Digital Banking: A New Era, or Banking On The Rocks?

Eight lessons learned by breaking GenAI to make it safer.

Topics:

Digital Banking: A New Era, or Banking On The Rocks?

Banking's Top 10 Hot Trends to Watch in 2025

In 2025 Real Time Payments Are All That Matters

Eight Lessons Learned By Expert Attacks On GenAI

Is Financial Fragmentation A $6.5 Trn GDP Threat?

Hi there, fintech and AI fans!

Many banks are having trouble with the transition to digital banking. One small group is forging ahead and making good progress, while another far larger group is falling hopelessly behind.

While consultants tell banks they must go digital and provide “how to guides”, the reality is that bank culture and systems thwart this effort for most of them.

This doesn’t spell sudden death for digitally challenged banks. Most are well-capitalized and can afford to bleed customers who leave for digitally sophisticated competitors for many years.

Many of these digitally unsophisticated banks will be zombies, falling further behind until eventually they become takeover targets.

Digital Banking on the Rocks

Today's first two articles focus on the sorry state of digital banking. The first article shows how while management consultants make going digital sound easy with a mere six steps to digital nirvana, the reality is that banks can’t deliver. Read on to see the recent statistics on how banks are falling behind: HERE

The second article follows on this theme. Unsurprisingly, the top trends for banks have an AI focus and are a great read. What is interesting about these trends is that one of them acknowledges the division in banking between the digital haves and have-nots. Read the full Top 10, I guarantee you’ll enjoy it: HERE

Real Time Payments Rule

Last week, I wrote about the Top Fintech reads for 2024 and said that I’d be interested to see how Capgemini’s annual payment report changed between 2024 and 25. We didn’t have to wait long! The result is that the only thing that matters in payments this year is going in real time.

When reviewing last year’s Capgemini 2024 payment report, I boldly proclaimed that “the only trend that really matters is real-time payments.” I beat Capgemini to this conclusion by a full year! Read on for more and how RTPs rule: HERE

Breaking GenAI

This is an important read for everyone interested in building safe GenAI systems. Microsoft’s red team, a group that intentionally tries to break a GenAI system, reveals eight lessons they learned by breaking over 100 genAI systems. This was a fabulous read because it changed my perspective on who can break a GenAI. Read on to see how genAI attacks can come from within: HERE

Financial Fragmention real or a ruse?

I am fascinated by the topic of de-dollarization and the transition to a multi-polar world. We’re in the midst of the biggest transition in finance to occur since Bretton Woods at the end of the Second World War. Naturally, not everyone is pleased with this, and SWIFT, which has a monopoly on currency transfers, is the first to lose out if things change. So I take SWIFT to task for claiming that financial fragmentation will be dangerously costly to the global economy in a thought-provoking read: HERE

Word of mouth contributes the vast majority of my new subscribers! If you know someone who would be interested in this newsletter, please share it!

Hot Topics for Subscribers only

What you’re missing in the section below:

CapGemini top banking trends report

The 5 Not-So-Obvious Things That Will

Change the Digital Economy in 2025

WEF: Global Risk Report

Visa: Money Travels: 2024 Digital Remittances

Adoption Report

My analysis of stablecoin fraud, it’s much more than you think!

Dear paying subscribers,

Thanks for subscribing and this week we’ve got an interesting batch of reports! I hope they pique your interest!

CapGemini top banking trends report: More top trends in banking. No surprise AI is top of the list!

The 5 Not-So-Obvious Things That Will Change the Digital Economy in 2025. This is a great read from the editor of PYMNTS. I loved it and think you will too.

WEF: Global Risk Report HERE This report shows us just where the big systemic risks are hiding in plain sight. Climate looms large.

Visa: Money Travels: 2024 Digital Remittances Adoption Report Great read that shows how APAC leads in digital money transmission. Can high cost Visa make a difference in remittances? Not in Asia, where low cost transfers rule but perhaps elsewhere.

My analysis of stablecoin fraud, it’s much more than you think!

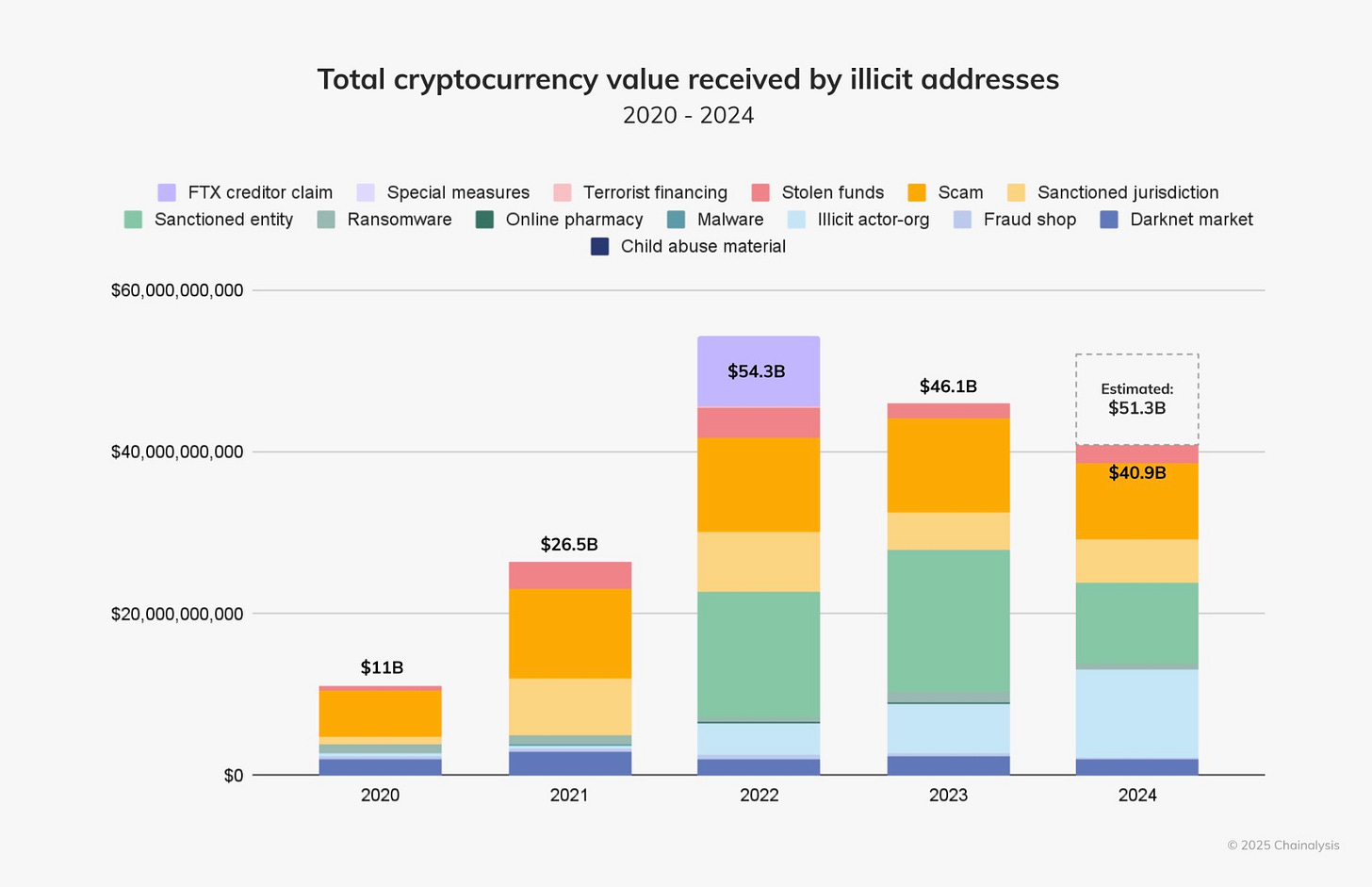

SHOCKER: around 1% of stablecoin use is by professional criminals!

Chainalysis reports $51bn in estimated criminal activity with stablecoins.

However, the crypto crowd will not admit to the problem. Chainalysis makes light of this fraud by saying it accounts for only 0.14% of the total on-chain transaction volume.

But on-chain value is BS and highly inflated! Chainalysis knows that, and Visa shows what BS on-chain value is for stablecoins, the primary crypto of criminals.

Visa has an adjusted stablecoin value of $5.8 tn for 2023. (Visa Onchain Analytics Dashboard HERE)

Adjusted because in Visa's words: "Visa wants to show how stablecoins are being utilized, clearly and plainly, adjusting for inorganic activity from bots and other artificially inflationary practices."

So $51bn in crime is around 1% of all stablecoin use!!

Chainalysis report HERE

Thanks for reading!

Reach out if you have any questions

Please share!