Fintech at the Speed of Asia

Cross-border QR payments are the next big thing!

While fintech is a global phenomenon, it has undisputedly had the most impact in Asia.

Asia’s growing economies and high levels of underbanked individuals and Small and Medium Enterprises (SMEs) amplified fintech’s impact far beyond anything seen in the West.

Payments are, of course, at the root of Asia’s fintech revolution, with China’s Alipay and WeChat Pay providing the model for other nations to follow.

While payments are a key pillar of fintech throughout the region, it isn’t the only force changing Asia’s fintech landscape.

👉TAKEAWAYS

The Continued Value-Add of Payments in Asia

Asia is at the forefront of QR-based payments, which are now bringing cross-border payments into the mainstream.

Digital Lending Models and Opportunities

Asia’s economic rise is based on SMEs and digital lending for businesses once starved for capital is one of fintech’s greatest success stories. That story started with Alipay.

Digital Banks Reach their Make or Break Moment

Superapps that bring all financial services onto mobile platforms gave rise to digital banks that are not held back by legacy systems. They are reinventing banking in regions where traditional banks closed their doors to large parts of the population.

Asia’s Wealthtech Revolution: A Quiet Disruption

Once the domain of the wealthy, asset management is now available to all. Digitally natives are now demanding not just banking but money management services as a complete package. Once again, the China model is in play.

The Continued Rise of Insuretech

Following close behind digital banking, insurance is going fully digital with products like micro-insurance reaching out to the uninsured.

Technologies that Will Shape the Future

GenAI, blockchain, and Quantum computing are all in Asia’s future. With digitally native services, all will likely leave their mark in Asia before the West.

The Risk of the Future

So what can go wrong? Asia is no stranger to fraud and scams, some especially targeted at uneducated populations with newfound financial inclusion. This is fintech’s double-edged sword, helping and hurting the vulnerable.

SME Lending is critical throughout Asia as shown by the high percentage of SME businesses throughout Asean nations.

👊STRAIGHT TALK👊

There is no going back.

Asia will continue to use fintech to advance financial inclusion that ultimately boosts GDP throughout the region.

The only question is: What is the next big thing beyond payments and superapps?

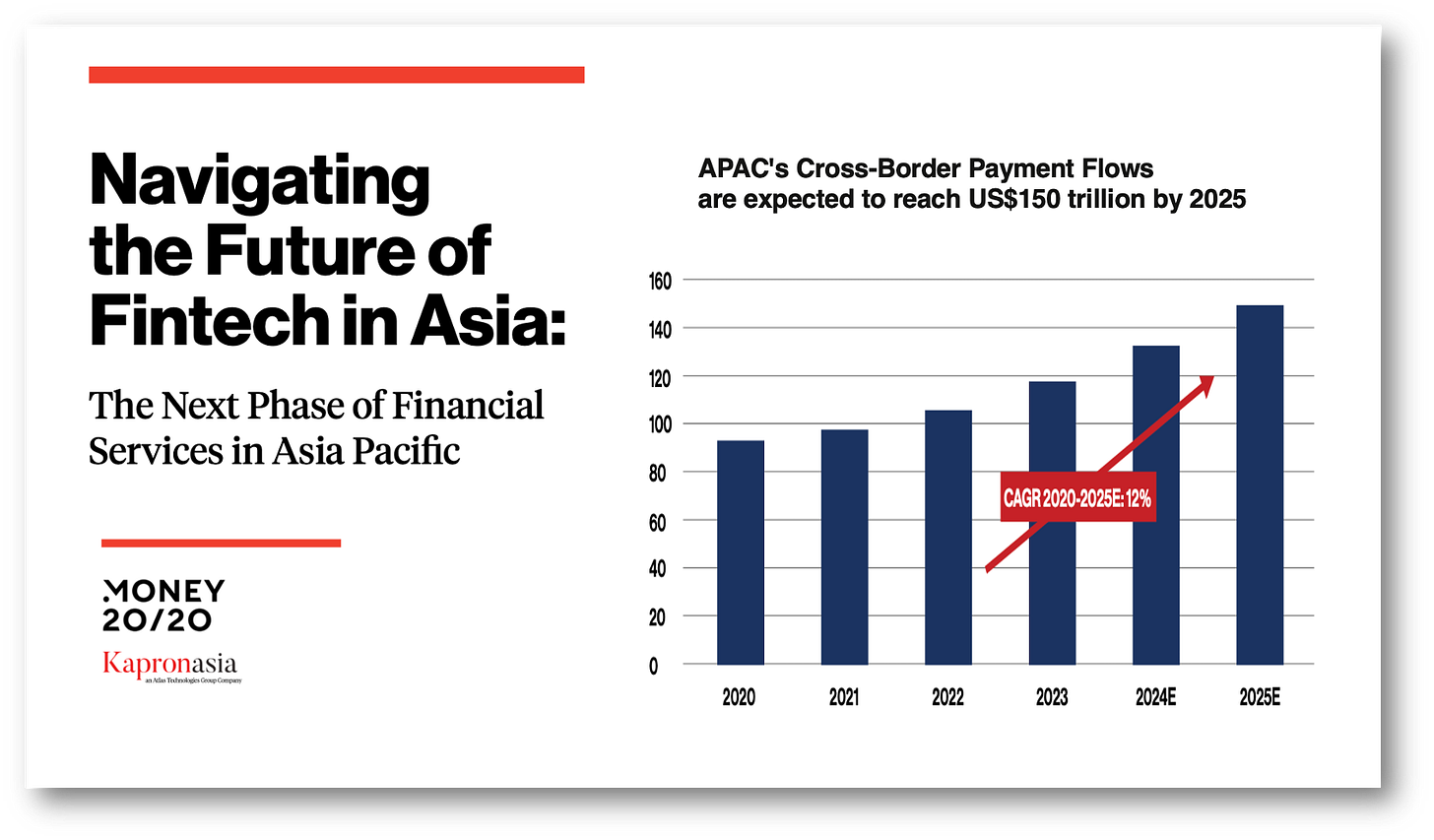

The most likely candidate for the next big breakthrough is cross-border mobile payments.

The region’s reliance on QR codes has created a common language of payment and led to the direct connection of some payment systems in Asia.

National payment systems in Singapore, India, Thailand, and Malaysia have now been connected, and payments and remittances are flowing with newfound efficiency and low cost.

But they aren’t the only game in town, third-party connectors like Alipay+ also provide global QR payments, including connectivity into European markets.

These cross-border payments are forging closer financial ties throughout Asia and must be seen not just as a nicety but as a geopolitical force.

They reduce US dollar dependence, a common regional goal, and bind nations together in trade.

Fintech at the speed of Asia is no joke; it’s happening faster here than anywhere else, and the stakes are far higher than most acknowledge.

Thoughts?