Fast and Furious: Asia's Real-Time Cross-Border Payment Boom

Asia is pulling ahead and showing us a future with a role for government in payments

Real-time cross-border payments in Asia are booming and will show the world what the future will look like.

Instant payment QR code digital wallets launched domestically are at the root of this revolution, along with two key components: new technology that links domestic real-time payment systems across borders and cooperative government policies.

Let’s take a look.

👉TAKEAWAYS

🔹New Technology:

The BIS Project Nexus: This initiative seeks to connect various national real-time payment (RTP) systems into a global network, facilitating instantaneous cross-border transactions. Project Nexus proposes a "network of networks" model that allows countries to maintain their domestic systems while enabling seamless international payments. It now connects payment systems in Singapore with India, Singapore, Malaysia, Thailand, and Eurosystem’s TARGET. (From memory)

Alipay+: This network will be the next Visa or Mastercard. What is key is that this is private technology that provides a bridge between QR code-based payment systems. It now connects over 88 million merchants in 57 countries and regions to more than 1.5 billion consumer accounts across over 25 bank apps and e-wallets.

🔹New Cooperation and Policies:

ASEAN’s Regional Payment Connectivity (RPC) Cooperation and Policy Framework ASEAN’s RPC cooperation and its accompanying payments policy framework represent a significant stride towards achieving a more integrated, efficient, and inclusive financial ecosystem within Southeast Asia. MoU signees include Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam.

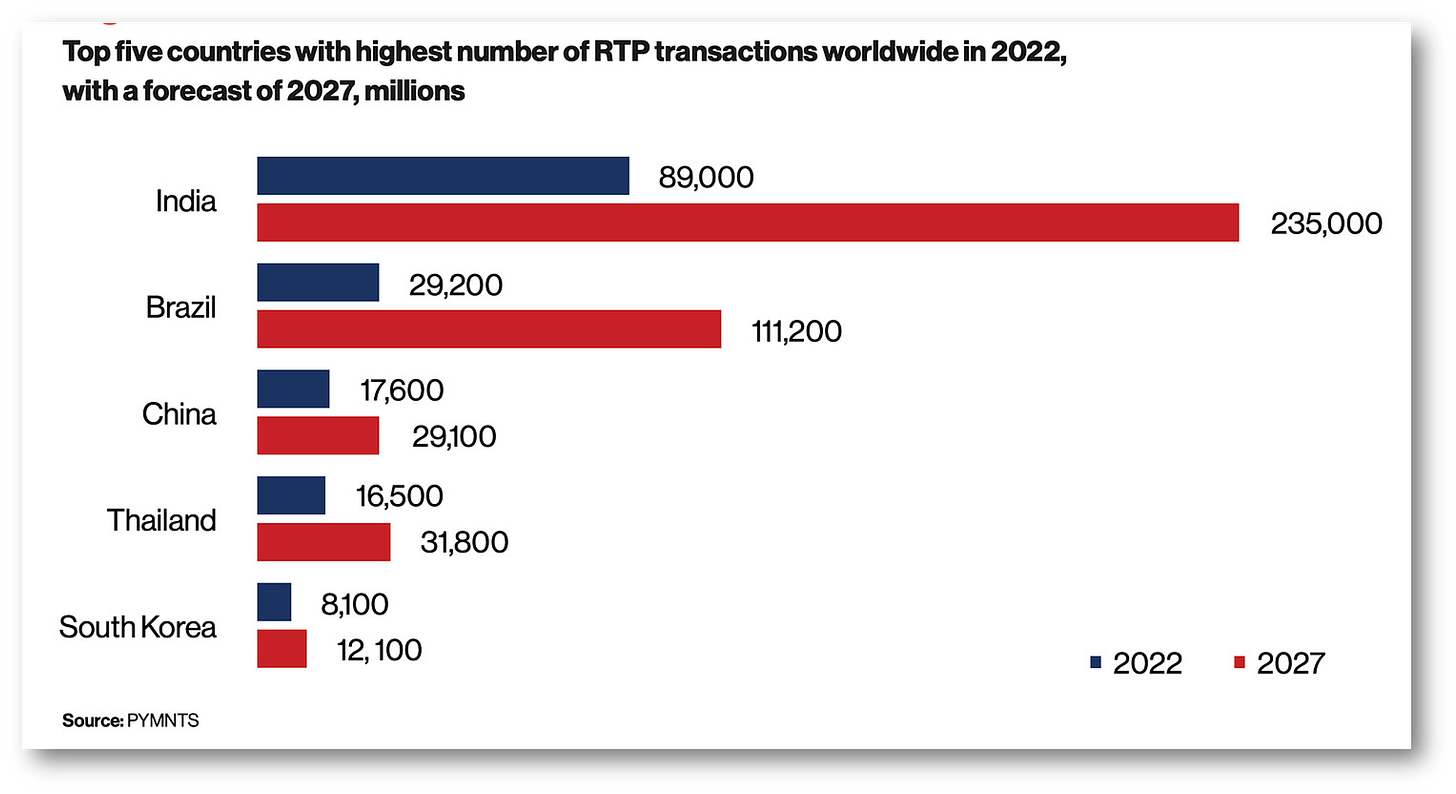

So why are China’s RTPs so small? The statistics are from government-sponsored RTP networks, and China’s payments flow mostly on WeChat and Alipay private networks and are not counted. The part that flows through the People’s Bank of China’s systems is a small fraction of the total, but it is what is reported in these studies. India and Brazil have all RTP payments flowing through government networks.

👊STRAIGHT TALK👊

You are witnessing a radical transformation of payments in Asia with global implications, all based on Alipay’s first use of QR code-based digital wallets.

I recently read an article that stated that China’s digital payment fintechs “have failed to reshuffle international finance.” My response: “Really? Have you looked at Asia?”

The interconnection of these payment systems, whatever technology is used, will create a new payment network that will be a game-changer, even if the West remains card-based.

The key to these systems’ success is that operating behind the scenes are governments who are cooperating with each other.

They fundamentally believe that their citizens have a right to cheaper cross-border payments and that these payments and trade will boost their own economies.

It is this cooperation throughout Asia that is just as critical as the technology.

Note that government participation and partnership with the private sector were also key to the success of PIX in Brazil, UPI in India, and Alipay and WeChat in China.

The government has a key role in payments despite how Visa, Mastercard, and Banks think otherwise and debate this point.

It is being demonstrated to us all right now, but most aren’t paying attention.

Thoughts?

For more on Asia’s QR wallet boom:

SE Asia Turns to QR Digital Wallets, Ditches Cash, and Cares Less About Cards

Southeast Asia is transitioning, with digital wallets taking over from cash payments at an alarming rate! (see below). What makes this transition so interesting is that SE Asia is leaving cards, favored by the West, out in the cold. Watch as the world is divided between card payments in the West and QR digital wallets in Asia!