GenAI in Financial Services is great but why not AI "incident reports" for when it goes haywire? Superapps are coming and so are privacy protecting CBDCs!

The IMF on AI economics, and I talk CBDC on a great podcast!

Artwork of the day: Composition IV - Vassily Kandinsky, 1911

“In the midst of his transition to abstraction, Vassily Kandisky created this work. The artist preferred to render the world abstract to incite a vision beyond material existence. He rationalizes a feeling of Nietzsche for whom destruction was linked to creation. The agitated left side is teeming with dark activity and shows a world gone haywire, while the right side is calmer and lighter, synonymous with spiritual regeneration symbolized by the blue mountain in the center.”

Only Kandinsky would do for today’s artwork. Note that the left-hand portion of the painting shows a world gone "haywire” while the right is calmer and lighter synonymous with spiritual regeneration. I love it!

I have news for you all: we are still on the left-hand side of the painting when we talk about AI and its impact on society.

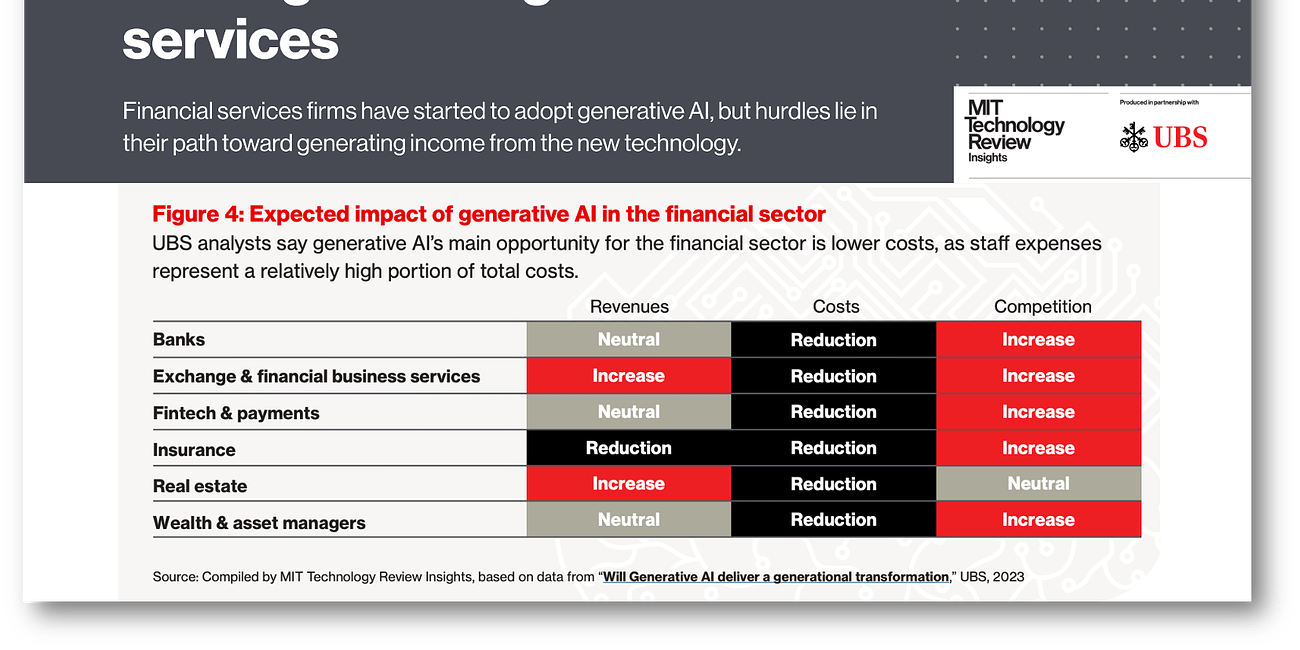

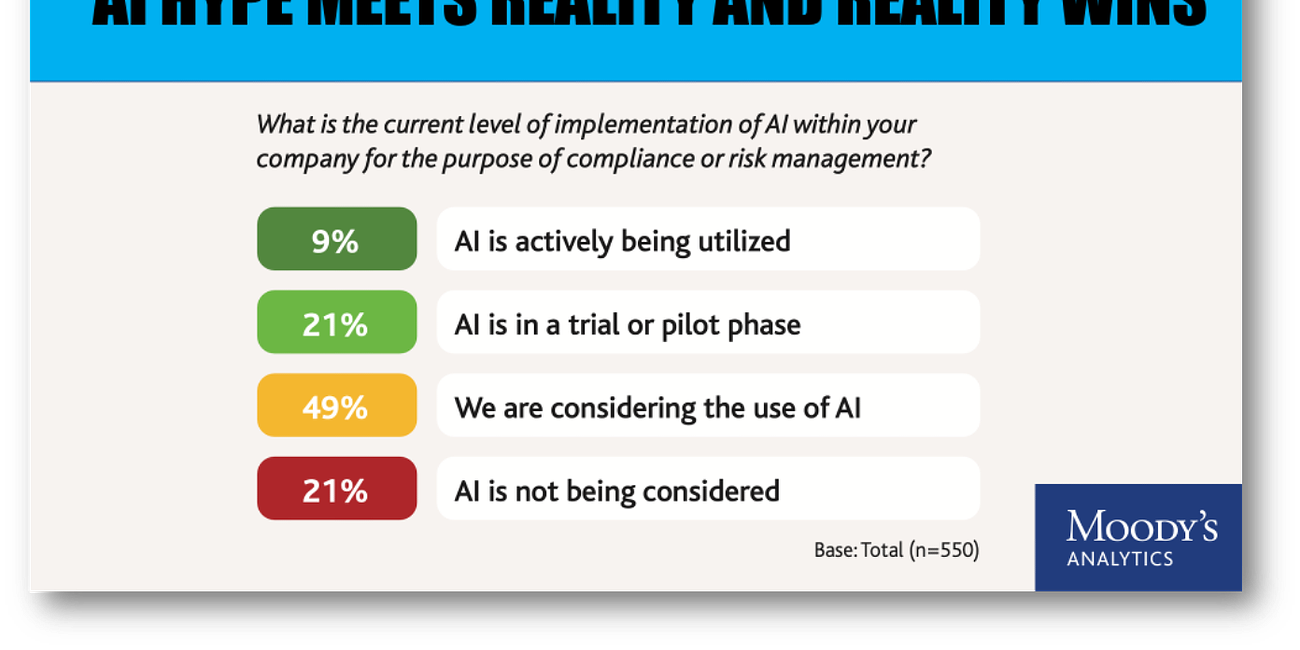

Today’s newsletter covers AI’s impact on financial services, which has yet to see peak disruption. But here’s why the world is haywire. While AI hype pushes out article after article on AI disruption, the reality is there are no control systems in place.

The OECD proposed an “AI incident” reporting system so that we can learn from AI errors and fix them. Did you read anything about this in the news? I’m sure you didn’t.

So, while the world is hell-bent on hyping AI, there is little discussion of the control systems that will allow us to attain the AI “spiritual regeneration” symbolized by the blue mountain in the center of Kandinsky’s work.

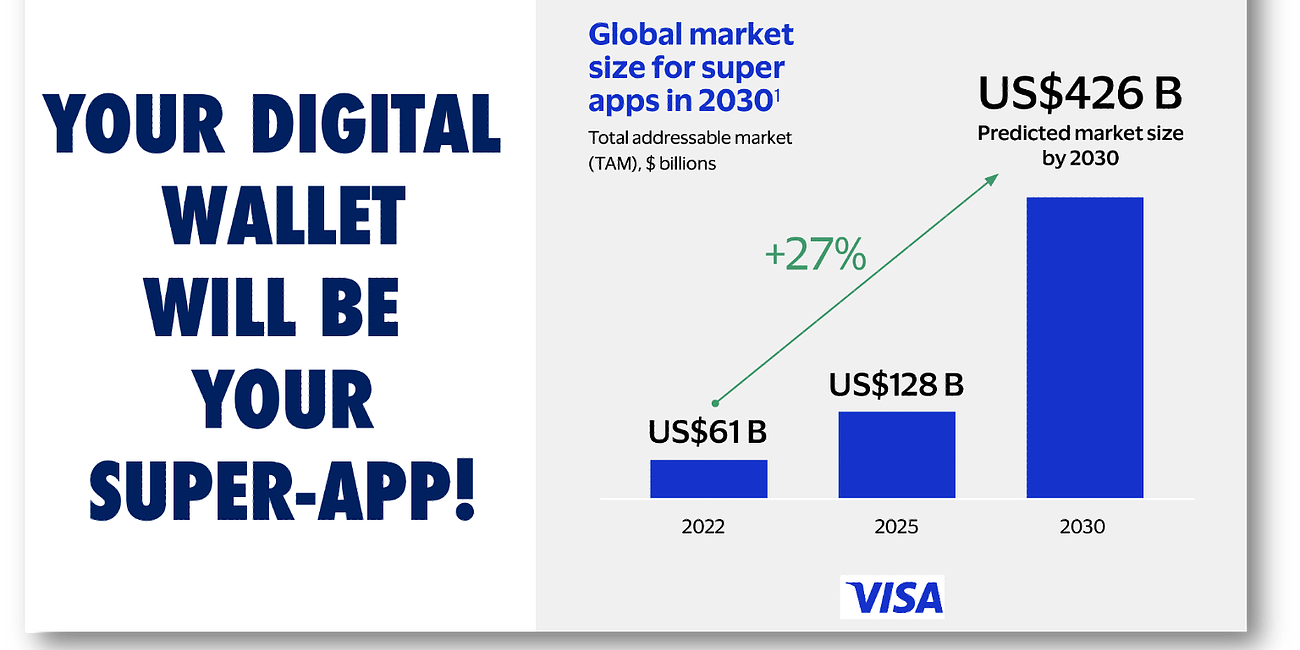

We’ve also got two other important reads. Super-apps, do you love them or hate them?" It’s not a rhetorical question because you’ll get one through your digital wallet someday soon. You’ll build your own, or as Nietzsche might point out destruction of card payments will lead to creation!

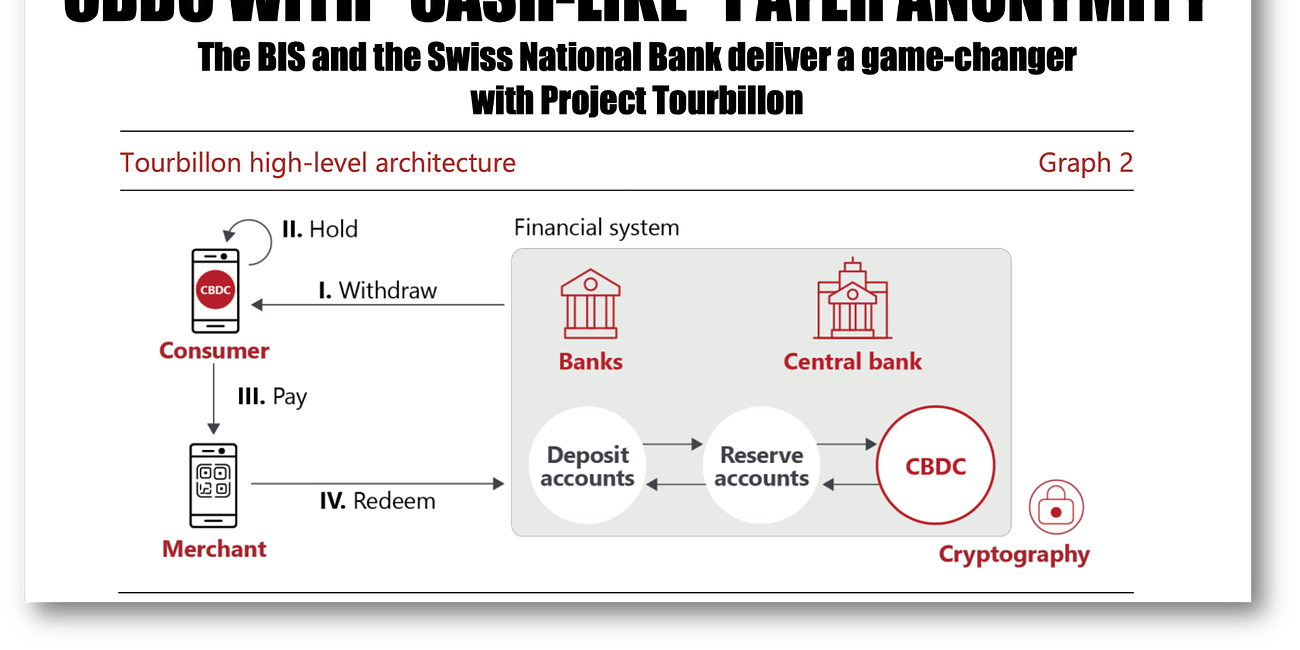

CBDC is seen by many as the peak of a world gone haywire, but in reality, privacy-protecting CBDCs are real. The only problem is that while they are great tech, they sacrifice key features.

Finally, the best free read of the month on AI economic impacts from the IMF!

And last but not least I talk about CBDC and dedollarization on a great podcast.

Two more that should catch your interest

1. IMF Gives Us the Best Free AI Read of the Month

The IMF’s quarterly magazine explores AI's MASSIVE economic impact through a fabulous series of articles written in plain English.

It is a captivating read! Articles cover AI's impact on income inequality, shared prosperity, planning for an AI future, benefits for the poor, and impact on finance.

Discover fascinating insights on China's economy and the plight of the Philippines' national bird in a must-read article. Don't miss page 76!

2. The best podcast of the month? My take on CBDC on the Tokenize Podcast!

Thanks to Arunkumar Krishnakumar for having me on as Guest No. 1 on his new podcast. Arun is a fintech and crypto expert of the highest pedigree, and it was great talking to him. We discuss CBDC, why they are game-changers, and their impact on pending dedollarization.

I also talk about Book No 3! If I can ever focus. The working title is: “BRICS BUCKS & BANKS: Digital Currency and De-dollarization in a multipolar world.”