GenAI’s Role In Asia’s Explosive Wealth Management Growth

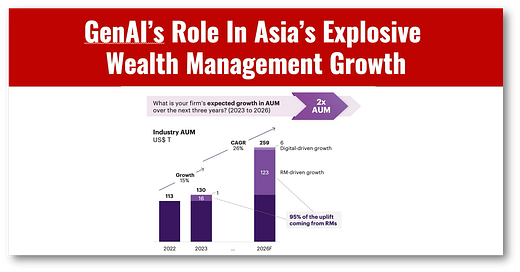

Doubling AUM under management in three years!

Accenture lays out how Asia’s wealth management industry is on fire and will use GenAI to help -double- AUM over the next three years!

Are you shocked? Don’t be.

The IMF says that Asia will contribute roughly 60% of global economic growth this year, making it the world's growth engine. Note that Asia’s share of the global economy rose from 21% in 1990 to 39% in 2023.

This is “Asset management at the speed of Asia,” and Accenture does a great job of explaining in granular detail how GenAI will play a big part in Wealth management.

👉TAKEAWAYS

GenAI’s six primary use cases for Wealth Management are:

GenAI-powered prospect identification:

Leads capture, prospect 360 view, conversation topics

Onboarding E2E tracking:

Workflow tools, digital document signing

Gen AI-driven investment recommendations:

Here, RMs are pushing back and view their expertise as the key differentiator in clients’ eyes and might worry that AI could replace them when it comes to investment recommendations.

Gen AI-powered E2E content dissemination:

Clients say content is the most important of 40 elements of the investment proposition; it also has the largest satisfaction gap at 7 percentage points versus expectations. Almost half of clients do not get relevant, personalized content.

Service agent co-pilot:

A chatbot to assist in client services, term sheet, and document generation, and compliance and fraud detection.

Knowledge management co-pilot:

Autogenerate reporting presentations.

👊STRAIGHT TALK👊

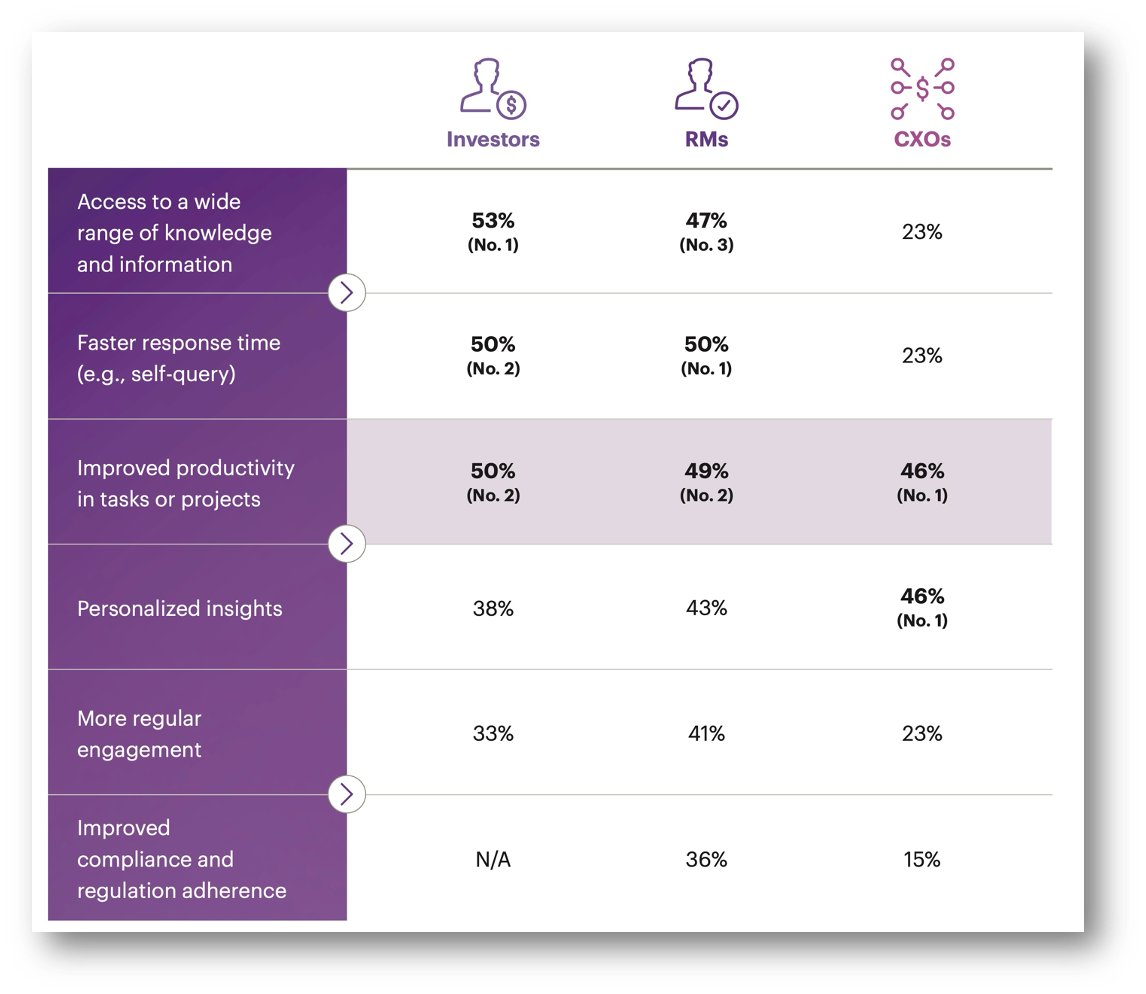

Accenture’s report does a fabulous job in capturing how clients, relationship managers (RMs) and CXOs all see GenAI from a different perspective.

This is a fundamental problem to overcome because AI development must serve many masters.

Take client prospecting, for example; here, RM's and CXOs have a large gap, with CXOs feeling that no GenAI intervention is required and that traditional referral and sourcing networks are doing their job. Meanwhile, RMs whose job depends on bringing in new clients need all the help they can get!

In contrast, CXOs want GenAI’s help in advisory, while RMs feel that their expertise is the key factor in their client relationships and don’t want GenAI to steal the show!

While these differences may impact roll-out speed, GenAI will ultimately become an integral part of the entire WM process, whether CXOs or RMs like it or not.

And why not? Accenture predicts that enabling the six primary GenAI systems above would allow a model firm to grow 3.5x GenAI-enabled compared to normal organic growth.

Who can argue with numbers like that?

Certainly not high-growth Asia!

Did you make it this far? There are even more benefits waiting for you when you subscribe.

Don’t get left behind: Get the expert insights on Central Bank Digital Currencies (CBDC), AI, Payments, and Financial Inclusion, that you need to stay ahead of the curve, all delivered directly to your inbox weekly;

See the future: Profit from a unique point of view directly from Asia that focuses on how the region is “leapfrogging” the West and showing us the future.

Be independent: My message doesn’t follow corporate diktats it’s a message that’s often controversial and does not conform with mainstream outlets;

Be prepared: CBDCs are no longer theoretical but coming soon, so keep up with the latest developments on the digital euro, yuan, sterling and dollar;

Understand AI: In-depth analysis of how our AI revolution impacts finance and will change how we interact with financial services.

Trust: My writing is trusted by over 50,000 executives, innovators, investors, policymakers, journalists, academics, and open-minded crypto hodlers daily

Subscribing is free, but I am honored by readers volunteering to opt for a paid subscription to recognize my high-quality writing. Thank you!

Sponsor Cashless and reach a targeted audience of over 50,000 fintech and CBDC aficionados who would love to know more about what you do!