GenAI: $1 tn Spent With Nothing to Show For It?

Expectations that investing in AI innovation will quickly pay for itself are wrong.

“Tech giants and beyond are set to spend over $1tn on AI capex in coming years, with so far little to show for it. So, will this large spend ever pay off?”

Goldman Sachs has a great analysis that asks fundamental questions about when AI will pay off with pro and con sides represented.

The argument is not whether GenAI is transformative but whether it is cost-effective and can live up to the claims of big GDP growth.

My take is that it is an unrealistic expectation to think that investing in any innovation will pay off quickly.

👉TAKEAWAYS

Con side:

🔹 Con Forecast: AI will increase US productivity by only 0.5% and GDP growth by only 0.9% cumulatively over the next decade.

🔹 Only a quarter of AI-exposed tasks will be cost-effective to automate within the next 10 years, implying that AI will impact less than 5% of all tasks.

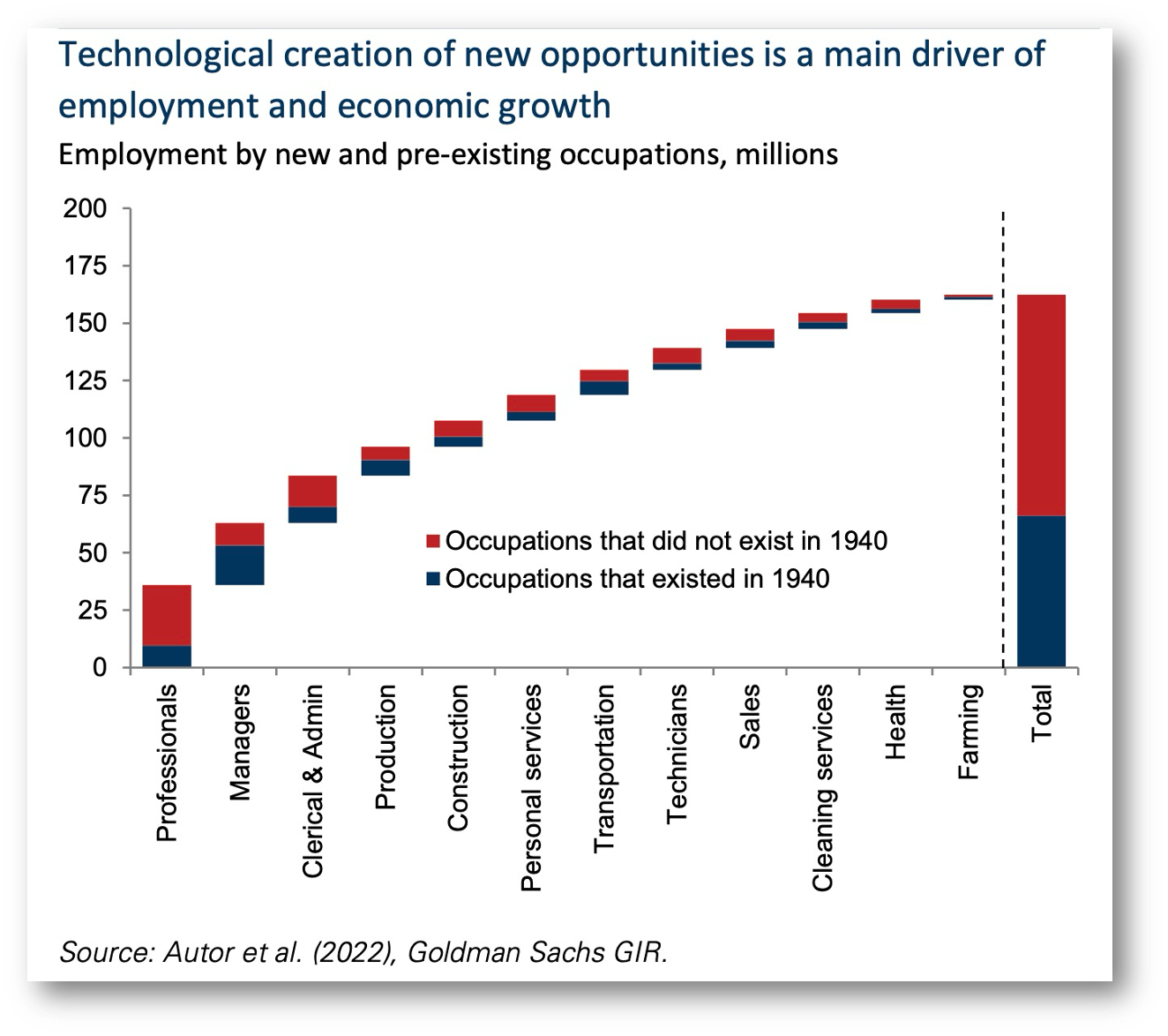

🔹 Can AI adoption create new tasks and products, saying these impacts are “not a law of nature.”

🔹 To earn an adequate return on the ~$1tn estimated cost of developing and running AI technology, it must be able to solve complex problems, which, he says, it isn’t built to do.

🔹 Truly life-changing inventions like the internet enabled low-cost solutions to disrupt high-cost solutions even in their infancy, unlike costly AI tech today.

🔹 Will AI’s costs ever decline enough to make automating a large share of tasks affordable, given the high starting point as well as the complexity of building critical inputs—like GPU chips?

Pro side:

🔹 Pro Forecast: AI will ultimately automate 25% of all work tasks and raise US productivity by 9% and GDP growth by 6.1% cumulatively over the next decade.

🔹 The large potential for cost savings and the likelihood that costs will decline over the long run—as is often, if not always, the case with new technologies—should eventually lead to more AI automation.

🔹 AI’s “killer application” has yet to emerge.

🔹 Current capex spend as a share of revenues doesn’t look markedly different from prior tech investment cycles.

🔹 The potential for returns from this capex cycle seems more promising than even previous cycles, given that incumbents with low costs of capital and massive distribution networks and customer bases are leading it

👊STRAIGHT TALK👊

So whose side are you on?

I’m on the pro side. We are too early in the AI cycle to expect big tech to recover its massive investment.

No one can argue that the investment isn’t huge, but the payoffs, even if only half of the 6.1% of US GDP predicted in the optimistic case, are still extraordinary.

The “Con” side does have a point. What will make or break this investment is the speed with which GenAI gets smarter and can do more complex tasks, i.e., make more humans redundant. Only then will its true economic impact be felt.

There is another “wild card” that is harder to predict: whether shortages of chips and electric power will be the limiting factor for AI potential.

I’m still the optimist and I wrote in my book “Innovation Lab Excellence” that expecting fast payback on innovation is a guaranteed way to cripple it.

We’ll need a few more years to see how AI develops before we can say whether the AI bubble was money well spent.

Ever the optimist, I think it will be.

Join our community by subscribing. You’ll be joining an exciting journey down the rabbit hole to our shared digital future—and you’ll be glad you did!

Subscribing is free, but I am increasingly honored by readers volunteering to opt for a paid subscription in recognition of my high-quality writing. Thank you!

If you like what I write, and this newsletter has created value for you, and want to support my independent writing with a paid subscription, you have my heartfelt thanks!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!