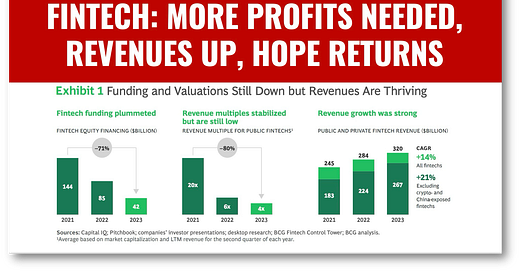

Fintech Outlook: More Profits Needed, Revenues Up and Hope Returns.

The fintech outlook is still a mixed bag with profits thin but revenues growing and hope returning for some.

In the end this is an old story we’ve heard for a while now: fintechs need to get profitable. This isn’t new but making things worse is that the road to riches through IPOs and buyouts is not just rocky, but downright dangerous!

But this dour message is balanced by some good news with $300 million in fintech revenue today expected to grow to $1.5 trillion by 2030 💥Boom!💥

More good news the embedded finance market will be worth $320 bn by 2030 and connected commerce for banks is also “poised for liftoff” as their next killer app.

The problem with both of these is that embedded finance which is 99% BNPL is a mature market, and if existing fintechs missed it they’re not jumping in now. As for connected commerce, I like it, but I still see it as being very niche, less aimed at fintech, and more toward marketing and e-commerce.

👉THE FINTECH STORY

FINTECH PROFITS ARE SPARSE, REVENUE IS GROWING, BUT COSTS ARE HIGH…

🔹 Profits: A Call for Fintechs to Improve EBITDA by More Than 25 Percentage Points. Only 33 of the 70 largest public fintechs were profitable in 2023, and top-quartile players in terms of EBITDA outpaced bottom-quartile firms by roughly 25 percentage points in 2023 in all cost categories.

…WHILE REGULATIONS TURN AGAINST THEM…

🔹 Prudence: Risk and Compliance as Competitive Advantage. The current regulatory environment, along with the growing opportunity for strong bank-fintech partnerships, is increasing the critical importance of risk and compliance readiness

…BUT FINTECH GROWTH THROUGH IPO IS NOT GUARANTEED…

🔹 Growth: Journey to IPO (or Strategic Sale) and Beyond. As interest rates moderate, we expect IPOs—along with strategic sales and other M&A activity—to take off. But many fintechs have made the IPO leap only to see their stock prices drop by as much as 40% to 80% from initial listing.

…AND GROWTH THROUGH BANK PARTNERSHIPS IN THE BOOMING EMBEDDING MARKET MAY ONLY HELP SOME…

🔹 Growth: Retail Banks As Digital Engagement Platforms. To provide a counterweight to fintechs that embed financial services into nonbanking journeys, banks can continue to develop their own commerce sites, where they can leverage their vast data on customer needs and behavior.

…DON’T COUNT ON GOV’T FOR HELP!

🔹 Growth: Government Support for Comprehensive and Integrated Digital Public Infrastructure. Many countries have tried to emulate the success of the two leading players: India’s UPI and Brazil’s Pix, but fintechs can’t expect a repeat performance!

THE MORAL OF THE STORY:

🔹 And the moral of this fintech story is that fintech will do fine long term but there is still a hangover from tremendous growth and weak profits. The new moral of the story is “Grow as fast as you can—subject to positive net income and neutral cash flow,” to live happily ever after.

When only 23 of 453 digital banks are profitable, it would seem that they have not yet demonstrated “profitability at scale.” What am I missing?

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—and you’ll be glad you did!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!