Four paradigms for digital money; Programmable e-CNY in the Greater Bay Area; King dollar and multipolarity

De-dollarization weekly kicks off in a new weekly section

1. Four paradigms for digital money

2. Programmable e-CNY in the Greater Bay Area

3. King dollar and multipolarity

Today’s art: Street art from Padua, Italy. Here are two pieces, one by Alessio-B reminiscent of Banksy. The second on the right, entitled “Weeping Position” is by Stefano Soffiato. The weeping position is, in fact, a place to cry on, available to everyone. Just lean on it and, with your face hidden, leave room for tears. “There are several reasons to cry” –said the artist.

Italian edition newsletter, please forgive any errors in editing.

I am proud to be the No. 4 global fintech influencer on the prestigious Onalytica influencer list. I got there by writing solid articles that people like you want to read. This is the place if you want crystal clear, hype-free discussion on all CBDCs, fintech, crypto, and China’s tech scene. All my writing is backed up by my curation of the very best educational PDFs in the business. Subscribe, and you’ll be glad you did!

1. Four paradigms for digital money

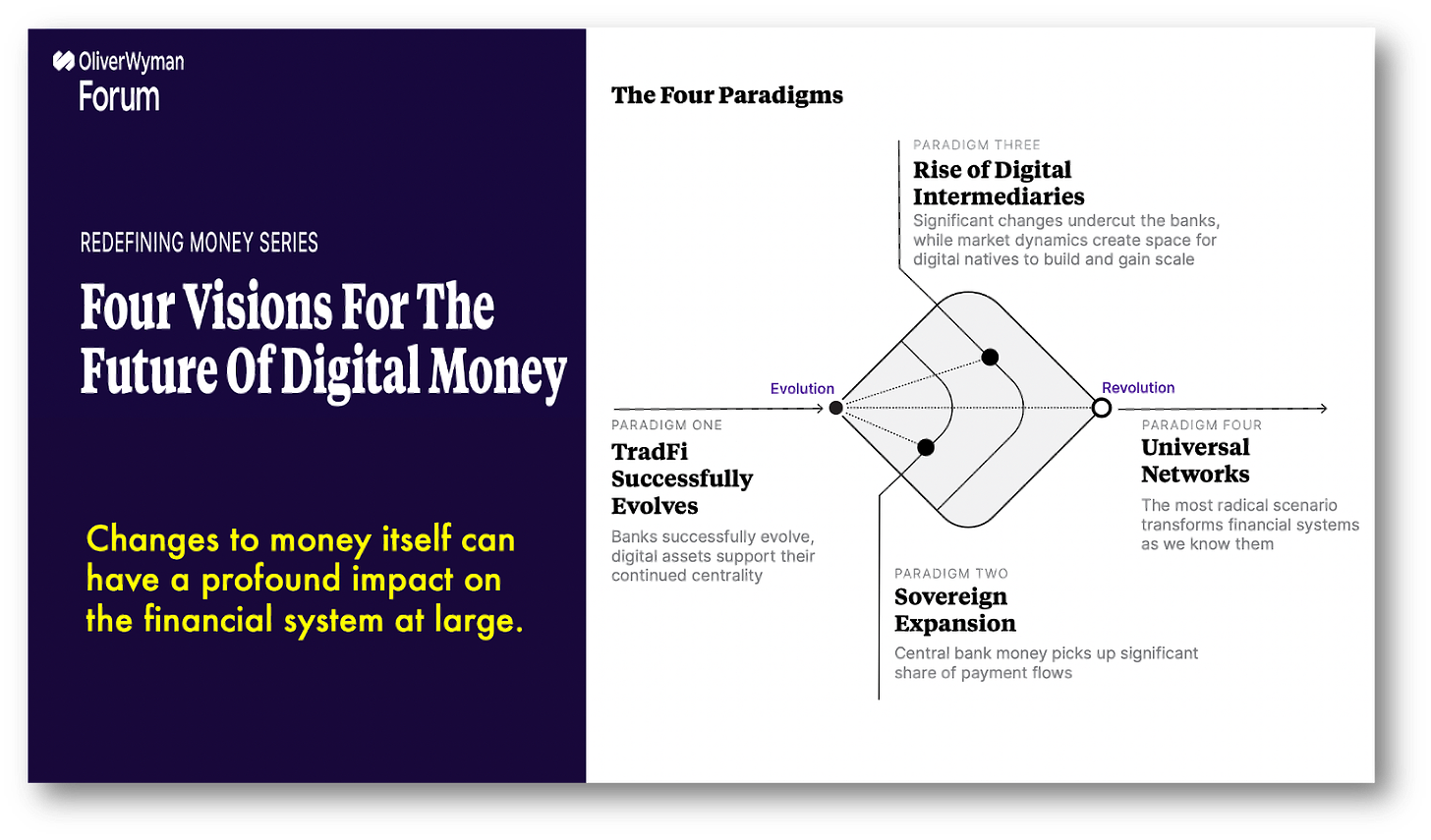

Four paradigms for the future of Digital Money and CBDC is the most likely winner.

Download: here

Oliver Wyman does a FABULOUS job at looking at the future of digital money and sees four potential paradigms for the future.

Which of these paradigms will win?

1️⃣ Traditional Finance Successfully Evolves

–Digital assets support the continued centrality of banks and other financial institutions.

This paradigm represents an evolution of the existing system, not a revolution, as banks and other incumbent financial institutions continue to dominate.

2️⃣ Sovereign Expansion (CBDC)

–Central banks use CBDCs to gain share in payment flows.

In this paradigm, central banks would provide retail or wholesale users with CBDCs and use their instantaneous settlement capabilities to pick up a significant share of payment flows.

3️⃣ Rise of Digital Intermediaries

–In between evolution and revolution.

This paradigm sits somewhere between evolution and revolution, with digital natives gaining scale as the traditional financial industry struggles to adapt. Banking could be squeezed, with digital natives controlling customer access and expanding financial services provided.

4️⃣ Universal Networks

–Revolution – the financial system as we know it is transformed

Transactions would be conducted without intermediaries, powered and governed by smart contracts and institutional decentralized finance protocols.

Of the four paradigms presented only two will take us into our “cashless” future. They are “Sovereign Expansion” which means CBDCs and “Digital intermediaries.”

These paradigms match the trajectory of China’s payment system, which is a decade ahead of the West and points to its future. China is putting CBDCs onto digital platforms like Alibaba and WeChat to form a new partnership that eliminates “walled gardens” and provides inclusion.

The other two paradigms presented are non-starters. Traditional finance can’t and won’t evolve fast enough to meet the needs of its users, particularly in the digitally hungry global south. In the West banks are already being challenged by the likes of Apple. “Universal networks” are overly utopian and likely will not receive regulatory approval.

What is key is that all four paradigms will coexist. The dominance of any does not mean that the others die off.

This isn't winner takes all.

Thoughts?

Takeaways:

—Our digital money’s future rests with CBDC and digital intermediaries.

—Traditional finance cannot evolve quickly, and the state will never permit universal networks.

—All four paradigms will coexist, it won't be winner take all.

Hey you, yeah you! Subscribe!

You’ll be glad you did!

2. Programmable e-CNY a game changer in the Greater Bay Area

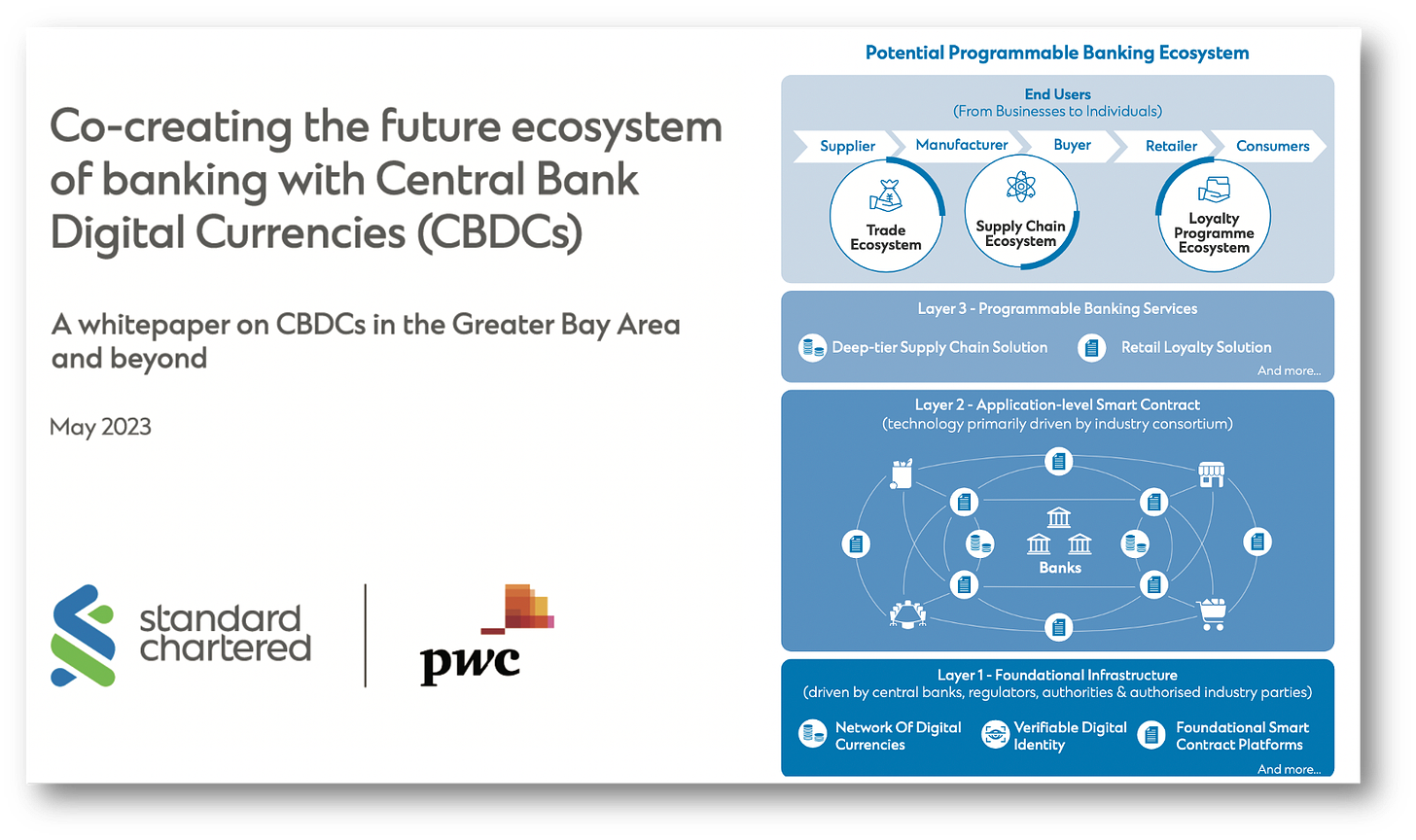

China's programmable CBDCs will create the "future ecosystem of banking."

Download: here

While the US passes laws prohibiting CBDCs and CBDC research China is pushing ahead with fully programmable CBDCs that will change our world. The big question is how will programmable CBDCs be used?

Standard Chartered and PwC teamed up on a white paper to show how programmable CBDCs may be used in the “Greater Bay Area” (GBA) in what is likely to be a “foundational framework for how other CBDCs could interact in cross-border commercial scenarios.”

Why the GBA?

The GBA comprises 11 megalopolises and three currencies, comprising the province of Guangdong, Hong Kong, and Macao. The "GBA” is a critical driver of China’s economic growth, with a total GDP of CNY12.6 tn in 2021, equivalent to 10% of the combined GDP of Mainland China, Hong Kong, and Macau.

What are the use cases for a programmable CBDC?

1️⃣ Programmable retail platforms

The report details how programmable CBDCs could be used for “cross-border loyalty platforms” and “loyalty programme alliances” which take the work out of managing these programs for the issuer and the user.

The pain point is that spending of loyalty points requires consumers to use separate cards and mobile apps, which are cumbersome and region-specific.

The solution is a CBDC programmed to be payable only to specific merchants could be a solution to loyalty programs. So a Chinese e-CNY programmed for use at “Lane Crawford” department stores could cross borders between HK and the mainland, combining their loyalty programs.

2️⃣ Programmable trade and supply chain financing

The pain point CBDCs solve is supplying underserved SMEs with credit. Currently, up to 80% of global trade is facilitated by financing solutions or credit insurance, which may not be available ‘deep-tier’ SME suppliers without credit history.

The solution is a programmable CBDC that allows the credit or liquidity of larger ‘anchor enterprises’ could be extended to their SME suppliers on project completion.

While loyalty programs are a valid use case, cross-border finance drives China's GDP!

This is why StanChart and PwC are spot on in saying: “CBDCs driven by central banks have the potential to be the trade instruments of the future.”

Thoughts?

Takeaways:

—Programmable CBDCs' first use will be in China's GBA.

—Watch the use cases in the GBA as they will likely be similar to those rolled out for BRI and RCEP nations.

—Look for CBDC to unlock further GDP growth.

—These are only the first of many use cases for programmable CBDCs, which will drive many more innovations.

Share this with someone you know will love it!

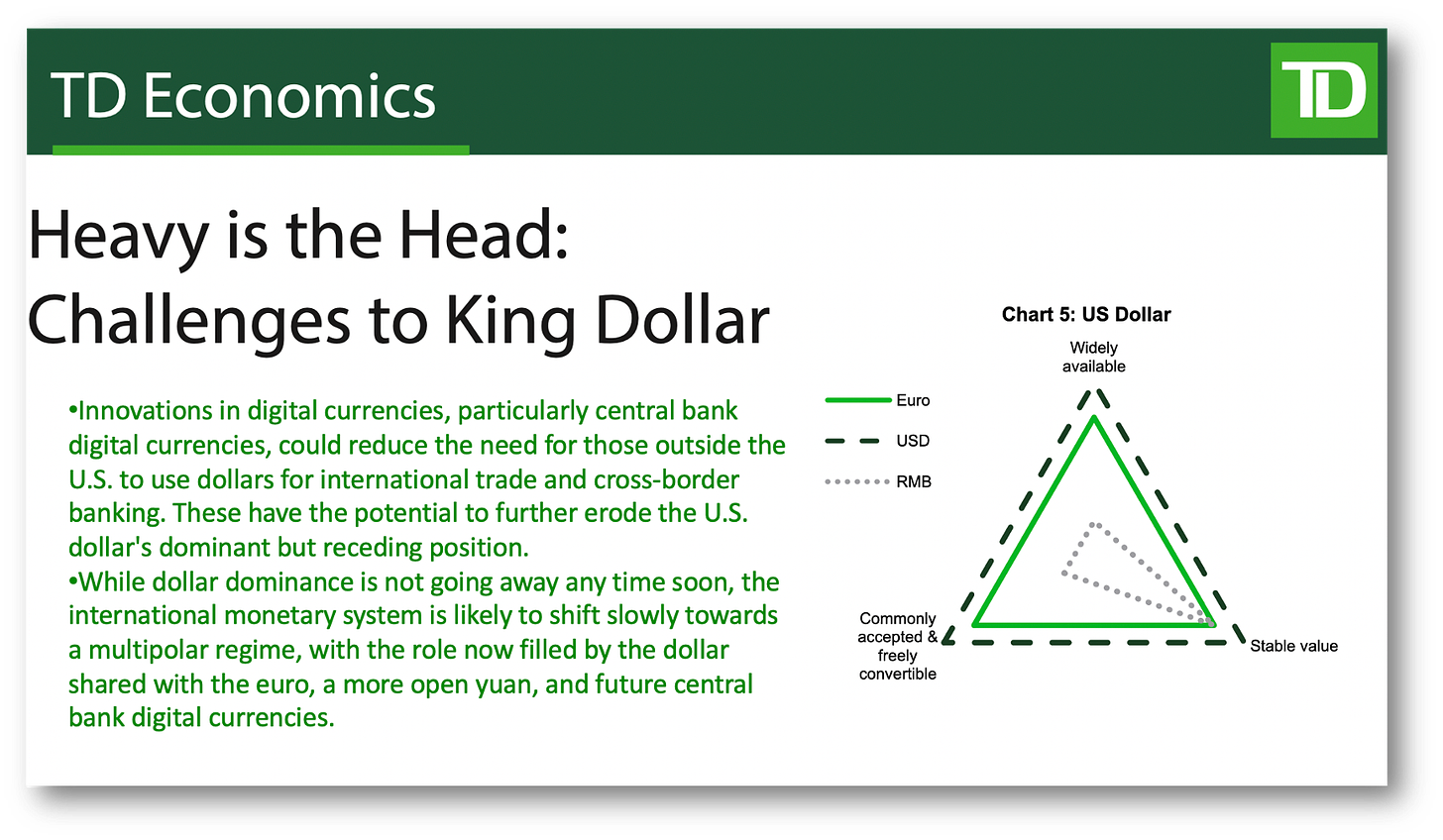

3. De-dollarization weekly: King Dollar and the shift to multipolarity

DE-DOLLARIZATION WEEKLY: Dollar dominance could give way to a new regime that includes the euro, yuan, CBDCs, and maybe something 'we have yet to see'

Download: here

I'm launching a new weekly feature called “De-dollarization Weekly” that tracks the trend for de-dollarization and the role of CBDCs and the Chinese yuan in this process.

De-dollarization is a hot topic and is increasingly going mainstream, with analysts at major banks, here TD Bank, claiming that the dollar’s grip on world payments will be loosened by sanctions fatigue and the desire of the global south for a better deal in payment.

These changes will lead to a “multi-polar” currency regime where the dollar will play a significant but diminished role.

CBDC will push this transition forward, and while I’ve written about it consistently in the past, I think it deserves a weekly special as it is a macro change that will impact us all.

Today a PDF from TD Bank, shows that this topic is mainstream and hardly the exclusive domain of China's “collaborators” or “sympathizers.”

Highlights from TD Bank research:

• Interest from countries across the globe in alternatives to the U.S. dollar-dominant international monetary and financial system has grown since the U.S. decision in 2022 to freeze Russia's foreign currency reserves.

• The most notable efforts to conduct international trade and finance without the U.S. dollar have been led by China.

• Despite the recent pronouncements from authorities in China, Russia and elsewhere, movement away from the U.S. dollar globally has been slow and small.

🔥 • Innovations in digital currencies, particularly central bank digital currencies, could reduce the need for those outside the U.S. to use dollars for international trade and cross-border banking. These have the potential to further erode the U.S. dollar's dominant but receding position. 🔥

• While dollar dominance is not going away soon, the international monetary system is likely to shift slowly towards a multipolar regime, with the role now filled by the dollar shared with the euro, a more open yuan, and future central bank digital currencies.

Thoughts?

Takeaways:

—De-dollarization doesn’t mean “death of the dollar” but a change in dollar status.

—Expect this to be a slow process, which is why many will deny its existence.

—CBDC and China’s e-CNY will play a role in this process.

—CBDC or the CNY needn’t “topple the dollar” to be transformational. Just provide a cheaper alternative.

Hey, if you read this far in this newsletter, go ahead and do us both a favor and subscribe. You’ll be glad you did. If you don’t like it, unsubscribe! How’s that for a deal?

Subscribing is the only logical course of action.

And share on Twitter because:

"The needs of the many outweigh the needs of the few or the one."

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. The best way to ensure you see the stuff I publish is to subscribe to the mailing list here on Substack, which will get you an email notification for everything I post.

Everyone, including platforms that disagree with me, has my permission to republish, use or translate any part of this work or anything else I’ve written (except my books) with credit given to me and this site (richturrin.substack.com) free of charge. For more info on who I am, what I do, and where I’m going, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE