. People want a fair deal and convenience now; whoever delivers these first wins. You get a superapp only after developing a killer use case!

With 94% of banking execs saying they can't change their business fast enough to keep up, my money is on big tech, fintech, and CBDC!

5. Digital ID is long overdue and costs $20bn a year!

We are overdue for DIGITAL IDs when identity fraud costs U.S. Financial Services $20 bn a year!

Download: here

How on earth is money going to digitally zip around on the new FedNow system or with CBDCs when the US is woefully behind on digital IDs? Even worse, whenever the topic comes up, citizens scream that it is dystopian while bemoaning identity theft!

Oliver Wyman and the American Bankers Association talk about digital IDs in a solid read that lays out how bad it is. Let's look at a real-world example from my book "Cashless!"

Digital ID is Alipay and UPI’s “secret sauce”

In China, digital ID has been a fact of life since cell phones were tied to state IDs around 2010, when rampant phone fraud was the norm. Digital IDs are the "secret sauce" behind Alipay and WeChat's success, even though unheralded as such. You can also look at India’s successful UPI transfer system, which is tied to the Aadhaar digital ID!

How well do digital ID and password-protected payments work in China? Alipay’s fraud rate was 0.0006 BPS or 0.64 in 10 mn in 2020. For every USD 10 mn worth of payments, fraud-induced loss is less than USD 0.64! Compare this with US card fraud of 12.4bps or USD 12,400 on 10 mn! Alipay is 19,000 times more effective!

The stakes are high, but still, the US dawdles even though the EU is working on a digital ID program.

What’s at stake for banks:

🔹Consumer reimbursement:

Where a customer’s credentials have been compromised and used by someone to make payments, the consumer generally has no liability, with the bank generally bearing the liability.

The banks then pass these losses back to consumers through higher fees. So you pay for fraud!

🔹Operational expenses:

This includes fraud prevention and compliance, as well as the cost of disputes and personnel. The cost of KYC for onboarding is estimated to be between $10 and $150 / customer and could be significantly reduced with digital IDs! The savings are roughly $1bn/yr for onboarding 13mn new accounts annually.

🔹Reputational damage:

Each time bad actors get into the system, banks shoulders the blame! Clients and regulators both come after the bank! While hard to quantify, these costs are real.

Takeaways:

Digital ID is at the heart of our digital world, and a key building block for digital societies.

The cost we now pay for letting digital payments get ahead of digital ID is stunning. China shows how digital ID can make a difference.

Digital ID systems are not dystopian and can be built to fit within the ideals of the US or EU.

The US gov't has a role to play but must stop ignoring the problem. The EU has!

Blockchain Self-Sovereign ID that works on Web3, the Metaverse, and my bank would also be great!

See how deep the “cashless” rabbit hole goes!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter, or Linkedin for more. If you want to learn more about Innovation Labs or China’s CBDC, check out my website richturrin.com which is full of videos, interviews, and articles. The best way to make sure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work (or anything else I’ve written outside of my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE