Embedded Finance's Remarkable Revenue Boom For US Banks

Banks were reluctant to embed, but those who did are now reaping the rewards.

Embedded finance is a money maker and sponsor US banks are raking in some 51% of revenue and deposits from their embedded partnerships. That’s a shocker!

Alloy Labs hits us with big numbers for how much money embedded finance is making for sponsoring banks in a survey that raised my eyebrows and will likely raise yours.

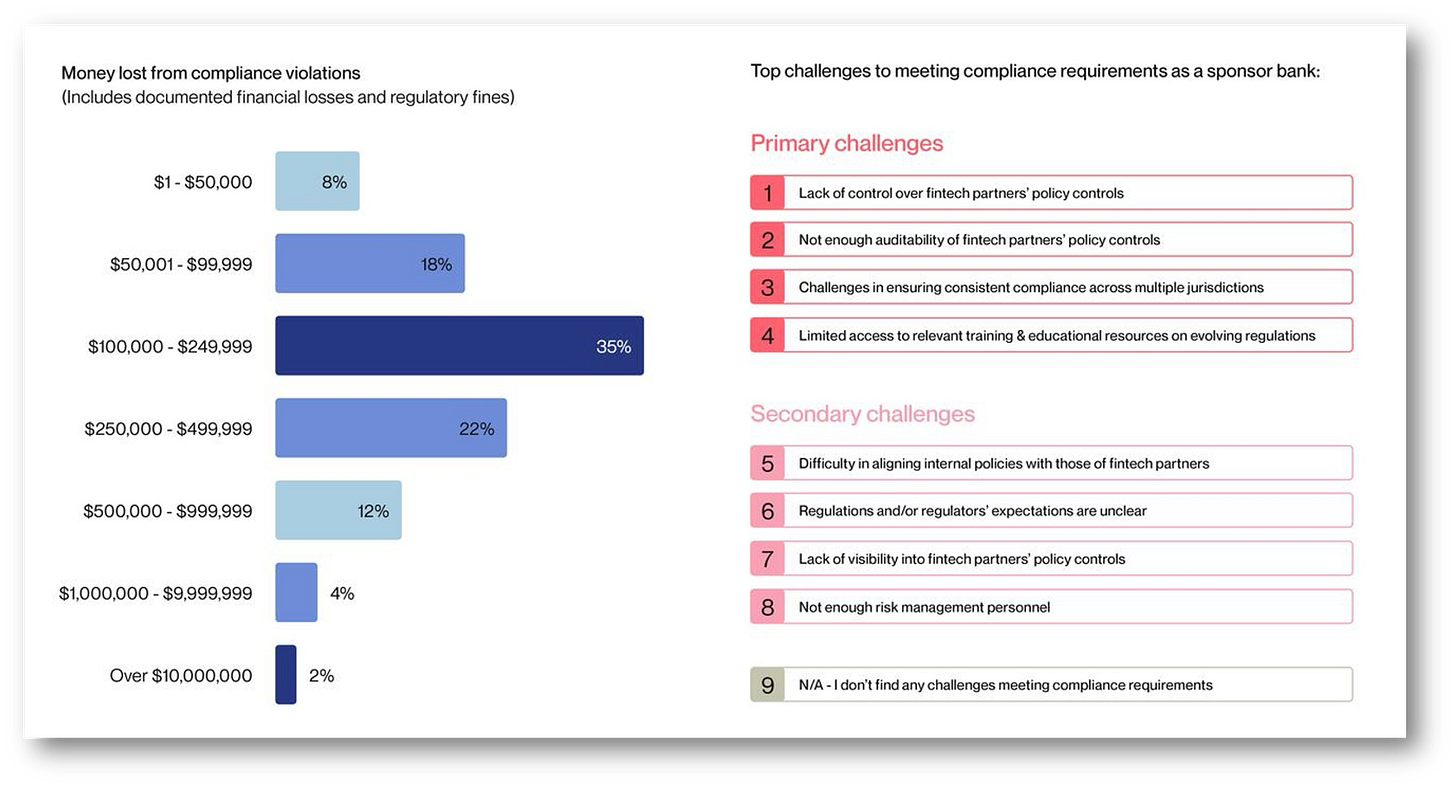

Of course, making money with embedded finance isn’t without peril. Compliance isn’t as easy as banks thought, with 75% of banks losing over $100k to compliance violations!

Who’d have guessed that fintechs would be lax in compliance? So it’s no wonder 80% of respondents report that meeting embedded finance compliance requirements is challenging!

The numbers are impressive, particularly as banks were reluctant to start embedding their services.

That said, I remain slightly skeptical and think more details are required to confirm these numbers are real, but I will take them at face for now.

👉TAKEAWAYS

🔹 94% say that it is “very or somewhat important” for their organization to invest in new compliance technology and increase compliance training

🔹 51% of sponsor banks’ revenue and deposits, on average, are driven by embedded finance partnerships

🔹 80% agree that meeting sponsor bank compliance requirements is challenging

🔹 39% of sponsor banks lost at least $250K to compliance violations in their embedded finance partnerships

🔹 92% of sponsor banks believe that there is a need for more adaptable embedded finance partnerships between banks and fintechs

🔹 Sponsor banks top motivators for embedded finance partnerships: 41% Innovation and acceleration, 39% Customer acquisition, 37% Cost reduction and efficiency

🔹 Most sponsor banks report 6 to 10 embedded finance partnerships

🔹 88% of sponsor banks agree that recent regulatory scrutiny has turned up the heat on embedded finance partnerships

👊STRAIGHT TALK👊

Embedded finance partnerships work and offer banks who use them a way to increase deposits without increasing customer acquisition costs.

The idea that fintech partners can handle customer acquisition for them is compelling.

That said, the compliance part of this relationship is fraught with danger, and the reality is that fintechs will often do “whatever it takes” to bring in the money regardless of compliance.

This leaves banks increasingly clamping down on fintech and, in the most severe model, actually controlling their fintech partners' risk management processes and handling compliance themselves.

Can you blame them?

What is interesting is that embedded finance isn’t just about deposit growth. Banks can also engage in fee-based partnership models, showing how they have more than one way to monetize fintech partnerships.

It’s good to see that fintech works!

You made it this far, so subscribe! Here are the six benefits waiting for you when you subscribe:

Save time: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

Know the future and profit: Get real payback from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing you the future;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Manage your personal AI risk: Don’t be disrupted; be the disruptor. In-depth analysis of how our AI revolution impacts finance so that you can be in front of this great transformation, not behind it;

Stay objective, avoid hype: My writing doesn’t follow corporate diktats. It’s a message that doesn’t conform with mainstream media and is gritty, practical, hype-free, and, on occasion, controversial;

Stay safe: My writing is trusted by nearly 60,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily.

Readers like you make my work possible! Subscribing is free, but I am honored when readers opt for a paid subscription to recognize my high-quality writing and help keep it flowing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!