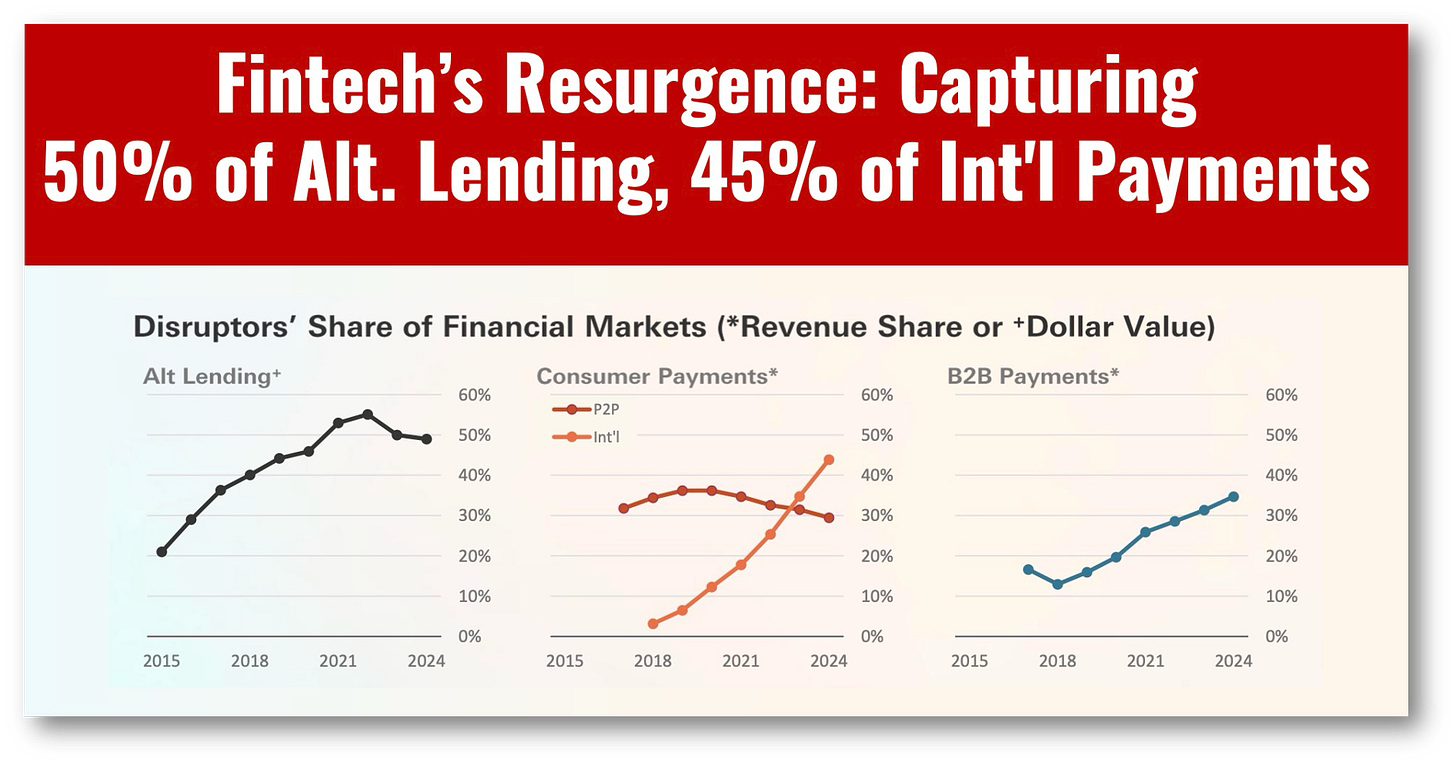

Fintech’s Resurgence: Capturing 50% of Alt. Lending, 45% of Int'l Payments

Fintech's dark days are behind it with new money and purpose.

This is my daily post. I write daily but send my newsletter to your email only on Sundays. Go HERE to see my past newsletters.

HAND-CURATED FOR YOU

HSBC released an overwhelmingly positive report on fintech, describing a “resurgence” and documenting how it is taking market share from alternative lending, consumer payments, and B2B payments.

This report from HSBC is great news, showing that fintech’s dark days are behind it, new money is coming to market, and how it is a real force for incumbents to contend with.

While many fintechs failed at great cost to investors, we celebrate those who did survive and the positive impact they have had in reshaping customer expectations, compressing margins, and making financial services better for all.

The most stunning revelation in the report is the commanding market share for fintechs in alternative lending, and consumer and B2B payments fintechs with 50%, 45% (int’l transactions), and 35%, respectively.

Other sectors may not command such impressive market shares, but they still force incumbents to offer better services.

Neobanks and trading platforms, for example, may capture only 2% and 7% of the market revenue share, respectively, but compress trading fees for all.

HSBC makes an interesting observation that suggests it won’t be smooth sailing for some of the larger fintechs as they expand into each other’s territories.

Many fintechs may have started in a particular vertical but have now expanded horizontally, competing with other fintechs.

Revolut, for example, now offers services in asset management, overlapping with Robinhood and Coinbase. Meanwhile, PayPal may have started early in banking for small businesses, but now has competition from Stripe, Adyen, and Block.

Many of these larger fintechs will build platforms that can cannibalize from other fintechs as much as incumbents.

Let’s savor the moment, as this report is overwhelmingly good news for fintech!

👉Key findings:

🔹 Horizontal Convergence Has Triggered a Platform Battle:

As key fintech players with vertical financial service offerings grow and expand, the services continue to expand into one another, creating increased competition and the opportunity for single solution providers.

🔹 Consolidation as a Defensive Strategy:

Where fintech startups have gained meaningful share - such as in business payments and asset management - incumbents have responded by consolidating with peers rather than acquiring disruptors. This signals a shift in strategy as traditional players fight to defend market position amid platform competition.

🔹 Emergence of Embedded Finance:

With the maturation of APls and BaaS infrastructure, the expanded opportunity for embedded financial services offering, by both financial and non-financial companies, is opening the door for massive disruption and potential ecosystem-shifting partnerships for incumbent financial services companies.

🔹 Al as a Defining Force for the Next Wave:

As the next broader technological wave of Al opens new customer opportunities, the financial services industry will find unique ways to both improve operating margins and to leverage data into new customer experiences, creating a paradigm shift in the way consumers and businesses engage with the market for their financial needs.

🔹 Resurgence of Fintech Liquidity: Consolidation within and outside of the financial services industry will push some to the public markets to leverage a public currency and lower cost of capital, while others seek acquisition by larger balance-sheet partners to compete in the next fintech wave that promises to further shakeup the status quo.