Fintech new growth paradigm: "show me the money"💰 The Asia century is now, and wealthtech knows it 🌏 Geopolitical risk in finance⛔️ IMF: financial access improving📈

China's digital yuan goes straight for the petrodollar!🛢

1. Fintech’s new growth paradigm: ‘show me the money.‘

2. Adapting to a changing world order

3. The Asia Century is now

4. Asia’s wealthtech is the future

5. IMF: Digital finserv improves financial access

6. China's digital yuan goes straight for the petrodollar!🛢

Today’s artwork: Roy Lichtenstein, Industry and the Arts (II), 1969,

“Roy Lichtenstein Industry and the Arts (I), 1969, C.85 is a vibrant print that features a diagonally split composition. As the title suggests, one side of the work embodies “Industry” and is filled with industrial buildings and factories with smokestacks pouring out pollution.

The other half of the work represents “the Arts,” and is bursting with music notes, birds, geometric designs, and other artistic symbols. The warmer color palette gives a more welcoming and positive energy to this half of the screenprint, especially in comparison to the “Industry” half.“

Lichtenstein was clearly commenting on the contrast between these two important parts of society in 1969 when the environmental moment was still young. The same theme works 50 years later for AI and technology, where we are split between tech and arts.

Lichtenstein thought the arts provide life, energy, and interest in an industrial world, and I think they do the same in our new technological world.

That’s why every week, I share great art!

Thanks so much to all of you who have been sharing my newsletter on “X” and other platforms! 🙏 I am so honored. Tweets, now called “posts,” have been turning up everywhere!

By the way on “X” I’m “@richardturrin” tag me in your post!

1. Fintech’s new growth paradigm: ‘show me the money.‘

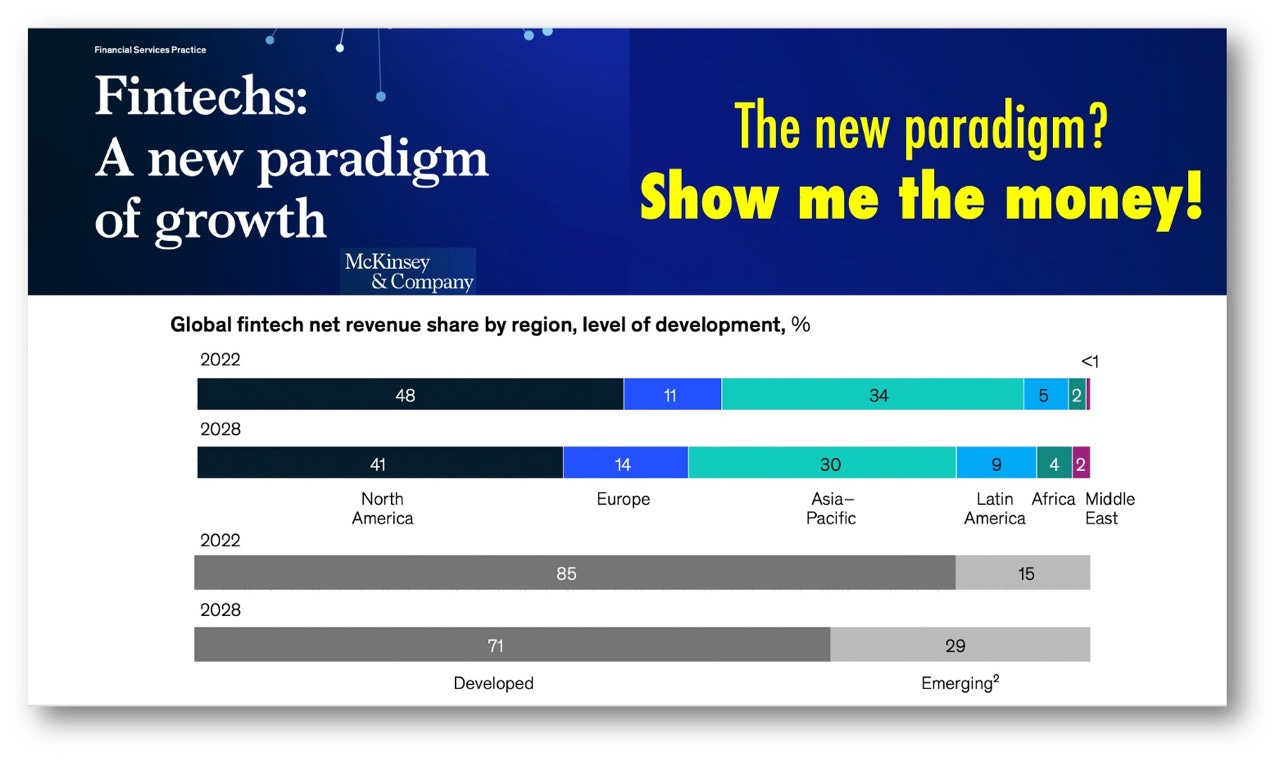

McKinsey declares Fintech “hypergrowth” is dead, and a new “value creation” paradigm is upon us!

McKinsey is right in proclaiming that the fintech party is over but seems not to have noticed that the Moet Chandon stopped flowing, and the disco ball went dark 18 months ago!

Were they passed out from drinking too much Moet or what?

Let me make it easy for McKinsey, the new fintech growth paradigm is called:

💰“SHOW ME THE MONEY!”💰

👉TAKEAWAYS:

Mckinsey’s framework for sustainable fintech growth:

1. Measured growth based on a stable core.

Rather than trying to grow while strengthening the core, ensure there is a strong and stable core business with a targeted and proven market fit before expanding.

2. Programmatic M&A.

Pursue M&A strategically and establish mutually beneficial partnerships based on a programmatic strategy rooted in value sharing (with incumbents and other fintechs), as opposed to pursuing M&A only as a response to a low-valuation environment.

3. Cost discipline.

Control costs to withstand the new funding environment while remaining flexible, nimble, and compliant.

4. Keep the culture alive.

Maintain the agility, innovation, and culture that have been the bedrock of disruption so far.

Is this enough or too late for struggling fintechs?

👊STRAIGHT TALK👊

So McKinsey is right. The party is over, but why did it take 18 months to notice the paradigm change?

Fintech funding faced a 40 percent year-over-year decline, from $92 billion to $55 billion in 2022. So far, in 2023, the market isn’t bouncing back and looks to be lower than in 2022.

First, this doesn’t mean that fintech is dead, dying or any other adjective conveying a sense of doom.

There is a lot of work to be done in modernizing our financial system and fintech will have a rich and important role to play in this process. I don’t doubt that for a moment, neither should you.

Even if it is far too late to be of use, McKinsey is correct in saying that fintech will have to live up to the new paradigm, which I call “show me the money.” The days of unicorn status based on promises of something big happening in the future are over.

But what Mckinsey doesn’t offer is a solution for the 53% of fintech that will be out of cash by Q3 2024 if they do not raise or exit. This is according to a recent Silicon Valley Bank Fintech report.

SVB Future of Fintech report: here

Many of these fintech are not going to get an opportunity to put McKinsey’s advice to the test.

Fintechs used to relying on a zero-rate environment will get hammered by the higher costs of capital, which represent a hurdle to their business models. The numbers just won’t add up.

So this will be a culling of fintechs where only the strong will survive, not an extinction event.

2. Adapting to a changing world order

“Now may be the most dangerous time the world has seen in decades,” says JP Morgan’s Jamie Dimon

JP Morgan Chase CEO Jamie Dimon was brutally honest last week when speaking to investors following third-quarter earnings reports.

He meant it, and he’s right.

This is why I think Oliver Wyman’s “Adapting to a Changing World Order" is an important read for us all.

The report contains six steps for financial institutions to manage GEOPOLITICAL risk.

None of them are difficult, but all require thought about what macro-risks you and your institution will likely confront and how they will impact you.

Two important points:

1) it’s never too late to start;

2) This matters for you, not just your company.

👉TAKEAWAYS:

1️⃣ Ownership definition

Designate central responsibility for monitoring and managing geopolitical risk across the institution

2️⃣ Risk identification and scenario design

Define geopolitical scenarios with varied duration and reach Identify and prioritize risks cascading from each scenario

3️⃣ Impact assessment

•Financial impact analysis: Identify vulnerable business lines, products, and clients and impact to P&L, balance sheet and other risk

•Non-financial impact analysis: Identify non–financial impacts, including people, reputation, cybersecurity

4️⃣ Mitigants, playbooks and simulations

•Identify “no regrets” moves to mitigate immediate identified risks

•Develop crisis playbooks outlining potential actions

•Test crisis playbooks via management simulations

5️⃣ Planning and steering

Incorporate geopolitical risk considerations into BAU strategic planning processes

6️⃣ Risk monitoring

Improve risk management monitoring and decision-making

•Create data dashboards to help inform decision-making

•Create compensating controls for vulnerabilities

I know that none of these are "feel good" exercises, but they are increasingly important.

👊STRAIGHT TALK👊

Geopolitical risk in financial services isn’t new, it has always been inescapable, but this year it is hitting particularly hard.

Jamie Dimon’s honesty was admirable, and you can bet that he has teams at JP Morgan Chase running “impact assessments” on their business for every geopolitical crisis imaginable.

Sadly, there are many crises to imagine these days with two wars and a global sense of dread over what comes next.

This is why I thought Oliver Wyman’s short but important paper was important to share, as it covers six basic planning stages that will help financial institutions plan for the worst.

This is a sobering business and nowhere near as uplifting as talking about AI or other tech marvels that will make our world better.

Some may say, "This is for corporate-level risk people, not me as a business manager."

I would argue that business managers need to think about these issues -before- your corporate risk team or boss asks.

How do you feel about this?

See Blackrock’s “Geopolitical Risk Dashboard” for a great example of the dashboarding recommendation above

3. The Asia Century is now

The Asian century is now. Are you ready?

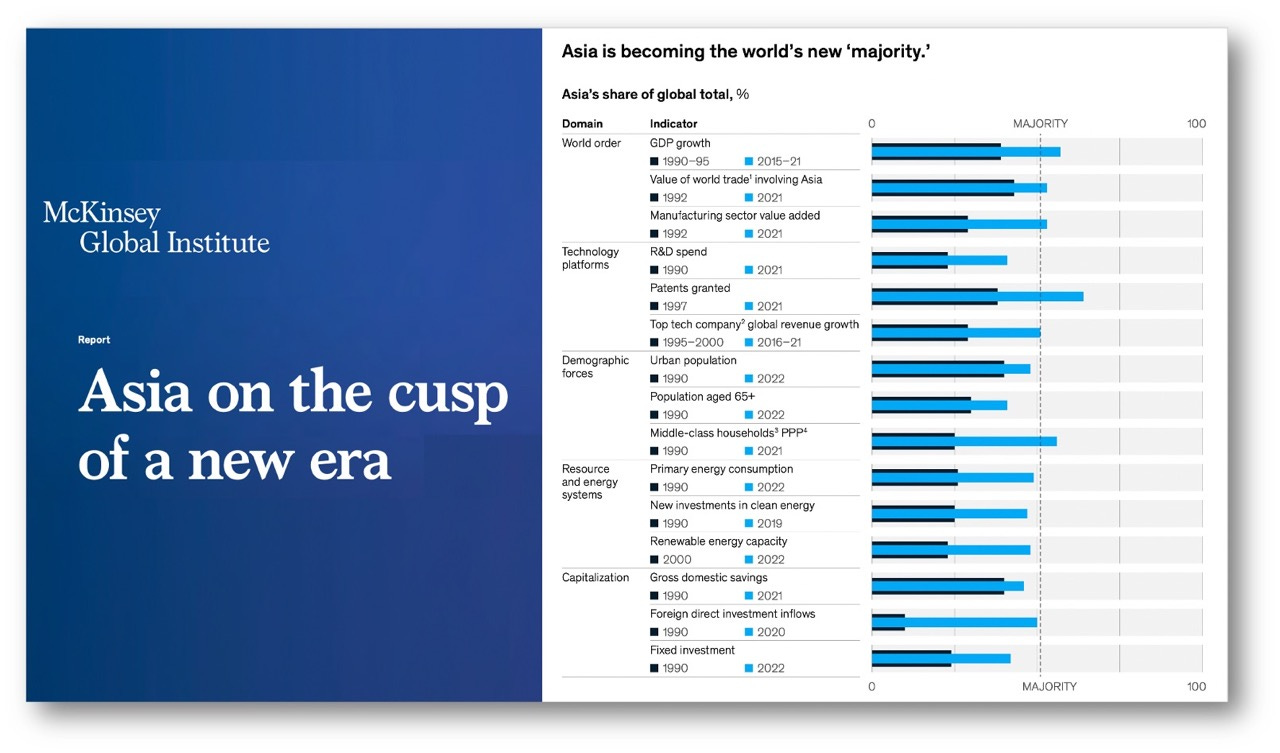

“Asia begins from a very different place being, in many respects, at center stage as this next era unfolds.”

As a follow-up to yesterday’s post on the Asian wealth management boom, we have McKinsey’s view of Asia, with mind-blowing 🔥 MUST READ🔥 statistics.

👉TAKEAWAYS:

🔷 Asia starts a new era in a position of strength as the world’s new “majority.”

•Asia accounted for 57% of global GDP growth between 2015 and 2021, and for the bulk of trade and manufacturing value added.

•It is home to 56% of the world’s middle-class households.

•In 2021, Asia contributed 42% of world GDP (PPP), more than any other region, and cemented its status as a major presence in world trade.

•In 2021, Asia accounted for 53% of global goods trade and 59% of trade growth between 2001 and 2021.

🔷Asia’s role in the world’s 80 largest trade routes, accounts for more than 50% of the value of global trade.

•Forty-nine routes include Asia on at least one end and 22 on both ends.

•Home to 18 of the 20 fastest-growing corridors and 13 of the 20 largest by value.

•Become the world’s largest economic and trading region.

🔥 •59% of Asian trade is with other Asian countries. 🔥

🔷 Asia also faces challenges as it transitions to a new era.

• It is the world’s trade crossroads but could find itself in the crosshairs of trade tensions. (China-US)

• The value created by technology is shifting beyond manufacturing, where Asia excels.

• Asia has the people to fuel growth, but the headwinds of aging are fiercest in the higher productivity economies.

• Its net-zero transition is simply bigger because it is the world’s industrial base and has surging energy demands.

• Asia’s lower capital returns are not sustainable if it needs to attract global capital to grow.

👊STRAIGHT TALK👊

Asia’s growth by the numbers is astounding and shows beyond doubt that we are entering the Asian century.

At the same time, Asia’s rise fuels discontent with the status quo, and the region's low representation in global geopolitics has also helped give rise to BRICS.

One Asian growth figure shocked me more than others, the fact that nearly 60% of Asian trade is with other Asian nations.

This figure shows that Asia is a major trading region in its own right, meaning that Western powers may no longer hold the upper hand in trade negotiations. Asia will not be humbled.

Trade with the West is certainly important but is no longer the cudgel it once was to keep Asian nations in line. Look for this to bring rise to increasing multipolarity that isn’t just China-centric; others want their say.

McKinsey is correct that Asia faces challenges that can’t be minimized and is already caught in US-China trade tensions.

How these will play out remains to be seen, but a US policy of forcing Asian nations to pick “us or them” looks increasingly dubious. Again, note the 60% of trade in the region.

Ignore Asia at your own peril.

The Asian century is upon us. Are you ready?

4. Asia’s wealthtech is the future

WealthTech in APAC will show the West what the future looks like. See why now!

Asia’s fast growth, rising middle class, love of digital, and future-minded regulators are rocket fuel for APAC’s WealthTech market.

But in the land of the super-app, the absolute key is for wealth-techs to use digital to bring the broadest-based access possible.

Asia’s biggest advantage compared to the West is its newly wealthy citizens, who see digital wealth management services as aspirational after being passed over by incumbents for generations.

Once these newly wealthy go for digital wealthtechs, it will be very hard for incumbents to recapture them as many never had an affinity for their brand, and others may even hold a grudge!

👉TAKEAWAYS:

🔷 Challenges for WealthTechs:

1. Conquering high customer acquisition costs.

2. Institutionalizing asset democratization and augmenting market liquidity.

3. Navigating cross-border complexities.

4. Unifying disconnected ecosystem players for seamless integration.

5. Elevating financial and investment literacy for informed decisions.

6. Bridging the funding gap.

7. Achieving self-sustainability, scalability, and profitability.

🔷 Disciplines to master for WealthTechs:

1. Crafting a strategic approach to distribution partnerships for programmatic scaling.

2. Reimagining geographic coverage and cross- border integration.

3. Adopting data-driven, segment-specific marketing.

4. Establishing world-class personalized digital experiences.

5. Unlocking emerging white spaces with core technological capabilities.

6. Transforming customer engagement and insight generation with digital analytics tools.

Asia’s markets are fiercely independent and very regional. I like McKinsey’s breakdown, but they seem to ignore how hard it is to provide cross-border services to extremely different cultures.

👊STRAIGHT TALK👊

Asia and APAC’s digital boom is not limited to payments, and wealthtech is following fast in its footsteps.

WealthTech is closely related to payments in APAC and are closely related.

Interestingly, McKinsey doesn’t make this connection in the report despite APAC being the home of the super-app.

Below this comment is THE MOST IMPORTANT GRAPH YOU WILL READ THIS MONTH.

The graph shows the 113 million people who will join the global middle class in 2024 and the vast majority come from Asia.

There is simply no other region in the world with an emerging wealthy class equivalent to Asia.

This is one reason wealthtech is focusing on the region. Where else could it go for unicorn-level growth?

These 113 million are the targets for the digital services provided by wealthtechs. They are newly affluent, and for the most part, they have no strong love of incumbents who likely ignored them on their rise up!

What is hard to get across to Westerners who grew up with wealth management services is that throughout Asia, brokerage accounts are aspirational.

People simply never had access to them before, and they are seen as a sign of having made it, even if the amounts invested are small.

5. IMF: Digital finserv improves financial access

The IMF's Financial Access Survey shows that digital financial services contribute to global gains!

Finally, some good news! The IMF looks at financial access and likes what it sees: “Data from 2022 indicate a sustained level of financial inclusion, bolstered by the rise in digital financial services.”

But this doesn’t mean we can rest easy. SME lending took a dive post covid, and the gender gap in financial access is still a pressing problem.

👉TAKEAWAYS:

🔷 Usage of Digital Financial Services Continued to Make Gains:

The means to access finance have seen a seismic shift in recent years. Traditional touchpoints like ATMs and bank branches are declining, while non-traditional platforms such as retail and mobile money agents are surging.

🔷 Lending to SMEs is Receding:

After an initial spike during the early days of the COVID-19 pandemic, there was a decrease in the outstanding loan amounts to SMEs Much of this decline is attributed to unwinding covid support provided by gov’t.

🔷 Gender Gaps Remain Persistent in Financial Access:

The persistence of the gender gap in financial access across many economies, is both concerning and critical to address.

🔥On average, men own 55 percent more deposit accounts than women in the sample and also hold significantly higher outstanding value of deposits than women. 🔥

Shocking numbers that show how much work remains!

👊STRAIGHT TALK👊

So are debit cards the answer to inclusion?

“The number of debit cards is rising over time in all regions, in line with the trend of deepening bank penetration. On the other hand, while the number of credit cards increased rapidly in the Western Hemisphere region, the uptake of credit cards remains limited in Africa, likely reflecting the popularity of mobile money in the region.”

In fact, in Africa, a hub for mobile money, the value of these transactions increased from 26 percent to 35 percent of GDP between 2021 and 2022!

So cards certainly have a role to play but are regionally limited. It’s not clear if they will conquer the developing world just yet.

On the gender gap, the IMF has no solution but makes the importance of closing this gap crystal clear:

“The broader implications of the gender gap are significant, with macro-critical effects on economic growth, income inequality, and poverty alleviation.”

6. China's digital yuan goes straight for the petrodollar!🛢

China's digital yuan goes where Alipay and WeChat Pay never could, straight for the petrodollar!🛢

China just sent chills down the spine of US Fed Governors when PetroChina International Corp Ltd bought 1 million barrels of crude in digital yuan (e-CNY) last Thursday. In doing so, PetroChina completed the first-ever international crude oil trade to be settled in e-CNY at the Shanghai Petroleum and Natural Gas Exchange (SHPGX).

Subscribing is 100% free, you’ll be glad you did!

In the unlikely event you don’t like my newsletter, click unsubscribe at any time to “invite danger!”

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE

Hi Stefano, thanks so much for the restack. Delighted you enjoyed my writing!