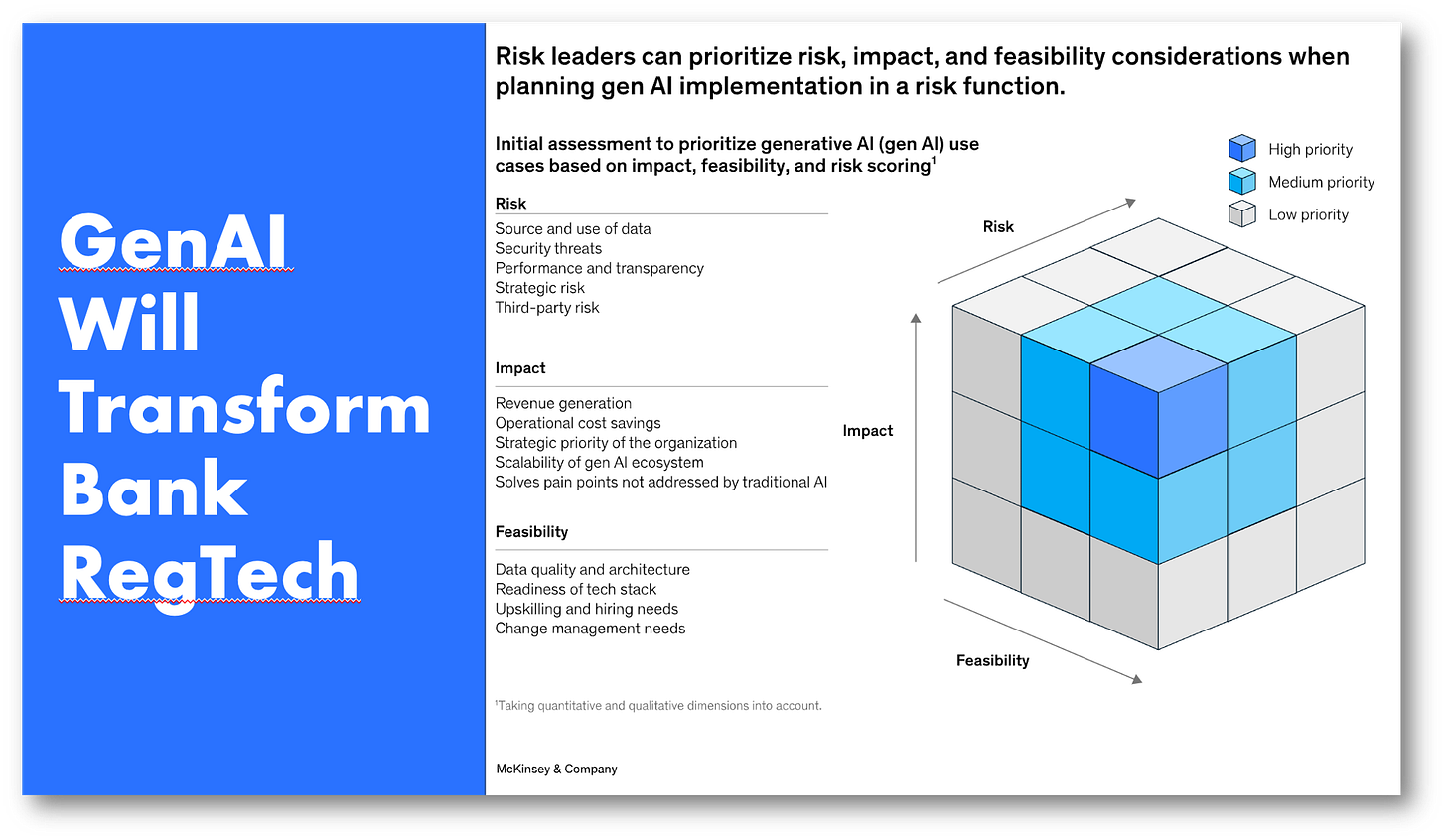

GenAI RegTech Will Transform Bank Risk and Compliance

Banks should begin the GenAI transition in Risk & Compliance immediately

Finally a use case for GenAI in Banks that I won’t complain about and say its overhyped!!

This McKinsey report on GenAI’s use in risk and compliance is far more practical than most!

Note that in this usecase GenAI is used internally, not facing clients! The answers are all aimed at bank professionals who hopefully can see through GenAI’s occasional error!

Compare this risk with a client-facing chatbot!

I worked on RegTech AIs while working for IBM and saw first-hand how effective they can be.

Now with “smarter” GenAI there is no reason for banks to delay rollout of GenAI as it is brilliant at extracting information.

👉TAKEAWAYS

McKinsey’s use cases, Graded from 1 to 5 on likelihood of success!

🔹 Regulatory compliance

Enterprises are using gen AI as a virtual regulatory and policy expert by training it to answer questions about regulations, company policies, and guidelines.

(5) AI did a fine job of this pre-GenAI, and now it can do even more. This should be at work now if not on bank systems, on regulatory web platforms that aggregate regs. I am excited about this because GenAI can read -everything- to pull out relevant sections.

🔹 Financial crime

Gen AI can generate suspicious activity reports based on customer and transaction information.

(4) Anything to stop my card from being blocked whenever I travel! This is a great use case because GenAI is good at spotting abnormalities. Privacy is an issue, but here again, it is bank personnel monitoring the data!

🔹 Credit risk

By summarizing customer information (for example, transactions with other banks) to inform credit decisions, gen AI can help accelerate banks’ end-to-end credit process.

(5) AI is already doing credit examinations in China, why shouldn’t GenAI join in? No doubt that GenAI can read a credit profile better than a human, but can it make exceptions?

🔹 Modeling and data analytics

Gen AI can accelerate the migration of legacy programming languages, such as the switch from SAS and COBOL to Python. Monitor model performance and generate alerts.

(4) So much for Cobol programmers making top dollar! Can GenAI reprogram bank core systems? I don’t know! I see monitoring as the easier of the two.

🔹 Cyber risk

Gen AI can use natural language to generate code for detection rules and accelerate secure code development by checking cybersecurity vulnerabilities.

(2) This is the least likely use case in my humble opinion, yes GenAI can help, but the whole point of cyber risk is to stay ahead of unseen and unknown exploits. GenAI only deals with the known.

🔹Climate risk

As a code accelerator, gen AI can suggest code snippets, facilitate unit testing, and assist physical-risk visualization with high-resolution maps.

(3) Yes no doubt GenAI has a role to play but letting GenAI write an ESG report shows just how little banks care about ESG!

👊STRAIGHT TALK👊

Regular readers know that while I see great potential in GenAI, its ability to make up answers makes it risky for banks to deploy in client-facing roles.

Last week I asked if banks will pay for GenAI’s mistakes? A reasonable question that no one in the banking space dares answer!

Here in the risk and compliance space I see nothing but smooth sailing for GenAI and encourage banks to experiment with these systems as soon as possible.

The providers of digital banking regs like Thomson Reuters must already have rolled out GenAI and it isn’t a matter of altering bank systems to use it.

GenAI can still make costly mistakes in compliance! Let there be no doubt about it!

The difference is that compliance professionals reading GenAI output would be more likely to spot an error than a retail client using a bank chatbot.

Foolproof? Not in the least, but certainly coming soon to a bank near you!

Thoughts?

Hey, do you have anything to say about my articles? I and others in our “Cashless” community would love to hear it!

Don’t pull your punches. Tell me why I’m right or wrong, but don’t miss this opportunity to leave a comment!

Thank you to all my subscribers who have been sharing Cashless! You are now the No 1 driver of subscriptions, and prove that word of mouth still works better than X!

Join the community by subscribing! You’ll be glad you did!

RegTech powered by gen AI in banking is truly transformative—streamlining compliance, automating reporting, and enhancing risk management. It’s exciting to see how these technologies are reshaping the financial sector. For more insights, check out this guide: https://www.cleveroad.com/blog/generative-ai-in-banking/