GenAI is coming for your job🔷 $250tn cross-border payment race🔷 Digital lending in ASEAN🔷 AIs with empathy? We hope so!

The digital dollar must die! Culture warriors will make it illegal.

1. Generative AI is coming for your job

2. The $250tn cross-border payment race

3. The digital dollar must die!

4. Digital lending fills the gap in ASEAN

5. Theodora Lau on AI empathy

Today’s art: White Zig Zags, Wassily Kandinsky, 1922

An uneasy equilibrium: to the right, angular trapezia, projecting shards of blue and yellow, jagged serrations of red(as well as the zig-zag of the title), and to the left, a looping arch of pink, with curving crescents and discs.

I love the concept of “uneasy equilibrium” as that is exactly where our fintech world stands now. With one foot into the modern and another in the past with an uneasy equilibrium as slowly puts one foot into the future in everything from cross-border payments to ASEAN’s lending gap. “Uneasy equilibrium” also speaks to our relationship with GenAI, which really is hell-bent on coming for your job after all! But for the digital dollar, there is no equilibrium uneasy or not, just death! A victim of the culture wars and those who live in fear of progress.

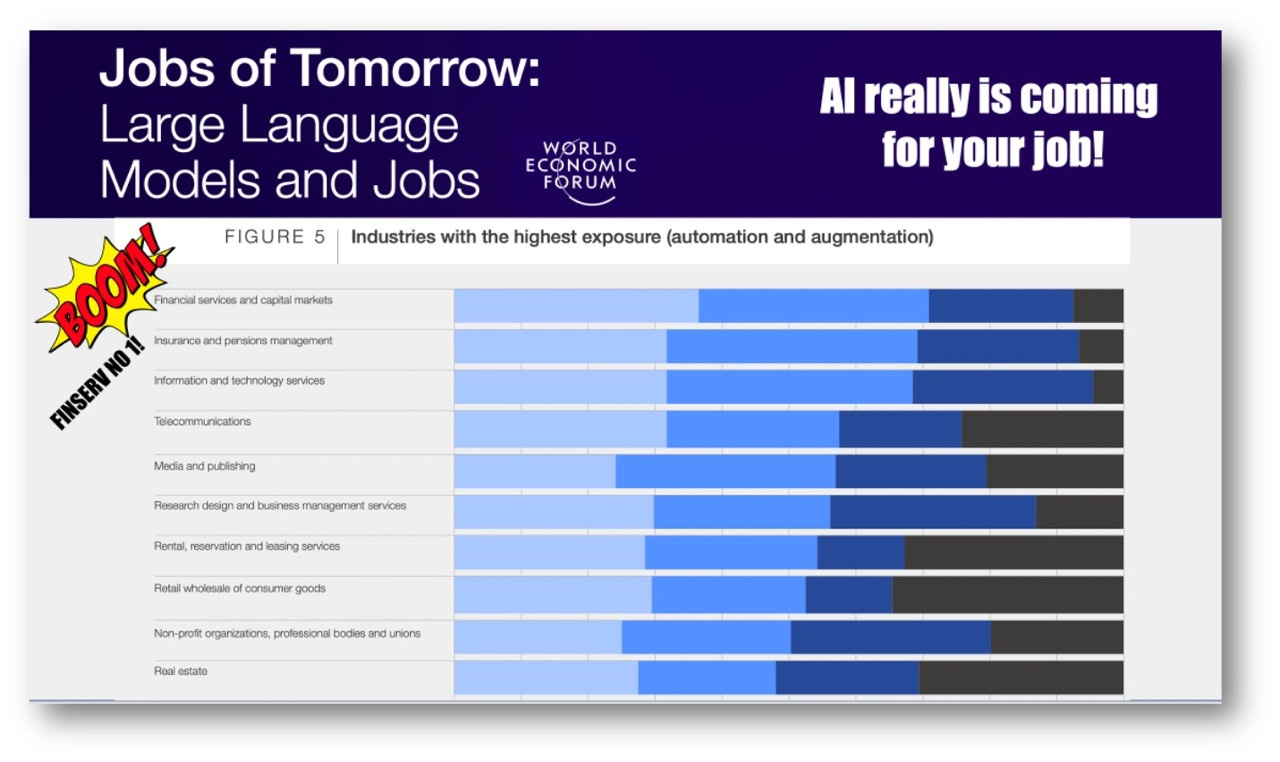

1. Generative AI is coming for your job

The WEF looks at the “Jobs of Tomorrow”

because GenAI really is coming for your job!

👉TAKEAWAYS:

🔷 The WEF tells us what many of us already know, the workplace is facing significant disruption as we enter the GenAI era.

🔷 By some estimates, 62% of total work time involves language-based tasks, all of which are ripe for AI disruption.

🔷 GenAI is coming for my job and yours, how do you feel about it? For many, this is no joke.

🔷Having a practical hobby like carpentry or plumbing will be the only refuge for many.

🔷Hardest impacted will be those hit mid-career

🔷The WEF urges responsible transitions for workers but I wouldn’t hold my breath.

STRAIGHT TALK

Go directly to Page 10 “Analysis by occupation,” to see which jobs have the “Highest potential for Automation and Augmentation.” If your job is on these lists, expect change and prepare! The list is thought-provoking!

The only jobs that are immune are those who work with their hands, medical, carpenters, chefs, or those with high degrees of personal interaction like clergy or marriage therapists! Everyone else should prepare for disruption.

As many of my readers are in financial services, check out Page 15, and you’ll see that our industry is at the top of the list for disruption!

So what to tell your children to study? Vocational skills are the only safe careers. Engineering with a minor in electrics and plumbing? Medicine with a minor in cooking?

Undoubtedly, there will be the creation of new jobs, but the reality is for those who are mid-career, these transitions will likely be difficult at best.

As an author and social media influencer, my job falls into Category 1 with a “high potential for automation” and an obvious candidate for disruption!

I eagerly await my replacement by GenAI!What category is your job?

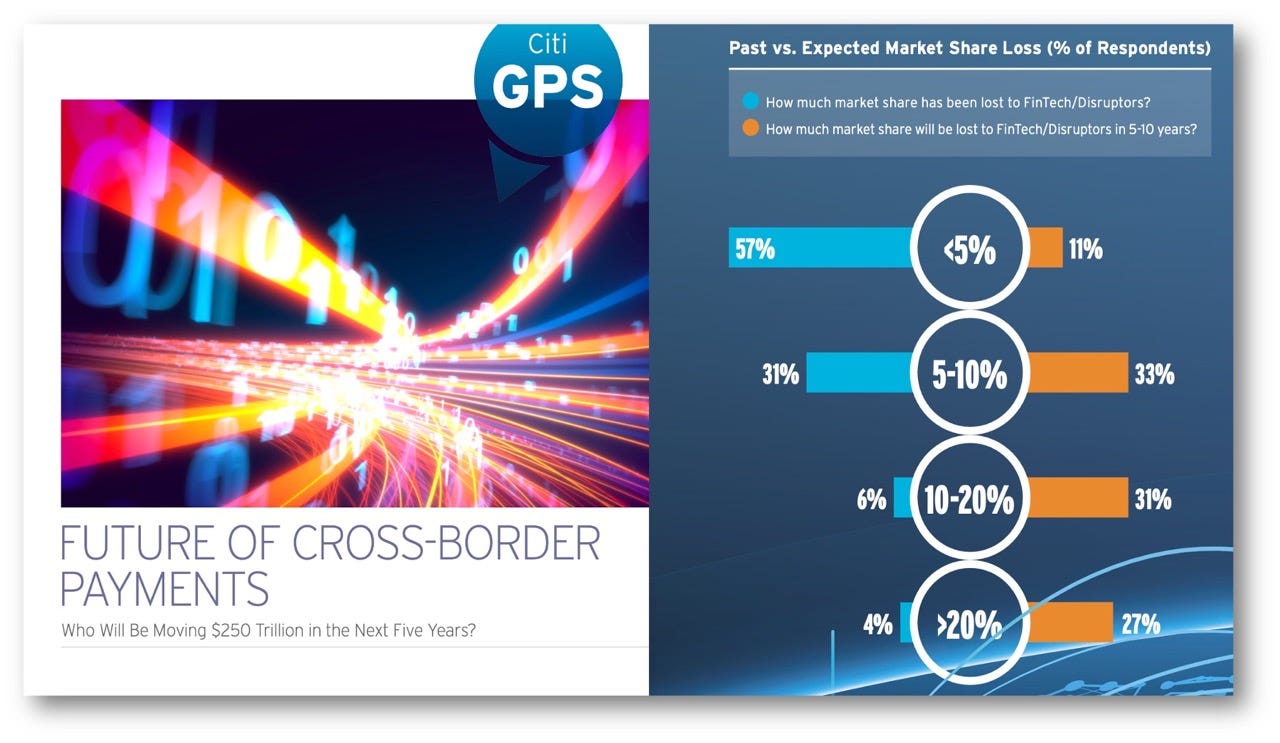

2. The $250tn cross-border payment race

Citi is leading the digital charge on $250tn in cross-border payments but has many challengers.

TAKEAWAYS

➣Kudos to Citi: “Those who embrace new technologies and invest in meeting evolving client expectations will emerge as winners and gain market share. Those who do not may eventually have to face the reality of their clients moving almost entirely to other providers.”

➣Citi makes a clear case for 24x7 payments and, while a proponent of “deposit tokens,” does a nice job of acknowledging that they aren’t the only solution clients will use. Citi acknowledges clients will use: CBDC, stablecoins and digital wallets.

➣Banks cooperated in payments through correspondent banking but that collegial world is no longer. “We must now talk about ‘coopetition’ (cooperation + competition) between traditional stakeholders and new entrants (FinTechs), who are fulfilling niche market requirements.”

➣🔥 “Payments has become a commodity, whether it is domestic or cross-border.”🔥 Consumers are thinking more and more globally and borders between local and global are disappearing progressively.

➣The last line is poignant. Payments are a commodity, and why competitors like JP Morgan, Stablecoins, and CBDCs are also working to “crack the code.”

➣Citi won’t have this market to itself.

STRAIGHT TALK

I salute Citi for their efforts, but the reality is that everyone, from giants like JPM to fintechs and governments, is after cross-border payments.

In the end, only the clients will decide, and I expect this battle to be similar to the VHS vs. Betamax video tape battle from another generation. The best tech doesn't always win, and it will take years for clients to eventually decide on a winner.

Big banks will focus on keeping high volumes of low-margin trades through walled gardens like WeChat and Alipay. The idea is that the ecosystem keeps you attached to their transfer services. You can see it already with Citi's transfer system and JPMorgan’s “JP Morgan Coin.” Both want the business and have separate standards.

What will be interesting to watch is how the US banks will fare in the Asian market, where regional CBDC trading will be the norm in Singapore and Hong Kong. In this market, their payment margins will be cut razor-thin.

Will this be revenue forever lost to the large banks? Yes absolutely! The glory days of bank payment divisions bringing in the “big bucks” are gone.

3. The digital dollar must die!

UPDATE

I sent this out earlier this week on substack: here Since published H.R. 5403 “CBDC Anti-Surveillance State Act” has passed the House Financial Services Committee and heading for a vote. Will it have the votes to become law? Time will tell, but with culture wars raging, it’s likely.

H.R. 5403, the "CBDC Anti-Surveillance State Act," offered by Majority Whip Tom Emmer (MN-06), prevents the Federal Reserve from issuing a CBDC directly or indirectly to individuals or maintaining accounts on behalf of individuals. It also prohibits the Secretary of the Treasury from directing the Board of Governors of the Federal Reserve System to issue a CBDC and clarifies that a CBDC can only be issued pursuant to congressional authorization.

So the “good news” is that only Emmer’s bill was passed, and other acts that prohibited CBDC pilots were not combined or added to this bill.

Rep. Stephen Lynch, D-Mass wins the award for the best quote of the day: “With all due respect, this bill is an act of breathless stupidity.” I couldn’t agree more.

I’ve also put some more thought into putting $0.6 trillion of payment costs into perspective. 2.2% of GDP is certainly impressive. But how about this? The US government’s annual defense spending for 2022 was $.75tn or 3% of US GDP.

Does that scare you? It should! It should also clarify why Article 2 above on cross-border transfers is so important!

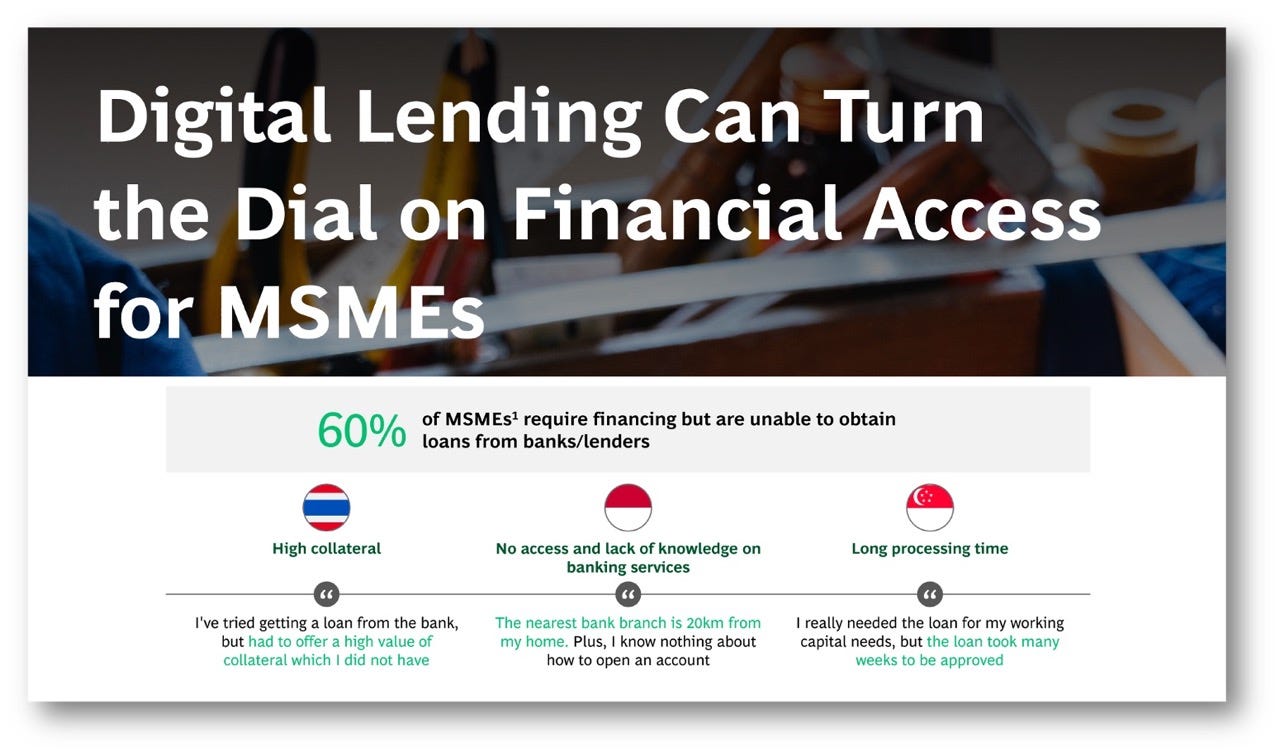

4. Digital lending fills the gap in ASEAN

ASEAN turns to digital lending to fill the regions lending gap, boost MSMEs and raise GDP!

ASEAN nations are copying the Tencent and Alipay model to bring digital lending to their MSME businesses, 60% of which have been ignored by traditional banking.

👉TAKEAWAYS:

🔷 Micro, small, and medium-sized enterprises (MSMEs) account for up to 99% of total enterprises across ASEAN, 85% of regional employment and 45% of gross domestic product (GDP).

🔷 Most MSMEs do not have access to finance to grow their business, which drives down GDP throughout the ASEAN region.

🔷 Showing how critical loans are, the IMF reports that better inclusion can grow GDP growth by 1% annually, and for every $US1mn invested in MSMEs, 16.3 new jobs are created.

🔷 60% of MSMEs are ignored by banks, so their only outlet is digital lending.

🔷 GREAT READ BUT WHERE IS THE SECTION ON CONSUMER PROTECTION???

🔷 Four key factors to accelerating Digital MSME lending in ASEAN are:

Build a robust, consistent and enabling regulatory and oversight framework

Develop a reliable, inclusive, and interoperable infrastructure

Credit bureaus or centralized databases for an integrated financial ecosystem.Champion the adoption of inclusive digital lending

Improving MSME digital lending literacy.Create an enabling environment for innovation

Regulatory sandboxes provide safe environments to test innovation.

STRAIGHT TALK

This isn’t the first time that we’ve read that digital lending will speed development throughout ASEAN nations. It likely will, but how it's implemented is everything.

Giving MSMEs access to loans cuts both ways. This isn’t new, and China and India’s experiences with small loans show that they have hurt quite a few people. Some didn’t understand what loans were, while in other cases, they intentionally took out loans on multiple platforms with no intent of repayment! Not all MSMEs are honorable!

So, while I too, see digital lending as important to the region, this report lacks a critical section: “CUSTOMER PROTECTION.” What you give MSMEs access to is critical and must not be usurious.

5. Theodora Lau on AI empathy

Fintech conference SIBOS’ magazine is a fabulous read!

There’s something for everyone in this publication, so dive in! The editors from Fintech Future did a great job, and the articles are all quite good and fun to read!

Today I’m going to call out only one article that made my list in a publication with many solid reads:

🔷 Empathy and AI: banking’s duty of care, by Theodora Lau, my friend and an unstoppable force of nature

🔷Theo asks the question that we all need the answer to: "What happens when all aspects of our lives are optimized and automated?“

🔷When this day arrives, we all better hope for empathetic AIs or are all in deep trouble.

STRAIGHT TALK

So far, our experiences with algorithms don’t give me much hope that AI will be empathetic. Take China’s “kuaidi” express delivery people who complained about delivery algorithms cheating them of pay and showing impossibly short delivery times or routes. Amazon in the US suffers from the same issues with delivery drivers peeing in bottles to save time while on their route.

AI and algorithms are closely related, with human’s having much more control over algorithms. This is why we should hope that AI has more empathy than the humans who control the algorithms. If these AI’s are like the people they replaced we’re all in trouble!

My work is entirely supported by reader gratitude, so if you enjoyed this newsletter, please do both of us a favor and subscribe or share it with someone. You can also follow me on Twitter or Linkedin for more. For more about what I do and my media appearances, check out richturrin.com

Rich Turrin is the international best-selling author of "Cashless - China's Digital Currency Revolution" and "Innovation Lab Excellence." He is number 4 on Onalytica's prestigious Top 50 Fintech Influencer list and an award-winning executive previously heading fintech teams at IBM following a twenty-year career in investment banking. Living in Shanghai for the last decade, Rich experienced China going cashless first-hand. Rich is an independent consultant whose views on China's astounding fintech developments are widely sought by international media and private clients.

Please check out my books on Amazon:

Cashless: HERE

Innovation Lab Excellence: HERE