Digital RMB: Cheap At Any Cost And Chinese Banks' Last Chance

Chinese banks lost the US$76 tn mobile payment market; the digital RMB is chump change.

S&P Global has an interesting analysis of China’s digital RMB that talks about costs but completely misses the point as to why the digital RMB is Chinese banks’ last chance!

To put it in the vernacular, S&P is “sweating the small stuff,” worrying about details while completely losing track of the bigger strategic picture.

The big picture is that China’s banks have lost the entire US$ 76 trillion instant payment market to WeChat and Alipay! Let that settle in.

Given the size of this calamity, why is S&P worrying about the bank’s development costs for rolling out the new digital RMB?

Compared to a loss on this scale, worrying about the roll-out costs of the digital RMB is nonsensical at best. It shows that S&P still doesn’t grasp what is at stake for China’s banks.

Data is the biggest Loss

Research from my book Cashless showed credible estimates that the losses in transaction fees to Chinese banks would be around RMB 400 billion ($US 61 billion) from 2014 to 2020. Those losses continue to this day!

But that is only half the story! What banks lose, which is more important than lost card revenue, is all of the customer data.

Banks went from having data on their clients’ debit card purchases before the launch of the payment apps in 2014 to receiving nothing more than a line entry notification that says “WeChat” or “Alipay” in their statements.

They know nothing about what their clients are doing, and now that is expensive! If we’ve learned anything from payment platforms and digital banking, it is that data is the new gold and is worth more than transaction fees!

Chinese banks have little transactional data on their clients while Alipay and WeChat monetize their client data by building credit profiles, selling marketing data, and even offering loans, among other opportunities.

Banks’ last chance

The digital RMB represents banks’ last chance and the only way to recover some of their payment business from mobile apps!

While Banks still have credit and debit cards, the best opportunity for them to recapture payment flow from the apps is to have compelling digital RMB apps and offerings.

We’re still in the early days, and we haven’t seen banks compete based on digital RMB wallet services, but believe me, it’s coming. As the national currency, all Chinese banks will have access to the digital RMB and the opportunity to build new financial products and services around it to win back customers.

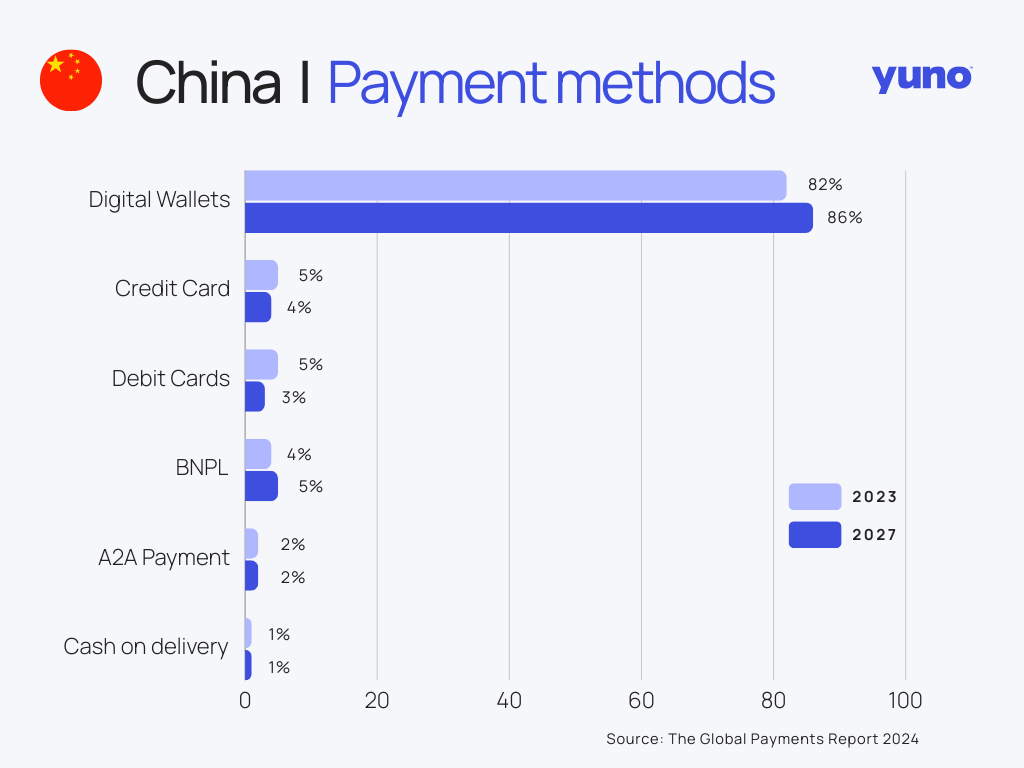

Credit and debit cards represent only 7% of the payment market by 2027! The digital payment market is worth 555 trillion yuan or USD 76 trillion!

Cheap at any cost

S&P notes that “increasing use of the digital RMB might have a moderately negative impact on Chinese banks.”

This is undoubtedly true, but banks will call this “cheap at any cost” if they regain even a small part of their lost payment business.

If they don’t and remain unimportant in payments, their revised status as “dumb pipes”—simple conduits rather than revered institutional gatekeepers—will be complete and permanent.

S&P doesn’t seem to get that the digital RMB is banks’ last chance.

Readers like you make my work possible! Subscribing is free, and I use the same business model as public broadcasting, where you can get all of my writing for free. If you like the content, please buy me a coffee or consider a paid subscription. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!