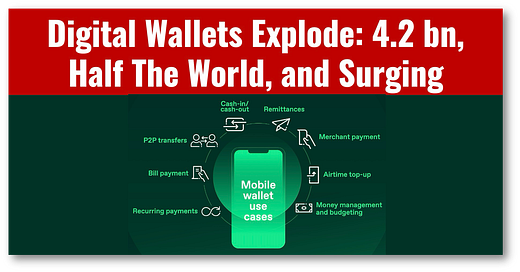

Digital Wallets Explode: 4.2 bn, Half The World, and Surging

Nothing in the world....is so powerful as an idea whose time has come, not even Visa or Mastercard!

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

There are now 4.3 billion digital wallets and 8.2 billion people on earth, meaning that more than half of the world now has a digital wallet.

If that doesn’t shock you into believing in digital payments and going “Cashless,” nothing will. Even more shocking is that by 2029, we are expected to have 5.9 billion.

The reality is that digital wallets are an idea whose time has come, and nothing can stop them, even Visa and Mastercard.

While people may argue over the details of how these wallets should function and their fees, they have become the preferred method of payment for most, and it should be up to users to choose any combination of wallets that suits their needs.

Digital wallets are broken into three primary categories:

Closed-loop wallets: Also known as stored-value wallets, closed-loop wallets allow users to top up a certain spending account that is linked to a credit/debit card. Examples: Starbucks, Subway, Walmart.

Open-loop wallets: Also known as card-based wallets, allow users to link their

credit and debit cards—often connected to their bank accounts—to their mobile phones. Examples: Apple and Google Pay

Semi-closed-loop wallets: Semi-closed-loop wallets allow users to shop and transfer virtual funds within the same wallet network. Often available as apps or integrated into super apps, these wallets typically operate on a local or regional scale. Examples: WeChat and Alipay, PayTM, MPesa, GrabPay

The category to watch is the semi-closed loop wallets, as they offer consumers the most freedom of payment, and usually the lowest fees, with one big catch.

The catch is that these wallets are not interoperable and all strive to build “walled gardens,” meaning that they keep you glued to their network only. The best examples of this are WeChat and Alipay, whose walls grew so high that the government interceded.

Wallets are only getting bigger. The assets on them are likely to expand as stablecoins, CBDC, and even crypto become more common, as will their utility with digital ID and health records.

The key is that consumers should have a choice and pick the wallets that work best for them.

👉Key Factors Driving Digital Wallet Growth

🔹 Global shift to digital payments:

As cash usage declines worldwide, digital wallets offer a secure, convenient alternative that aligns with the global trend toward payment digitisation.

🔹 Digital-native generations:

Generations Z and Alpha, who have grown up with technology, naturally prefer digital wallets for their speed, convenience, and seamless integration with digital lifestyles.

🔹 Widespread technological advancements:

Part of a broader transformation in payments, including open banking and real-time payments (RTPs), digital wallets are at the forefront of this change.

🔹Changing consumer expectations:

As consumers increasingly expect instant payments, digital wallets meet the demand for quick, hassle-free financial transactions

🔹 Expanding internet and gig economies:

The growth of the internet and gig economies have fueled the demand for flexible, instant payment options, which digital wallets efficiently provide.

🔹 Serving the Unbanked and Underbanked:

Beyond providing services to the Unbanked, digital wallets also support the Underbanked by offering essential financial services and access to the digital economy.