Deloitte's Top 5 US Payment Trends To Watch In 2025

Unlike the rest of the world, instant payments don't even make the list in the US!

Deloitte picks five solid trends for the future of payments in US markets, showing that while change comes slowly to the US payment market, it is coming.

The first thing to note about this report is that it is one of the few that doesn’t tout instant payments as the next big thing!

Surprised? Don’t be. The US is so far behind in instant payments that they won’t be a dominant “trend” for another five years!

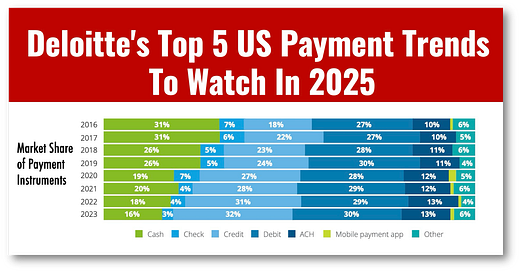

While cash use is increasingly declining and checks (remember them?) are finally on their way to extinction, the US is relying on credit and debit cards to go digital.

To show just how dominant cards are, I am sad to report that the Fed’s relatively new FedNow account-to-account payment system doesn’t even make the report!

It’s as though the US is saying that no one needs nearly free and immediate payment when you’ve got cards!

👉TAKEAWAYS

🔹Trend 1: Cash finds its floor

Consumers use credit cards, peer-to-peer (P2P), and other digital payments more frequently as checks move toward extinction and cash finds its floor.

🔹Trend 2: Regulators bring nonbanks into the fold

Expanded scope of banking regulation, to include nonbanks, will change the players of the payment market as some nonbank payment providers leave due to increased regulation.

🔹Trend 3: BNPL moves to industry sectors

Buy now, pay later (BNPL) and other digital payment options will expand into new sectors like housing and utilities, grocery, car payments and repairs, and travel, especially as consumers battle inflation and focus on nondiscretionary spending.

🔹Trend 4: ISVs increase their SMB hold

Small and midsize business (SMB) merchants gravitate to integrated software vendors (ISVs) for operational simplicity and provide pre-integrated payment rails, including consumers’ go-to digital wallets.

🔹Trend 5: AI drives fraud prevention to newer dimensions

Artificial intelligence (AI)- driven fraud models will expand to better consider consumers’ digital identity and personalized spend insights to combat the growing complexity of fraud.

On average nearly 36% of U.S. consumers used these non-bank FIs, which is a bump over the 33% who did so one year earlier. No wonder they are under increasing regulatory scrutiny in the payment space. Link (Sorry for the poor quality of this chart)

👊STRAIGHT TALK👊

What interested me most in this report is the trend of cracking down on non-bank financial institutions (NBFIs) in the payment space.

This means that PayPal, Venmo and BNPL providers will be in for a rough ride in the next few years which I view as a positive trend.

Ensuring consumer protections are more evenly extended over the payment spectrum is hard to fault. BNPL is the best example, with new regulations requiring BNPL providers to refund disputed charges as card companies do. It just makes sense.

That GenAI will create more fraud is given and likely doesn’t surprise anyone! AI’s ability to defraud through deepfakes is now the stuff of legend. We can only hope AI’s ability to detect fraudulent activity provides a counterbalance.

Regarding BNPL’s continued rise, I still have misgivings about this product and want to see it work through a negative credit cycle. I think I’ll be able to say, “I told you so.”

Is BNPL fintech’s most outstanding achievement at doing good for society?

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee by subscribing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!